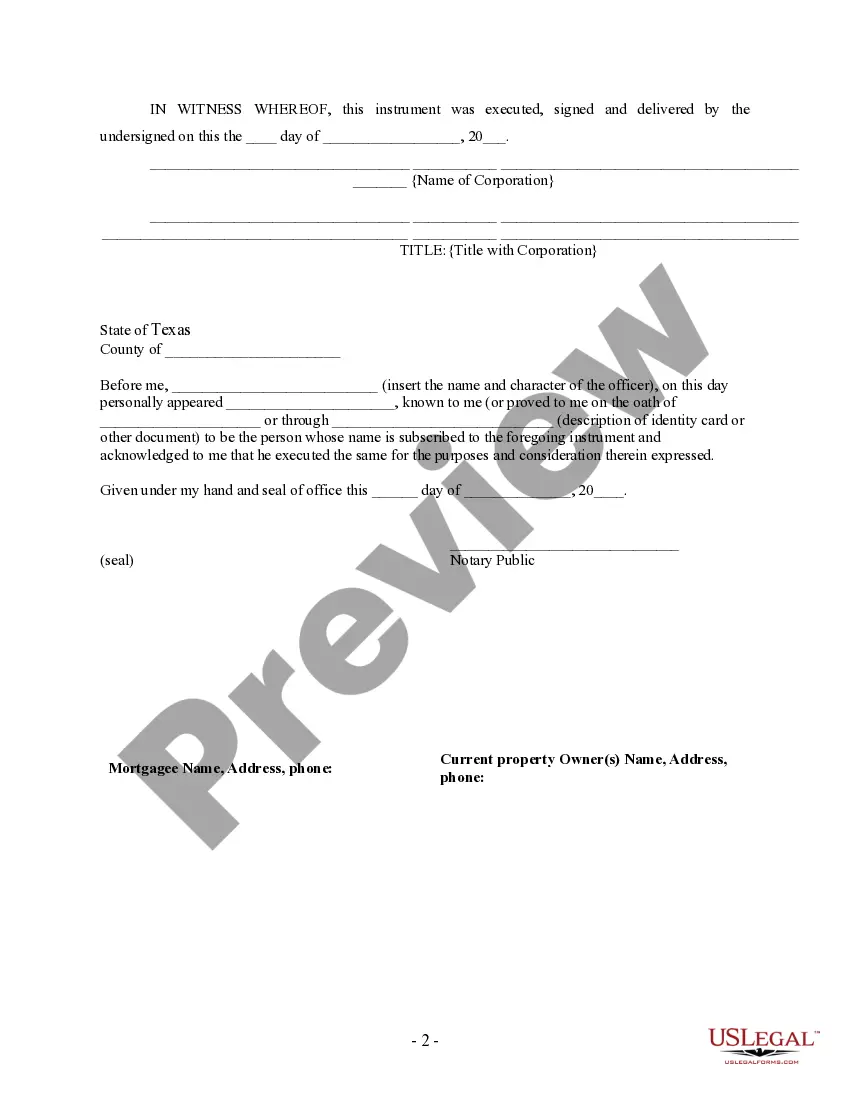

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

San Antonio Texas Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Texas Partial Release Of Property From Deed Of Trust For Corporation?

We consistently endeavor to lessen or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we enlist legal services that are typically very expensive.

Nevertheless, not all legal challenges are equally complicated. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

