Austin Texas Notice to Purchasers

Description

How to fill out Texas Notice To Purchasers?

If you have previously utilized our service, Log In to your account and store the Austin Texas Notice to Purchasers on your device by selecting the Download button. Ensure your subscription is active. Otherwise, renew it according to your billing plan.

If this is your inaugural encounter with our service, adhere to these straightforward steps to acquire your file.

You have continuous access to all documents you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and obtain any template for your personal or professional purposes!

- Ensure you have found the correct document. Review the description and use the Preview feature, if available, to determine if it satisfies your needs. If it’s not suitable, employ the Search tab above to discover the right one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Austin Texas Notice to Purchasers. Select the format for your document and store it on your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

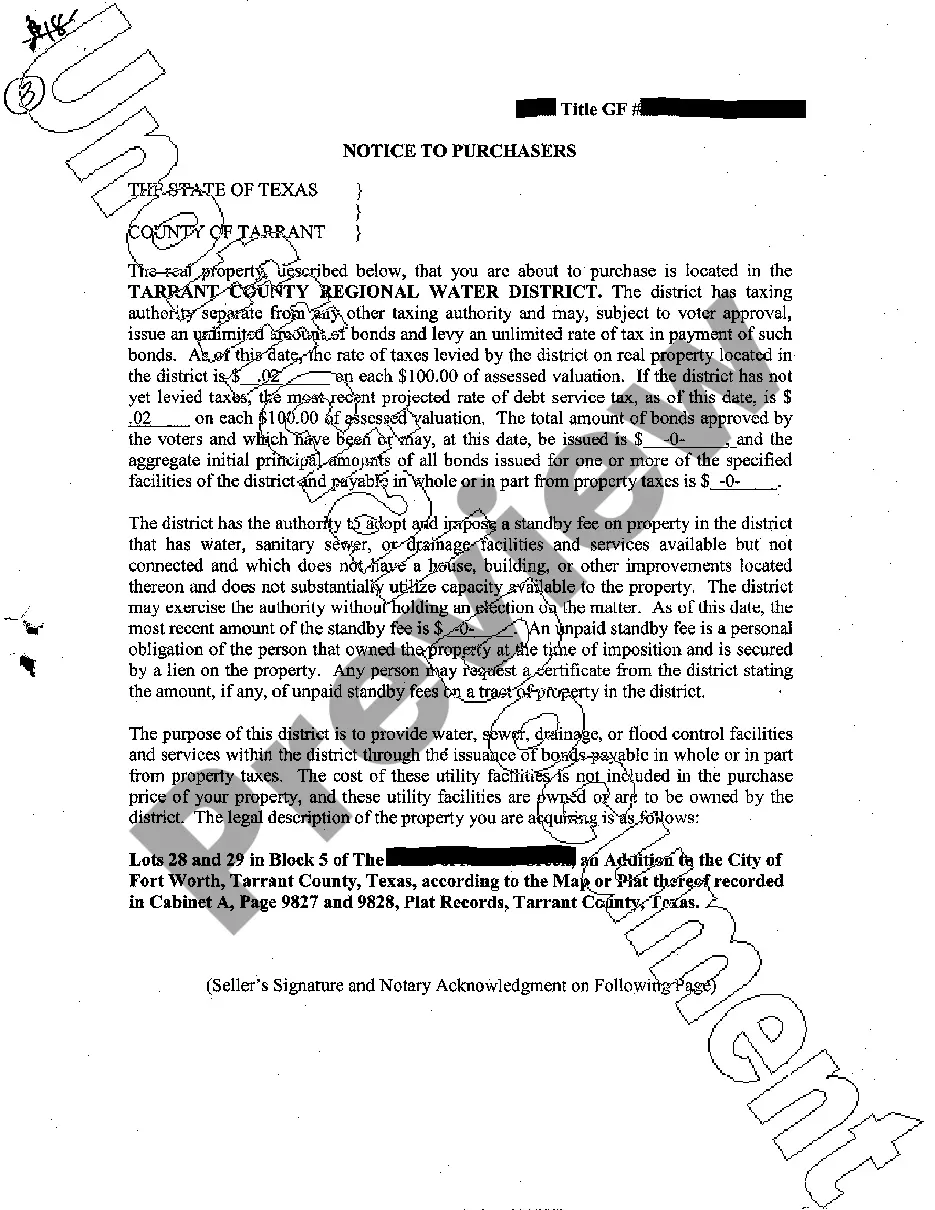

A Municipal Utility District (MUD) is one of several types of special districts that function as independent, limited governments. The purpose of a MUD is to provide a developer an alternate way to finance infrastructure, such as water, sewer, drainage, and road facilities.

