Clark Nevada Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Agreement Adding Silent Partner To Existing Partnership?

Drafting documents for professional or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it's essential to account for all federal and state laws pertinent to the particular area.

Nevertheless, smaller counties and even municipalities can also have legislative rules that you need to take into account.

Join the platform and swiftly obtain verified legal forms for any scenario with just a few clicks!

- All these particulars contribute to the stress and duration of composing a Clark Agreement Adding Silent Partner to Existing Partnership without specialized assistance.

- It's simple to evade incurring costs on attorneys for preparing your paperwork and produce a legally binding Clark Agreement Adding Silent Partner to Existing Partnership independently, utilizing the US Legal Forms online repository.

- It is the largest online compilation of jurisdiction-specific legal templates that are professionally affirmed, ensuring you can trust their authenticity when selecting a sample for your county.

- Previously subscribed users merely need to Log In to their profiles to obtain the required document.

- If you haven't subscribed yet, adhere to the step-by-step directions below to acquire the Clark Agreement Adding Silent Partner to Existing Partnership.

- Peruse the page you've accessed and confirm if it contains the document you require.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

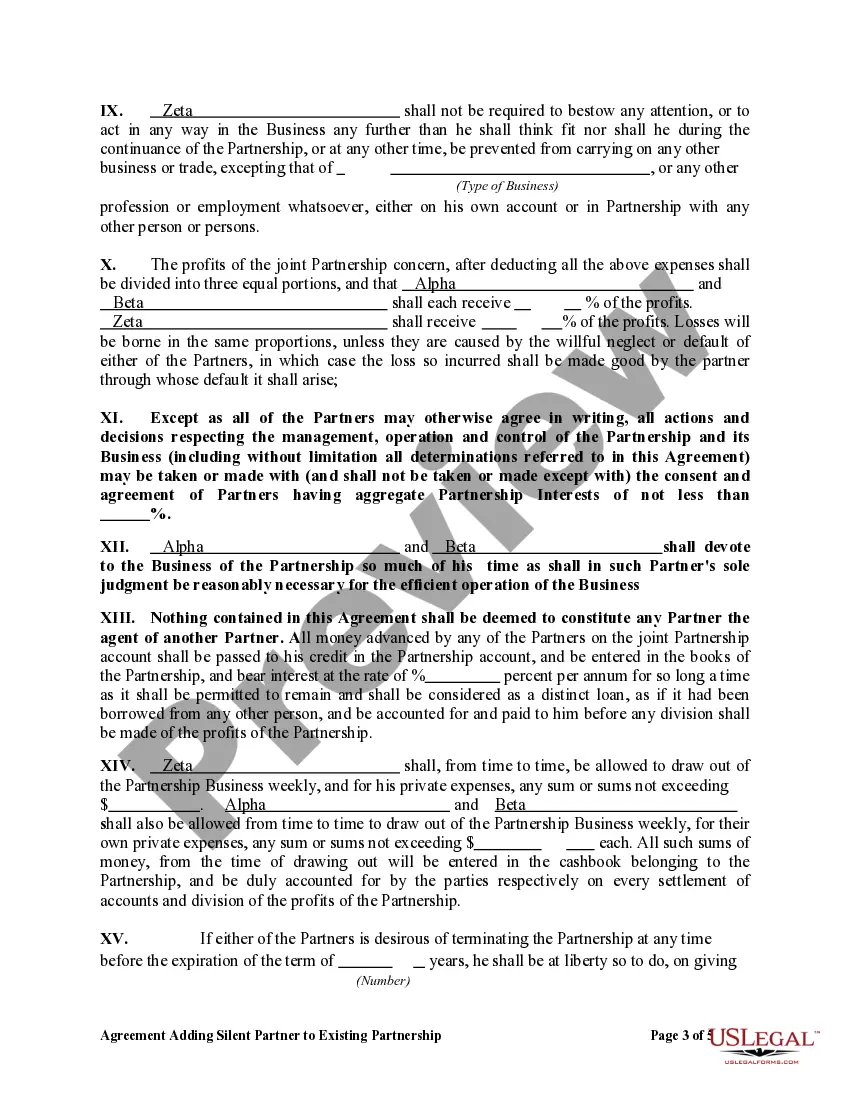

The silent partner steps back and lets you run the business. Once your business turns a profit, the silent partner receives 20% of the net profit. The profit is what's left after you subtract business expenses from your total sales revenue.

