Phoenix Arizona Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

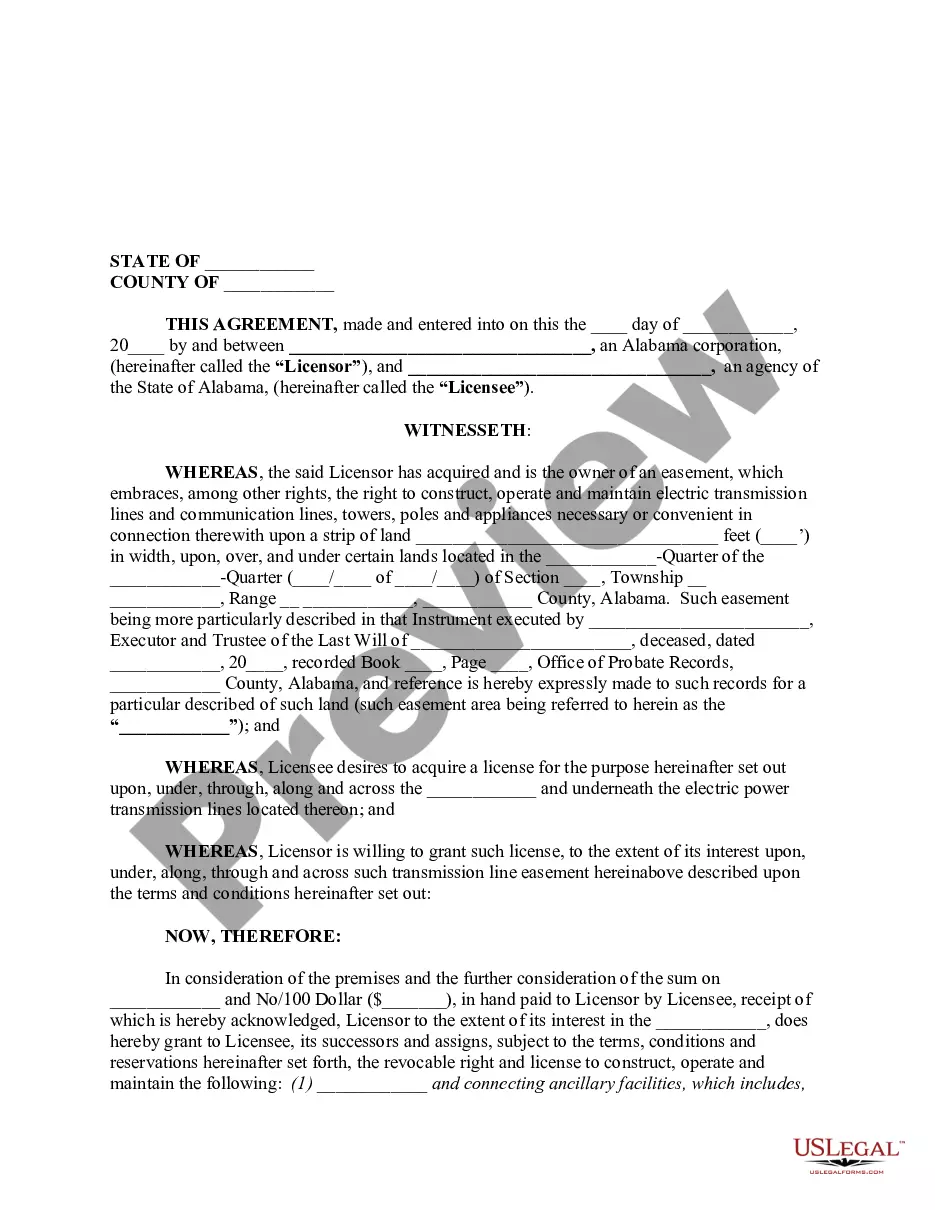

Are you eager to swiftly generate a legally-binding Phoenix Miller Trust Documents for Medicaid or potentially any other paperwork to manage your personal or business affairs.

You have two choices: engage a legal advisor to draft a legal document for you or create it entirely by yourself. Fortunately, there’s a third option - US Legal Forms.

To begin, verify whether the Phoenix Miller Trust Documents for Medicaid aligns with your state or county’s laws.