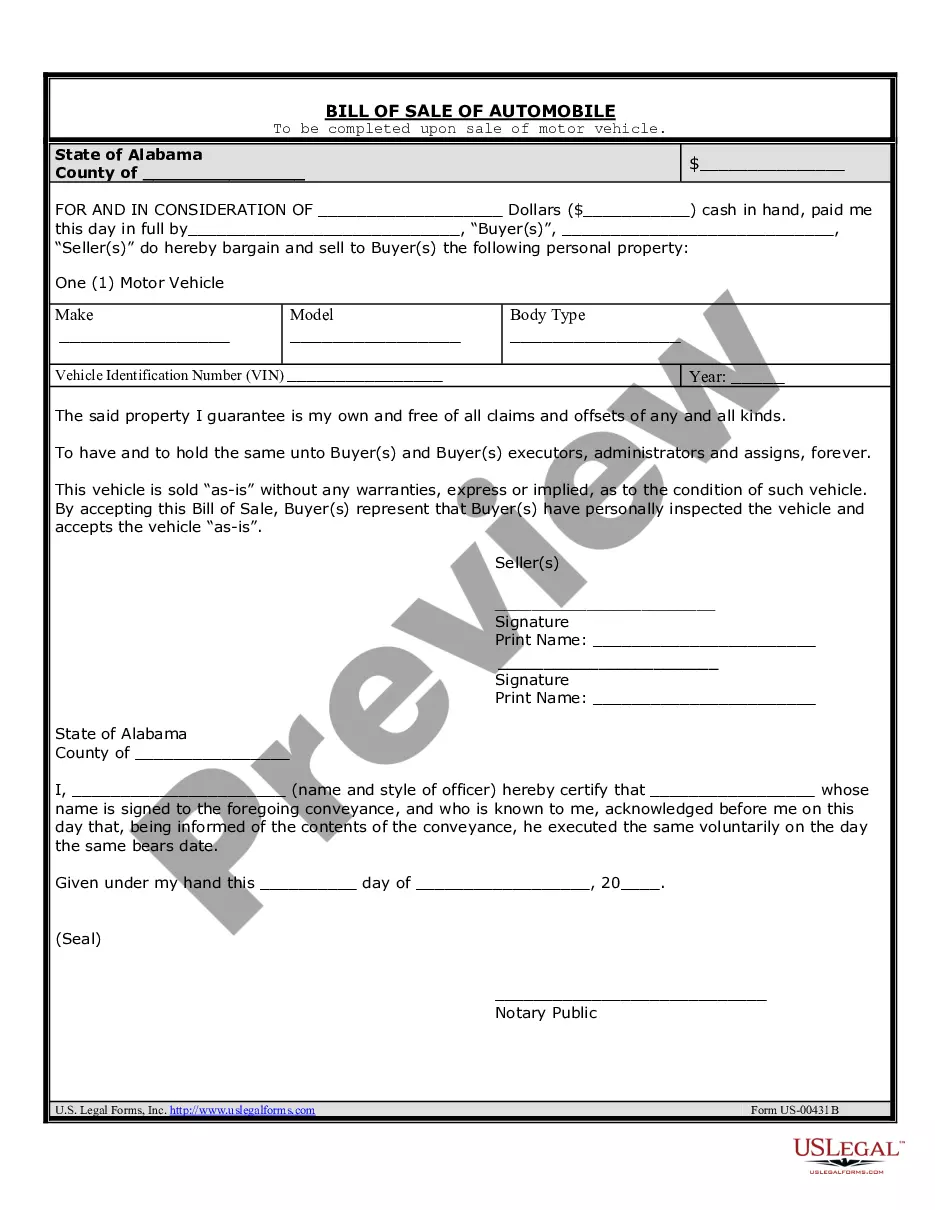

Description: This notice acknowledges that the buyer has been advised by a license holder to have the abstract covering the property examined by an attorney or to obtain a title insurance policy.

