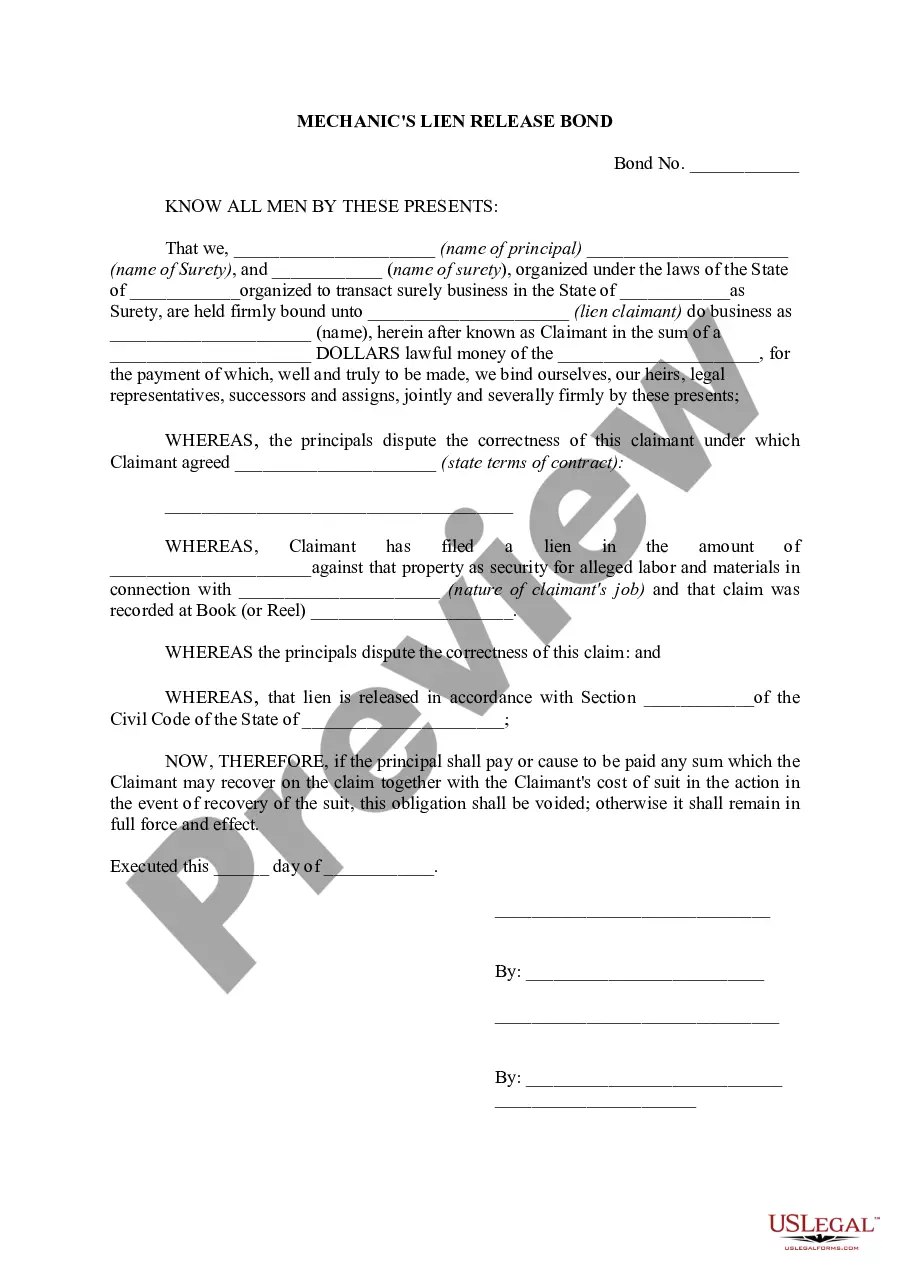

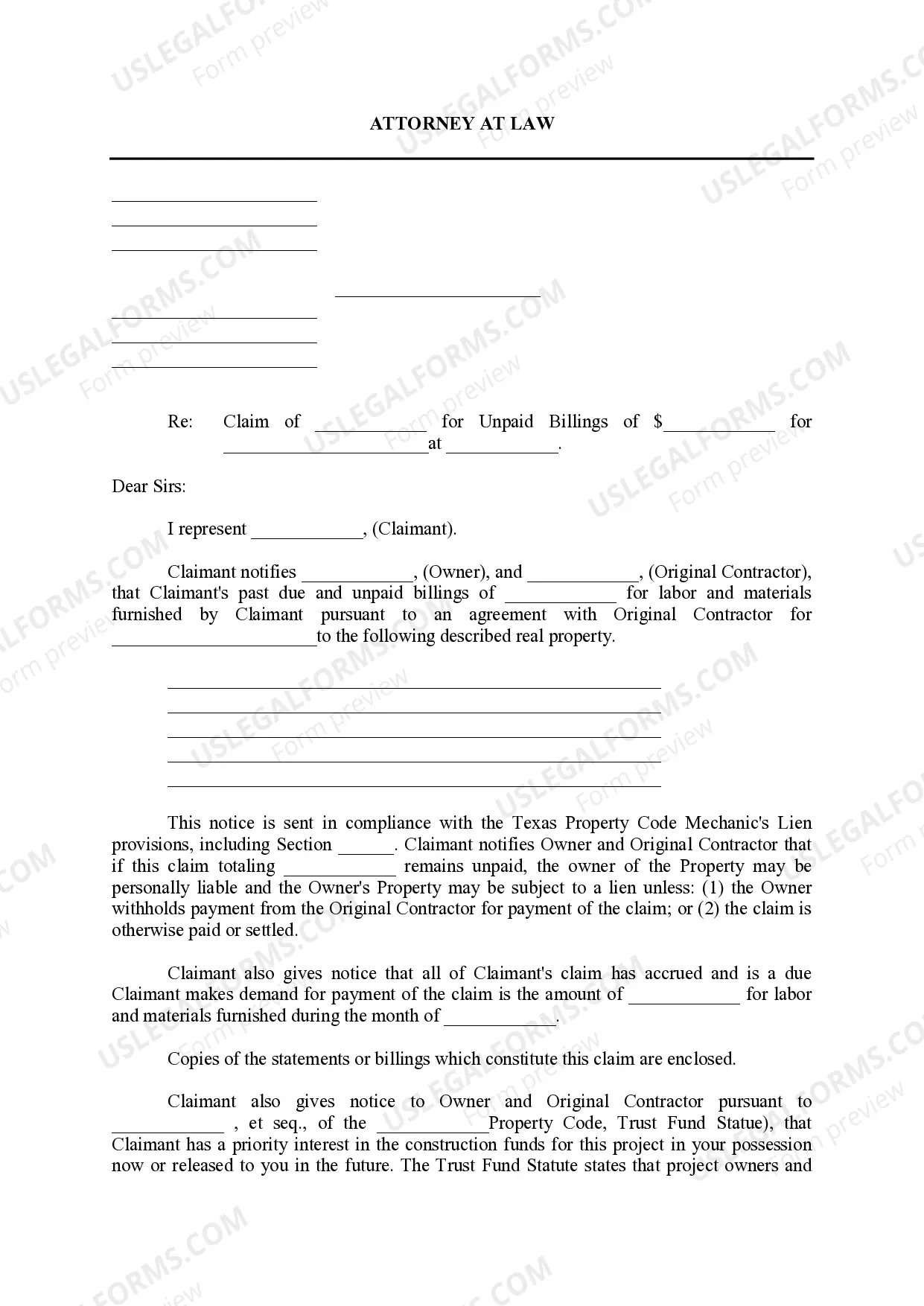

Harris Texas Mechanic's Lien Release Bond

Description

How to fill out Texas Mechanic's Lien Release Bond?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly platform, featuring a vast array of documents, streamlines the process of locating and obtaining nearly any form sample you may need.

You can export, complete, and authorize the Harris Texas Mechanic’s Lien Release Bond in just a few moments instead of spending countless hours searching online for an appropriate template.

Using our catalog is an excellent approach to enhance the security of your document submissions.

If you haven't set up an account yet, follow the steps below.

Visit the page with the necessary form. Ensure that it is the template you are looking for: check its title and description, and utilize the Preview feature when available. Otherwise, use the Search field to find the required one.

- Our skilled legal experts routinely evaluate all documents to guarantee that the templates are applicable to a specific jurisdiction and adhere to recent laws and regulations.

- How can you obtain the Harris Texas Mechanic’s Lien Release Bond.

- If you already possess an account, simply Log In to your profile.

- The Download button will be activated on all documents you view.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

If you are seeking to remove a lien from a vehicle, the lender will typically send the release of lien once the loan is paid in full. It can take up to thirty days to receive the title and the lien release after the final payment.

Does a mechanic's lien expire in Texas? Once a mechanic's lien is filed against a property, it will remain in place until it is ?released?, which is a formal process.