In case the form includes a description, ensure to check what it’s intended for. Restart the search process if the template isn’t what you need by utilizing the search bar in the header. Choose the plan that best suits your requirements and proceed to payment. Select the file format you prefer to receive your form in and download it. Print it out, fill it in, and sign where indicated. If you are already a registered user, you can readily Log In to your account, find the Phoenix Miller Trust Documents for Medicaid template, and download it. To re-download the form, simply navigate to the My documents tab. It’s simple to purchase and download legal documents when you use our services. Additionally, the documents we provide are refreshed by legal professionals, which offers you added reassurance when handling legal matters. Try US Legal Forms now and experience it for yourself!

- It assists you in obtaining professionally crafted legal documents without incurring exorbitant fees for legal services.

- US Legal Forms provides an extensive collection of over 85,000 state-specific form templates, including Phoenix Miller Trust Documents for Medicaid and form packages.

- We furnish templates for a multitude of life situations: from divorce papers to real estate paperwork.

- With over 25 years in the industry, we boast a flawless reputation among our clients.

- Here’s how you can join them and acquire the necessary document without hassle.

Form popularity

FAQ

To record a trust in Arizona, you need to prepare the necessary documentation, including Phoenix Arizona Miller Trust Forms for Medicaid. First, ensure that the trust document complies with state laws. Then, visit your county recorder's office to officially file your trust. Using a reliable platform like US Legal Forms can simplify this process, as they provide templates that are easy to complete and enhance your understanding of the requirements.

To prevent Medicaid from taking your assets, consider establishing a trust using Phoenix Arizona Miller Trust Forms for Medicaid. These forms help create a secure financial structure that protects your assets and ensures you qualify for Medicaid without risking your property. Additionally, maintaining a clear strategy concerning asset transfers can greatly aid in protecting your wealth. Consulting with a Medicaid planning expert is also wise to ensure your assets remain safe.

In Arizona, Medicaid has specific asset limits that determine eligibility for programs. As of 2023, an individual can have up to $2,000 in countable assets. However, specific assets, like a primary residence or certain types of trusts, may not count against these limits. Utilizing Phoenix Arizona Miller Trust Forms for Medicaid allows you to find solutions to meet these requirements effectively.

Yes, Medicaid does examine trusts when determining eligibility. However, using Phoenix Arizona Miller Trust Forms for Medicaid can help you ensure that your trust is structured correctly. A properly established trust may protect your assets from being counted against Medicaid limits. It is crucial to understand how Medicaid evaluates trusts to maximize your benefits.

To avoid the Medicaid 5-year lookback period, you may use Phoenix Arizona Miller Trust Forms for Medicaid effectively. These forms can help you establish a trust before any significant gifts or asset transfers. By doing this, you can reduce the risk of penalties or delays while applying for Medicaid benefits. Consulting with a specialist can also provide guidance on proper asset management to navigate the lookback period.

To protect your assets from Medicaid in Arizona, consider using Phoenix Arizona Miller Trust Forms for Medicaid. These forms allow you to create a trust that can help you qualify for Medicaid while shielding your assets. By properly placing your assets in a trust, you can ensure Medicaid does not access them or consider them for eligibility. It is essential to work with a legal expert to ensure your trust complies with Arizona laws.

Certain assets can be protected from Medicaid, including your primary residence, personal possessions, and some retirement accounts. Additionally, funds placed in a Miller trust are typically shielded from Medicaid calculations, allowing you to safeguard your financial future. Understanding which assets qualify for protection is essential when considering Phoenix Arizona Miller Trust Forms for Medicaid. Using the right forms can ensure you make informed decisions about your assets.

Setting up a Miller trust in Arizona requires a few essential steps, including creating a written trust document and appointing a trustee. It's important to follow Arizona’s specific legal requirements to ensure the trust is valid. Utilizing Phoenix Arizona Miller Trust Forms for Medicaid can simplify this process significantly, making it easier for you to navigate the necessary paperwork. Seeking professional guidance can also enhance your setup experience.

A Miller trust functions as a legal tool that allows individuals to qualify for Medicaid while retaining some income. It redirects excess income into the trust, which then makes the individual eligible for coverage. By managing funds in this way, you can ensure the preservation of your assets. Therefore, understanding Phoenix Arizona Miller Trust Forms for Medicaid is crucial for successful implementation.

A Miller trust works by allowing excess income to be deposited into the trust, which then helps to bring your countable income below the Medicaid threshold. In Arizona, this trust enables individuals to maintain access to their Medicaid services while adhering to state guidelines. It’s vital to ensure that the trust is managed correctly to avoid complications. You can easily find Phoenix Arizona Miller Trust Forms for Medicaid to get started.