Bexar Texas Lien -Property

Description

How to fill out Texas Lien -Property?

Locating authenticated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms database.

It is a digital repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are aptly classified by usage area and jurisdictional zones, making it simple and swift to find the Bexar Texas Lien -Property.

Preserving paperwork orderly and in accordance with legal stipulations is of utmost significance. Take advantage of the US Legal Forms library to always have crucial document templates within reach for any requirements!

- Examine the Preview mode and document description.

- Ensure you've picked the correct one that fulfills your criteria and completely aligns with your local jurisdictional specifications.

- Seek another template, if necessary.

- If you spot any discrepancies, utilize the Search tab at the top to find the appropriate one. If it fits your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

You can look up liens on a property in Texas through the county appraisal district or the county clerk’s office. Many areas have online tools that provide easy access to property records, detailing any liens attached. For an efficient search regarding Bexar Texas Lien -Property, consider using uslegalforms to simplify your inquiry.

Yes, property liens can expire in Texas, but the timeline depends on the type of lien involved. Certain liens, such as judgment liens, have specific timeframes within which they must be enforced. Staying informed about your Bexar Texas Lien -Property can help you manage your liabilities effectively.

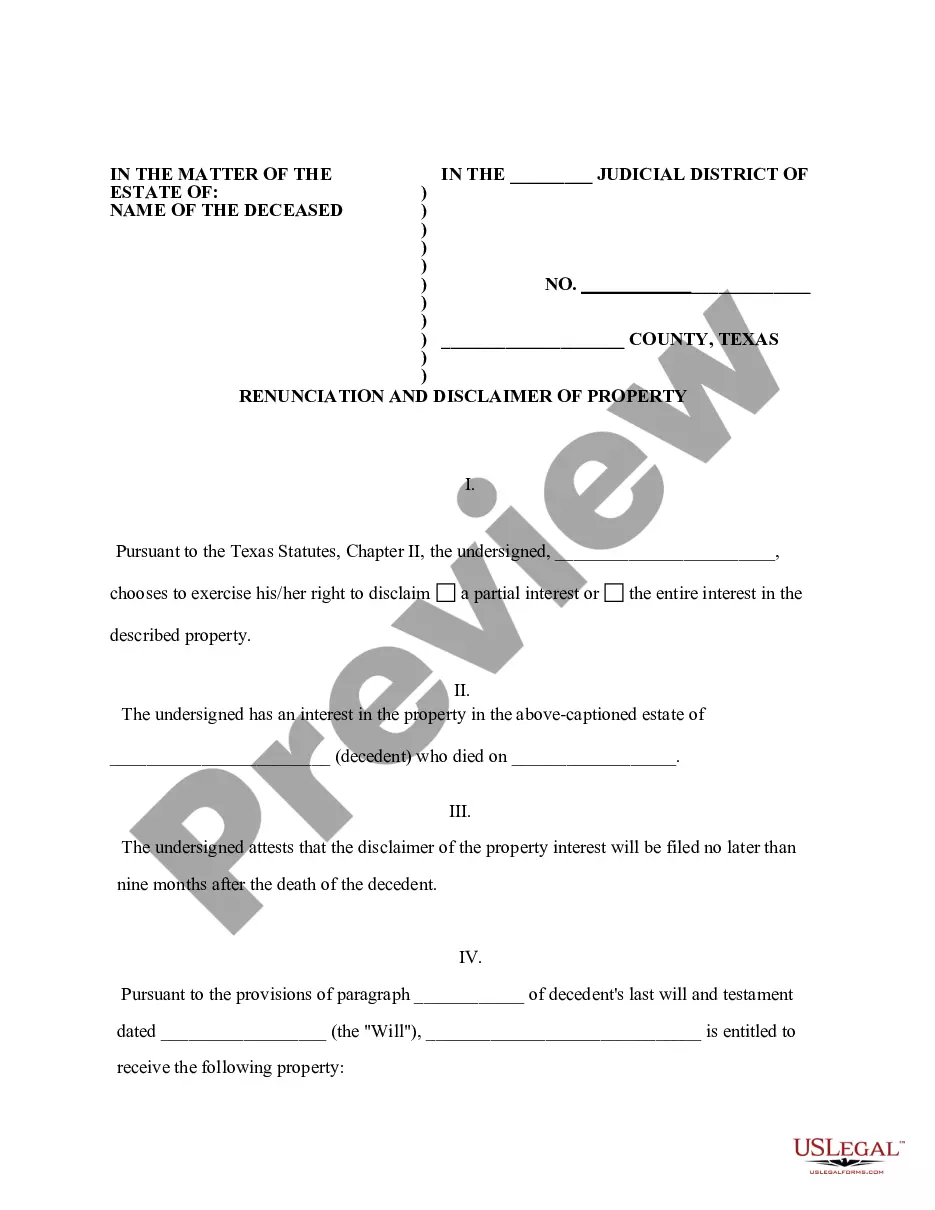

To remove a lien from your property in Texas, you typically need to settle the underlying debt or reach an agreement with the lienholder. Once the debt is resolved, the lienholder must file a release of lien with the county clerk. This process ensures a clear title for your Bexar Texas Lien -Property.

In Texas, a property lien is a legal claim against a property to secure payment for a debt. When a lien is placed, the property owner cannot sell or refinance the property freely until the lien is settled. This process ensures that creditors have a way to recover what they are owed, protecting their interests in Bexar Texas Lien -Property.

To put a lien on a car title in Texas, you need to complete the Application for Texas Title and/or Registration, where you can list the lienholder's information. Once you complete the application, submit it to your local Department of Motor Vehicles along with the appropriate fees. If you are dealing with a Bexar Texas Lien -Property, ensure you follow the necessary steps to protect your rights. Platforms like US Legal Forms offer resources to help you navigate this process smoothly, ensuring your lien is recorded correctly.

