Riverside California Commercial Space Simple Lease

Description

How to fill out Commercial Space Simple Lease?

Do you require to swiftly generate a legally-enforceable Riverside Commercial Space Simple Lease or perhaps another document to oversee your personal or business affairs.

You have two choices: engage a legal consultant to draft a legal document for you or formulate it entirely by yourself. The encouraging news is, there's a third alternative - US Legal Forms.

To begin, thoroughly check if the Riverside Commercial Space Simple Lease is customized to your state's or county's regulations.

If the document includes a description, ensure you confirm what it is appropriate for.

- It will assist you in obtaining well-written legal paperwork without incurring exorbitant charges for legal services.

- US Legal Forms provides an extensive catalog of over 85,000 state-appropriate document templates, including the Riverside Commercial Space Simple Lease and various form packages.

- We present templates for a multitude of life situations: from divorce documents to real estate forms.

- We've been operating in the industry for more than 25 years and have maintained an impeccable reputation among our customers.

- Here's how you can join them and secure the required document without unnecessary hassles.

Form popularity

FAQ

Rent Per Square Foot xx per square foot of the leased space. This can be expressed either as an annual or a monthly amount: Annual quote: A 2,200 square foot office space is quoted rent of $11.50 per square foot. This works out to 2,200 X $11.50 = $25,300 per year for rent.

How to Calculate Commercial Rent Price Per Square Foot Simplified YouTube Start of suggested clip End of suggested clip Total square feet equals total annual rent. So you multiply the price per square foot by the totalMoreTotal square feet equals total annual rent. So you multiply the price per square foot by the total square footage.

