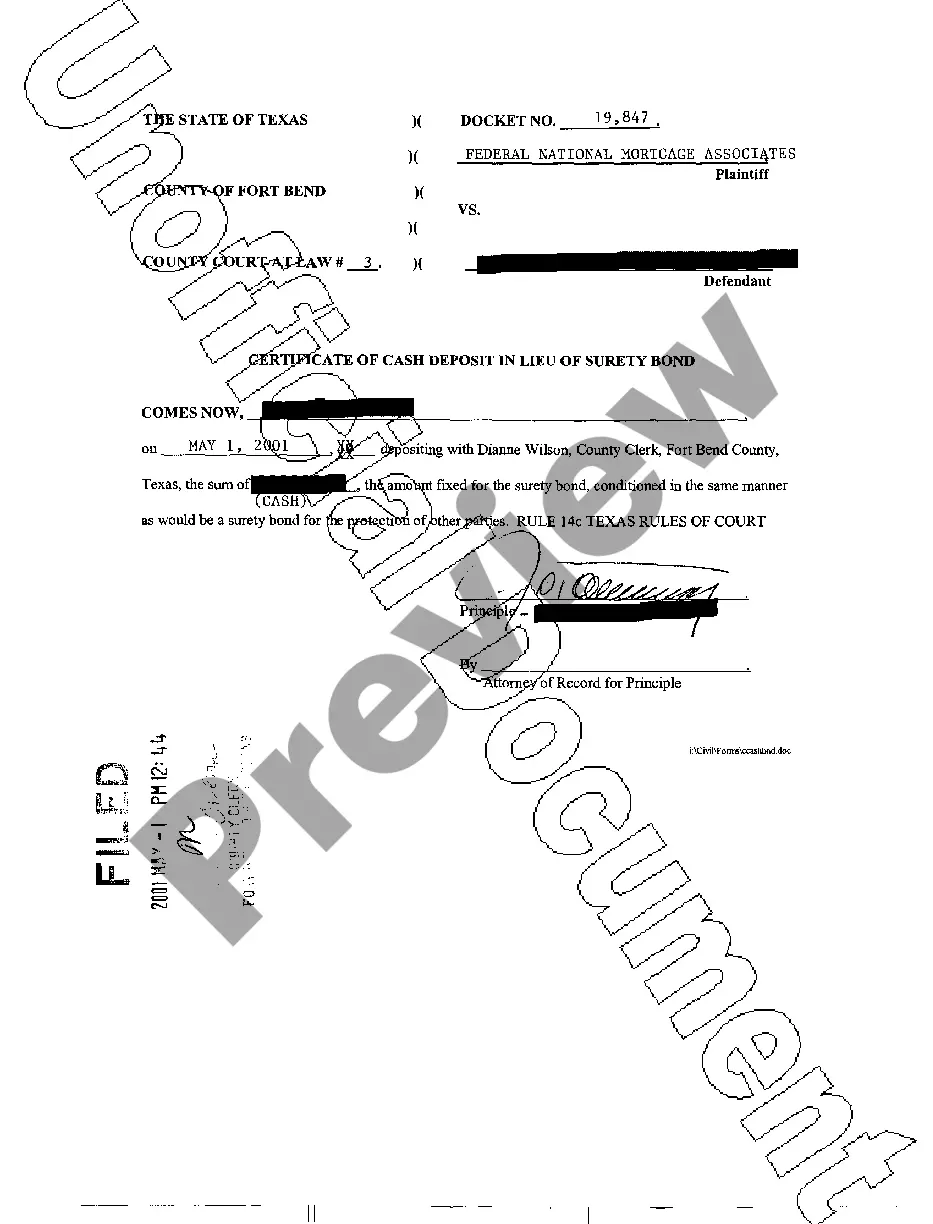

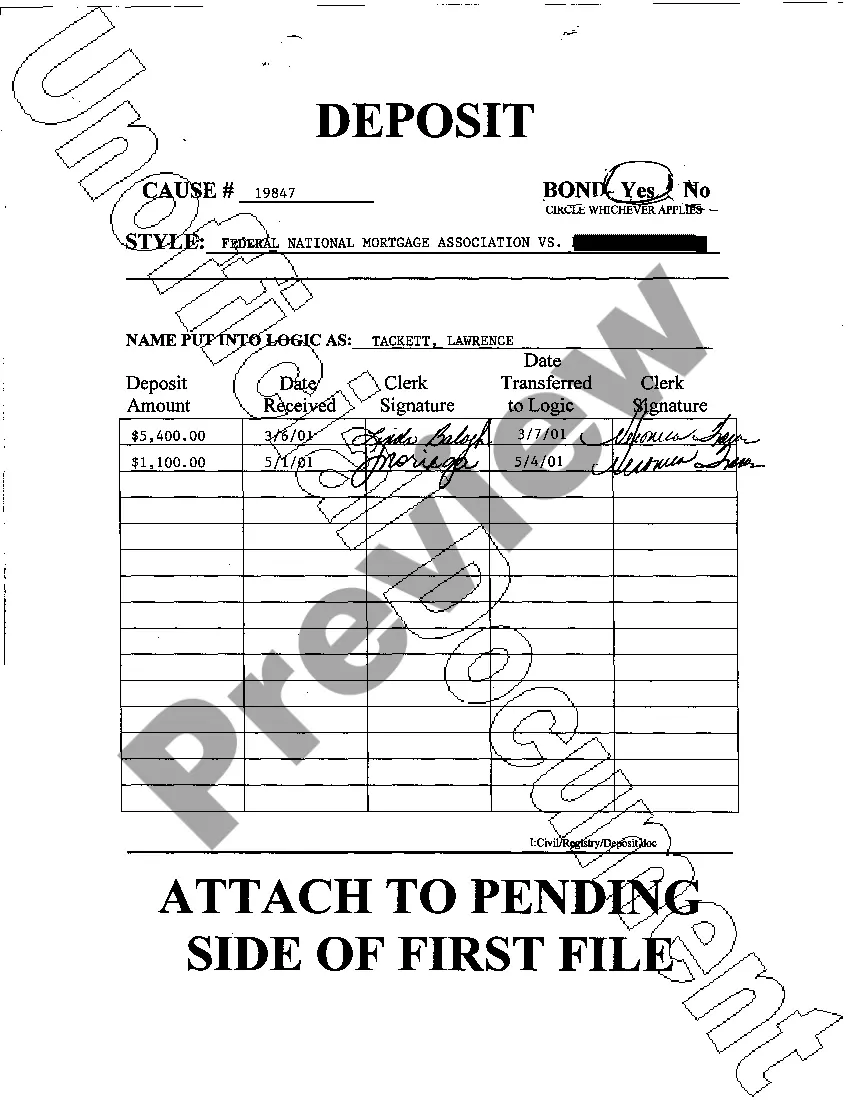

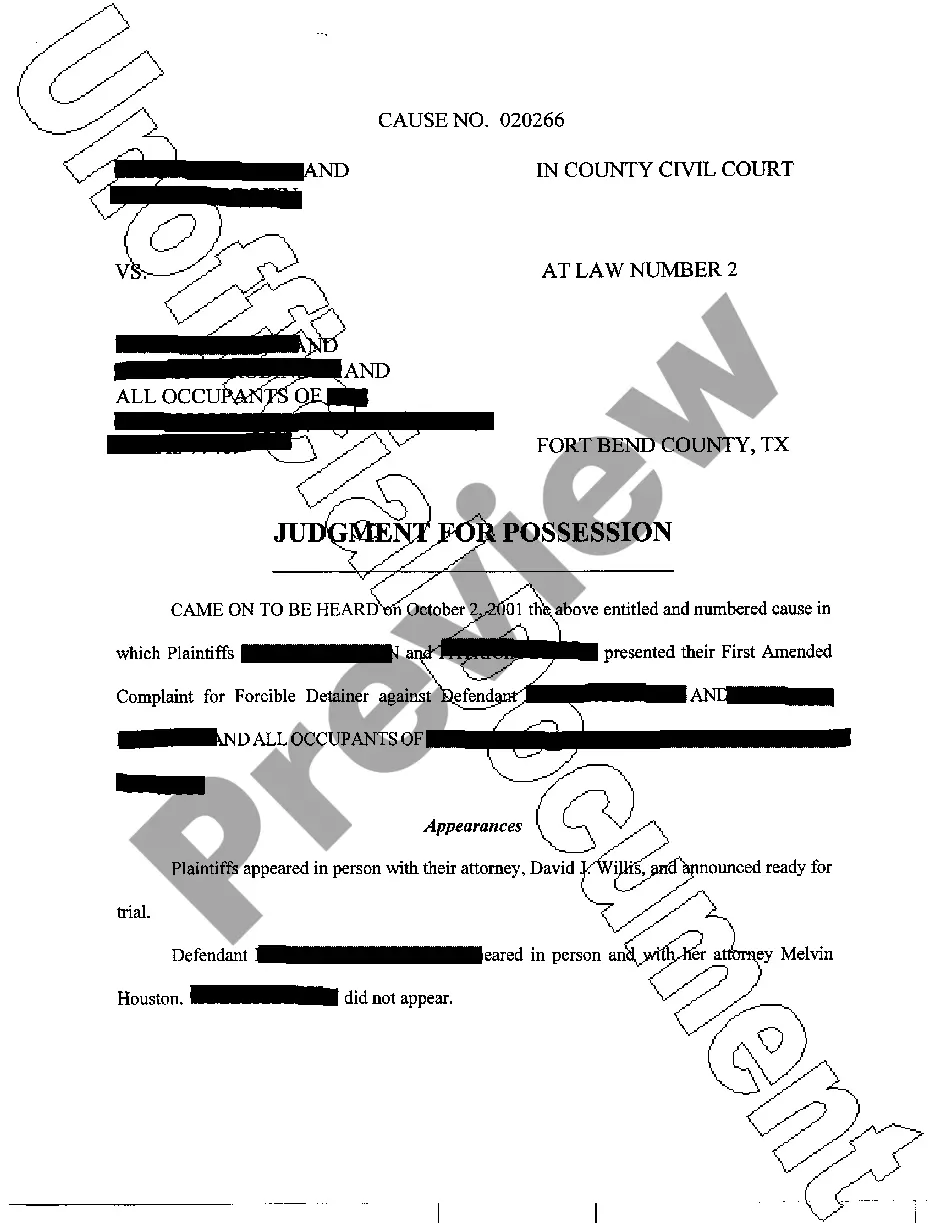

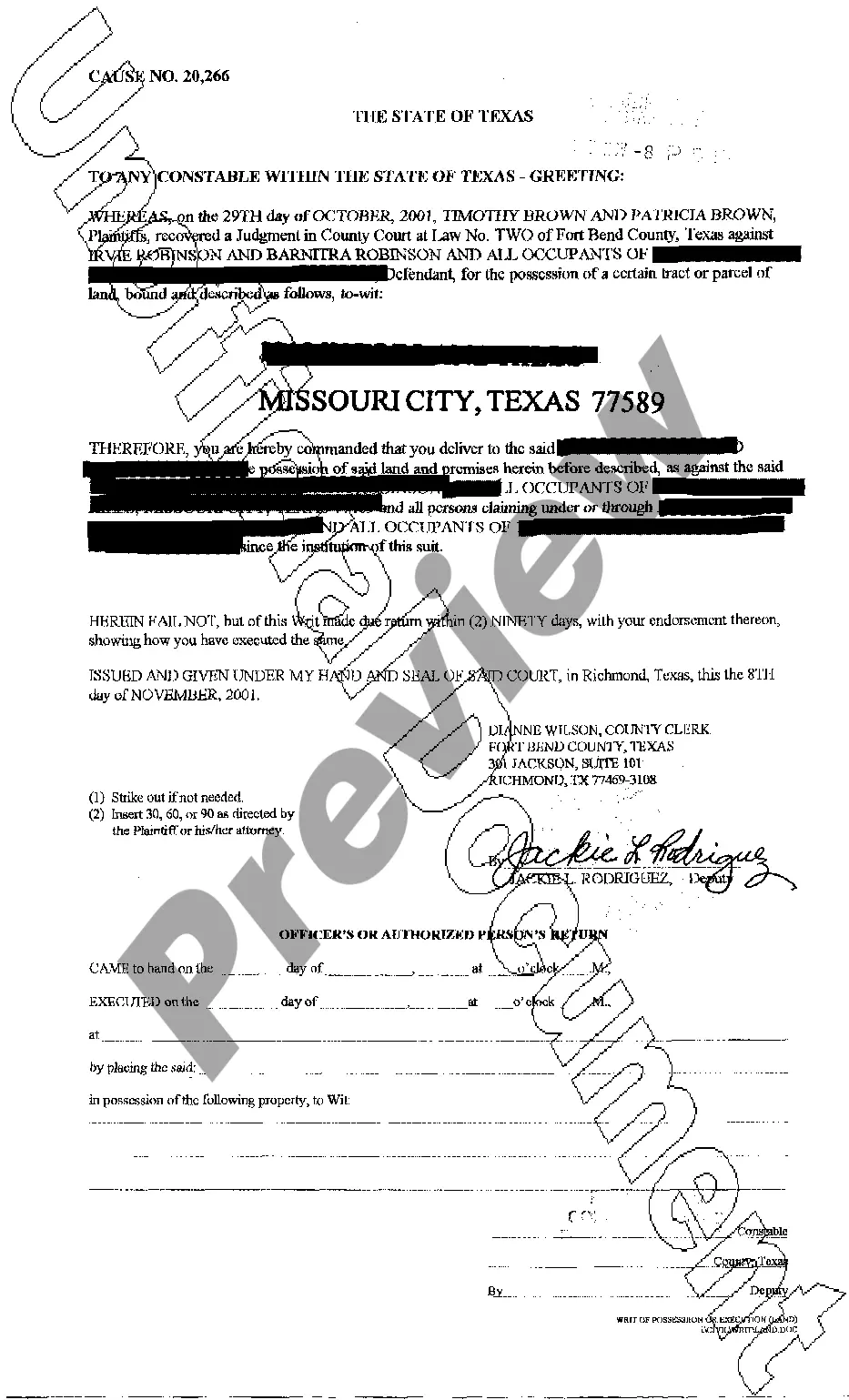

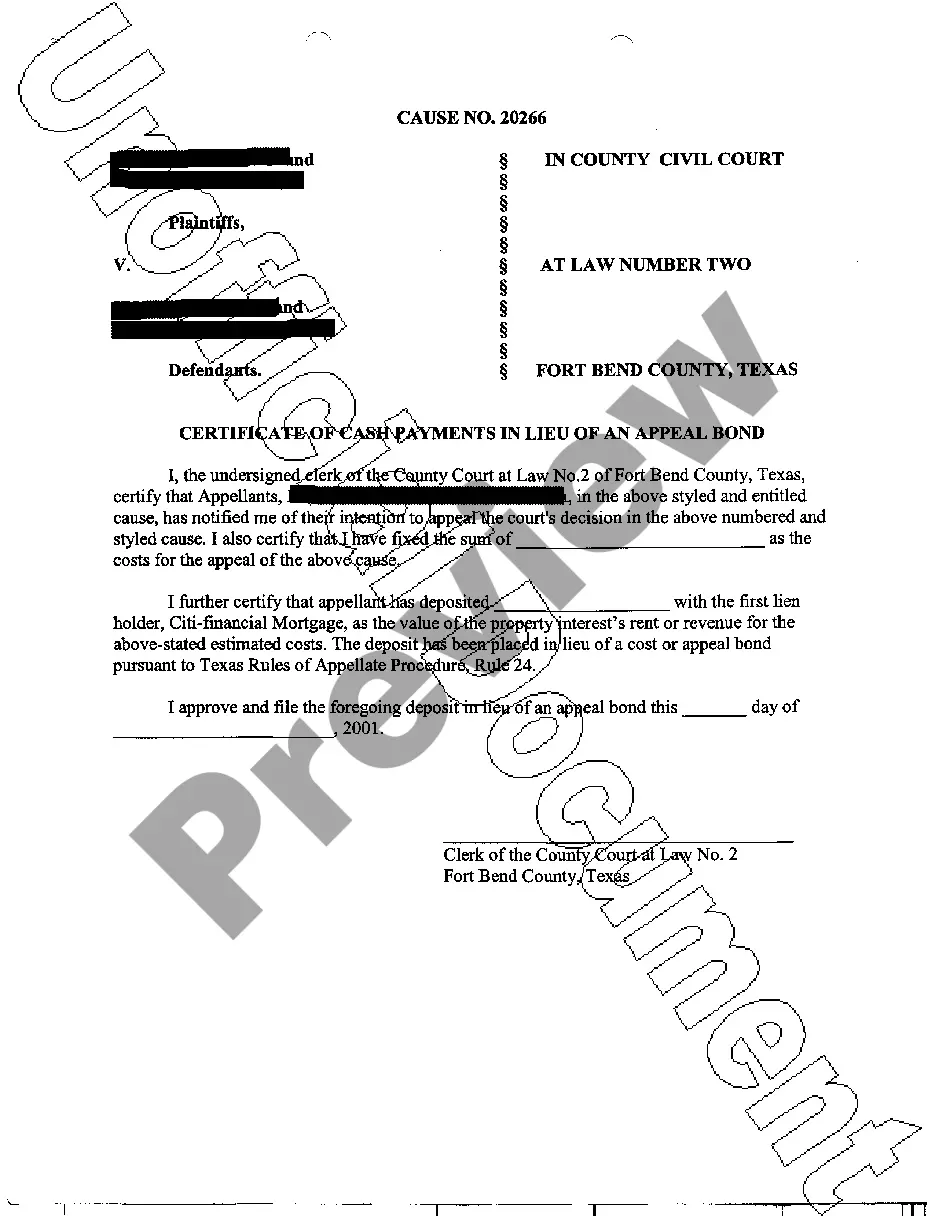

Abilene Texas Certificate of Cash Deposit In Lieu of Bond

Description

How to fill out Texas Certificate Of Cash Deposit In Lieu Of Bond?

Locating authenticated templates tailored to your regional legislation can be challenging unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All the paperwork is correctly categorized by the area of application