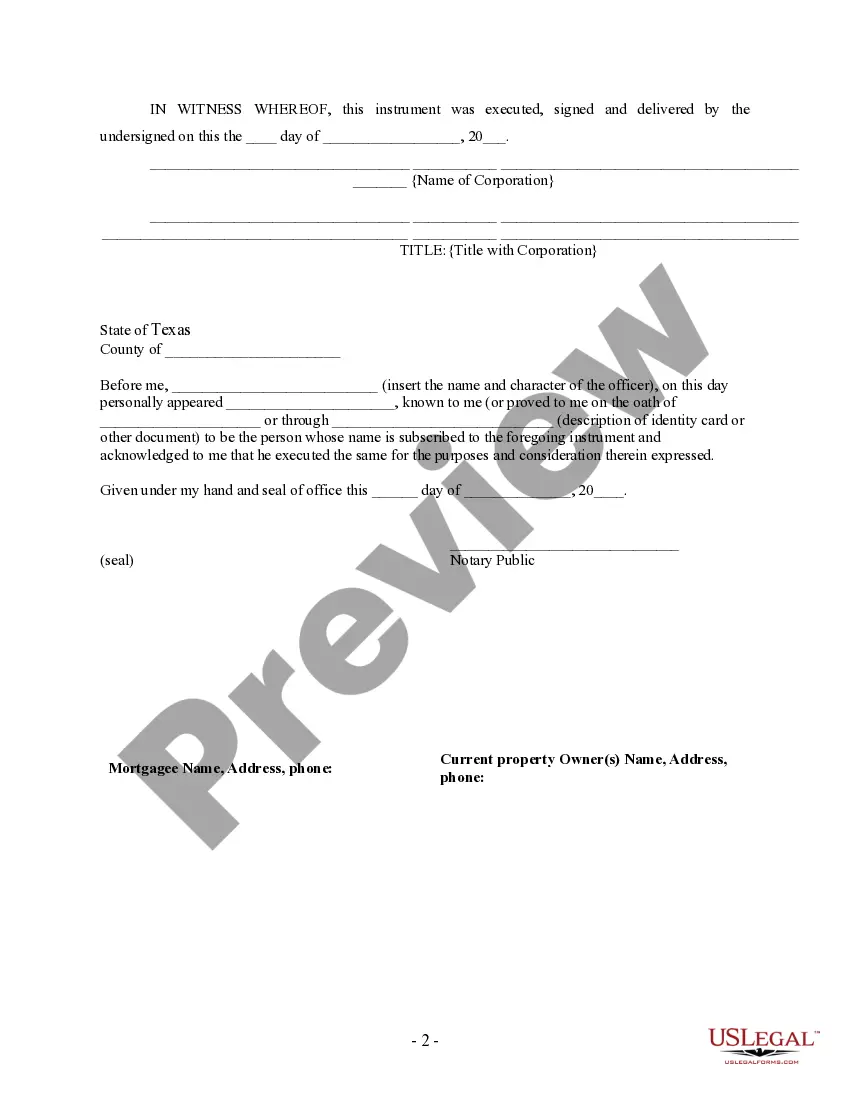

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Harris Texas Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out Texas Partial Release Of Property From Deed Of Trust For Corporation?

Irrespective of social or career position, filling out legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly unattainable for an individual without a legal background to create such documents from scratch, primarily due to the complex terminology and legal nuances they encompass.

This is where US Legal Forms comes to the aid.

Confirm that the form you selected is appropriate for your region as the laws of one state or county may not be applicable in another.

Examine the document and review a brief summary (if available) of scenarios in which the form is applicable.

- Our service offers a vast assortment with more than 85,000 ready-to-use, state-specific forms applicable for nearly any legal circumstance.

- US Legal Forms also serves as a valuable resource for associates or legal advisors who aim to enhance their time efficiency by utilizing our DIY forms.

- Whether you need the Harris Texas Partial Release of Property From Deed of Trust for Corporation or any other document suitable for your locale, with US Legal Forms, everything is readily available.

- Here’s how to acquire the Harris Texas Partial Release of Property From Deed of Trust for Corporation swiftly using our reliable service.

- If you’re already a registered customer, you can proceed to Log In to your account to retrieve the required document.

- If you are not acquainted with our collection, ensure that you follow these steps before downloading the Harris Texas Partial Release of Property From Deed of Trust for Corporation.

Form popularity

FAQ

To file a release of lien in Harris County, you must first complete the necessary forms for the Harris Texas Partial Release of Property From Deed of Trust for Corporation. Then, submit the completed forms to the Harris County Clerk's office along with any applicable fees. It's essential to ensure that all information is accurate and conforms to local requirements to prevent processing delays. Utilizing services like US Legal Forms can streamline this process, providing you with the right documents and guidance to navigate the filing efficiently.

Partial release of lien means that a borrower can remove a property from a lien without affecting the lien on other secured properties. This creates more flexibility for corporations in Harris Texas, allowing them to manage their assets more effectively. By utilizing tools like US Legal Forms, businesses can streamline this process, ensuring compliance and efficiency.

A partial release of lien in Texas refers to the process of releasing a specific property from the legal claim of a lien, as described in a deed of trust. For corporations, this action is part of Harris Texas Partial Release of Property From Deed of Trust for Corporation, allowing them to access funds tied up in real estate. This can be instrumental in facilitating new investments or improving liquidity without losing other secured properties.

Partially released means that a specific asset or property has been removed from the lien of a deed of trust while the remaining assets are still secured. In the context of Harris Texas Partial Release of Property From Deed of Trust for Corporation, this term implies that the corporation retains their obligations on other properties, while freeing up one for sale or refinancing. It’s a strategic move that enhances property management capabilities.

A partial release works by formally documenting the removal of a specific property from the deed of trust. The lender must consent to this release, and once approved, the deed is updated to reflect which properties remain encumbered. This process ensures legal clarity and allows the corporation to utilize the released property for other financial opportunities.

A deed of partial release is a legal document that removes a specific property or asset from a deed of trust. In the context of Harris Texas Partial Release of Property From Deed of Trust for Corporation, this document effectively frees the chosen asset from the lien created by the deed of trust. This process allows a corporation to access the equity in that asset while still maintaining the security interest in the remaining property.

A partial claim deed of trust refers to a situation in which the lender releases a specific part of the property from the control of a deed of trust, while the rest remains secured. This can provide corporations breathing room to restructure their finances. For those looking into the Harris Texas Partial Release of Property From Deed of Trust for Corporation, it's a useful strategy. It can assist in managing real estate assets effectively and legally.

A partial deed is a document that conveys a portion of property rights from one party to another, while the remainder of the interests stays intact. This can be beneficial for corporations looking to divide properties for sale or financing purposes. When dealing with a Harris Texas Partial Release of Property From Deed of Trust for Corporation, a partial deed may come into play to clarify ownership shares. It's wise to work with legal professionals to navigate these transactions.

The release on a deed of trust is typically handled through a formal process where a partial release form is filed with the local county clerk. This document specifies the property being released and outlines any remaining obligations. For a successful Harris Texas Partial Release of Property From Deed of Trust for Corporation, it’s essential to ensure all paperwork is completed accurately. Engaging with platforms like USLegalForms can simplify this complex process.