Irvine California Option For the Sale and Purchase of Real Estate - General Form

Description

Form popularity

FAQ

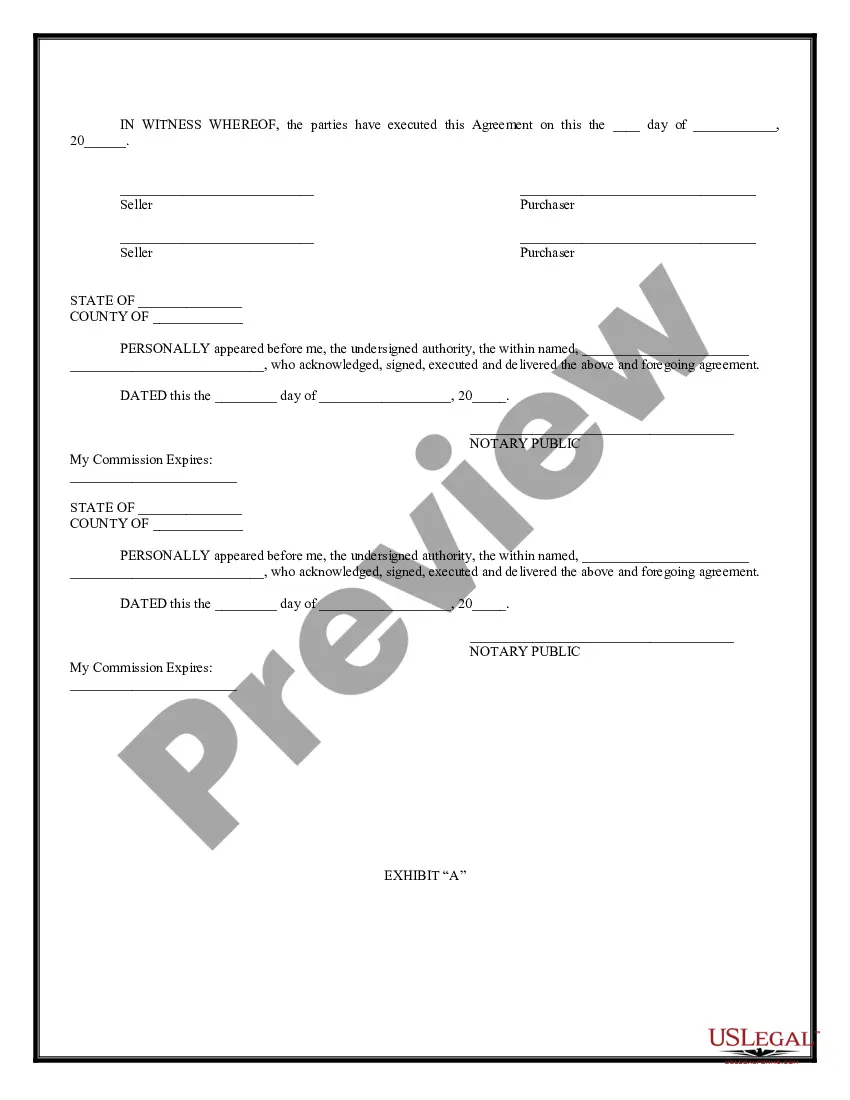

In most cases, an offer to purchase does not need to be notarized to be valid in California. However, notarization can add an extra layer of authenticity and may be required in some situations. If you are unsure about the requirements for the Irvine California Option For the Sale and Purchase of Real Estate - General Form, consult with a legal professional or refer to resources available on uslegalforms.

You can obtain an offer to purchase form from various sources, including real estate websites and legal document platforms. For the Irvine California Option For the Sale and Purchase of Real Estate - General Form, uslegalforms provides templates that are easy to customize and comply with California laws. This ensures you have a reliable document tailored to your needs.

NC form 580 T is a specific document used in North Carolina real estate transactions, which may not directly relate to the Irvine California Option For the Sale and Purchase of Real Estate - General Form. This form is typically utilized for real estate disclosures. If you need a form for transactions in California, consider looking at state-specific documents that meet your needs.

Yes, you can submit an offer without a realtor when using the Irvine California Option For the Sale and Purchase of Real Estate - General Form. This approach allows you to have more control over the transaction. However, ensure that you understand the legal requirements and procedures involved, as they can be complex.

Yes, you can write your own purchase agreement for the Irvine California Option For the Sale and Purchase of Real Estate - General Form. However, it is crucial to ensure that the agreement includes all necessary legal elements to protect your interests. If you're unsure about the process, consider using a template from a reputable platform like uslegalforms to guide you.

The 3-3-3 rule in real estate refers to a guideline for evaluating property investments. It suggests that potential buyers should analyze the property's condition, location, and market trends over three months, three years, and three decades. This method helps you assess the potential growth and risks associated with your investment. When considering the Irvine California Option For the Sale and Purchase of Real Estate - General Form, understanding this rule can guide your decision-making process.

CA form 593, which addresses withholding on real estate transactions, is offered by the California Franchise Tax Board. To access this form, you can visit their official website or utilize the Irvine California Option For the Sale and Purchase of Real Estate - General Form for guidance. Our platform at uslegalforms provides templates and resources that can help you obtain and understand CA form 593.

To determine if you are subject to California withholding, first review the conditions set forth by the state regarding the sale or purchase of real estate. If you are selling property in California and are not a resident, you likely need to comply. It is essential to understand these requirements through the Irvine California Option For the Sale and Purchase of Real Estate - General Form. For more assistance, you can utilize resources available on the uslegalforms platform.

California Form 590 needs to be completed by sellers or buyers who wish to claim an exemption from withholding based on specific criteria. Individuals who qualify under certain exemptions must ensure that this form is filled out correctly to avoid unnecessary tax deductions during the sale. When preparing this documentation, leveraging the Irvine California Option For the Sale and Purchase of Real Estate - General Form can streamline your process and help ensure compliance.

The seller of the California real estate is primarily responsible for withholding tax if they are a non-resident. The withholding serves as a means to collect tax from the seller before the sale is finalized. Buyers may also play a role in ensuring that this requirement is fulfilled, especially in complicated sales. For assistance, the Irvine California Option For the Sale and Purchase of Real Estate - General Form can provide clarity and structure.