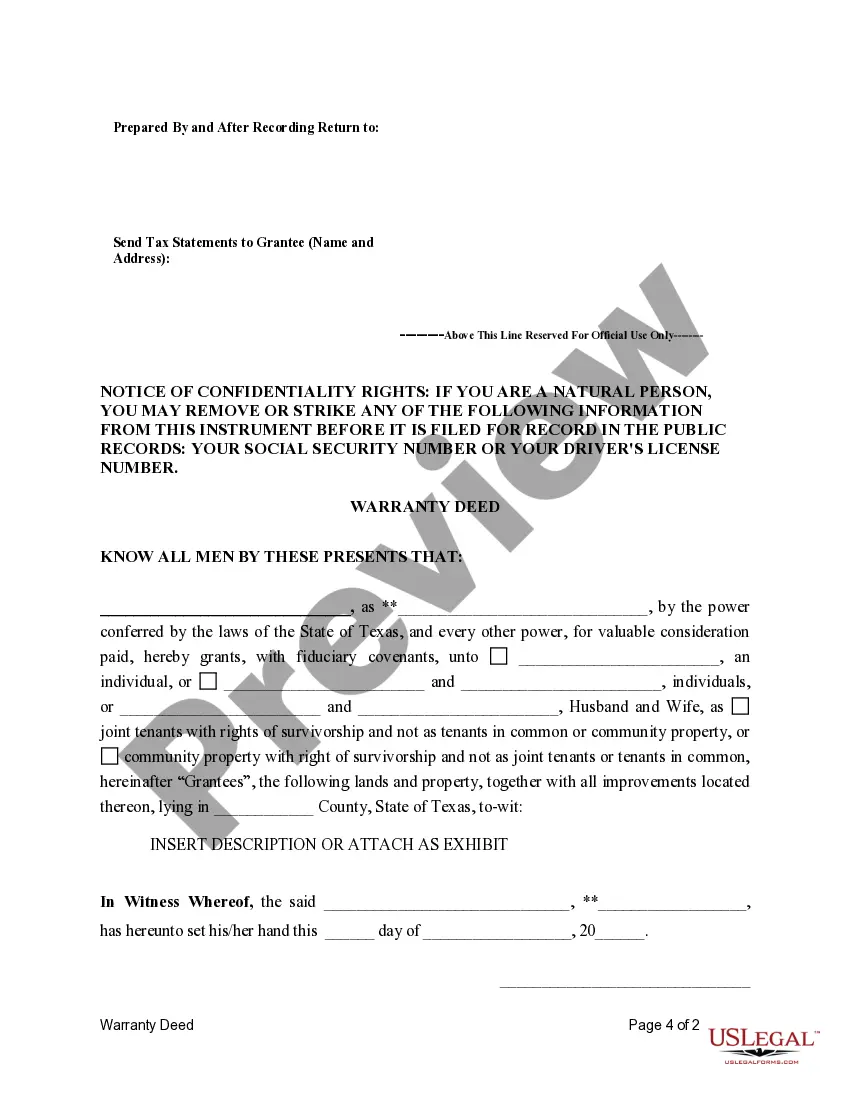

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Texas Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We consistently aim to minimize or circumvent legal complications when managing intricate legal or financial matters.

To achieve this, we opt for legal services that are typically very costly.

Nonetheless, not every legal concern is equally convoluted.

A majority of them can be handled independently.

Utilize US Legal Forms whenever you need to locate and obtain the Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other document swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal paperwork encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs autonomously without the necessity of employing an attorney's services.

- We provide access to legal document templates that aren't always readily accessible.

- Our templates are specific to states and regions, greatly easing the search process.

Form popularity

FAQ

An executor's deed is a legal document that an executor uses to transfer property from a deceased person's estate to a beneficiary. This type of deed acts as proof that the executor has the authority to convey the property as specified in the will. If you are managing an estate, it's important to understand how an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries fits into this process.

