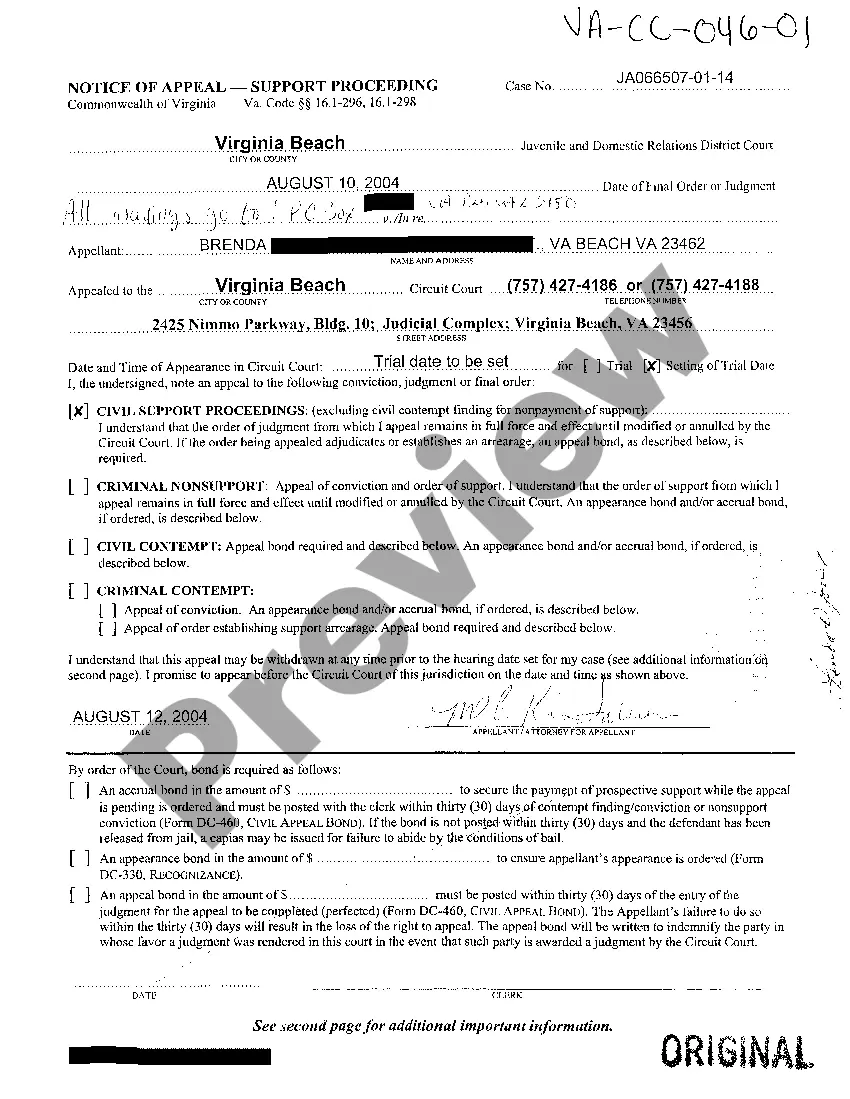

With this Assignment of Mortgage Package,you will find the forms and letters that are necessary for the owner of a deed of trust/mortgage to convey the owner's interest in the deed of trust/mortgage to a third party.

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;