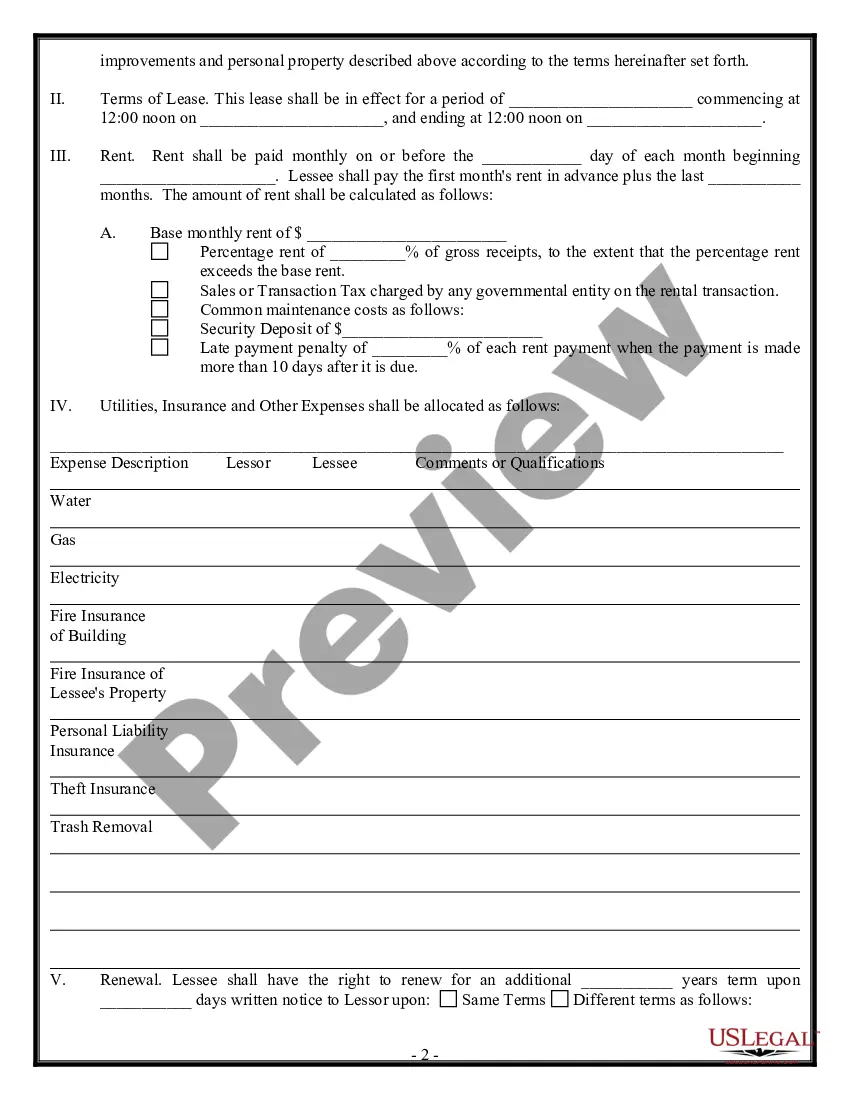

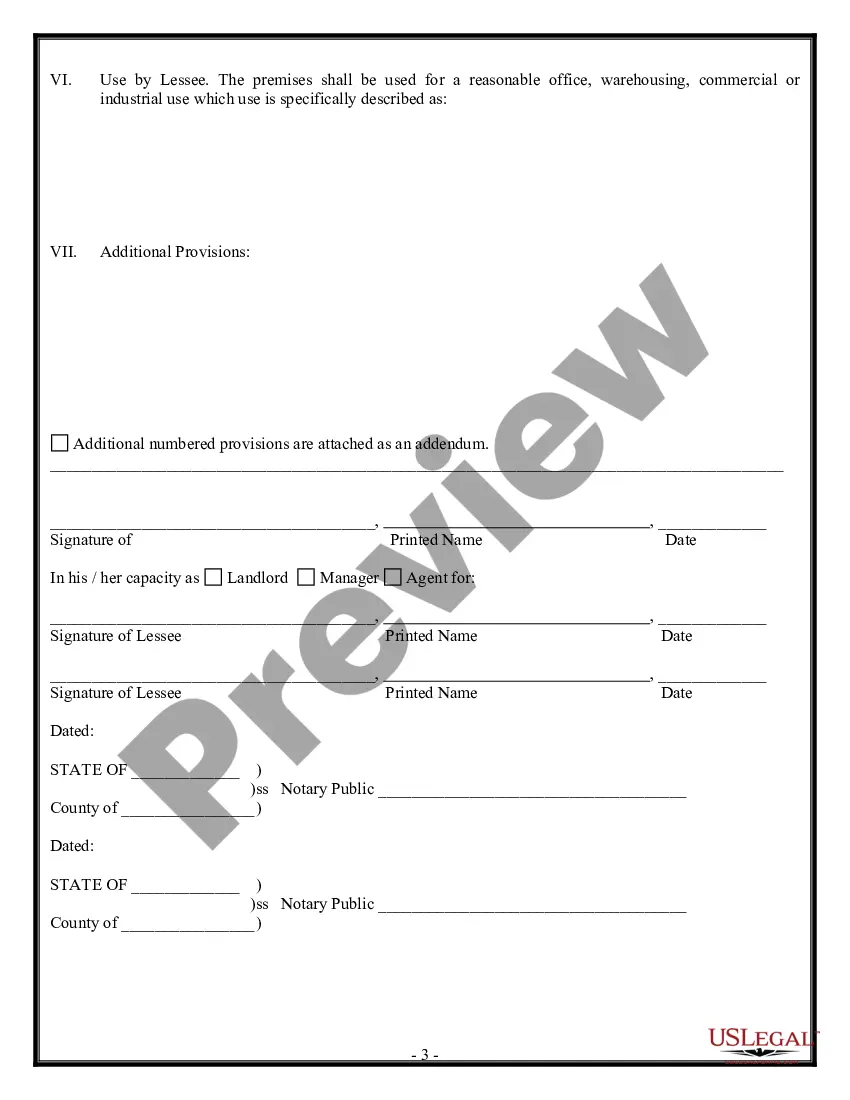

How to Write a Commercial Lease Agreement Step 1 Write the Effective Date. Effective Date.Step 2 Fill in Landlord and Tenant Information.Step 3 Identify Premises.Step 4 Describe Lease Terms.Step 5 Note Rental Terms.Step 6 Choose Tax Option.Step 7 Discuss Past Due Payments.Step 8 Note Security Deposit.

$10 per square foot would be the annual rental rate for the space in question. What you would do you would take the size of the space, multiply it by the $10 per square foot, divide that by 12 and you'll have your monthly rent.

Example: $15/SF In most cases (at least on the east coast of the US) this means you will pay $15.00 per square foot per year. Example: $15 per square foot for 1200 square foot would be calculated $15.00 X 1200 = $18,000 for the year or ($15.00 X 1200)/12 = $1,500 per month.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Tenants pay: Rent and utilities and their pro-rata share of all of the building's operating expenses, including maintenance fees, building insurance, and property taxes.

You will typically see this quoted as an annual rate or a monthly rate. Example with a yearly price per square foot: A 3,000 sf office space has a yearly asking rental rate of $25 per square foot. 3,000 x $25.00 = $75,000 per year for rent. Divide by 12 months to get a monthly rental amount of $6,250.

Your offer letter should always include the following information: The Person Liable for the Lease.Your Business Structure.How Long You Have Been in Business.The Nature of Your Business.Contact Information.Your Proposed Terms (or, Counter Offer)The Length of the Lease. Condition of the Property.

A lease is a contract outlining the terms under which one party agrees to rent an assetin this case, propertyowned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.