This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

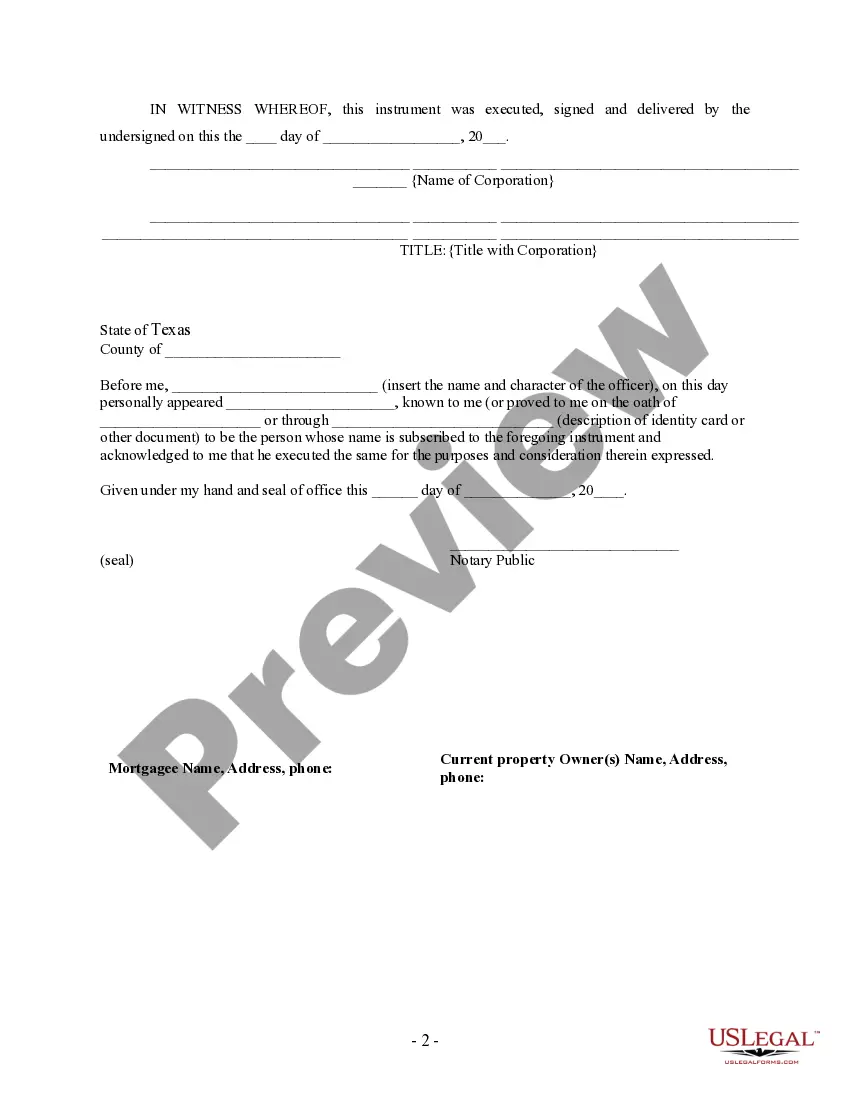

Houston Texas Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Texas Partial Release Of Property From Deed Of Trust For Corporation?

If you have previously utilized our service, Log In to your account and retrieve the Houston Texas Partial Release of Property From Deed of Trust for Corporation onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have acquired: you can locate it in your profile under the My documents section whenever you wish to reuse it. Use the US Legal Forms service to conveniently find and download any template for your personal or business needs!

- Confirm you’ve located an appropriate document. Review the description and use the Preview feature, if available, to determine its suitability for your requirements. If it does not suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Houston Texas Partial Release of Property From Deed of Trust for Corporation. Choose the document format you need and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

A release of a portion of real property from the lien of a deed of trust securing a loan on commercial real property in Texas. Lenders in Texas customarily use a partial release of lien to discharge a deed of trust lien against some but not all of the borrower's real property.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

The Texas Deed of Trust A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A partial lien release is a legal contract that enables your lender to release their lien on a part of your mortgaged property. Under the typical terms of a partial release, if you pay down a certain amount of your mortgage principal, your lender will agree to release some of your property from the loan contract.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.