Bronx New York Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

Whether you intend to launch your business, engage in a transaction, request your ID amendment, or tackle family-related legal matters, you must prepare particular documentation that complies with your local statutes and regulations.

Finding the appropriate documents may require considerable time and energy unless you utilize the US Legal Forms library.

The platform offers users over 85,000 expertly crafted and verified legal templates for any personal or commercial situation. All documents are organized by state and area of application, making it quick and easy to select a document like the Bronx Certificate of Trust for Successor Trustee.

Documents provided by our library are reusable. With an active subscription, you can access all of your previously purchased documents at any time in the My documents section of your profile. Stop expending time on an endless quest for current formal documents. Register for the US Legal Forms platform and manage your paperwork effectively with the most extensive online form repository!

- Ensure the template aligns with your personal needs and state law standards.

- Examine the form description and review the Preview if available on the page.

- Use the search option above for your state to locate another template.

- Press Buy Now to acquire the document when you locate the appropriate one.

- Choose the subscription plan that best suits your needs to continue.

- Log in to your account and process the payment using a credit card or PayPal.

- Download the Bronx Certificate of Trust for Successor Trustee in your desired file format.

- Print the document or fill it out and sign it electronically via an online editor to save time.

Form popularity

FAQ

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.

A successor trustee is the person or institution that takes control of the trust assets when the original trustee dies, resigns, or becomes incapacitated. A successor trustee's primary objective is to properly administer the trust assets according to the trust's terms and in keeping with fiduciary standards.

Generally, a successor trustee cannot change or amend a trust. Most trusts are initially managed by their creator or original trustee, while they are still alive and competent. But after their passing, a successor trustee must step in to take legal title to assets and administer the trust according to its terms.

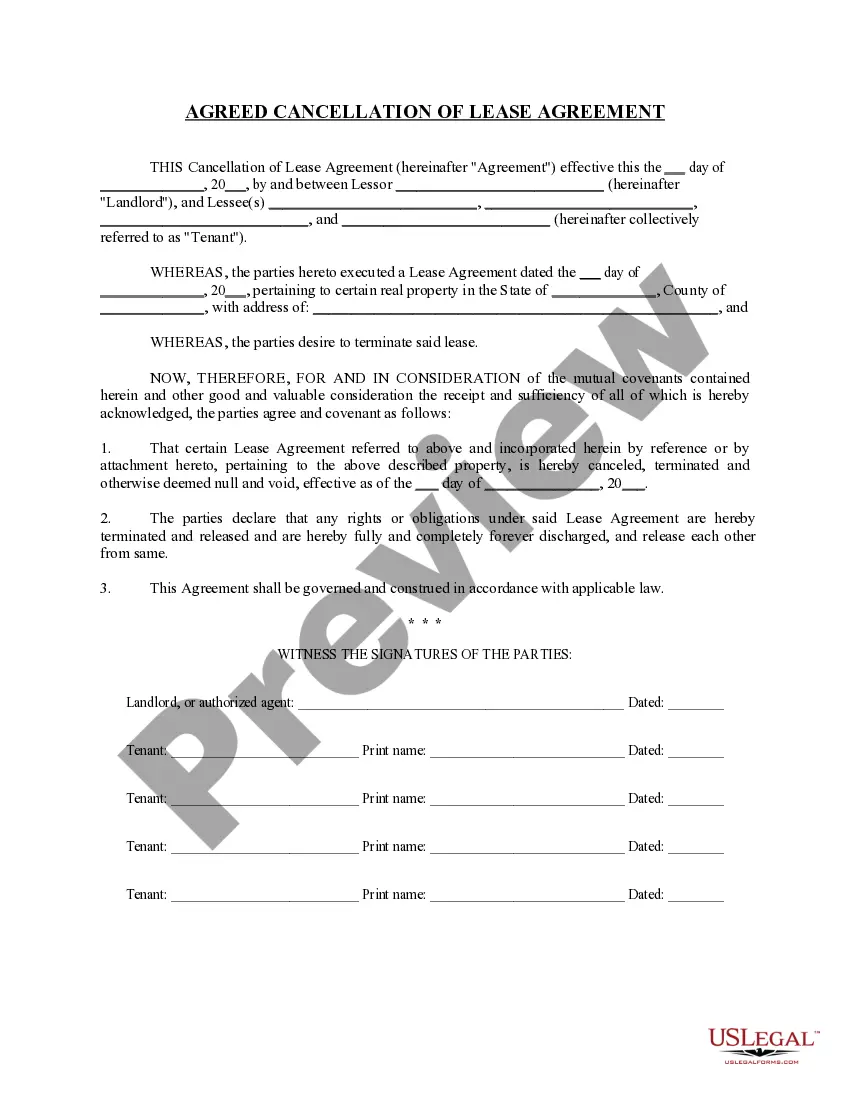

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

Unlike wills that are admitted to probate, trusts are not part of public records. If you are a beneficiary to a trust, to obtain a copy, you will need to contact the trustee by making a written request. Another way is to have another beneficiary get you a copy.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.

As a Trust, you need to prepare the Trust Deed on stamp paper.In addition to this, you need to pay a fee of Rs.Once you submit the papers, you can collect a certified copy of the Trust Deed within one week's time from the registrar's office.

A Trustee and Successor Trustee have a similar responsibility, but on a different timeline. As soon as a Trust is created, a Trustee is placed in charge of any property within the Trust. They become the legal owner of its assets, and they must act in accordance with the Declaration of Trust.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

An executor operates under the supervision of the probate court. A successor trustee is answerable to the beneficiaries of the trust.