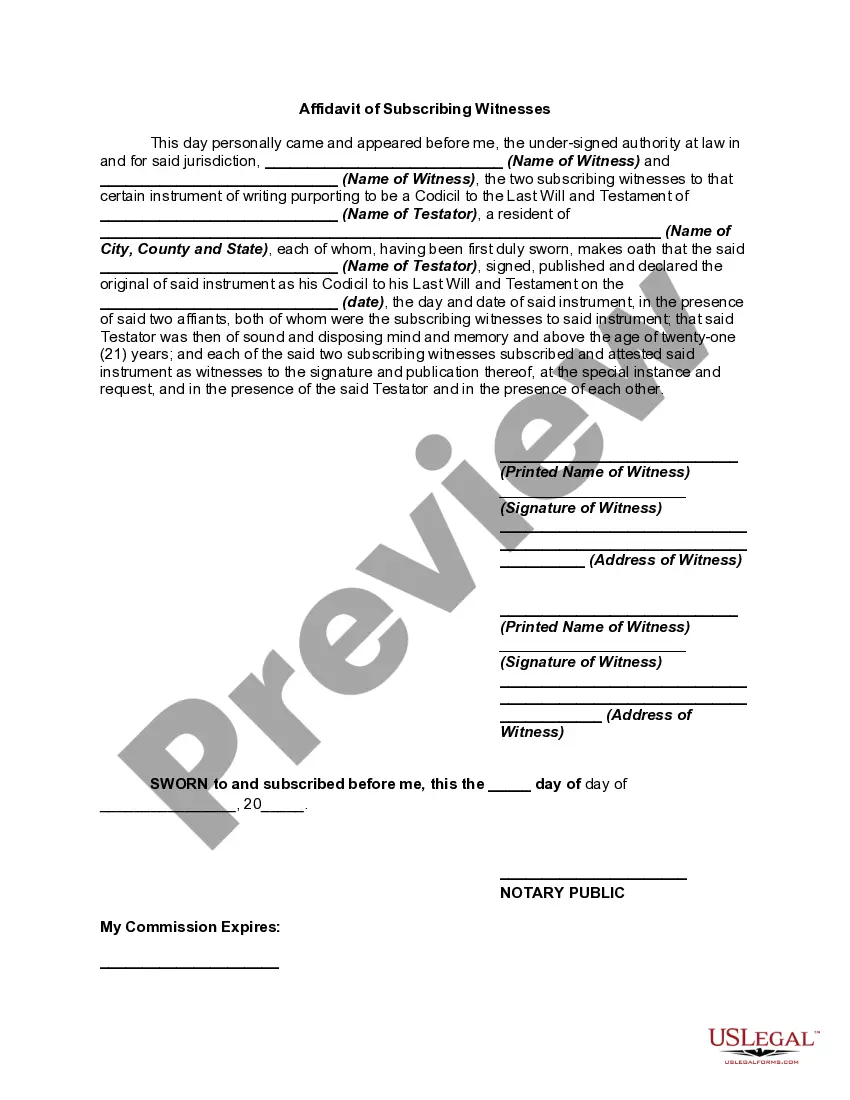

A codicil is a written supplement to a person's will, which must be dated, signed and witnessed under the same legal rules applicable to the making of the original will, and must make some reference to the will it amends. A codicil can add to, subtract from, revoke or modify the terms of the original will. When the person dies, both the original will and the codicil are subject to the probate process and form the basis for administration of the estate and distribution of the assets of the deceased.

A codicil is used to avoid rewriting the entire will. A codicil should reference each section number of the will and the specific language that will be affected. It is important that a codicil is as clear and precise as possible to avoid undue complications.

Statutory provisions in the various jurisdictions specify the formal requisites of a valid will. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.