A silent partner is any individual who provides funding to a business as his only contribution. Partnerships and LLCs can have silent partners. Silent partners can also be referred to as limited partners (LPs).

A silent partner is an individual whose involvement in a partnership is limited to providing capital to the business. A silent partner is seldom involved in the partnership's daily operations and does not generally participate in management meetings.

Becoming a Silent PartnerYou can become a silent partner by entering into a limited partnership agreement with another person. The other person is the general partner, and they will be responsible for managing the business on a day-to-day business.

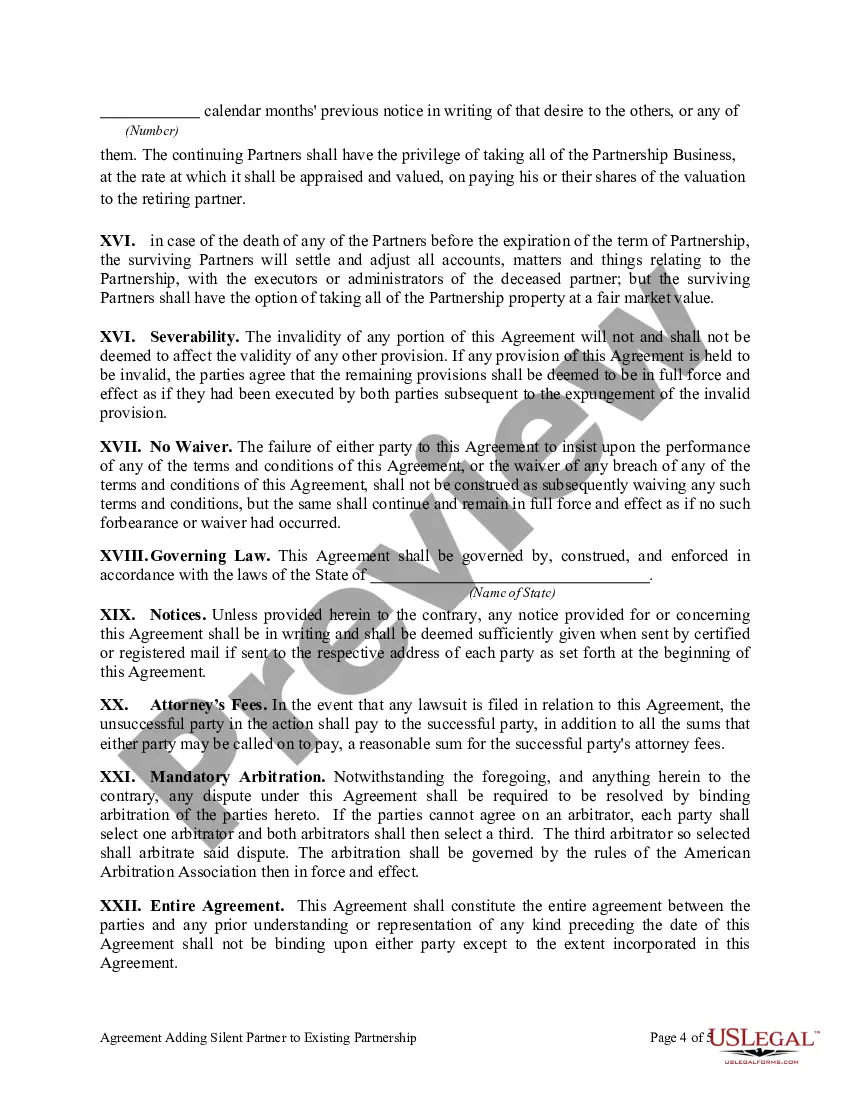

Although state regulations can vary regarding silent partners, their relationship with the business and their potential liability, silent partners are commonly protected from unlimited personal liability for any debts or obligations of the partnership business.

