Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Relocation Agreement Between Employer And Employee Regarding Moving Expenses?

Organizing documentation for the enterprise or personal requirements is always a significant duty.

When formulating an agreement, a public service application, or a power of attorney, it's crucial to consider all national and state regulations and guidelines of the particular area.

Nonetheless, smaller counties and even towns have legislative processes that you must take into account.

Ensure that the template meets legal standards and click Buy Now. Choose a subscription plan, then Log In or register for an account with the US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the selected document in your desired format, print it, or fill it out electronically. The advantage of the US Legal Forms library is that all the documents you've ever acquired never get misplaced - you can access them in your profile within the My documents tab at any time. Join the platform and swiftly attain validated legal forms for any situation with just a few clicks!

- All these factors make it stressful and time-consuming to prepare a Chicago Relocation Agreement between Employer and Employee Regarding Moving Expenses without expert assistance.

- It is feasible to save money on lawyers drafting your documents and create a legally binding Chicago Relocation Agreement between Employer and Employee Regarding Moving Expenses by yourself, utilizing the US Legal Forms online library.

- It is the largest digital repository of state-specific legal paperwork that is professionally validated, ensuring their legitimacy when selecting a sample for your locality.

- Previously subscribed users simply need to Log In to their accounts to download the required document.

- If you do not yet have a subscription, follow the detailed instructions below to obtain the Chicago Relocation Agreement between Employer and Employee Regarding Moving Expenses.

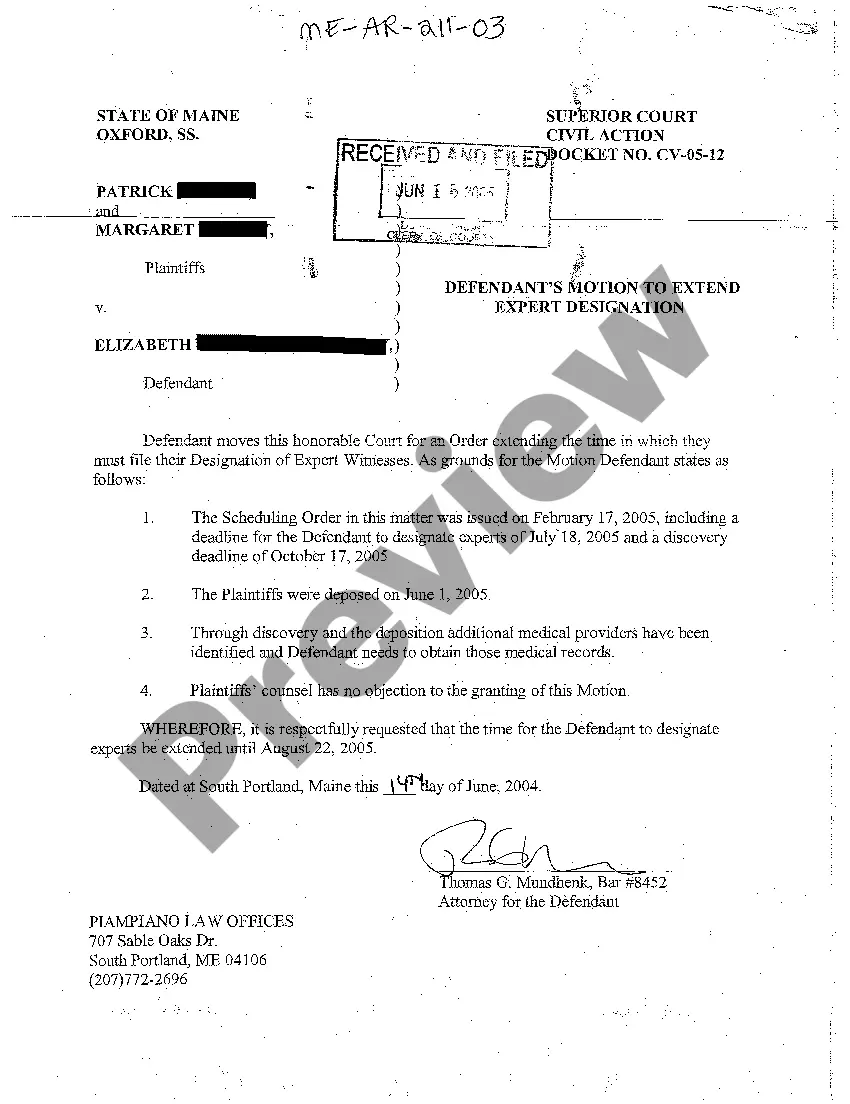

- Review the page you've accessed and verify if it contains the sample you require.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Yes, moving expenses for job relocation can be tax deductible, depending on specific criteria. You must meet certain requirements to qualify for deductions on your moving costs, as outlined by the IRS. Use the Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses to help clarify what expenses you can deduct. This guide not only assists you in understanding eligibility but also helps you navigate the claims process effectively.

Form 3903 is a document used by taxpayers to deduct certain moving expenses related to job relocation. This form helps you report the costs incurred while relocating for work, including expenses directly connected to your move. To benefit from the Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses, understanding this form is essential. It ensures you maximize your deductions and comply with IRS regulations.

An example of relocating includes an employee moving to a new city for a job promotion, which may require them to change their residence to a different location. This process often involves not just the physical move, but also adjusting to a new community and possibly incurring various expenses. A well-defined Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses can help streamline this transition by clearly outlining financial support and logistics involved in the relocation.

The relocation clause in an employment agreement identifies the conditions under which an employee may be required to relocate for work. This clause typically addresses the employer's responsibilities for covering moving expenses, temporary housing, and additional support. It’s vital for employers and employees alike to understand the implications of this clause, especially when negotiating a Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses.

An example of a relocation clause might state that the landlord can relocate the tenant with a 60-day notice if needed for renovations or other business needs. The clause may also specify that the landlord must cover reasonable moving costs incurred by the tenant. This type of clause becomes increasingly relevant in a Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses, as both parties need clear guidelines to ensure a seamless transition.

A relocation clause is a legal provision that stipulates the terms and conditions under which an individual or organization may be required to move from one location to another. This clause often includes details about notice periods, costs associated with the move, and the provision for related expenses. For both employers and employees, navigating a Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses can clarify responsibilities and expectations around relocations.

A relocation clause in a commercial lease is a provision that allows a landlord to relocate a tenant to a different space within the same property or to another property altogether. This clause typically outlines the conditions under which the tenant can be moved, including notice periods and potential financial responsibilities. Understanding this clause is crucial, especially in terms of logistics, as it impacts both the tenant's operations and costs. When considering a Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses, it's important to think about how such a clause might affect work spaces.

You may be able to deduct moving expenses if you relocated for work, but it largely depends on your specific situation. The IRS provides criteria regarding whether your move qualifies, often related to distance and time. Additionally, the Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses may outline what expenses your employer can reimburse. You should consult a tax professional or utilize resources like uslegalforms to understand eligibility and process your deduction properly.

Relocation contracts are generally enforceable if they are properly drafted and meet legal requirements. The Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses serves as a formal contract, outlining the obligations of both parties. To ensure enforceability, make sure the agreement includes essential details, such as terms of relocation and any repayment conditions.

Repayment agreements can be enforceable, provided they comply with relevant laws and include clear terms. In the context of a Chicago Illinois Relocation Agreement between Employer and Employee Regarding Moving Expenses, both parties must agree on the conditions for repayment. For added assurance, consider consulting a legal expert to discuss the implications.