Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion

Description

Form popularity

FAQ

The $100,000 loophole for family loans allows individuals to gift up to $100,000 to family members without incurring a gift tax. This can be particularly beneficial when considering options like the Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion. By utilizing this loophole, families can support each other financially while avoiding the complexities of tax implications. For those interested in navigating these financial opportunities efficiently, uslegalforms provides resources and templates that simplify the process.

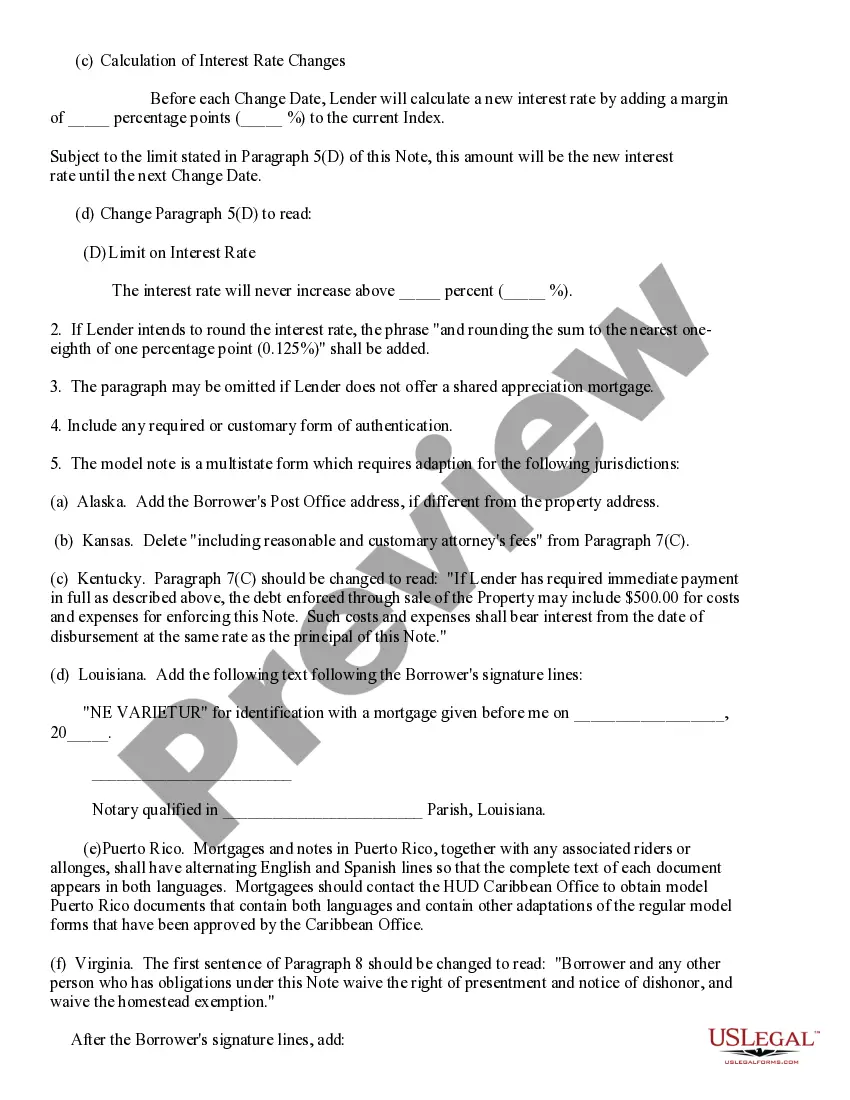

The primary downside of an adjustable-rate mortgage (ARM) is the uncertainty of changing interest rates, which can lead to increased monthly payments in the future. With the Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion, your payments might start lower but can rise as rates adjust. This unpredictability requires careful budgeting and planning to manage potential future costs.

One downside of a home equity conversion mortgage (HECM) is the potential for accumulating interest, which can reduce the equity in your home over time. The Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion may also come with higher fees compared to traditional mortgages. It’s essential to evaluate these factors and consult with a financial advisor to ensure this option aligns with your overall financial strategy.

An adjustable-rate home equity conversion mortgage (HECM) offers flexibility by allowing the interest rate to change periodically based on market conditions. The Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion is designed to help seniors unlock their home equity while keeping payments manageable. This type of mortgage can provide access to funds for retirement expenses, home improvements, or other financial needs.

To qualify for an adjustable-rate mortgage (ARM) like the Boston Massachusetts Model Adjustable Rate Note - Home Equity Conversion, you generally need a steady income, a good credit score, and a reasonable debt-to-income ratio. Lenders typically require you to provide personal financial information, including your employment history and assets. Additionally, some lenders may ask for a down payment, depending on your financial profile.

One of America's most historically rich cities, the story of our nation is evident on nearly every corner in Boston. Officially founded in 1630 by English Puritans who fled to the new land to pursue religious freedom, Boston is considered by many to be the birthplace of the American Revolution.

02108, 02109, 02110, 02111, 02112, 02113, 02114, 02115, 02116, 02117, 02118, 02119, 02120, 02121, 02122, 02123, 02124, 02125, 02126, 02127, 02128, 02129, 02130, 02131, 02132, 02133, 02134, 02135, 02136, 02137, 02141, 02149, 02150, 02151, 02152, 02163, 02171, 02196, 02199, 02201, 02203, 02204, 02205, 02206, 02210, 02211, 02212, 02215, 02217, 02222MORE, ?

Top 10 Boston Foods in 2023 (& Where to Find Them) Boston Baked Beans - Union Oyster House. New England Clam Chowder - Atlantic Fish Co. Boston Cream Pie - Omni Parker House. Giambotta Pizza - Regina Pizza. Italian sub - Monica's Mercato. Frappes - Boston Burger Company. Lobster Roll - Neptune Oyster. Oysters - Row 34.

Significance: Considered the oldest public park in the United States, Boston Common played an important role in the history of conservation, landscape architecture, military and political history, and recreation in Massachusetts.

As we have explored, Boston's unique character is the result of its rich history, vibrant culture, diverse food scene, robust economy, and distinct neighborhoods. Each of these facets contributes to the city's singular identity, making it unlike any other city in the world.