Hennepin Minnesota Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

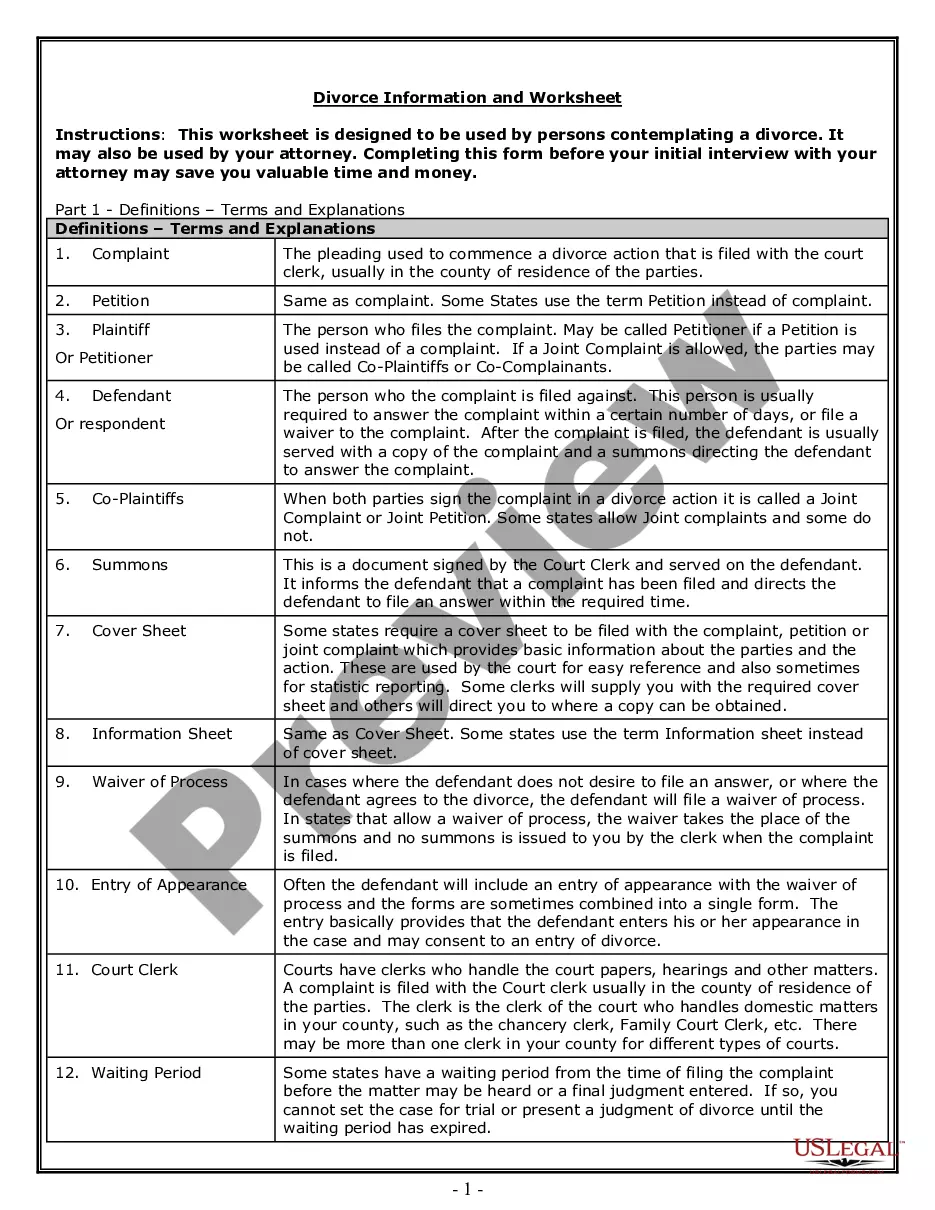

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Do you require to swiftly compose a legally-enforceable Hennepin Complaint Against Drawer of Check that was Rejected Due to Lack of Sufficient Funds (Bad Check) or perhaps another document to manage your personal or business matters.

You can opt for one of two choices: reach out to an expert to create a legitimate document for you or construct it entirely by yourself. Fortunately, there exists a third option - US Legal Forms.

To begin with, ensure that the Hennepin Complaint Against Drawer of Check that was Rejected Due to Lack of Sufficient Funds (Bad Check) is compliant with your state’s or county’s laws.

If the document includes a description, confirm what it is intended for. If the document isn’t what you were searching for, start your search anew by using the search bar located in the header.

- It will assist you in obtaining professionally crafted legal paperwork without incurring exorbitant fees for legal assistance.

- US Legal Forms offers an extensive collection of over 85,000 state-compliant document templates, encompassing Hennepin Complaint Against Drawer of Check that was Rejected Due to Lack of Sufficient Funds (Bad Check) and various form packages.

- We provide documents for a wide array of purposes: from divorce papers to real estate document templates.

- We have been in operation for over 25 years and have established a strong reputation among our clientele.

- Here's how you can become one of our satisfied customers and secure the necessary document without unnecessary hassle.

Form popularity

FAQ

Go in person to your local bank and ask to have the fee removed from your account and ask your bank to write a letter to the person who you wrote the bounced check to state that your were not responsible for the check bouncing.

Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony. The exact penalty depends on the amount and the state in which the check is written.

If your financial institution doesn't cover the check, it bounces and is returned to the depositor's bank. You'll likely be charged a penalty for the rejected check; this is a nonsufficient funds fee, also known as an NSF or returned item fee.

Since banks are not required to physically examine every check, companies may be held liable for all or a substantial portion of any given loss - even if the bank did not verify the signature on a fraudulent check.

It is also a crime to forge a check or write a fake check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items. Depository banks attempt to deposit checks twice before being considered dishonored.

So, can you go to jail for cashing a bad check? Yes; you can face criminal check fraud charges if you knowingly cash a bad check. If the value of the check is significant, then you might even get convicted of a felony offense.

How Do You Recover Money From a Bounced Check? As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.

Inform them that their check has bounced and see if they can use an alternative payment method, like a money order. Most checks have the person's name, address and phone number on them, so it should be relatively easy to contact the check writer.

In the United States, check kites are prosecuted under Title 18, U.S. Code Section 1344, which is defined as obtaining the funds of a federal bank under false pretenses. In effect, a check kite is obtaining an interest-free loan from a bank without the bank's knowledge.