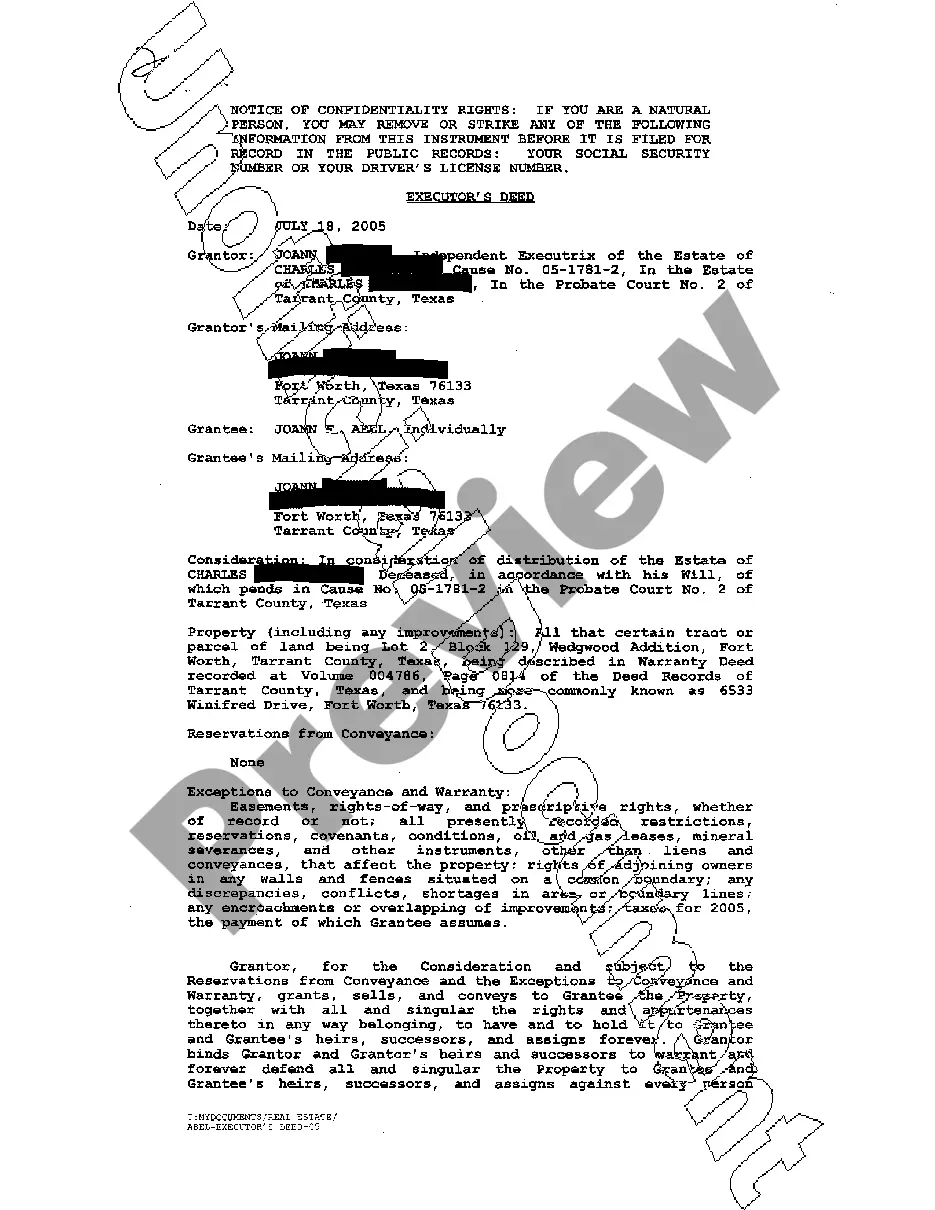

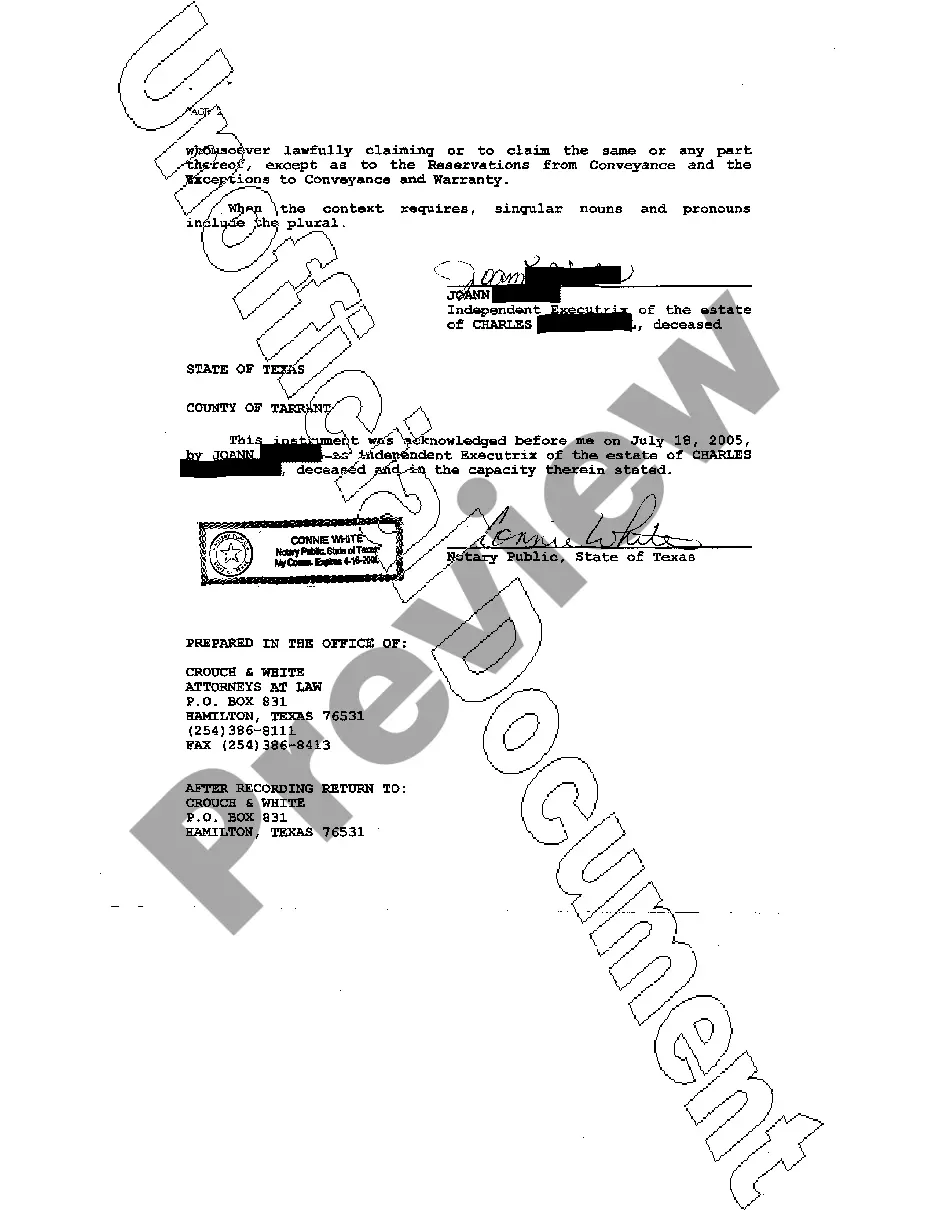

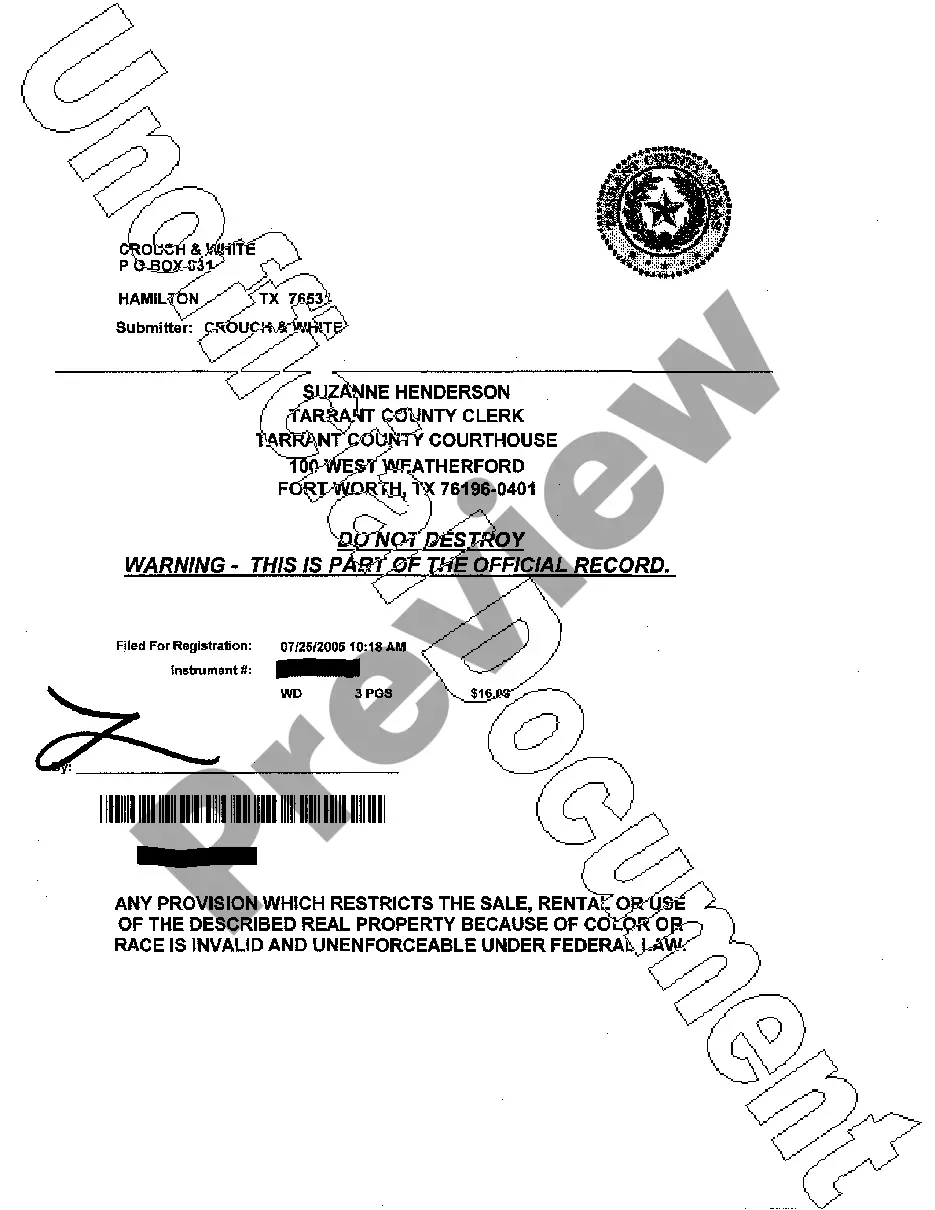

San Angelo Texas Executor's Deed

Description

How to fill out Texas Executor's Deed?

We consistently attempt to diminish or avert legal complications when addressing intricate legal or financial issues.

To achieve this, we seek legal assistance that is typically very expensive.

Nevertheless, not all legal challenges are that complicated; many can be handled independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorneys to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button beside it. If you have lost the document, you can always retrieve it again in the My documents section. The procedure is just as straightforward for newcomers! You can create your account in just a few minutes. Ensure that the San Angelo Texas Executor's Deed adheres to the laws and regulations of your state and area. Additionally, it is crucial to review the form’s outline (if available), and if you notice any inconsistencies with what you originally needed, look for an alternative form. Once you confirm that the San Angelo Texas Executor's Deed