King Washington Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

Drafting legal documents is essential in the contemporary world.

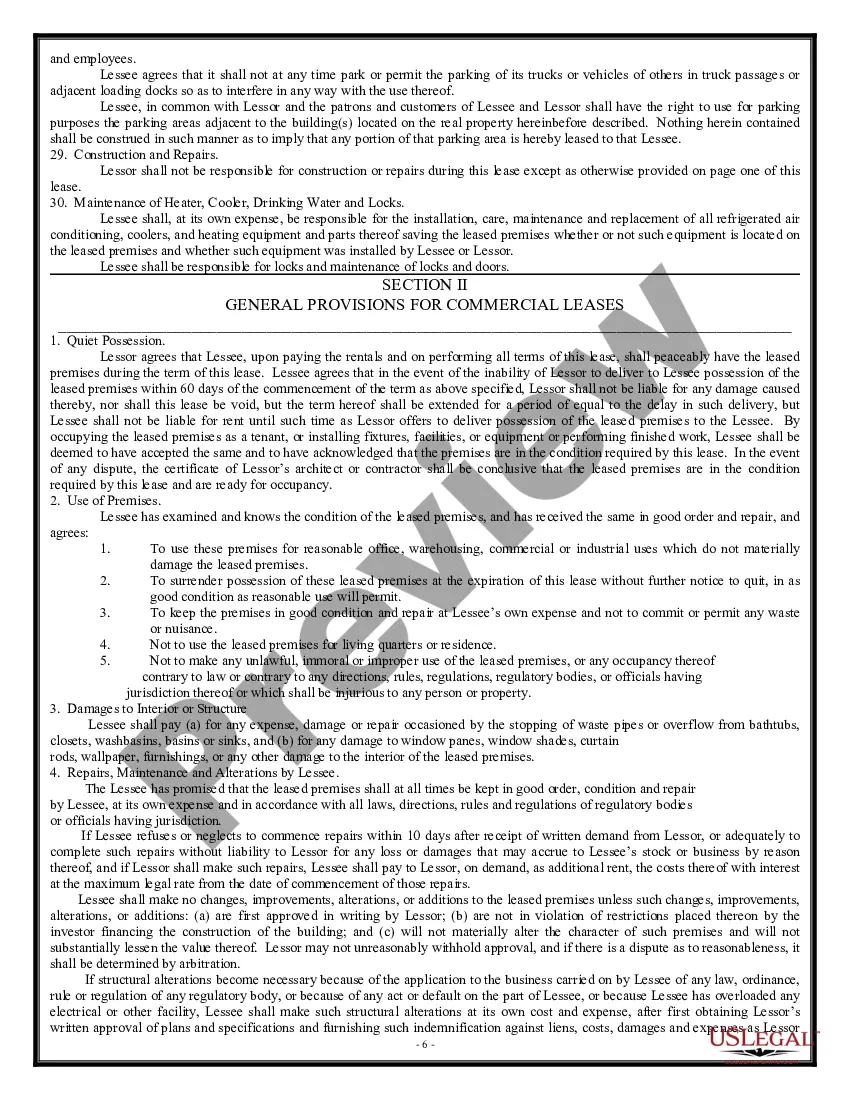

However, you don't always have to seek professional help to create some of them from scratch, such as the King Triple Net Lease for Residential Property, by using a service like US Legal Forms.

US Legal Forms offers more than 85,000 templates to select from across various categories, including living wills, real estate paperwork, and divorce forms. All templates are organized by state, making the search process less annoying.

Go to the My documents tab to re-download the file.

If you're already a member of US Legal Forms, you can find the necessary King Triple Net Lease for Residential Property, Log In to your account, and download it. Undoubtedly, our platform cannot entirely substitute for a legal expert. If you're faced with an exceptionally complex case, we suggest hiring a lawyer to review your document before signing and submitting it.

- Review the document's preview and outline (if available) to understand what you’ll receive after acquiring the form.

- Verify that the document you select is suited to your state/county/region, as state regulations may affect the validity of certain documents.

- Check the associated document templates or restart the search to find the correct file.

- Click Buy now and set up your account. If you already have one, choose to Log In.

- Select the pricing option, then a suitable payment method, and buy King Triple Net Lease for Residential Property.

- Decide to save the form template in any available format.

Form popularity

FAQ

A triple net lease includes property taxes, insurance, and maintenance costs, in addition to the base rent. Tenants may attempt to get out of a triple net lease because of the high costs associated with them, so landlords generally use a bondable net lease.

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

NNN Properties in California are an excellent investment option. They offer greater cash flow, appreciation potential, and diversification. If you're looking for a safe investment that will pay off over time then it's definitely worth considering NNN properties in California!

Real estate subject to a triple net lease is sold on a cap rate based on the creditworthiness of the tenant. The cap rate is the capitalized annual rate of return that the marketplace requires for there to be a purchase of the property.

In general, cap rates tend to vary based on location (and can range anywhere from 4% to 7%, though most tend to be somewhere between 4.8% and 5.25%), according to a few different variables including: Geographical Location.

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

From an investor standpoint, NNN Leases/Triple Net Leases offer a stable long-term real estate investment where the owner/investor has very little to do with the active management of the property. Normally, these leases are with credit worthy tenants with corporate guarantees.

NNN Cap Rate You will see all NNN properties for sale advertised with the cap rate, or capitalization rate, usually between 5.50% and 7.00%. This number is the level of equity return on your investment for a single year. A higher cap rate, which would indicate slightly more risk, typically provides a better ROI.

NNN is a good investment vehicle because it's a source of passive income with minimal responsibilities for the landlord. Tenants also benefit from a lower base rental rate than a gross lease agreement.