Columbus Ohio Sample Letter for Abstract of Judgment

Description

Form popularity

FAQ

An abstract of judgment sent to doc refers to the formal transmission of the abstract to the relevant court or agency for recording. This action ensures that the judgment is publicly accessible and enforceable. For individuals in Columbus, Ohio, having a Columbus Ohio Sample Letter for Abstract of Judgment can simplify this process, providing a clear template for necessary documentation.

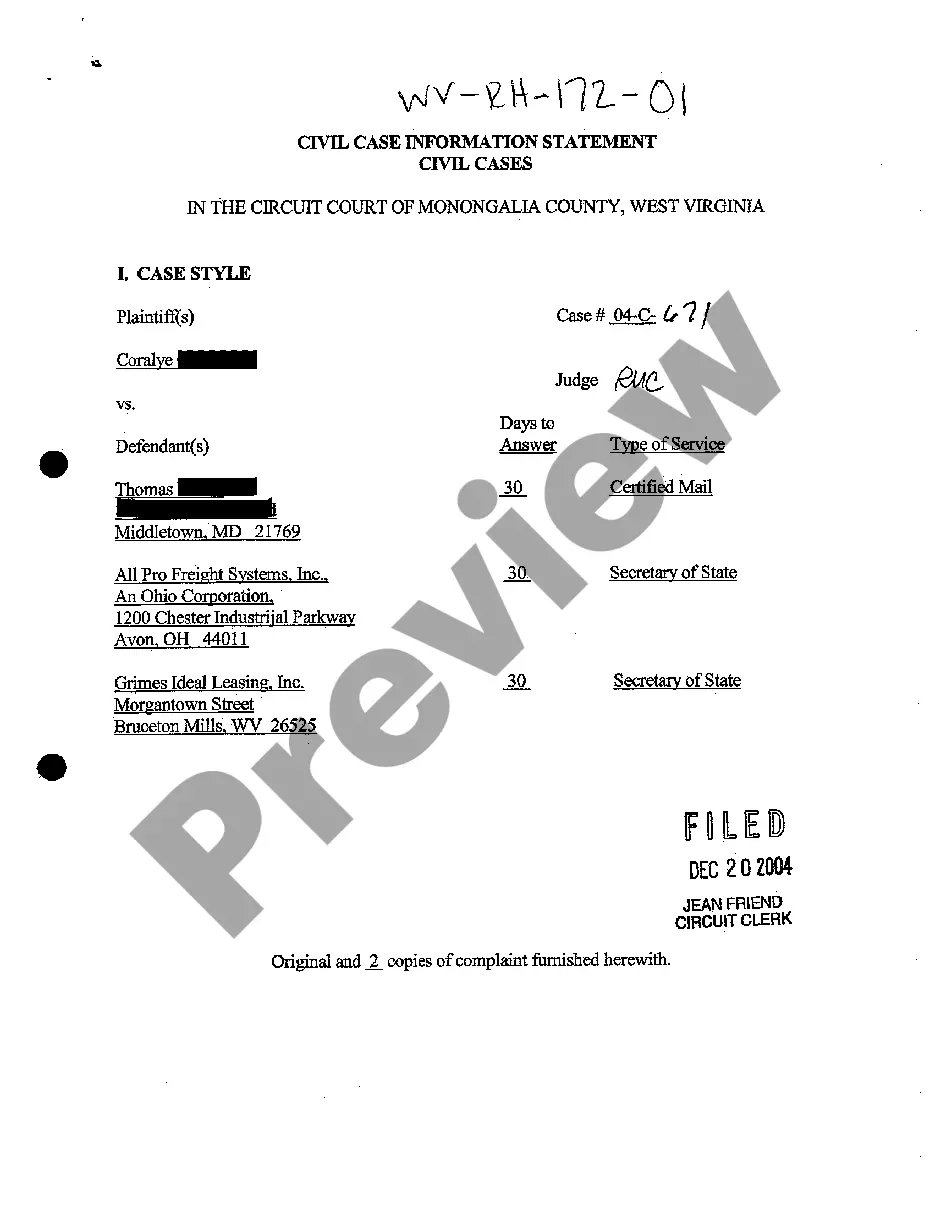

An abstract of judgment is a legal document that summarizes a court's decision regarding a financial obligation. It serves to record the details of the judgment, including the parties involved, the amount owed, and the date of the judgment. In Columbus, Ohio, utilizing a Columbus Ohio Sample Letter for Abstract of Judgment can help you create an official document that meets local legal standards.

To appeal a judgment in Ohio, you must file a notice of appeal with the appropriate court within a specified timeframe, typically 30 days from the judgment date. After filing, gather the necessary documentation, including the trial transcript and your Columbus Ohio Sample Letter for Abstract of Judgment. Using uslegalforms can streamline your preparation, ensuring you present your case effectively.

A certificate of judgment in Ohio is a formal document that confirms the existence of a court judgment against a debtor. It serves as official proof which can be used to enforce the judgment, particularly if the debtor has property in the state. If you need help creating a Columbus Ohio Sample Letter for Abstract of Judgment to support your claim, platforms like uslegalforms can provide valuable templates.

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.

1. WHO SHOULD FILE THIS RETURN: a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis- ter and report income with the Ohio City Tax Office. b) High School Students 18 years of age and under, working part time, do not have to register with the Ohio City Tax Office.