MUDs (Municipal Utility Districts) finance the construction of public infrastructure that does not yet exist, typically utility facilities and roadways. Over time, developers within a MUD can be reimbursed for water, sewer, drainage and sometimes road infrastructure through property taxes.

What is the MUD's tax rate? The MUD levies a property tax on all taxable property in the MUD, which may change from year to year. Taxes are currently $0.71 per $100 of taxable value. The tax consists of $0.46 for debt service, and $0.25 for maintenance.

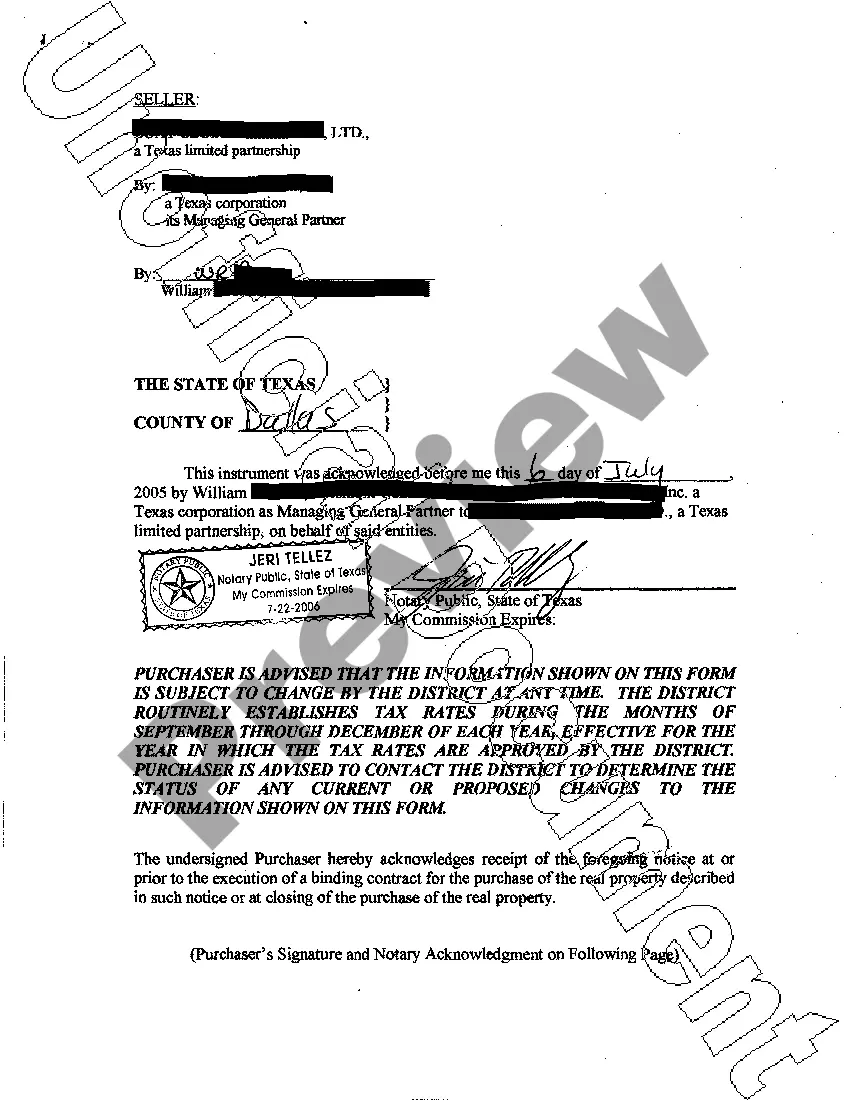

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

MUD stands for Municipal Utilities District. A MUD is a political subdivision authorized either by the Texas Legislature or by the Texas Commission of Environmental Quality (TCEQ) to provide utilities such as drinking water, waste, sewage, and drainage to its district.

After 20-30 years, the MUD tax can be totally eliminated. Who Oversees and Operates a MUD? A MUD is governed by the Texas Commission on Environmental Quality (TCEQ) which makes sure all activities, services, and infrastructure are in line with local and state regulations.