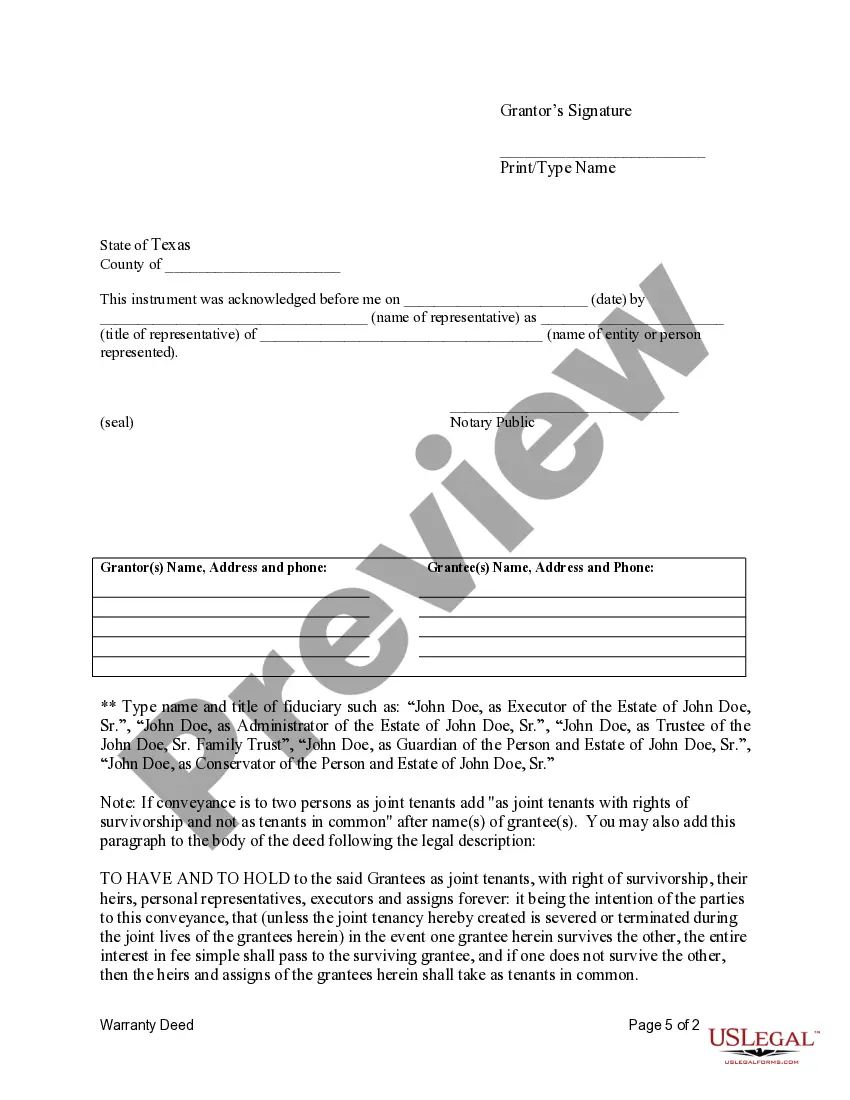

An executor and an administrator serve similar functions, but they are not the same. An executor is appointed in a will and has the responsibility to execute the terms of that will. In contrast, an administrator is appointed by the court when there is no will. Understanding the differences is crucial when dealing with an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

An administrator's deed is utilized when a person dies intestate, meaning without a valid will, while an executor's deed is employed when a will is present. The primary role of an administrator is to manage the estate according to state laws, whereas an executor follows the directions specified in a will. Both deeds play crucial roles in managing an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

An executor may deed property to himself, but this requires careful attention to the wishes outlined in the will and adherence to any legal standards. Transparency and fairness to other beneficiaries are essential to prevent disputes. When managed properly, the executor's actions can be supported by an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

In Texas, an executor transfers property by executing an executor's deed after the probate process is complete. This deed must accurately reflect the decedent's wishes as outlined in the will, ensuring legal compliance. Utilizing the Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries helps streamline this process and provide clarity in property transfers.

One notable disadvantage of a trust deed is the potential for complications in the administration of the trust. If the terms of the trust are unclear, disputes among beneficiaries may arise, leading to delays and extra costs. Understanding these challenges can help individuals better navigate their responsibilities under an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

An executor's deed is a document that an executor uses to convey property from a deceased person's estate to the beneficiaries. It is crucial in the probate process, affirming that the executor has the right to distribute the property according to the will. This type of deed plays a significant role in executing an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

A trustee's deed is a legal document used by a trustee to transfer property held in a trust to beneficiaries. This deed outlines the specifics of the property being transferred and confirms the authority of the trustee. In the context of an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it ensures a smooth transition of property rights.

The purpose of a fiduciary deed is to facilitate the lawful transfer of property within the context of a trust or estate, ensuring fiduciaries fulfill their responsibilities to beneficiaries. This deed serves as a formal record that verifies the fiduciary's authority to manage and distribute property. Those dealing with property transfers should look into the advantages of utilizing an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

The safest type of deed is often regarded as a warranty deed, as it provides the highest level of buyer protection against potential claims on the property. This deed guarantees that the seller holds clear title, making it a secure option for those purchasing property. However, understanding the implications of an Odessa Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is also essential when working within an estate or trust context.