Fort Worth Texas Statement of Authority to Transfer Property

Description

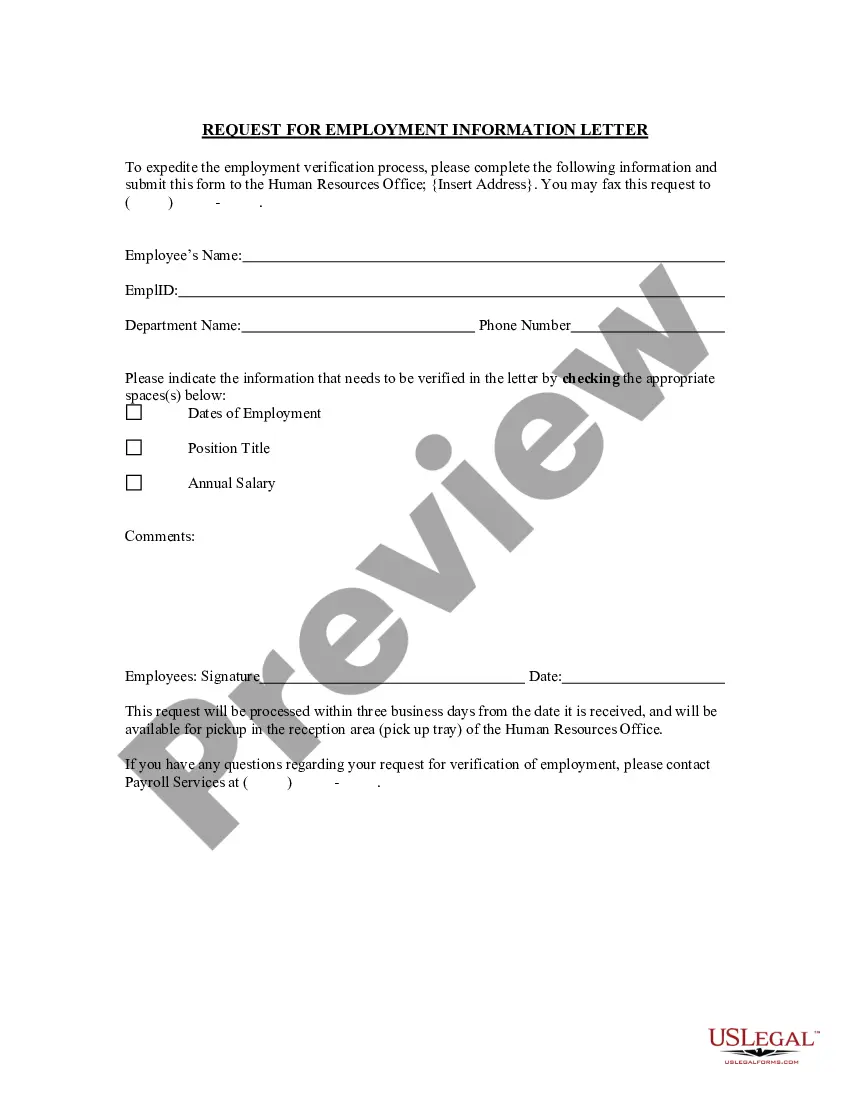

How to fill out Texas Statement Of Authority To Transfer Property?

No matter the social or professional standing, finalizing legal documents is a regrettable necessity in the modern world.

Frequently, it’s nearly impossible for individuals lacking a legal background to compose these types of papers from scratch, mainly due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms comes to the aid.

Confirm that the template you selected is relevant to your location since the laws of one state or region do not apply to another.

View the form and read a short overview (if available) of cases the document can address.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents that cater to almost any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to enhance their time efficiency using our DIY documents.

- Whether you require the Fort Worth Texas Statement of Authority to Transfer Property or any other paperwork that is applicable in your state or region, with US Legal Forms, everything is readily available.

- Here’s how you can quickly obtain the Fort Worth Texas Statement of Authority to Transfer Property using our reliable service.

