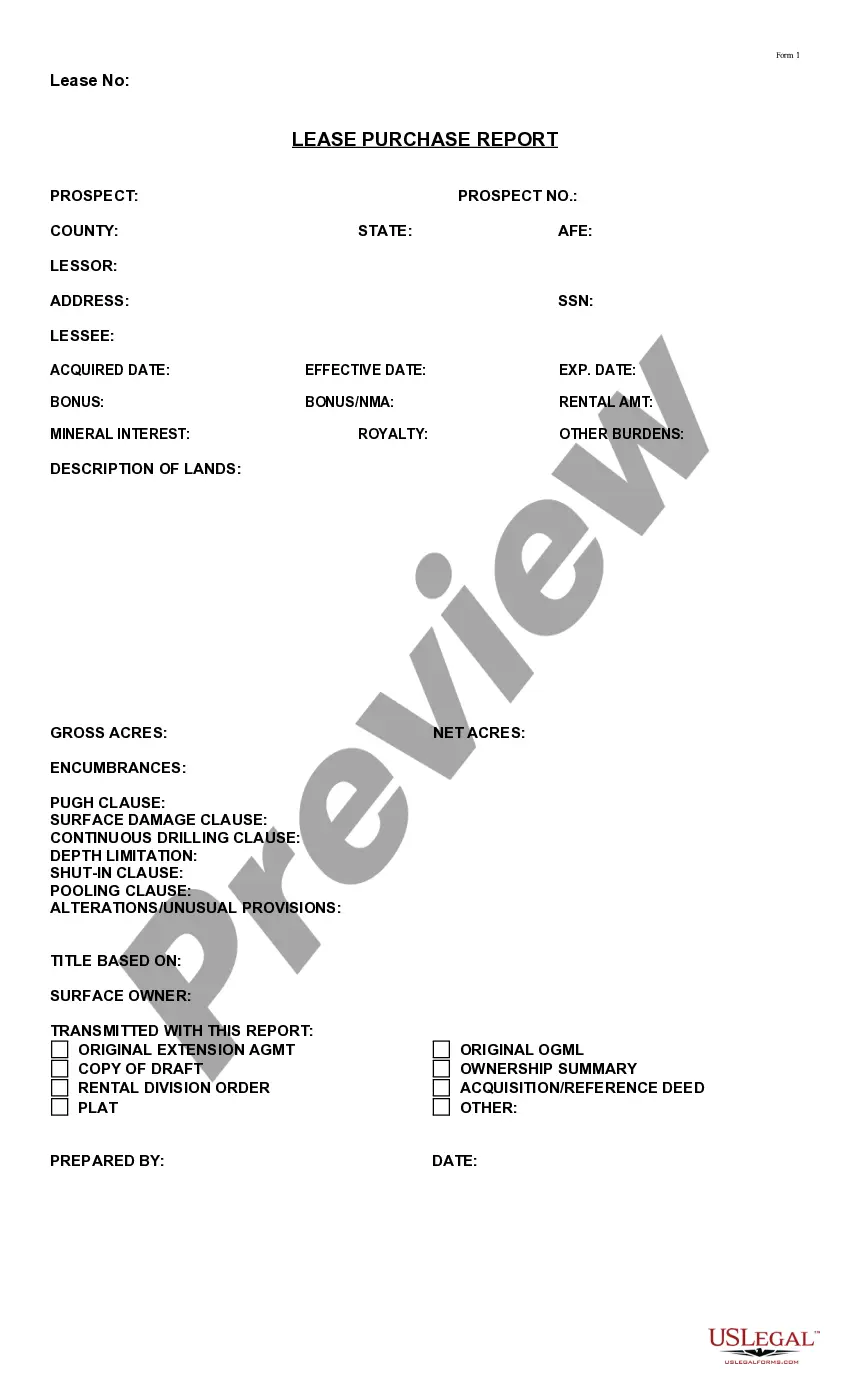

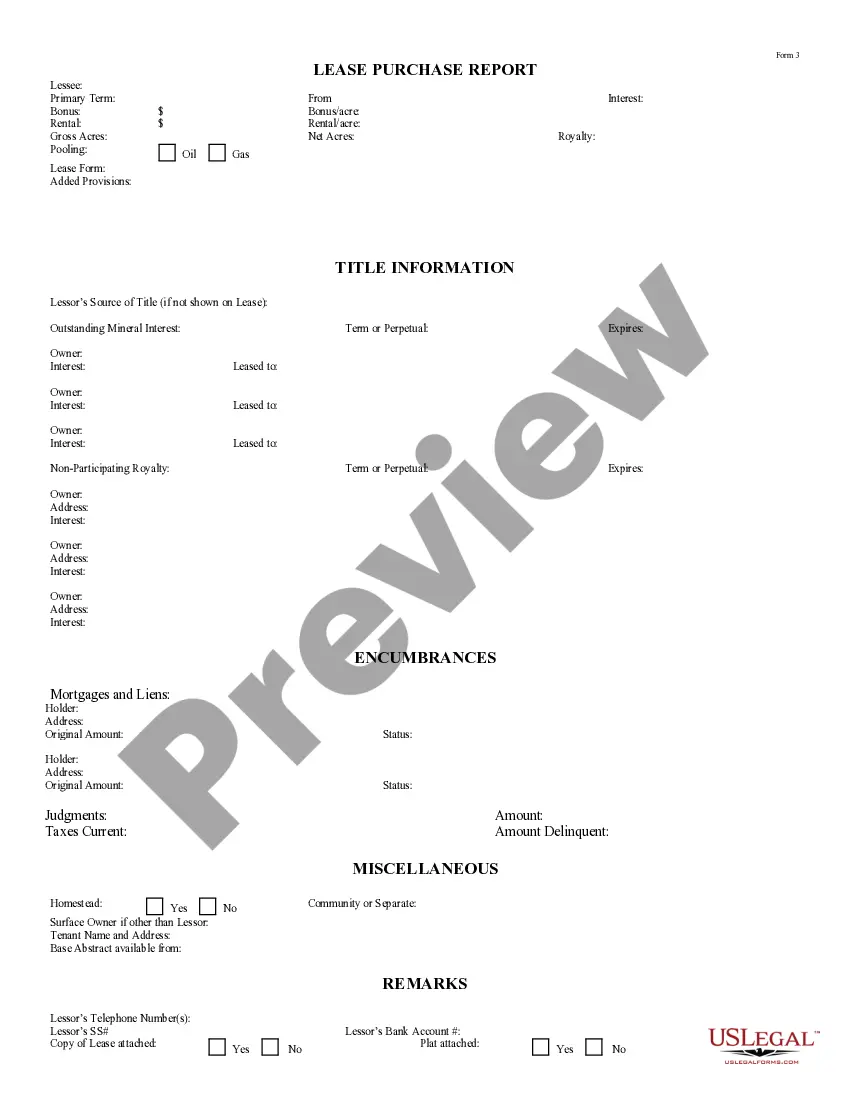

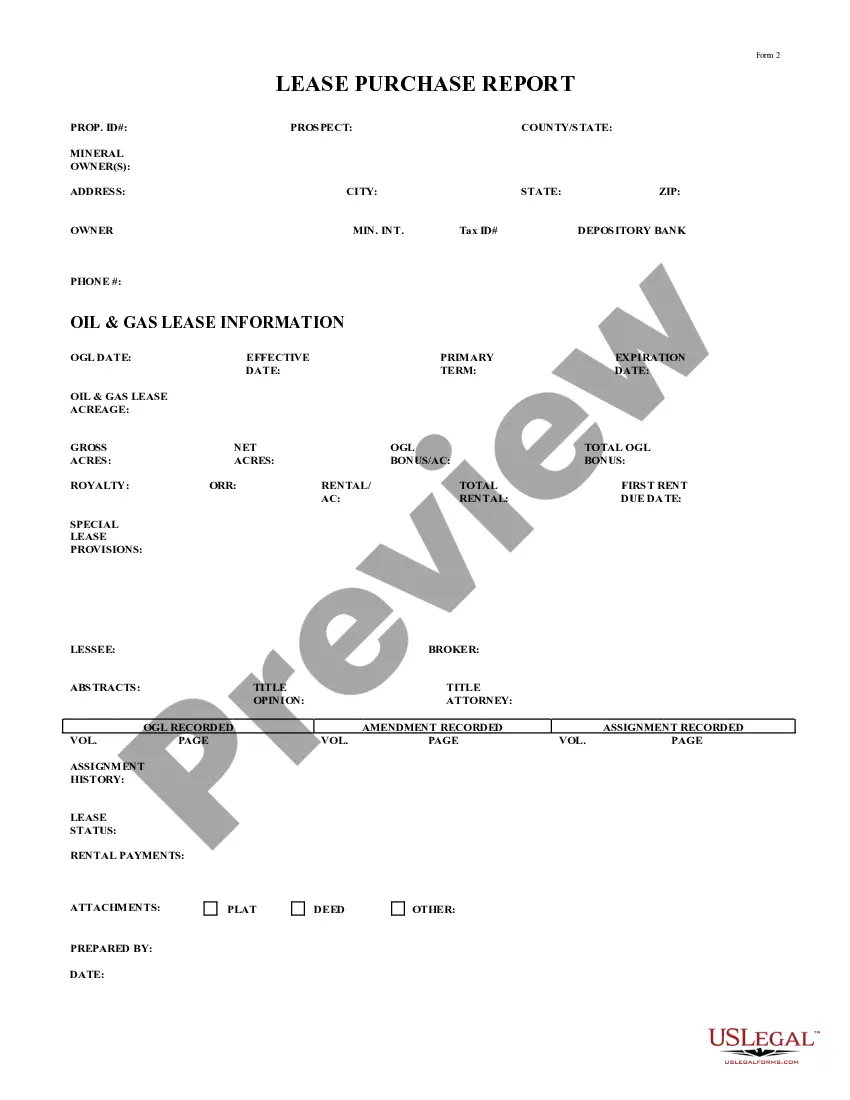

This oil, gas, and minerals document is a report form documenting information of sellers and purchasers that enter into a legally binding obligation to sell and purchase real property at the expiration of or during a lease term. Oil and gas lease information is also documented in this report.

Harris Texas Lease Purchase Report Form 2

Description

How to fill out Texas Lease Purchase Report Form 2?

We consistently seek to minimize or evade legal repercussions when managing intricate legal or financial situations.

To achieve this, we seek legal assistance from attorneys whose services are typically costly.

Nonetheless, not every legal challenge is equally intricate; many can be handled independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can re-download it from the My documents section. The process remains as simple even if you are not accustomed to the website! You can set up your account in a matter of minutes. Ensure that the Harris Texas Lease Purchase Report Form 2 complies with the laws and regulations of your state and locality. Furthermore, it’s essential to review the form’s description (if available), and if you identify any inconsistencies with your original needs, look for an alternate form. Once you verify that the Harris Texas Lease Purchase Report Form 2 meets your requirements, you may select the subscription plan and proceed with the payment. Following that, you can download the form in any desired file format. With over 24 years in the industry, we’ve assisted millions by providing ready-to-customize and up-to-date legal forms. Utilize US Legal Forms today to conserve time and resources!

- Our library empowers you to manage your own affairs without resorting to legal advice.

