Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home

Description

Form popularity

FAQ

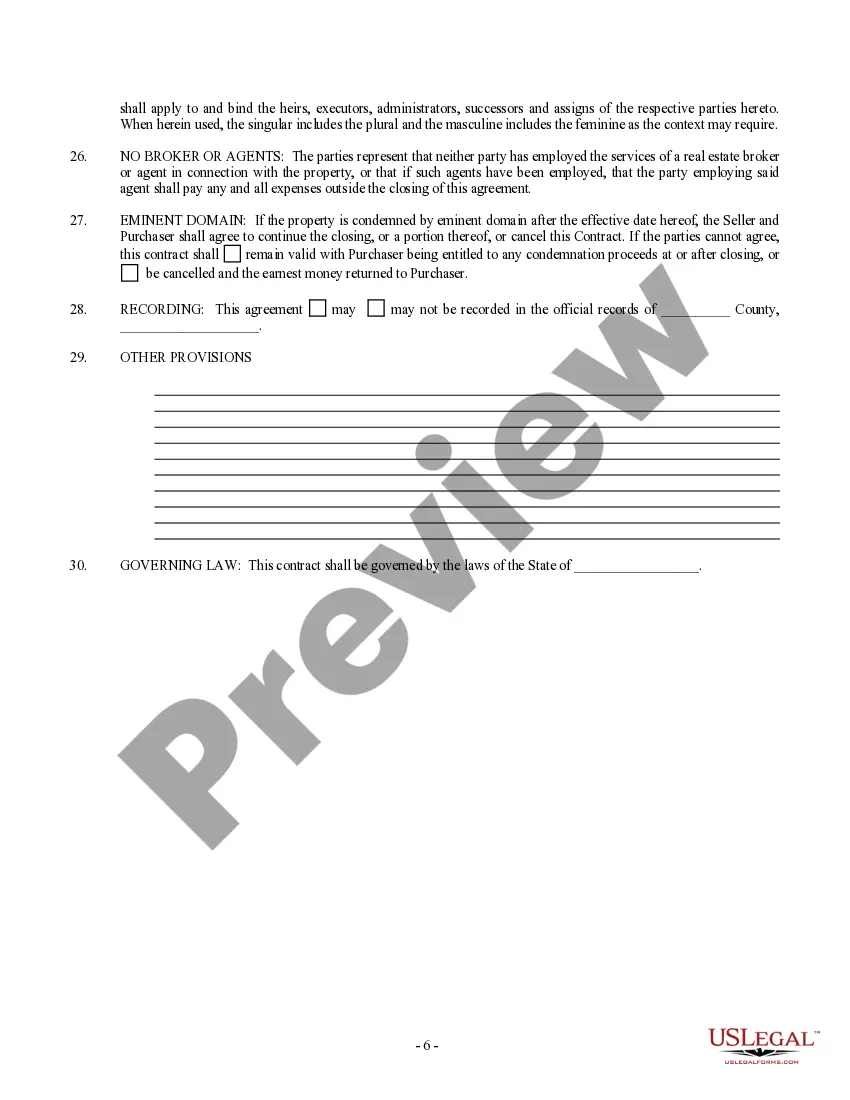

To write a simple agreement, start with a clear title that states the purpose of the document. Then, list the parties involved, followed by the key terms and conditions related to the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home. Ensure all points are concise and easily understandable. Using platforms like uslegalforms can make this process even smoother by providing you with easy-to-follow templates.

Yes, Arizona typically requires a buyer broker agreement, particularly when working with a real estate agent. This agreement establishes the relationship between the buyer and the agent, ensuring clear communication and obligations regarding the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home. Consult with a local expert or use uslegalforms to access specific templates that comply with Arizona regulations.

To draft an agreement, start by clearly outlining the terms and conditions that both parties agree upon. It is essential to include details such as the names of the parties involved, a description of the property, and any stipulations for the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home. You may choose to use templates available on platforms like uslegalforms to ensure you cover all necessary aspects.

In Chandler, Arizona, the transaction privilege tax rate is typically around 6.3%, combining state and local fees. This tax applies to sales of goods and services, including those related to residential real estate. When working through the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, it is essential to factor this tax into your transaction costs.

The transaction privilege tax rate in Arizona varies by city and county, with rates generally ranging from 5.6% to 8.6%. Many cities have their own additional sales taxes. When considering the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, understanding these rates can help you budget for any applicable taxes.

The Primary Tax Effective (PTE) tax rate in Arizona can vary based on the type of business and location. Typically, the rates can range from 2.5% to 5.6% depending on the jurisdiction. If you're engaged in the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, it is wise to consult a tax professional for specific information relevant to your situation.

Yes, an Arizona transaction privilege tax license is necessary for businesses selling goods or services, including those in real estate. This license ensures that you adhere to local tax laws and regulations. If you're exploring the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, obtaining this license is an important step.

To apply for an Arizona TPT license, you can complete the process online through the Arizona Department of Revenue's website. Gather your business details, including entity formation documents, and submit the application. Once approved, you can confidently move forward in the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home.

Arizona does not have a specific transfer tax on real estate transactions. However, local counties or municipalities may impose fees or taxes on sales. When engaging with the Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, it is essential to check local regulations to ensure full compliance.

Yes, if you sell goods or services in Arizona, you likely need a Transaction Privilege Tax (TPT) license. This applies to various businesses, including those involved in residential real estate transactions. For those interested in Chandler Arizona Option For the Sale and Purchase of Real Estate - Residential Home, having this license is crucial for compliance.