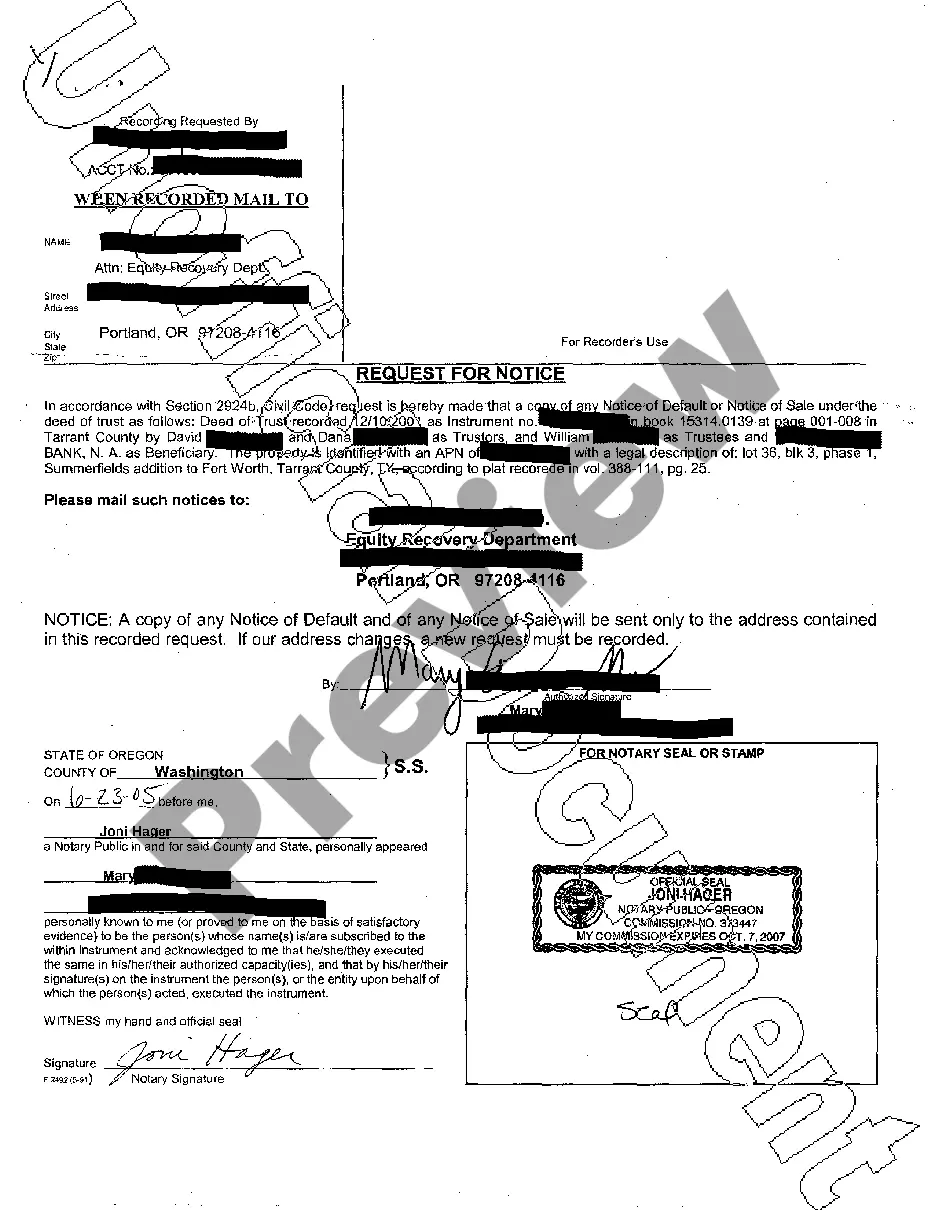

Dallas Texas Request for Notice of Default or Notice of Sale

Description

How to fill out Texas Request For Notice Of Default Or Notice Of Sale?

