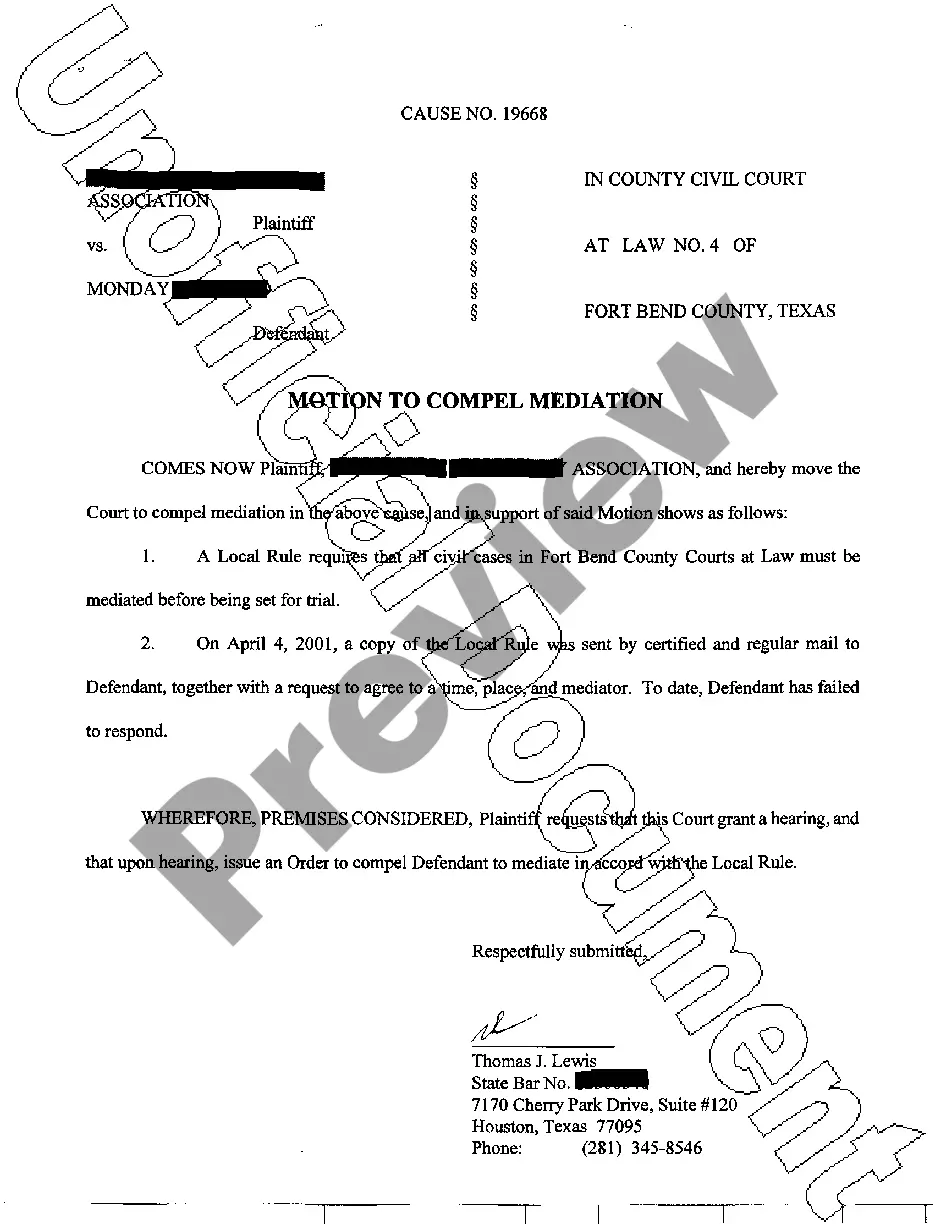

Pasadena Texas Tax Lien Contract

Description

How to fill out Texas Tax Lien Contract?

Are you seeking a reliable and affordable legal document provider to acquire the Pasadena Texas Tax Lien Contract? US Legal Forms is your ideal solution.

