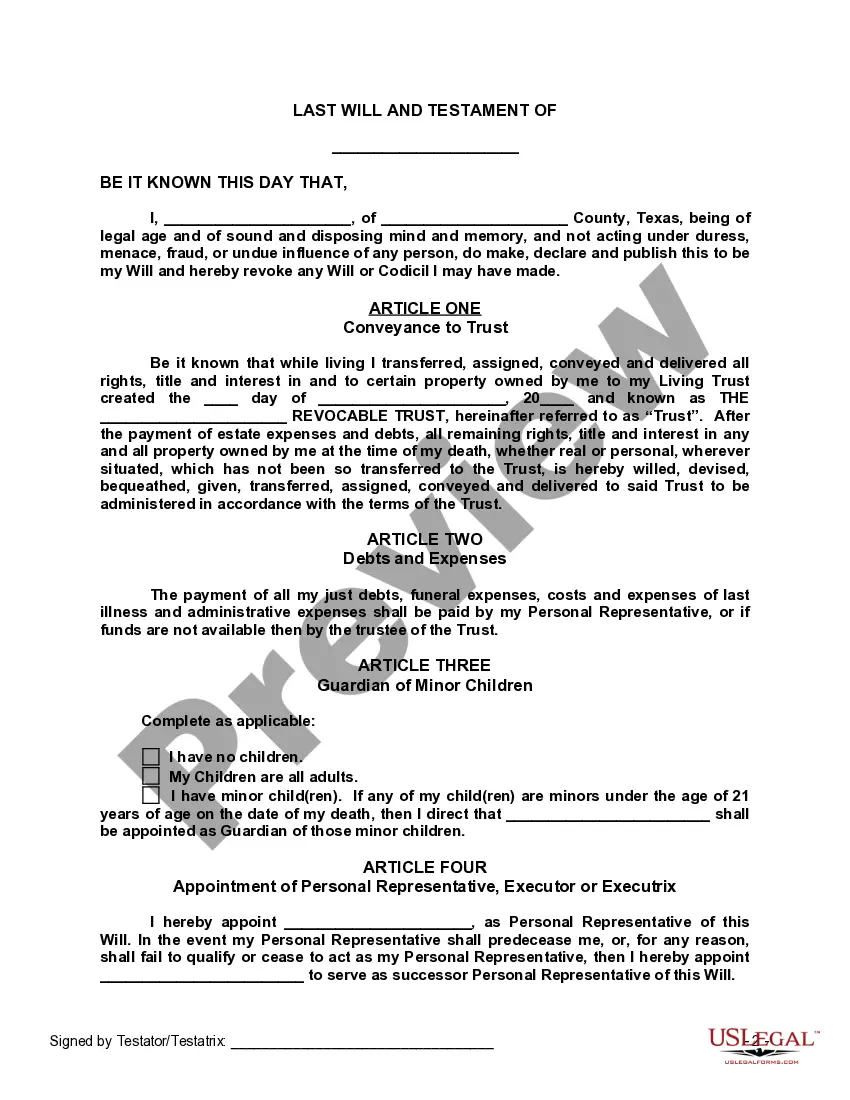

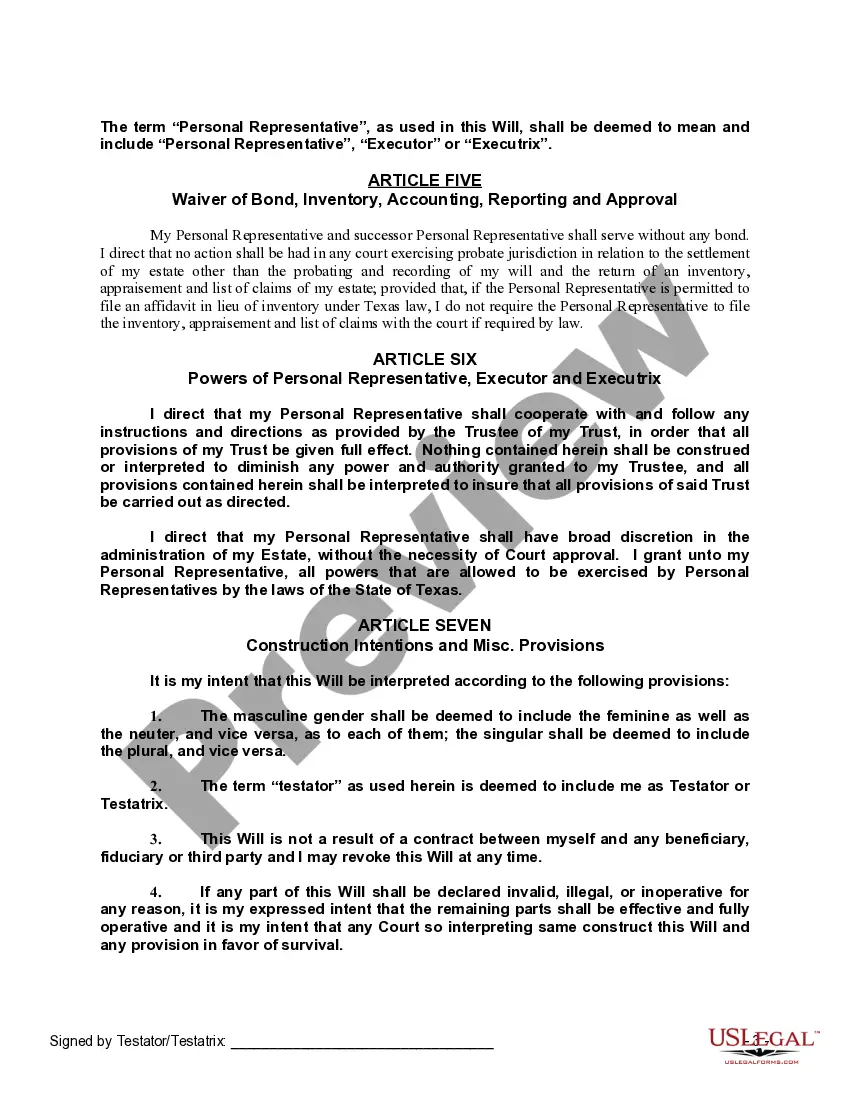

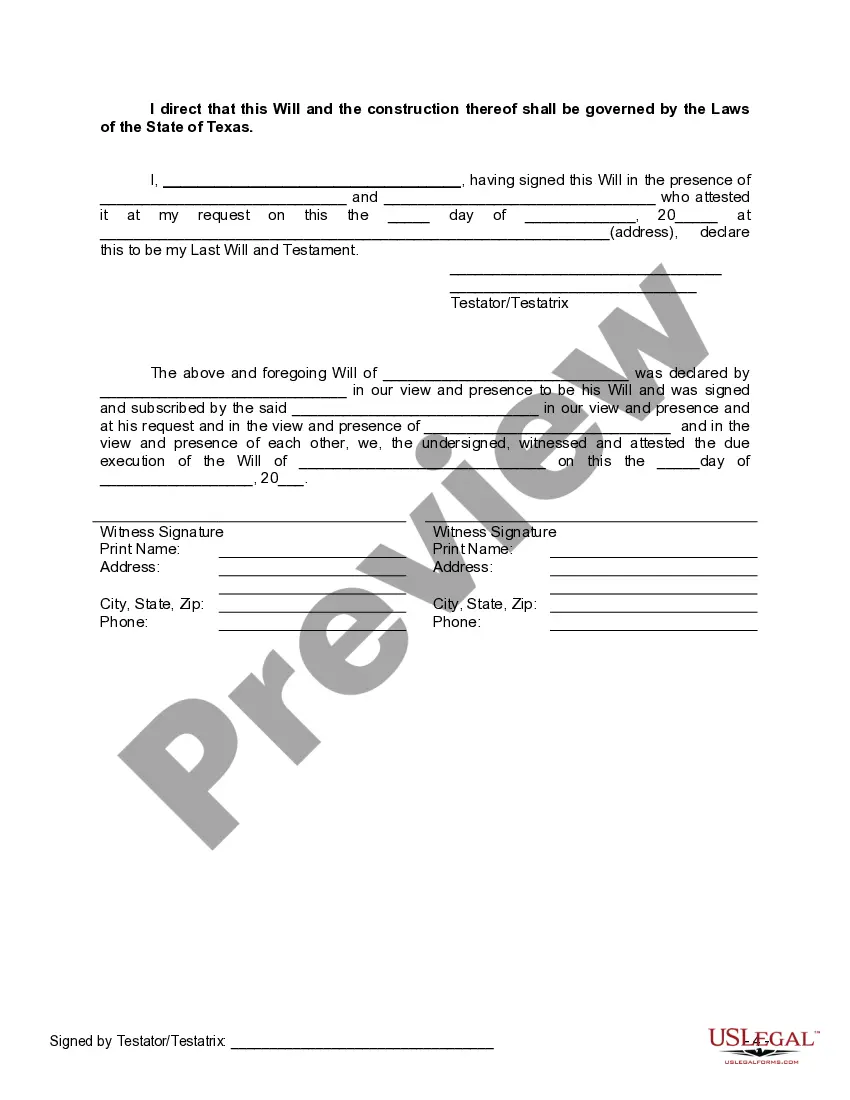

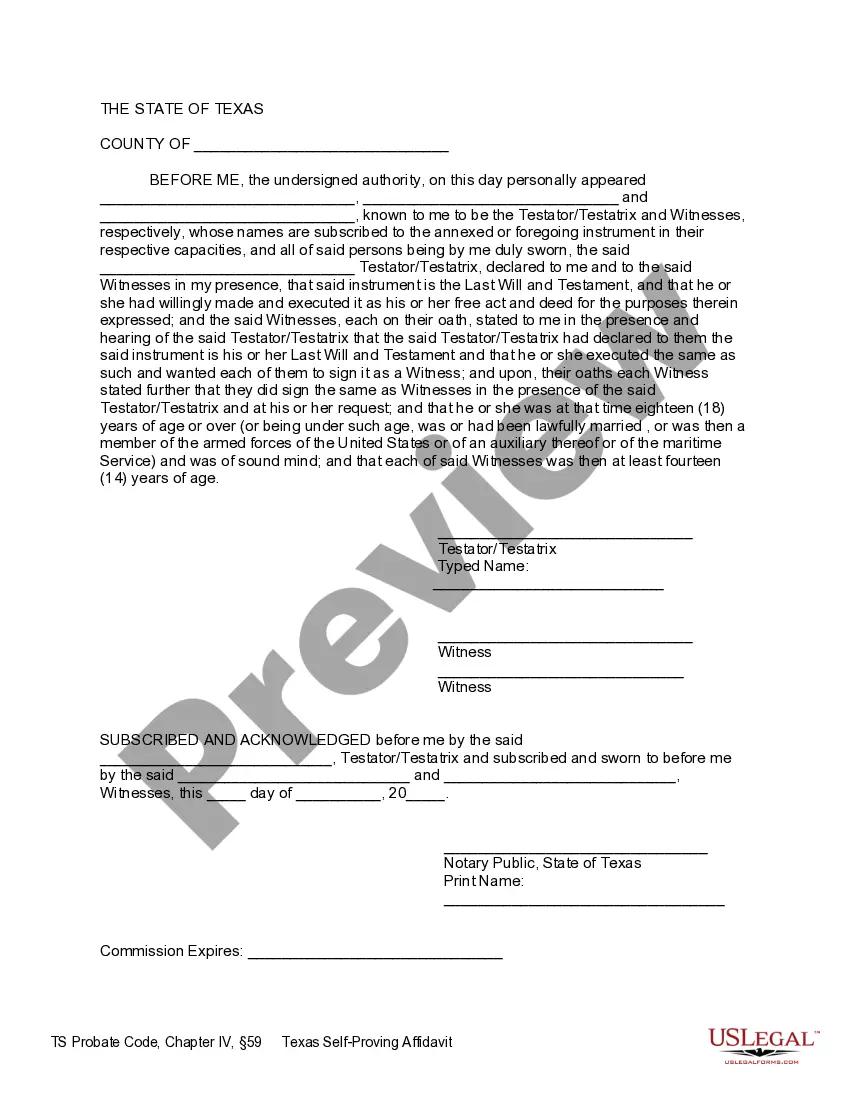

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Texas Last Will And Testament With All Property To Trust Called A Pour Over Will?

We consistently endeavor to minimize or avert legal complications when addressing intricate legal or financial issues. To accomplish this, we seek out attorney services that are typically quite costly. However, not every legal situation is as complicated as the next. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our platform empowers you to manage your affairs without needing to consult a lawyer. We provide access to legal document templates that are not always readily available to the public. Our templates are tailored to specific states and regions, making the search process much easier.

