Clark Nevada Notice of Default under Security Agreement in Purchase of Mobile Home

Description

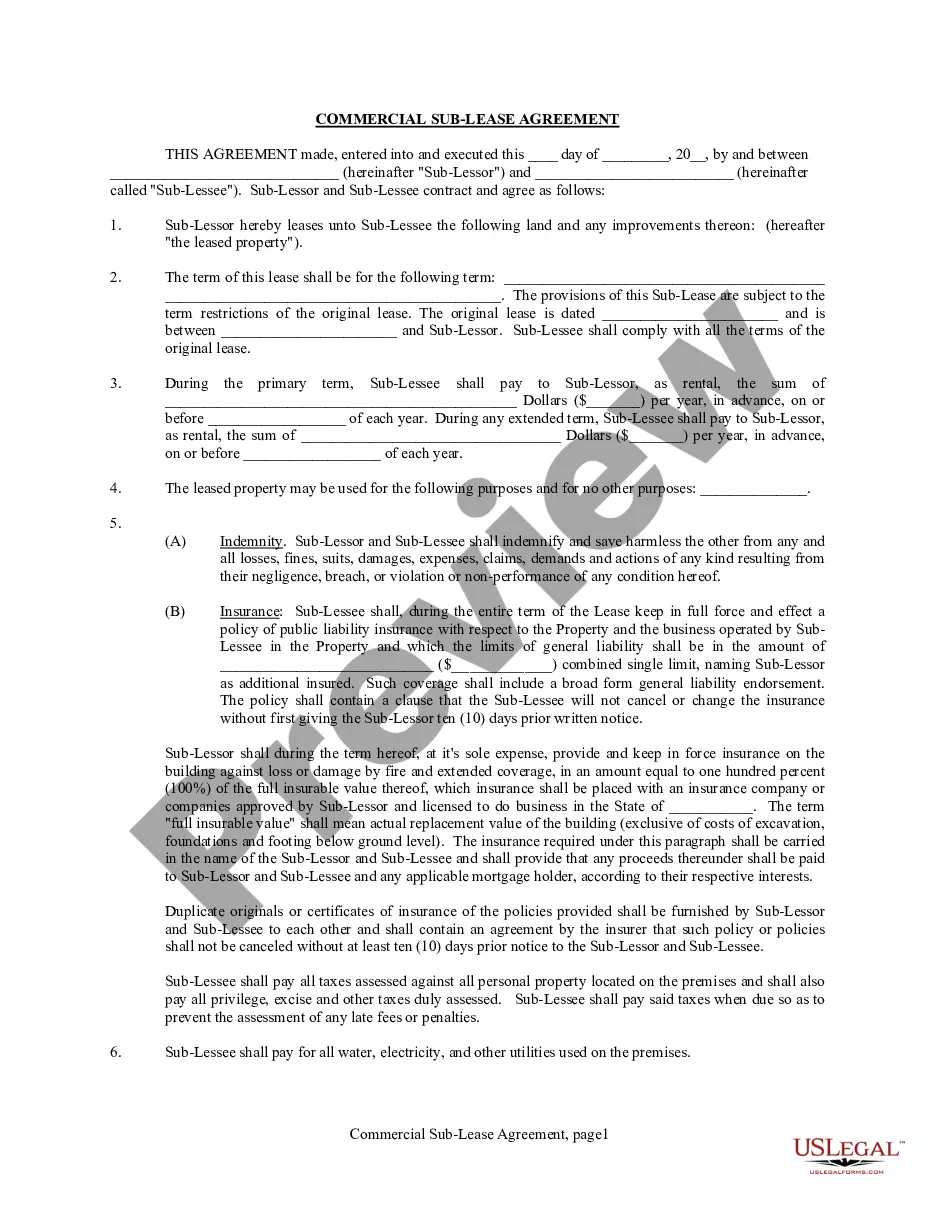

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

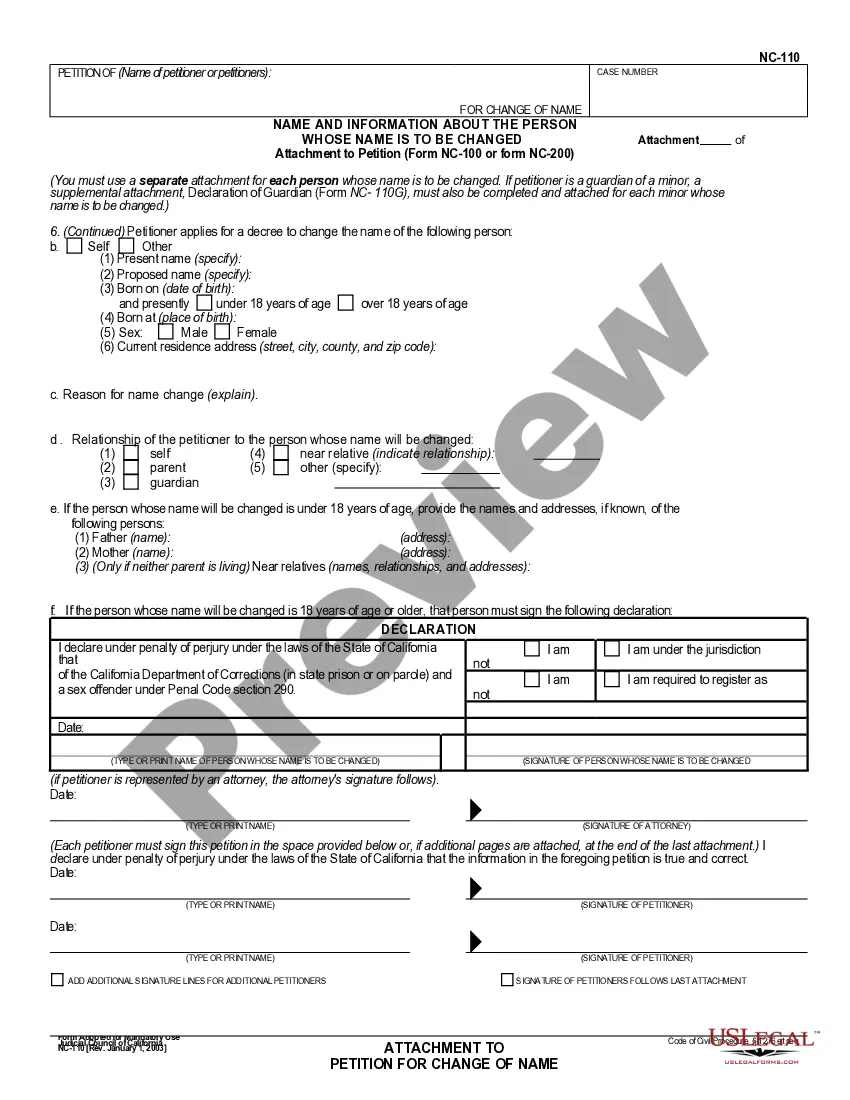

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Developing legal documents is essential in today’s society.

Nonetheless, you don't always need to seek expert assistance to generate some of them from the beginning, including Clark Notice of Default under Security Agreement in Purchase of Mobile Home, using a service like US Legal Forms.

US Legal Forms offers more than 85,000 documents to select from in various categories ranging from living wills to real estate contracts to divorce forms.

Select the pricing plan, then the required payment option, and purchase the Clark Notice of Default under Security Agreement in Purchase of Mobile Home.

Choose to save the document template in any available format.

- All documents are categorized by their applicable state, making the searching process much less daunting.

- You can also discover informational resources and guides on the website to simplify any tasks associated with document completion.

- Here’s how to find and download the Clark Notice of Default under Security Agreement in Purchase of Mobile Home.

- Examine the document’s preview and description (if accessible) to acquire basic knowledge on what you will receive after obtaining the document.

- Ensure that the template you choose is relevant to your state/county/region since state laws can influence the legality of certain documents.

- Review similar documents or restart the search to find the correct file.

- Click Buy now and establish your account. If you already possess an existing one, choose to Log In.

Form popularity

FAQ

Article 9 contains a statute of frauds which requires a security agreement to be in writing unless it is pledged.

The debtor must authenticate the security agreement by signing a statement that announces the intention to grant a security interest in the property specifically outlined in the security agreement.

Under the UCC, to be valid and enforceable against the borrower or other grantor of a security interest (debtor), a security interest in personal property and fixtures must first attach.

(The UCC uses the term "authenticate" to include the possibility of electronic signatures.) A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

In order to have a valid security interest the creditor must have a security agreement with the debtor that meets certain specific requirements, namely, it must be signed, it must clearly state that a security interest is intended, and it must contain a sufficient description of the collateral subject to the security

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In a Chattel Loan transaction, a disclosure is not required at the time of application and the disclosure at closing is less than a page.

An enforceable security interest can also be created by pledge (i.e., by possession of the collateral) or in certain circumstances control of the assets. UCC 9- 203(b)(3). e. In most commercial cases, creation of the security interest is a fairly easy requirement to meet.

Send a notice (a PMSI Notice) to each creditor identified in the UCC search as having a competing security interest that would cover the goods, which notice must state that seller has or expects to obtain a security interest in the goods and include a reasonable description of those goods.