- We offer access to legal form templates that aren’t always readily available.

- Our templates are tailored to specific states and areas, which greatly simplifies the search process.

- Benefit from US Legal Forms anytime you wish to locate and download the Harris Texas Lease Purchase Report Form 2 or any other form easily and securely.

Form popularity

FAQ

To get a copy of your house deed in Harris County, Texas, you can start by visiting the Harris County Clerk's office website. They provide online access to property records, allowing you to search by property address or owner name. If you prefer, you also have the option to visit their office in person for assistance, where staff can help you locate and print the necessary documents.

In most cases, you do not need an appointment to complete a title transfer in Harris County. However, it is always a good idea to check the official Harris County tax office website for any updates or requirements. Visiting during less busy hours can also help you avoid long lines. Being prepared with your documents on hand makes the process even smoother.

In Harris County, the primary form required to transfer a car title is the Application for Texas Title and/or Registration (Form 130-U). You will also need the existing title, which should be signed by the seller. Make sure to fill out all sections of the form accurately to avoid delays. This process ensures that ownership changes are correctly documented.

To transfer a car title in Harris County, Texas, you will need a few essential forms. First, you need the Application for Texas Title and/or Registration (Form 130-U). Then, gather the original title signed by the seller, along with proof of identity. If applicable, sales tax payment receipt may also be necessary. Ensure that all documentation is in order to complete the transfer smoothly.

Looking up property taxes in Harris County is easy. You can utilize the Harris County Appraisal District website, where you can enter your property address or account number to access tax information. This platform enables you to view detailed records, including tax history and payment status. For more personalized assistance, you can visit the office or contact their support team.

To obtain a copy of your property tax bill in Texas, you can visit the Harris County Appraisal District's official website. They provide online access to property tax inquiries, allowing you to view and print your tax bill. Alternatively, you can contact your local tax office directly for assistance. Make sure to have your property details handy when you reach out.

Interested persons must visit the local county recorder or tax assessor-collector's office during business hours to request copies of property records. Alternatively, a requester can also access property records online by checking the designated record custodian's office.

For specific instructions, please call the Harris County office at (713)755-6439. For Fee Schedule, go to . Liens Contact Information.

In order to conduct a property title search on your own without paying a lawyer or a title company, you should head to your county clerk's office. In Texas, each county clerk's office is responsible for keeping detailed property records ? these records are public, and therefore available for you to view.

You may obtain Texas land records, including deeds, from the county clerk in the Texas county in which the property is located. You can search online for a deed in some counties, or else request the deed from the clerk in person, by mail, phone, fax or email.