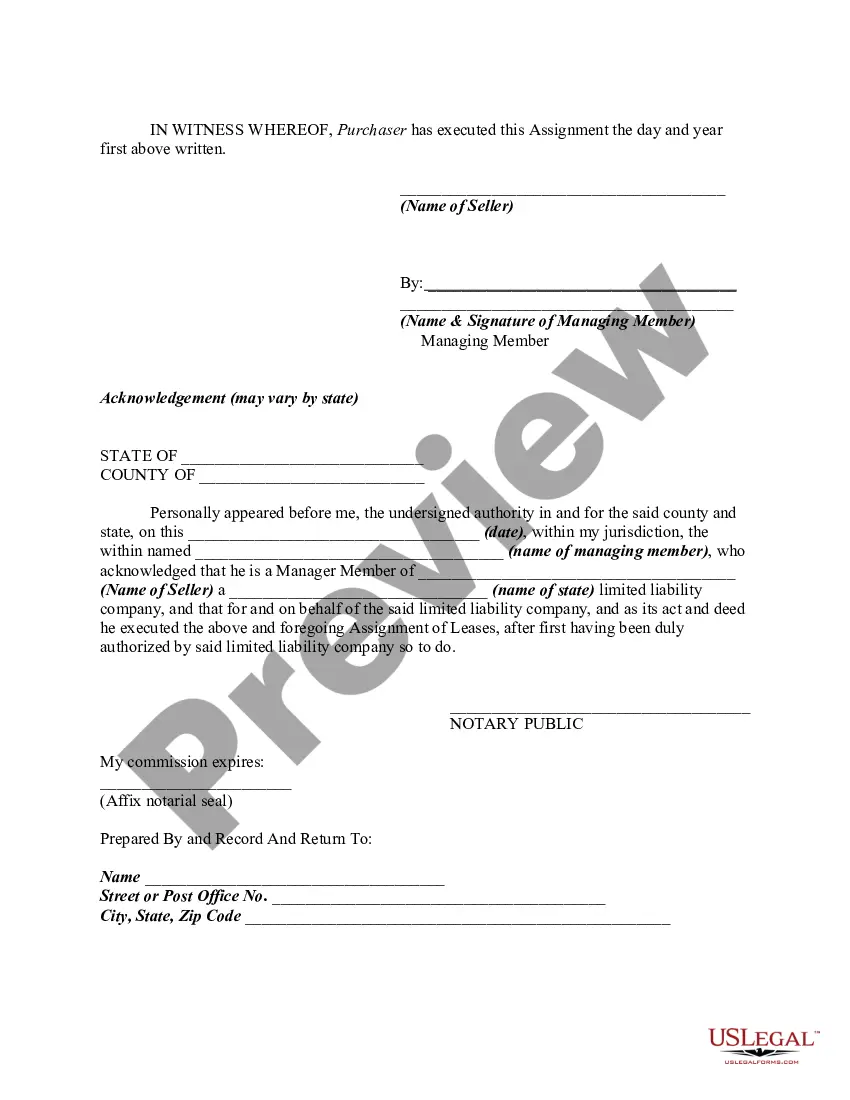

This document assigns specific leases on the property as well as any leases that are not specifically named. This is an outright assignment as opposed to a collateral assignment. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Bexar Texas Assignment of General and Specific Leases

Description

How to fill out Bexar Texas Assignment Of General And Specific Leases?

Do you need to quickly create a legally-binding Bexar Assignment of General and Specific Leases or probably any other document to manage your personal or corporate affairs? You can select one of the two options: hire a legal advisor to write a valid document for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Bexar Assignment of General and Specific Leases and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Bexar Assignment of General and Specific Leases is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the document isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Bexar Assignment of General and Specific Leases template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the documents we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Texas law allows for reduced property taxes if you meet certain requirements....Claim All Texas Property Tax Breaks to Which You're Entitled Basic homestead exemption.Senior citizens and disabled people.Disabled veterans.Veteran's surviving spouse.

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

The Bexar County Appraisal District is responsible for accurately valuing the houses in Bexar County. Overall, the average, or an ideal fair market value, should be extremely close to 100%. This is also called the median. The median is what defines the middle value.

What Is a Texas Homestead Exemption? At its core, a Texas homestead exemption is basically a tax break for qualifying homeowners. It's one of the many perks of buying and owning a home in the Lone Star State. A homestead exemption allows you to write down your property value, so you don't get taxed as much.

Texas Homestead Exemption Explained - How to Fill- YouTube YouTube Start of suggested clip End of suggested clip So you would start with google.com. You go in the search bar and you're going to put hcad dot orgMoreSo you would start with google.com. You go in the search bar and you're going to put hcad dot org hcad means harris county appraisal district. So you click on that.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

Do I apply for a homestead exemption annually? Only a one-time application is required, unless by written notice, the Chief Appraiser requests the property owner to file a new application. However, a new application is required when a property owner's residence homestead is changed.

How to Fill Out Homestead Exemption Form Texas - YouTube YouTube Start of suggested clip End of suggested clip First you must own and reside in your home on January 1 of the tax year and cannot claim homesteadMoreFirst you must own and reside in your home on January 1 of the tax year and cannot claim homestead exemption on any other property in the state of Texas. This means let's say if you lived in your home

Effective for tax year 2019, persons with a residence homestead are entitled to a $5,000 exemption of the assessed valuation of their home.

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.