is appropriate for your situation, you can choose a subscription plan and proceed with payment. Then, you can download the document in any format that is available. For over 24 years, we have assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our library empowers you to manage your affairs without the need for legal representation.

- We provide access to legal form templates that are not always readily available to the public.

- Our templates are specific to states and regions, making the search process significantly easier.

- Benefit from US Legal Forms whenever you need to locate and rapidly download the San Angelo Texas Executor's Deed or any other document safely.

Form popularity

FAQ

HOW DO I GET APPOINTED EXECUTOR? Be at least 18 years old and of a sound mind ? that is, not judged incapacitated by a court.Not have been convicted of a felony under any state or federal law, unless he or she has been pardoned or had all civil rights restored.

No probate will be necessary to transfer the property, although of course it will take some paperwork to show that title to the property is held solely by the surviving owner. In Texas, two forms of joint ownership have the right of survivorship: Joint tenancy.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. The beneficiary's rights. The person you name in the TOD deed to inherit the property has no legal right to it until your death.

Under the Texas Estates Code, the standard compensation is a five (5%) percent commission on (1) all amounts that the executor or administrator receives; or (2) pays out in cash in the administration of the estate (the Texas two-step on executor compensation).

According to the Estates Code, an executor in Texas is entitled to up to 5% of the estate's total financial transactions. For Example: If an executor has to settle an estate worth $250,000 - if they do their duties correctly, and honestly are entitled up to $12,500 as compensation for administering the estate.

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.

Executor Compensation of Estate Fees Under the Texas Estates Code, a five (5%) percent commission is standard on all amounts received or paid in cash by an executor or administrator of an estate (the Texas two-step on executor compensation).

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.