and jurisdictional categories, making it as swift and simple as ABC to find the Abilene Texas Certificate of Cash Deposit In Lieu of Bond.

Maintaining documentation organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have crucial document templates for any needs readily available!

- Review the Preview mode and form details.

- Ensure you’ve picked the correct one that fulfills your requirements and aligns completely with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

The Basics of Texas Surety Bonds Basically, it's a legally binding three-party contract that guarantees one party's performance or payment of an obligation to another party. There are special terms for each of the parties to the surety bond agreement.

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract.

How Does a Payment Bond Work? Payment bonds are purchased by contractors, from a surety, who they pay a premium relative to the bond requirement. The bond then acts as a guarantee that if an issue arises, the parties involved in a project can be repaid for damages up to the required amount of the bond.

Texas Surety Bond Costs Bond costs are generally 1-10% of the full bond amount that's required of you in Texas. So, for example, if you need a $10,000 bond, your costs could be anywhere between $100 - $1,000.

Surety ? A person who undertakes to ensure that an accused person will appear court and abide by bail conditions. The surety puts up security, such as money or title to a property, which can be forfeited to the court if the accused person fails to appear in court.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor. Although similar to a guarantor, a financial surety's liability arises as soon as the agreement is closed. business law.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

The surety company will give the Principal (the person who is bonded) a chance to satisfy the claim. If the Principal fails to satisfy the claim, the surety company will step in and satisfy the claim. The surety company will then go to the Principal for repayment of satisfying that claim.

How much does a $10,000 Texas notary public bond cost? A $10,000 Texas notary public bond costs $50 and can be issued instantly 24/7.