Take advantage of US Legal Forms whenever you need to obtain and download the Harris Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, or any other document swiftly and securely. Simply Log In to your account and click the Get button next to it. If you have misplaced the document, you can always re-download it from the My documents section.

The procedure is just as uncomplicated if you are a newcomer to the website! You can establish your account in just a few minutes.

With over 24 years in the industry, we have assisted millions of individuals by offering customizable and current legal forms. Utilize US Legal Forms now to conserve time and resources!

- Ensure that the Harris Texas Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will, complies with the laws and regulations of your state and locality.

- It is also essential to review the form's outline (if provided), and if you find any inconsistencies with what you initially sought, look for an alternative template.

- Once you confirm that the Harris Texas Legal Last Will and Testament Form with All Property to Trust, referred to as a Pour Over Will, meets your needs, you can select a subscription plan and complete your payment.

- Afterward, you can download the document in any available format.

Form popularity

FAQ

In most cases, a trust does take precedence over a last will and testament, particularly when it comes to managing your estate. The Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will explicitly directs that your assets be placed into the trust upon your passing. This setup ensures that your wishes are honored and your property is managed according to the terms of the trust. This structure not only simplifies the distribution of your assets but also provides more control over how they are handled after you are gone.

In Texas, a will, including a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will, does not automatically avoid probate. A will must be executed and validated through the probate process before any distributions can occur. However, establishing a revocable living trust can minimize probate, making the estate administration process smoother. Using our platform, US Legal Forms, you can ensure all documents are properly prepared to optimize your estate planning.

One notable drawback of a pour-over will is that it still requires probate in Texas. While it effectively transfers assets to your trust upon your death, the initial process can be lengthy and potentially expensive. Additionally, any assets included in your Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will may not be available to your heirs until probate is finalized. Therefore, it's important to consider how this may impact your estate planning.

In most cases, a last will and testament does not override a trust. Instead, assets placed into a trust are handled according to the trust's terms, even if the will mentions those same assets. When you use a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will, it ensures that any assets not transferred to the trust before your death will be allocated accordingly, preserving your wishes. It's essential to ensure consistency across your estate planning documents to avoid disputes and confusion.

Typically, a will does not have power over a trust; instead, a trust governs the management and distribution of assets placed within it. If you create a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will, it directs assets into the trust upon your death, but the trust's terms take precedence in managing those assets. A well-structured estate plan ensures that your will and trust function cohesively, avoiding confusion and enhancing the functionality of your estate plan.

In Texas, a trust generally takes precedence over a will when both documents handle the same assets. If your will states assets you want in a trust, the terms of your Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will can ensure all specified assets are funneled into the trust. This clarity helps avoid potential conflicts and ensures your wishes are accurately fulfilled. Always consider updating both documents to maintain alignment with your estate planning goals.

over will does not completely avoid probate in Texas; it does, however, simplify the process. Upon your death, assets specified in the Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will will transfer to your trust, which can be easier to manage. Although probate is necessary for the will, assets in the trust can be distributed without further court involvement. This makes the estate settlement process more streamlined and efficient.

A trust is often seen as more powerful than a will because it can manage your assets while you're alive and provide instructions for their distribution after your passing. A will, on the other hand, only takes effect upon your death. When you utilize a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will, you combine the benefits of both by allowing your assets to flow seamlessly into the trust, simplifying the management and distribution processes. Each serves its purpose, and understanding their roles can enhance your estate planning.

Generally, a trust takes precedence over a will in Texas, especially when both documents address the same assets. If you have a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will, it ensures that any assets not transferred into the trust during your lifetime will pour over into it after your death. This flow preserves the intent of your estate plan, avoiding direct conflicts between the two documents. Clarity in your estate documents helps in preventing unintended outcomes.

In Texas, a trustee can sell trust property without the approval of all beneficiaries if the trust document grants that authority. However, effective communication with beneficiaries is crucial to maintain trust and transparency. It is often beneficial for a trustee to seek consensus among beneficiaries to prevent disputes. Utilizing a Harris Texas Last Will and Testament with All Property to Trust called a Pour Over Will can help structure your estate and clarify these roles.