Whether you need a straightforward agreement to establish rules for living with your partner or a collection of paperwork to process your separation or divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for both personal and commercial use. All templates we provide are not generic and are tailored to meet the specifications of distinct state and county requirements.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button next to it. Please remember that you can access your previously purchased document templates anytime via the My documents section.

Is this your first visit to our platform? No problem. You can set up an account in just a few minutes, but before doing so, ensure you take the following steps.

Now you can establish your account. Then select the subscription plan and proceed with the payment. Once the payment is finalized, download the Pasadena Texas Tax Lien Contract in any available format. You can revisit the website whenever needed and redownload the document at no additional cost.

Acquiring updated legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal documentation online for good.

- Verify if the Pasadena Texas Tax Lien Contract meets the statutes of your state and local area.

- Review the form's description (if available) to understand who and what the document is designed for.

- Restart your search if the template does not suit your legal needs.

Form popularity

FAQ

To buy a tax lien property in Texas, start by researching available properties through county tax offices or online platforms. Once you identify a property, familiarize yourself with the auction process, as Texas allows the sale of tax liens through public auctions. You will need to understand the terms of the Pasadena Texas Tax Lien Contract to make informed bids. Utilizing resources like US Legal Forms can help you navigate the legal aspects and ensure compliance throughout the buying process.

In Colorado, tax liens can last for up to 15 years if not addressed. After this period, the lien may expire, but it is crucial to resolve your Pasadena Texas Tax Lien Contract within this timeframe to protect your property and financial standing. Regularly check with the county assessor or tax collector for updates on your lien status. Staying proactive can help you manage your liens effectively.

To navigate around a tax lien, consider negotiating directly with the tax authority to create a payment plan. You can also explore options for lien releases, which can relieve you from certain obligations attached to your Pasadena Texas Tax Lien Contract. Seeking professional advice from a tax consultant or legal expert can provide additional strategies tailored to your situation. Always stay informed about the terms of your tax lien to avoid further complications.

In Texas, a state tax lien typically lasts for a period of two years if no action is taken on the part of the lien holder. After this time frame, if the property owner has not redeemed the lien, the lien may become void. Understanding the timeline and implications of the Pasadena Texas Tax Lien Contract can help investors make informed decisions about when to act. Always check with local authorities or legal experts to get the most accurate and up-to-date information.

Investing in tax liens, such as those available under the Pasadena Texas Tax Lien Contract, can expose investors to potential pitfalls. One disadvantage is the possibility of property owner redemption, which may prevent you from acquiring the property outright. Additionally, the investment may yield lower returns if the property's value does not appreciate as expected. It's also essential to consider the legal complexities involved, which can be challenging without proper guidance.

Yes, you can sell your house if you owe back taxes in Texas, but the tax obligations will need to be resolved during the sale process. Buyers will usually want to ensure that there are no liens attached to the property. It’s essential to refer to the Pasadena Texas Tax Lien Contract for guidance on how to handle unresolved taxes when selling your home.

A tax lien in Texas can last indefinitely as long as the taxes remain unpaid. Enforcement actions may take place if the lien is not resolved within a certain period. Consulting details in the Pasadena Texas Tax Lien Contract can help explain how long you may be affected by a tax lien.

The statute of limitations on a lien in Texas is generally four years for most cases, but property tax liens may follow different rules. This time frame determines how long a creditor has to enforce the lien. Familiarizing yourself with the Pasadena Texas Tax Lien Contract provides clarity on these legal time limits.

Yes, tax liens can negatively impact your credit score, potentially making it harder to secure loans. Lenders often view tax liens as a sign of financial distress. Understanding the significance of a Pasadena Texas Tax Lien Contract can help you address these issues and protect your credit.

In Texas, tax liens remain valid as long as the taxes remain unpaid, but they may eventually be subject to expiration if not enforced. Generally, a lien can be enforced within a certain timeframe, usually before property foreclosure occurs. Reviewing the Pasadena Texas Tax Lien Contract will help clarify these timelines.