Broward Florida Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

Preparing documents for business or personal needs is always a significant obligation.

When forming a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state laws and regulations pertinent to the specific region.

Nonetheless, small counties and even municipalities also have legislative regulations that must be taken into account.

To find the one that suits your needs, use the search tab in the page header.

- All these factors make it stressful and time-consuming to draft a Broward Multistate Promissory Note - Secured without professional help.

- It is possible to avoid incurring expenses for attorneys to draft your paperwork and create a legally valid Broward Multistate Promissory Note - Secured independently, using the US Legal Forms online library.

- This is the largest digital collection of state-specific legal documents that are professionally verified, ensuring their validity when selecting a sample for your county.

- Previously registered users just need to Log In to their accounts to retrieve the needed form.

- If you still lack a subscription, follow the step-by-step guide below to obtain the Broward Multistate Promissory Note - Secured.

- Browse through the page you've accessed and check if it includes the document you need.

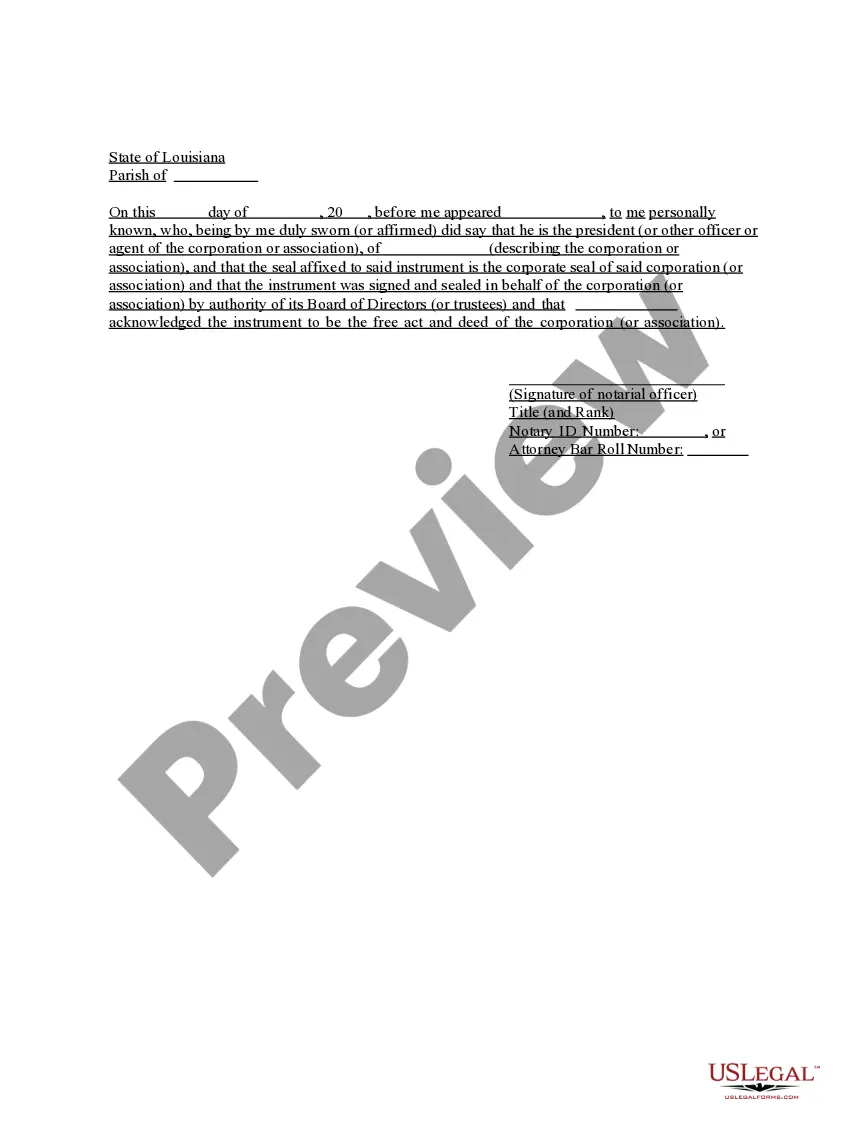

- Utilize the form description and preview if these features are available to achieve this.

Form popularity

FAQ

An unsecured promissory note is one that is not secured by any collateral. With this type of promissory note, the maker borrows money from the holder without relinquishing any interest in his property.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

The borrower agrees to pay a certain amount of money (which may include interest on principle), in installments, on demand or in full at a specified time. Today's promissory notes usually fall into two camps: secured and unsecured.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

While a promissory note is not typically a negotiable instrument as defined in the UCC, it is intended to be and is codified as an instrument that can be easily transferred by the lender to a third party.

BORROWER'S PROMISE TO PAY.INTEREST.PAYMENTS.BORROWER'S RIGHT TO PREPAY.LOAN CHARGES.BORROWER'S FAILURE TO PAY AS REQUIRED.GIVING OF NOTICES.OBLIGATIONS OF PERSONS UNDER THIS NOTE.More items...