Columbus Ohio Sample Letter for Revised Release and Reference to Settlement Proceeds

Description

Form popularity

FAQ

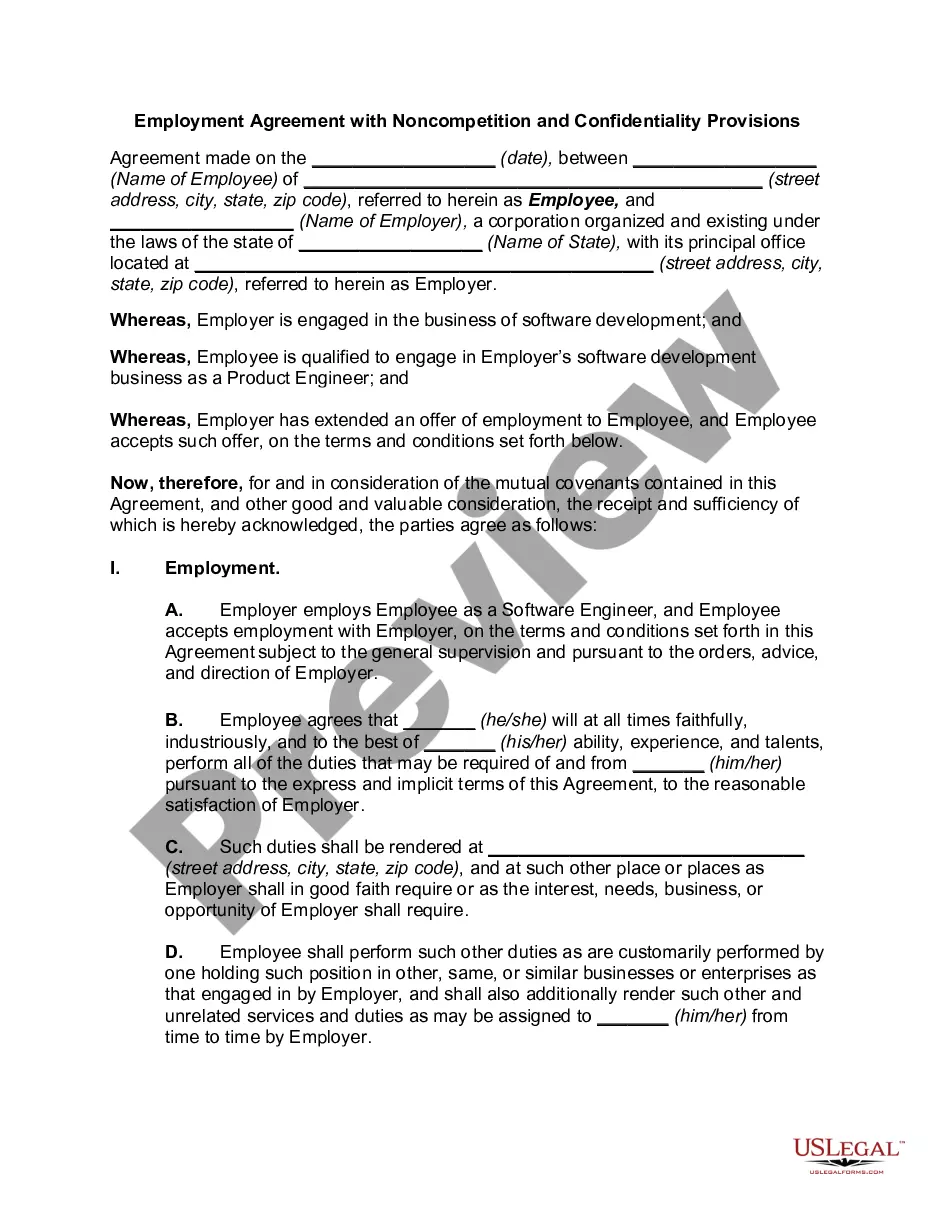

An example of a settlement offer letter includes a formal introduction, a detailed explanation of the issue, and the proposed settlement terms. You should clearly state the amount you are offering and the rationale behind it, while remaining open to negotiation. For a professional touch, review the Columbus Ohio Sample Letter for Revised Release and Reference to Settlement Proceeds, which can serve as a reference for writing your own comprehensive and effective settlement offer.

When writing a letter for a settlement amount, clearly specify the proposed figure and justify why this amount is reasonable. Include any documentation or evidence that supports your claim, and make sure to outline all terms. It’s essential to be clear about the payment timeline and confirm that both parties agree. Utilizing the Columbus Ohio Sample Letter for Revised Release and Reference to Settlement Proceeds can enhance the professionalism and clarity of your letter.

To write a settlement letter, begin by formally addressing the recipient and introducing the purpose of the letter. Include details about the case or dispute, followed by the proposed settlement terms. Clearly articulate what you expect in return, making sure to stay concise and direct. For inspiration, refer to the Columbus Ohio Sample Letter for Revised Release and Reference to Settlement Proceeds, which provides a solid framework for effective settlement letters.

Writing a letter of payment settlement involves clearly stating the agreement between parties regarding the terms of the payment. Start by including your contact information, the date, and the recipient's contact information. Outline the details of the settlement, specifying the amount, payment due dates, and any relevant terms. For a reliable format, you might consider the Columbus Ohio Sample Letter for Revised Release and Reference to Settlement Proceeds to guide your structure and content.

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.

1. WHO SHOULD FILE THIS RETURN: a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis- ter and report income with the Ohio City Tax Office. b) High School Students 18 years of age and under, working part time, do not have to register with the Ohio City Tax Office.