Finding validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s a web-based repository of over 85,000 legal documents for both individual and professional requirements as well as various real-world scenarios.

All the files are neatly categorized by usage area and jurisdictional domains, making the search for the Dallas Texas Request for Notice of Default or Notice of Sale quick and straightforward.

Maintaining documentation orderly and in accordance with legal standards is of utmost importance. Take advantage of the US Legal Forms library to have crucial document templates for all needs readily available!

- Check the Preview mode and form summary.

- Ensure you’ve selected the appropriate one that satisfies your needs and completely aligns with your local jurisdiction requirements.

- Search for an alternative template, if necessary.

- If you find any discrepancies, use the Search tab above to locate the correct one. If it meets your criteria, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

A notice of sale foreclosure in Texas is a formal announcement by the lender that a property is scheduled for auction due to default on the mortgage. This notice must be filed with the country clerk and published, giving the homeowner and the public official notice of the forthcoming sale. If you wish to stay informed, consider a Dallas Texas Request for Notice of Default or Notice of Sale to receive timely updates regarding foreclosure actions.

The 37 day foreclosure rule means that after a notice of sale is posted, the auction must take place at least 21 days later, with the entire process requiring the lender to allow at least 37 days for the borrower to respond or rectify the situation. Understanding this timeline is essential for anyone involved in the foreclosure process. A Dallas Texas Request for Notice of Default or Notice of Sale will help clarify your rights during this period.

The five stages of foreclosure action in Texas include pre-foreclosure, notice of default, notice of sale, auction, and post-foreclosure. During pre-foreclosure, the lender contacts the borrower, while the notice of default formally begins the foreclosure process. Each stage is crucial, and a Dallas Texas Request for Notice of Default or Notice of Sale can provide guidance and support throughout.

The 120 day rule in Texas stipulates that a lender must wait 120 days after a borrower defaults on a mortgage before initiating foreclosure proceedings. This period allows homeowners a chance to rectify the missed payments or find alternatives. By understanding this rule, you can better navigate a Dallas Texas Request for Notice of Default or Notice of Sale.

In Texas, the lender must send a notice of foreclosure sale to the borrower at least 21 days before the scheduled sale date. Additionally, the notice must be posted at the courthouse, filed with the county clerk, and published in a local newspaper. For those interested in understanding this better, a Dallas Texas Request for Notice of Default or Notice of Sale can help clarify the process and ensure compliance.

After receiving a notice of default, the homeowner typically faces a period to catch up on payments or negotiate alternatives. If no resolution occurs, the lender may proceed with filing a Dallas Texas Request for Notice of Sale, which places the property at risk of foreclosure. Homeowners should seek guidance to explore their options and protect their rights during this critical time.

In Texas, foreclosure begins when a lender files a Dallas Texas Request for Notice of Default after a borrower defaults on their mortgage. The lender must follow specific legal steps, including notifying the homeowner and scheduling a foreclosure sale. It is essential for both lenders and homeowners to understand this process to navigate it effectively.

When a property goes into default, it means the homeowner has failed to make mortgage payments. This situation can lead to a series of legal actions, including the filing of a Dallas Texas Request for Notice of Default or Notice of Sale. It is crucial for homeowners to understand their rights and options at this stage, as it can impact their ability to keep their home.

In Texas, a lender typically initiates foreclosure proceedings after two to three missed payments. The exact timing can depend on the lender's policies and state laws. It is vital for homeowners to maintain open communication with their lenders to avoid escalating the situation. By using the Dallas Texas Request for Notice of Default or Notice of Sale, you can stay updated on your mortgage status and take timely action.

A foreclosure notice of default means the lender has officially identified the borrower as delinquent on mortgage payments. This notice initiates the foreclosure process, urging the homeowner to work on a resolution. Homeowners should not ignore this notice, as it is a critical indicator of impending legal actions. The Dallas Texas Request for Notice of Default or Notice of Sale can serve as a useful tool to help you navigate this process.