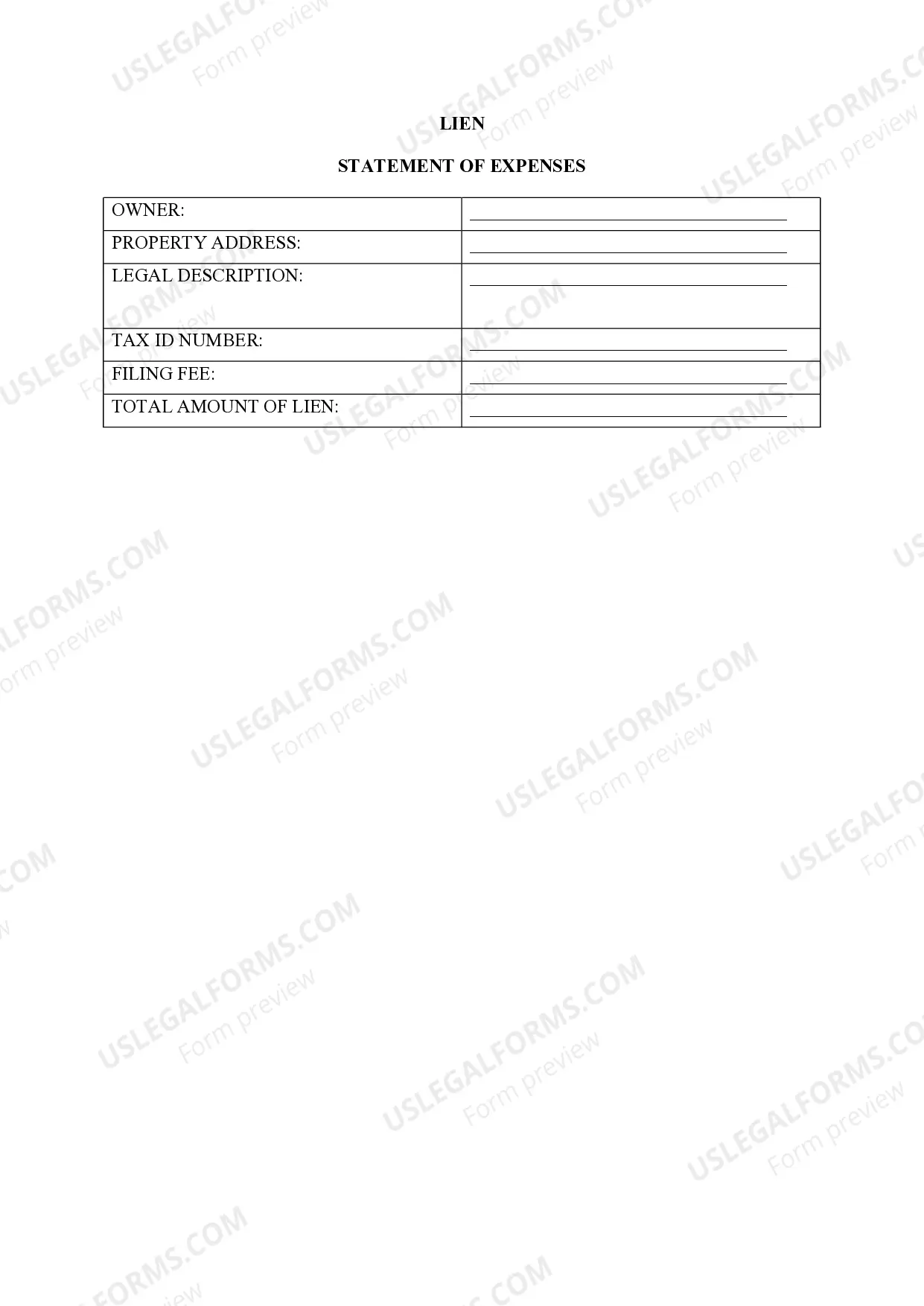

Form 130 in Texas is typically filled out by the owner of the property or a representative, such as an attorney or a title company. This form is crucial for establishing a Bexar Texas Lien -Property and serves as a notice of the lienholder's interest in the property. It's important to provide complete and accurate information on the form to avoid complications. Using a service like US Legal Forms can simplify this process by providing the correct forms and detailed instructions.

To file a lien in Texas, you need to prepare a document called a lien affidavit, which provides essential details about the debt and the property involved. Once you have this affidavit, you must file it with the County Clerk’s office in the county where the property is located, such as Bexar County for a Bexar Texas Lien -Property. It's important to ensure that all information is accurate and complete to avoid any delays. Consider using platforms like US Legal Forms for easy access to the necessary forms and guidance throughout the process.

To file a lien in Texas, you need specific information and documents. This includes the property owner’s details, a legal description of the property, and documentation proving the obligation or debt. Additionally, it is beneficial to familiarize yourself with Texas lien laws and requirements. Utilizing uslegalforms can guide you through these requirements for your Bexar Texas lien -property effectively.

No, in Texas, you generally cannot file a lien without a contract. A valid contract is essential as it serves as the foundation for claiming your rights. If you provide goods or services, ensure you have a written agreement to support your claim. For assistance in understanding your needs regarding a Bexar Texas lien -property, consider exploring the resources available at uslegalforms.

Filing a lien in Texas involves several steps. First, you need to prepare the necessary documents, including the lien application and any supporting paperwork. Next, you submit these documents to the appropriate county office, either in person or online, depending on your county's services. Using resources from uslegalforms can simplify this process and help ensure you complete each step properly for your Bexar Texas lien -property.