To find a Texas release of lien form, locate the address and phone number of the county clerk's office from the internet, then go in person to ask for a copy of their Texas release of lien form.

After the lien on a vehicle is paid off, the lienholder has 10 days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

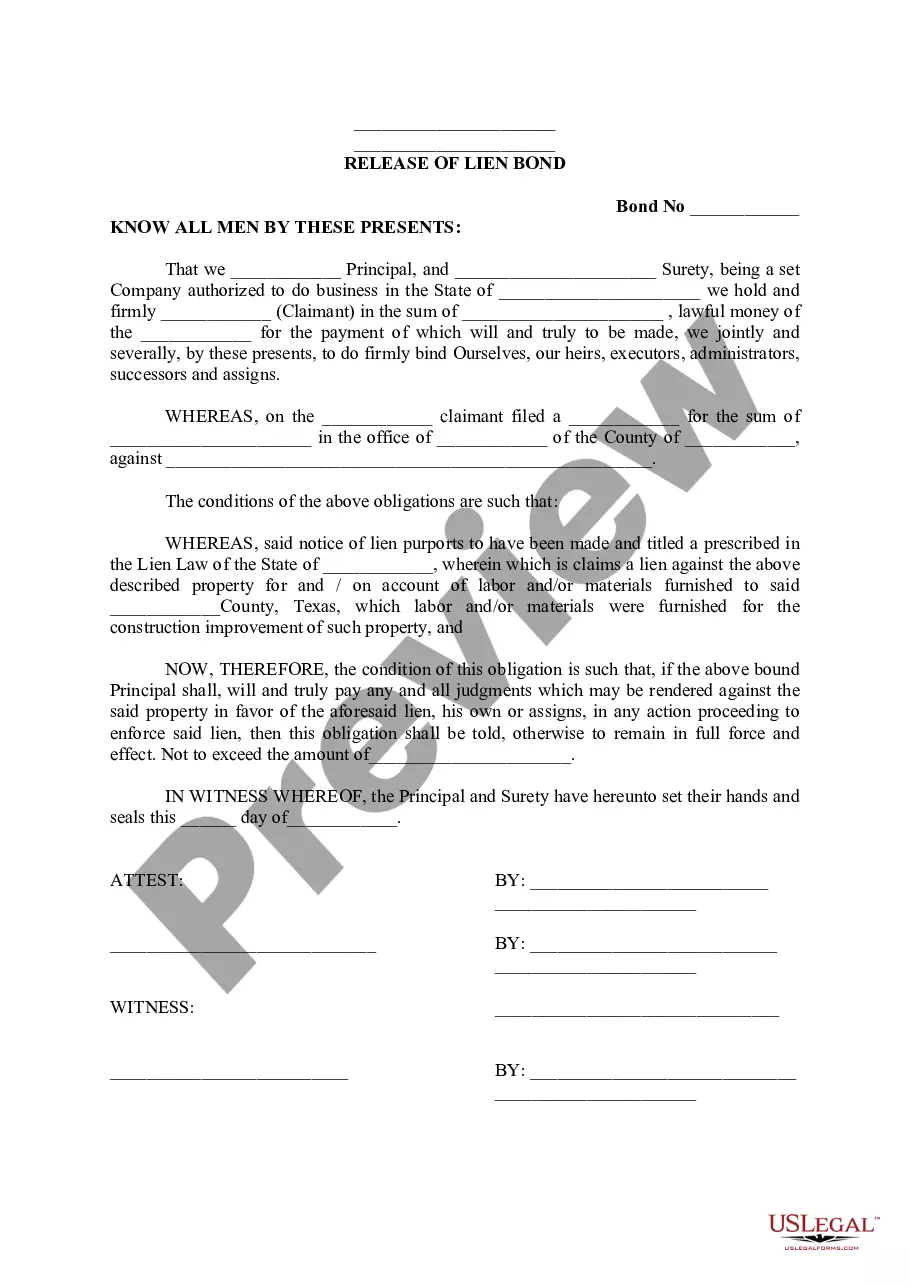

The process of bonding off a mechanics lien starts after a claimant has filed a mechanics lien. After the claim is made, a general contractor or a property owner can contact a surety bond company to purchase a surety bond that replaces the value of the lien that was filed against the property.

Remedial Bonds Under Section 53.171 of the Texas Property Code: Under Section 53.171(c) of the Texas Property Code, a mechanic's lien can be discharged with a bond even after the dispute has arisen and the lien has been filed. The bond must be substantially higher than the lien amounts.

