This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property

Description

Form popularity

FAQ

Not all renovations count as capital improvements. Routine maintenance activities, such as painting, fixing plumbing leaks, or repairing windows, do not enhance the property’s value in the long term and are considered ordinary repairs. When working on the Supplementation to and Clarification of Contract for the Sale of Real Property in Charlotte, North Carolina, it's important to distinguish these from significant improvements to understand their effect on property assessments. Recognizing these differences can aid in smoother transactions.

Capital improvements in North Carolina generally encompass renovations that improve a structure and its lifespan. This includes things like kitchen remodels, bathroom updates, or adding energy-efficient windows. Understanding what qualifies as a capital improvement is vital when engaging in the Supplementation to and Clarification of Contract for the Sale of Real Property, as it can impact financing and valuation considerations. This knowledge helps you approach buying or selling real estate more confidently.

In North Carolina, a capital improvement is defined as a significant alteration that increases the property's longevity or value. This can include renovations and upgrades that enhance the overall functionality of a property. When drafting the Supplementation to and Clarification of Contract for the Sale of Real Property, knowing what constitutes a capital improvement is crucial for making informed decisions in real estate. Clearing up these terms helps ensure accuracy in contracts.

Capital improvements on a house include structural enhancements that increase the property's value or extend its useful life. Examples include adding a new roof, upgrading the electrical system, or building an addition. In Charlotte, North Carolina, understanding these improvements can help in the context of the Supplementation to and Clarification of Contract for the Sale of Real Property. These enhancements are essential when discussing property value in real estate transactions.

To avoid capital gains tax when selling your primary home, ensure that you meet the ownership and use tests outlined by the IRS. If you have lived in the home for at least two of the five years prior to the sale, you may qualify for the exclusion. Additionally, maintaining good records of capital improvements can also reduce your taxable gain. For comprehensive guidance, the Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property can provide tailored strategies.

In North Carolina, a capital improvement generally refers to any enhancement made to a property that increases its value, extends its life, or adapts it to new uses. Examples include major renovations, additions, or significant upgrades to plumbing and electrical systems. Understanding what qualifies as a capital improvement can be crucial when calculating taxes or selling your home. Referencing the Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property can help clarify these distinctions.

To minimize or avoid capital gains tax when selling a house in North Carolina, you should take advantage of the capital gains exemption for primary residences. This requires living in the home for at least two of the last five years before the sale. Additionally, you can also consider reinvesting in another property. Consulting the Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property can provide you with valuable insights for ensuring compliance and maximizing your benefits.

In North Carolina, the 2 year 5 year rule refers to the period during which certain tax benefits related to real estate transactions apply. Specifically, it addresses the capital gains tax exemptions for homeowners. If you sell your primary residence and meet specific criteria within two of the last five years, you may qualify for this exemption. Understanding this rule is vital as it relates to the Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property.

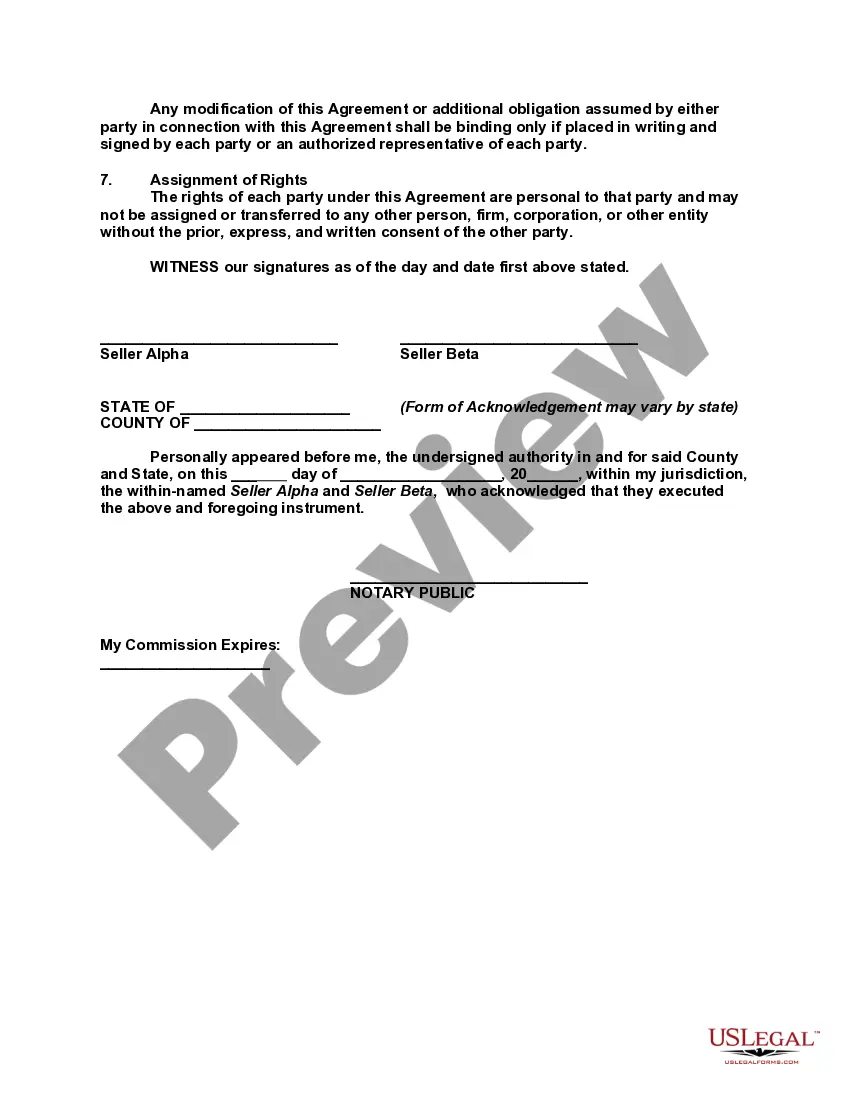

In the context of the Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property, the seller's agreement to the assignment of the contract is essential. Typically, the seller must provide written consent for the assignment to ensure that all parties acknowledge the change. If the seller does not agree, the original buyer may face challenges in transferring their rights. For smooth transactions, it's beneficial to consult a legal form provider like USLegalForms.

The five essential elements of a contract in real estate include offer, acceptance, consideration, competency, and legality. The offer lays the groundwork for the agreement, and acceptance is the acknowledgment by the other party. Consideration represents what is exchanged, while competency confirms that all parties are capable of entering the contract. The legality of the agreement is paramount, especially when dealing with Charlotte North Carolina Supplementation to and Clarification of Contract for the Sale of Real Property, ensuring that all elements are lawful and enforceable.