Although silent partners can involve themselves as needed, they usually don't participate in managing the business. Their ownership is motivated by return on investment. Silent partners can prevent other partners from making any drastic changes in business structure.

How much does a silent partner get paid? Silent partners get paid depending on their contribution and their equity in your business. Let's say that your silent partner invested $50,000, and your business is valued at $500,000. That means they have 10% ownership of the business, and they'll receive 10% of the profits.

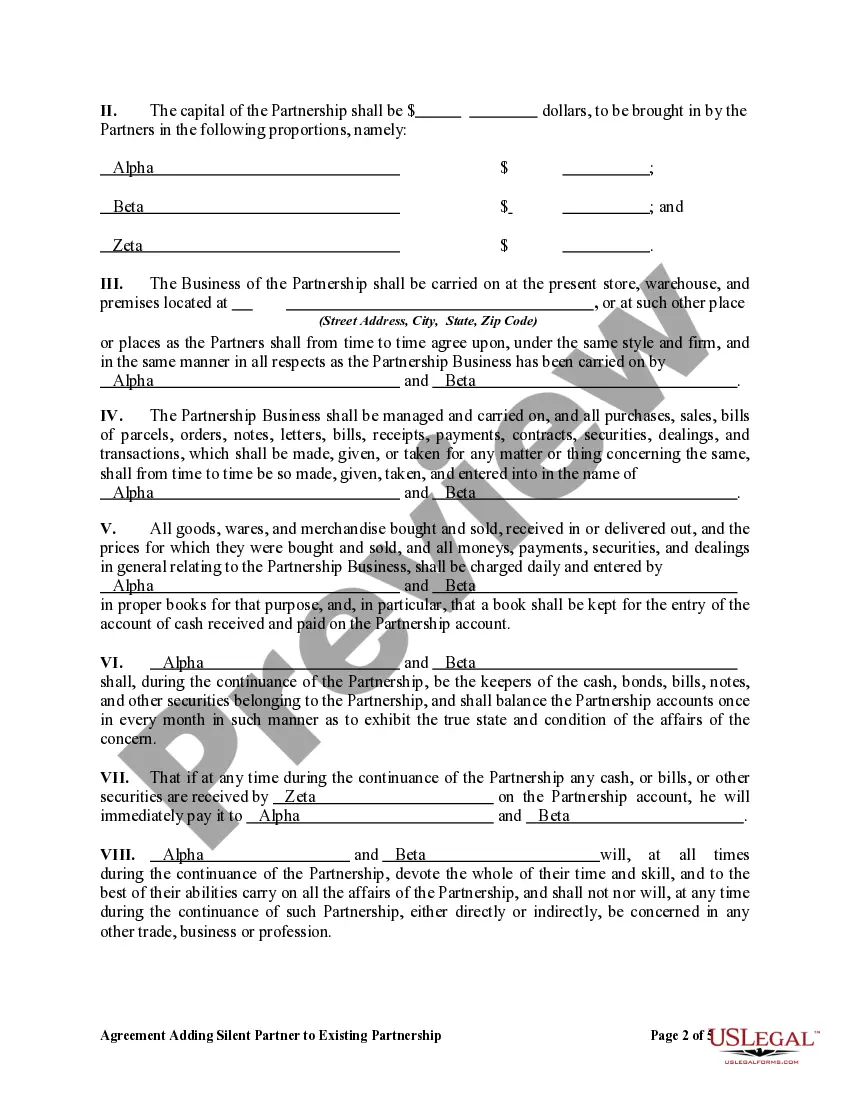

What should a Silent Partnership Agreement include?Information about the partnership, including name, place and purpose.Term of the partnership.Percentage of ownership in the business.Specific contributions to be made by each Partner.How additional contributions are handled by the partnership.

Becoming a Silent Partner If you want to form a limited partnership, you need a written partnership agreement, and all partners should agree to the terms of the contract. You will need to formally register your limited partnership with both the county clerk where your business is located and your Secretary of State.

Becoming a Silent Partner If you want to form a limited partnership, you need a written partnership agreement, and all partners should agree to the terms of the contract. You will need to formally register your limited partnership with both the county clerk where your business is located and your Secretary of State.