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

What is a bond to indemnify against a lien? For the bond to be effective against a subcontractor's lien, the general contractor must file it among the real property records in the county in which the property is located. Additionally, the bond must be in an amount that is double the amount of the lien.

Deposit the Lien Amount with the Court: A lien can be removed from the property if you file a lawsuit and deposit the lien amount into the court's registry. This allows the parties to litigate the validity of the claim, without the lien encumbering the property.

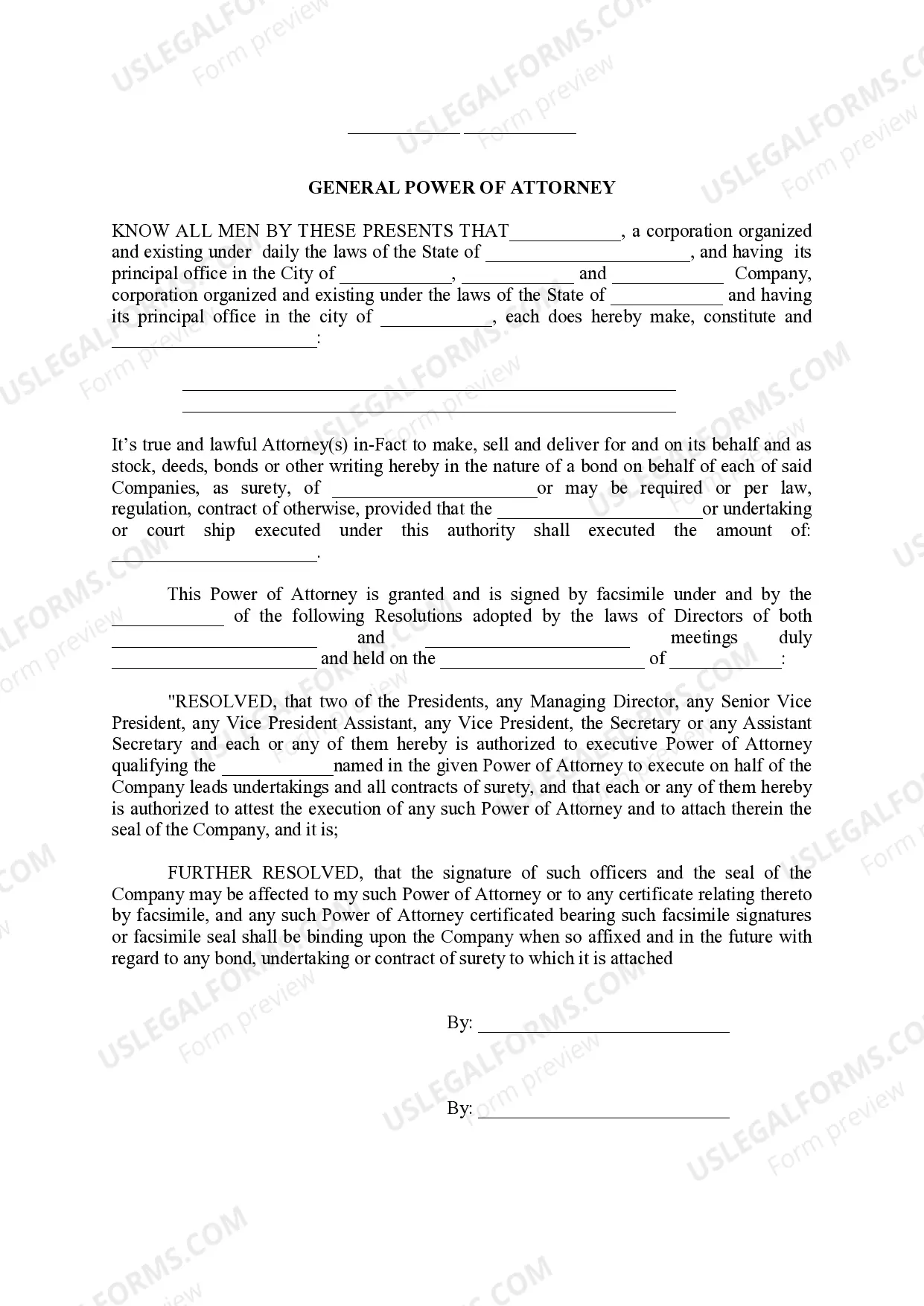

2d 902, 904-05 (Tex. 1983)). There is no required form of release. A release generally must: Be executed by the lender.