A Public Improvement District is a special district created by a City or County under the authority of Chapter 372 of the Texas Local Code. The statute allows for a city or county to levy a special assessment against properties within the District to pay for improvements to the properties within the District.

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

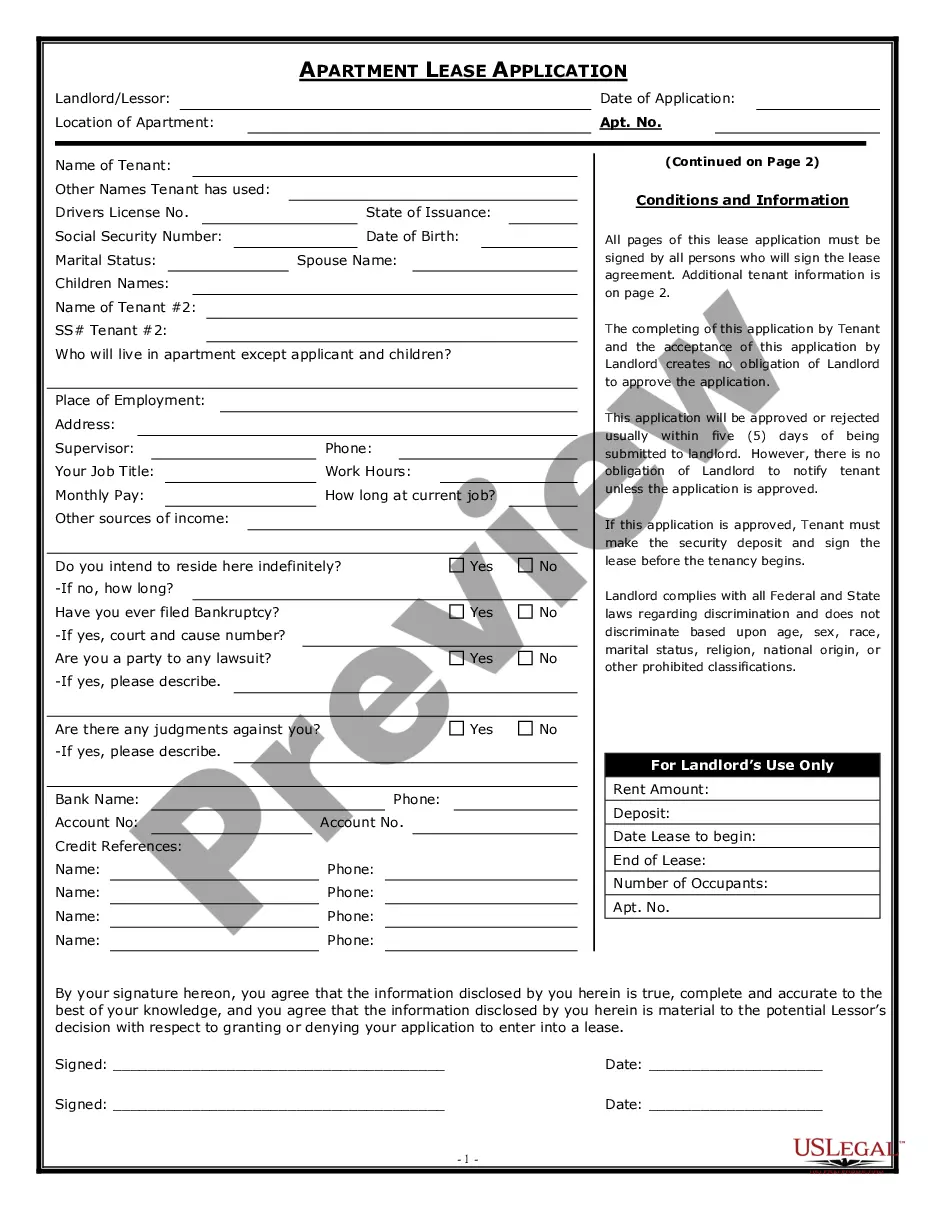

Texas REALTORS® has added a Property Values section to form 1506, General Information and Notice to Buyers and Sellers. This form is intended to be presented to clients so that agents discuss the topics on the form with their buyers and sellers.