Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet

Description

Form popularity

FAQ

Failing to file local taxes in Pennsylvania can result in penalties and interest on any unpaid taxes. This noncompliance might also complicate future tax filings or lead to collection actions. To avoid these issues, it's advisable to utilize services like uslegalforms which can guide you through the filing process, incorporating information from documents such as the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet.

Certain individuals can be exempt from the Pittsburgh local services tax, including those earning below a specific income threshold. Additionally, exemptions may apply to specific occupations or statuses. For clarity on your situation, consulting resources like the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet can provide valuable insights.

To calculate Allegheny County taxes, you need to consider various factors including your income level and any applicable deductions. The county’s tax office provides resources and tools to assist in your calculations. Additionally, the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet can serve as a useful tool to summarize your estimated tax obligations.

The Local Services Tax (LST) in Pittsburgh is a tax levied on individuals working within the city. It's designed to help fund local services such as public safety and infrastructure. If you're unsure about the specifics, the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet can guide you in understanding your LST obligations.

Yes, if you live or work in Pittsburgh, you must file local taxes. This requirement is essential to maintain your tax standing and comply with city regulations. For assistance, consider utilizing platforms like uslegalforms to navigate your obligations, ensuring you have the necessary documents, such as a Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet.

The local tax in Pittsburgh PA primarily includes the Earned Income Tax and the Local Services Tax. The Earned Income Tax is collected on wages and net profits, while the Local Services Tax is applicable to those who work within city limits. Understanding these taxes, along with the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet, can help you stay informed about your financial obligations.

To register for payroll expense tax in Pittsburgh, you need to fill out the necessary forms provided by the City of Pittsburgh. Visit the city’s website or contact their finance department for specific details. This registration is critical to maintain compliance and access useful resources, like the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet, to help manage payroll costs effectively.

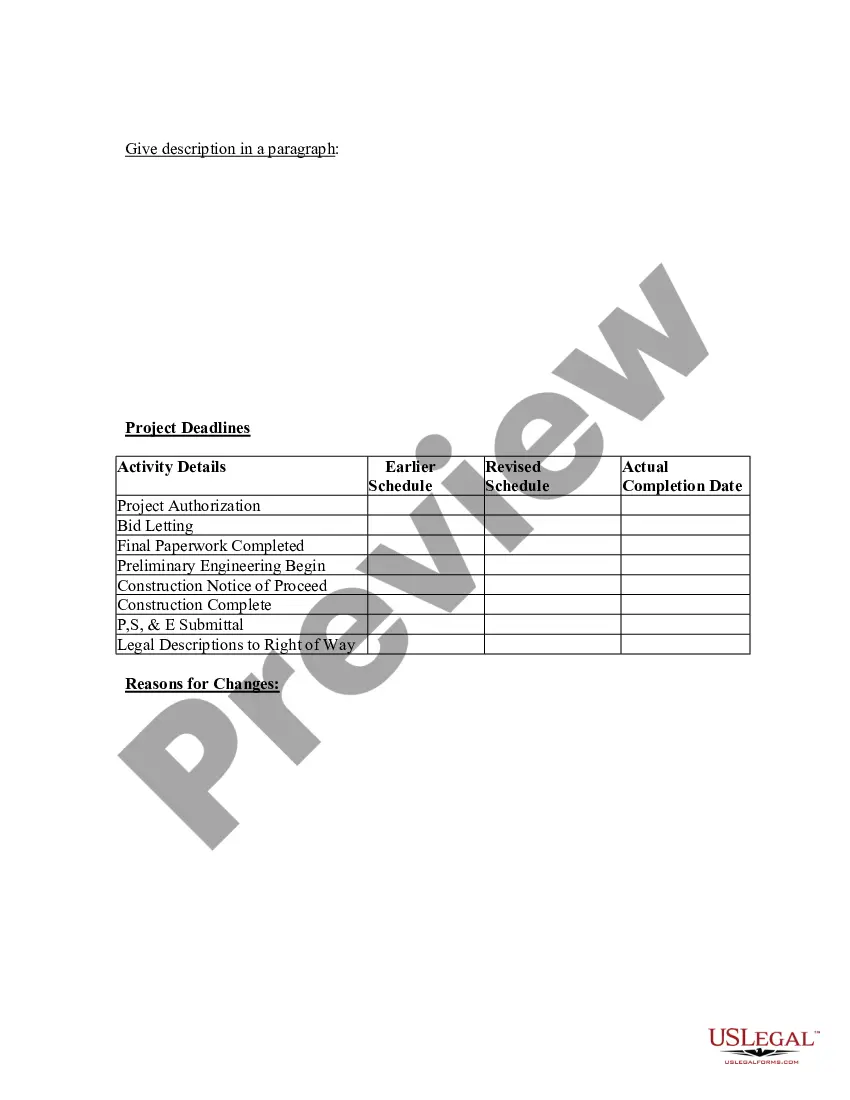

Filling out a Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet involves several key steps. Begin by gathering all relevant project details, including material costs, labor expenses, and timelines. Ensure that you accurately input each figure into the designated sections of the data sheet. Utilizing tools like USLegalForms can simplify this process, providing you with templates and guidance that ensure you don't miss any essential information.

In Pittsburgh, the city tax rate is set at 3.0%, while the school district tax rate typically falls around 0.92%. Together, these taxes contribute significantly to local funding for essential services and education. The Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet provides comprehensive details about these tax rates and how they affect your total property tax liability. By using this resource, you can make informed decisions regarding your investments and budgeting.

The Common Level Ratio (CLR) in Allegheny County for the year 2025 plays a crucial role in property assessments and tax calculations. This ratio is established to ensure fair taxation across properties within the county. For accurate details, you can refer to the Pittsburgh Pennsylvania Cost Estimate and Schedule Data Sheet, where you will find valuable insights. Understanding the CLR will empower you to navigate your property taxes with confidence.