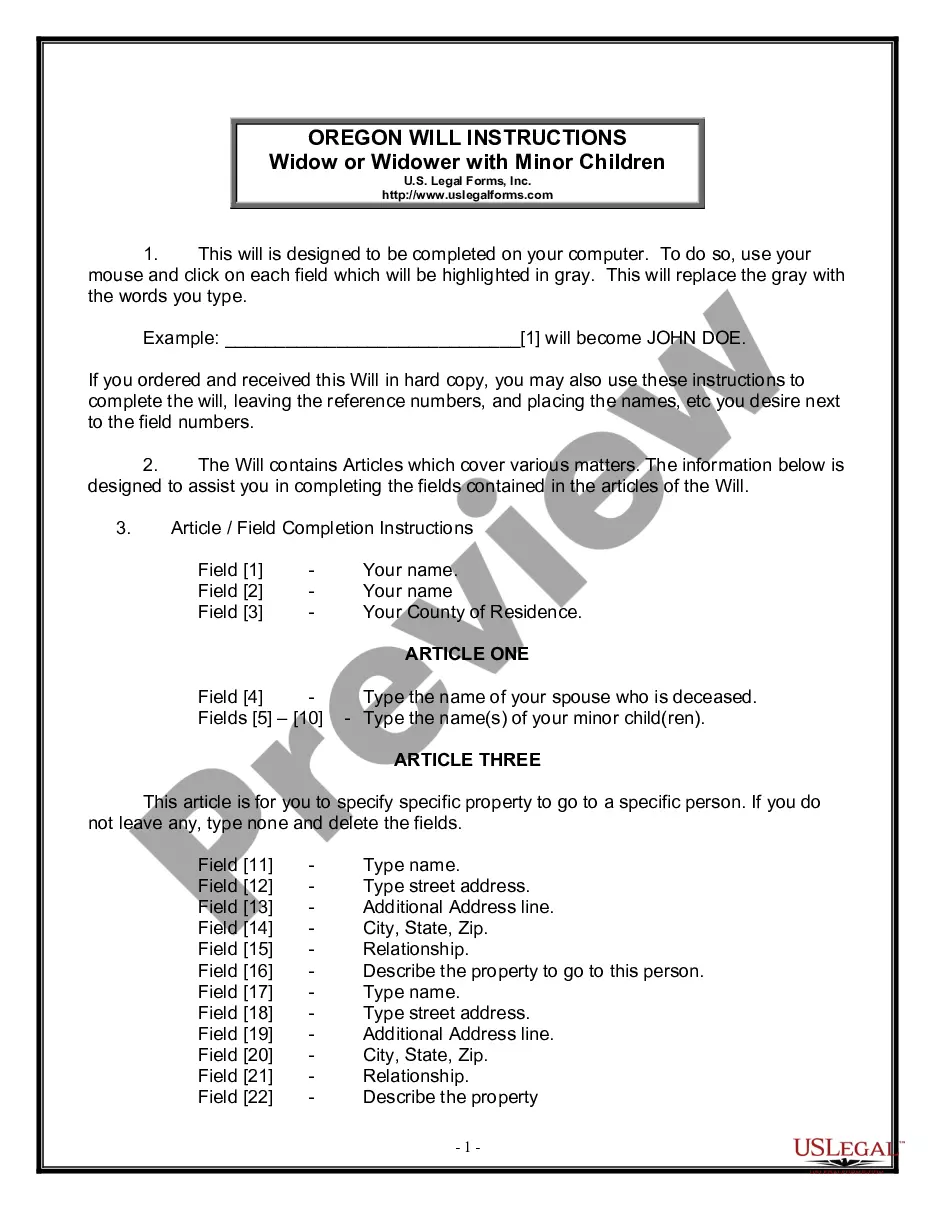

Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure is equally simple if you're not familiar with the platform! You can establish your account in just a few minutes. Ensure to verify if the San Antonio Texas Partial Release of Property From Deed of Trust for Corporation complies with your state's and area's laws and regulations. Also, it’s vital to review the form’s outline (if provided), and should you find any inconsistencies with your initial requirements, seek an alternative template. Once you are certain that the San Antonio Texas Partial Release of Property From Deed of Trust for Corporation is suitable for your situation, you can select the subscription plan and move forward to payment. Subsequently, you can download the document in any appropriate file format. For over 24 years, we’ve assisted millions by providing ready-to-customize and updated legal documents. Maximize the benefits of US Legal Forms today to conserve your time and resources!

- Our platform empowers you to take control of your affairs without the necessity of an attorney's services.

- We furnish access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Leverage US Legal Forms whenever you need to locate and download the San Antonio Texas Partial Release of Property From Deed of Trust for Corporation or any other document promptly and securely.

Form popularity

FAQ

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

The Texas Deed of Trust A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate.

THIS NOTICE IS A DISCLOSURE OF SELLER'S KNOWLEDGE OF THE CONDITION OF THE PROPERTY AS OF THE DATE SIGNED BY SELLER AND IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR WARRANTIES THE PURCHASER MAY WISH TO OBTAIN. IT IS NOT A WARRANTY OF ANY KIND BY SELLER OR SELLER'S AGENTS.

The three players involved in a deed of trust are: The ?trustor,? also known as the borrower. The ?trustee,? typically a title company with the power of sale, legal title to the real property, and the ability to hold a nonjudicial foreclosure. The ?beneficiary,? also known as the lender.

Sec. 5.008. SELLER'S DISCLOSURE OF PROPERTY CONDITION.

5.008. SELLER'S DISCLOSURE OF PROPERTY CONDITION.

A partial lien release is a legal contract that enables your lender to release their lien on a part of your mortgaged property. Under the typical terms of a partial release, if you pay down a certain amount of your mortgage principal, your lender will agree to release some of your property from the loan contract.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.

A release of a portion of real property from the lien of a deed of trust securing a loan on commercial real property in Texas. Lenders in Texas customarily use a partial release of lien to discharge a deed of trust lien against some but not all of the borrower's real property.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.