This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Bronx New York Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, reallocating ownership, and numerous other life circumstances require you to prepare official documentation that differs from state to state.

That is why having it all consolidated in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal forms.

Choose the appropriate subscription plan, then Log In or create an account.

- On this platform, you can effortlessly find and obtain a document for any personal or business purpose used in your area, including the Bronx Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

- Finding templates on the platform is exceptionally straightforward.

- If you already have a subscription to our library, Log In to your account, locate the sample using the search bar, and click Download to save it on your device.

- After that, the Bronx Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased will be accessible for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this straightforward guideline to acquire the Bronx Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

- Ensure you have accessed the correct page for your local form.

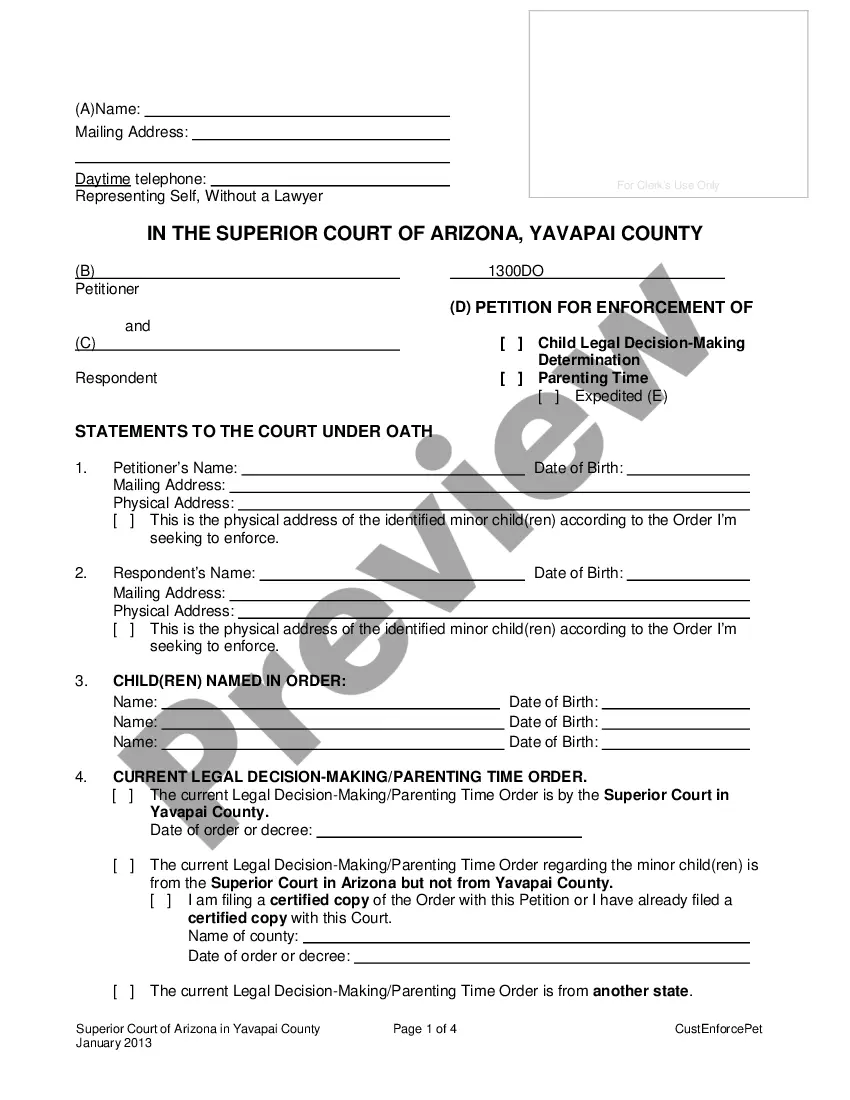

- Utilize the Preview mode (if available) and review the template.

- Examine the description (if any) to confirm the template meets your requirements.

- Look for an alternative document via the search tab if the sample does not suit your needs.

- Click Buy Now once you find the necessary template.

Form popularity

FAQ

For more information about the Tax lien Sale, visit nyc.gov/liensale, or call 311. From outside NYC call 212-NEW-YORK. People with hearing impairments should call TTY: 212-504-4115. For general information about taxes and to pay online please visit the Department of Finance website.

If you don't pay your New York property taxes, you might lose your home to a tax foreclosure. Failing to keep up with the property taxes on your New York home can lead to a tax foreclosure.

Each year, the Department of Finance sells tax liens. If your property has unpaid debt that qualifies for a lien sale, we will sell your lien debt (the amount owed) to an authorized buyer.

In a tax lien sale, the City sells delinquent liens to a single authorized buyer, who does not take title to the property, but does purchase the right to collect the money owed plus interest and fees. Ultimately, if the property owner does not pay, the lien holder may foreclose and the building will be sold at auction.

Property taxes are considered delinquent for purposes of this program under either of the following circumstances: The taxes remain unpaid one year after the last date on which they could have been paid without interest.

Under the existing program, which expires Monday, New York City sells property tax and water debts to private investors for about 75 cents on the dollar, allowing those firms to collect servicing fees as they pursue the money and, potentially, take possession of people's homes.

New York is an average state for tax lien certificates and a good state for tax deed sales, but rules vary and some municipalities have their own sales. New York Tax Lien Auctions are usually in April or August but can vary; New York Tax Deed Sales occur throughout the year.

Generally, when taxes remain unpaid, the taxing authority will eventually sell the lien (and if you don't pay the past-due amount to the lien purchaser, that party can foreclose or use some other method to get title to the home), or sell the property itself in a tax sale.