- If you are already a member, proceed to Log In to your account to access the needed form.

- However, if you are new to our collection, ensure to follow these steps before downloading the Fort Worth Texas Statement of Authority to Transfer Property.

Form popularity

FAQ

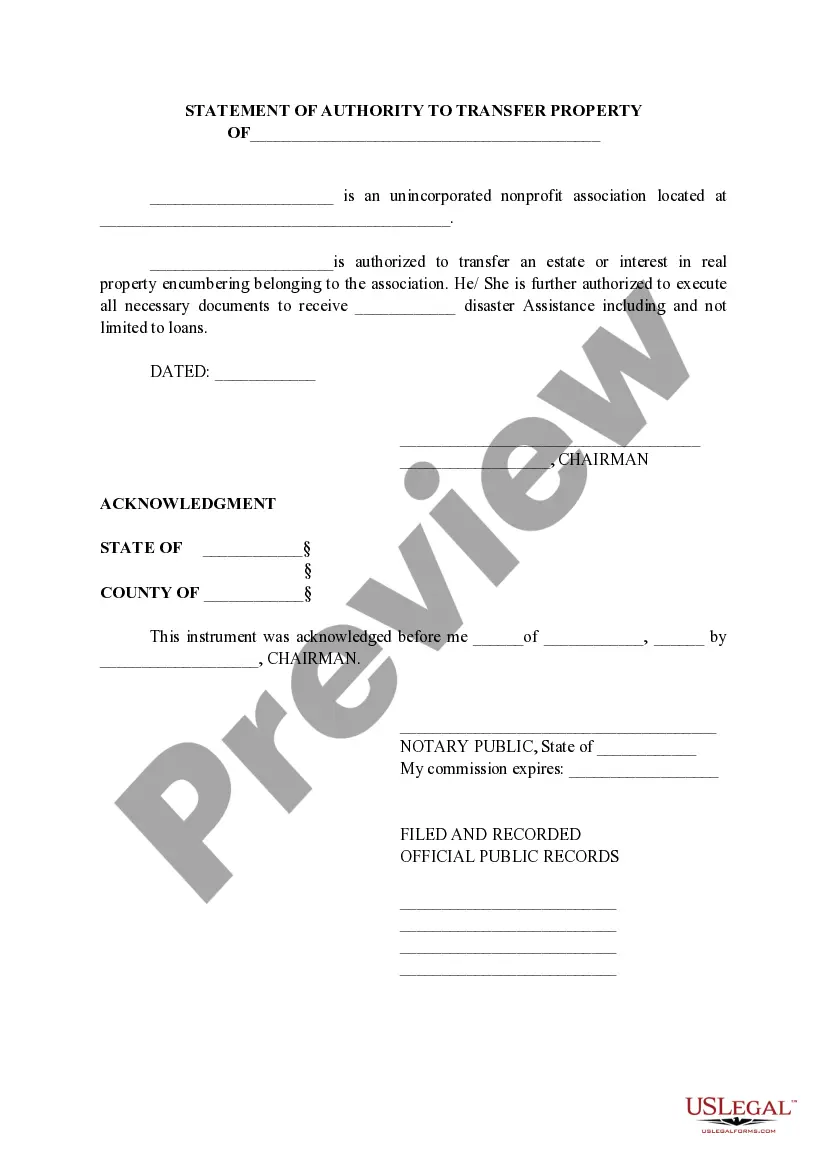

When the Will is filed for probate, the person named as the Executor will need to sign the Executor's Deed to transfer the property from the deceased owners to the heirs named in the Will. If there is no Will, a probate judge may appoint an Administrator for the estate.

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

The transfer process can take up to 3 months. There are different phases involved in the transfer of a property. These phases are: Instruction: a conveyancer receives the instruction to transfer the property.

An Affidavit of Heirship. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased. Once it is signed notarized, the Affidavit of Heirship is ready to be recorded with the deeds records in the county where the property is located.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.