Austin Texas Financial Responsibility Insurance Certificate

Description

How to fill out Texas Financial Responsibility Insurance Certificate?

Irrespective of social or vocational standing, finishing legal documents is an unfortunate requirement in today’s society.

Too frequently, it’s nearly impossible for an individual without legal education to create such paperwork from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms provides assistance.

Ensure the form you have selected is appropriate for your area since the regulations of one state or county may not apply to another.

Examine the form and review a brief description (if available) regarding scenarios for which the document can be utilized.

- Our service offers a substantial library containing over 85,000 state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent asset for associates or legal advisors seeking to conserve time by utilizing our DIY forms.

- Regardless of whether you need the Austin Texas Financial Responsibility Insurance Certificate or any other document that is valid in your region or county, with US Legal Forms, everything is readily accessible.

- Here’s how to swiftly obtain the Austin Texas Financial Responsibility Insurance Certificate using our trustworthy service.

- If you are already a customer, you can go ahead and Log In to your account to acquire the necessary form.

- However, if you are new to our library, make sure to follow these steps before downloading the Austin Texas Financial Responsibility Insurance Certificate.

Form popularity

FAQ

You must maintain a valid SR-22 for two years from the date of your most recent conviction, or the date that a judgement has been rendered against you. Failure to maintain an SR-22 for two years without a lapse in coverage can result in additional enforcement actions and/or reinstatement fees.

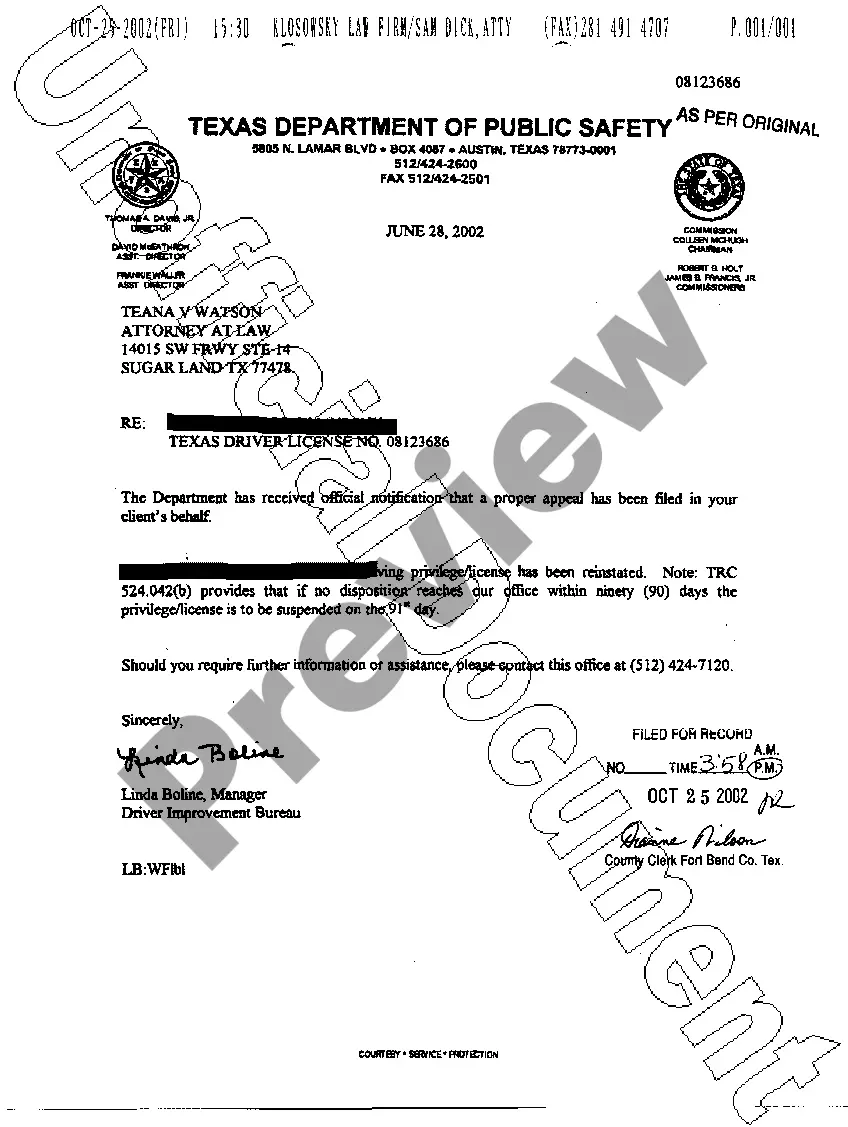

A Financial Responsibility Insurance Certificate (SR-22) is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance. A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law.

In most cases, the State of Louisiana will require you to maintain an SR-22 for a minimum of three years. If you fail to maintain proof of future financial responsibility, your driving privileges may be suspended.

The DOL can require the SR-22 certificate to be on file for up to three (3) years. It is imperative that you do not cancel your policy or allow it to lapse during the three-year requirement. The Department of Licensing can suspend or revoke your driving privileges if you allow this to happen.

A standard proof of liability insurance form promulgated by the Texas Department of Insurance and issued by a liability insurer that includes: (A) The name of the insurer; (B) The insurance policy number; (C) The policy period (dates of coverage and issued for 30 days or more); (D) The name and address of each insured

A Financial Responsibility Insurance Certificate (SR-22) is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance. A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law.

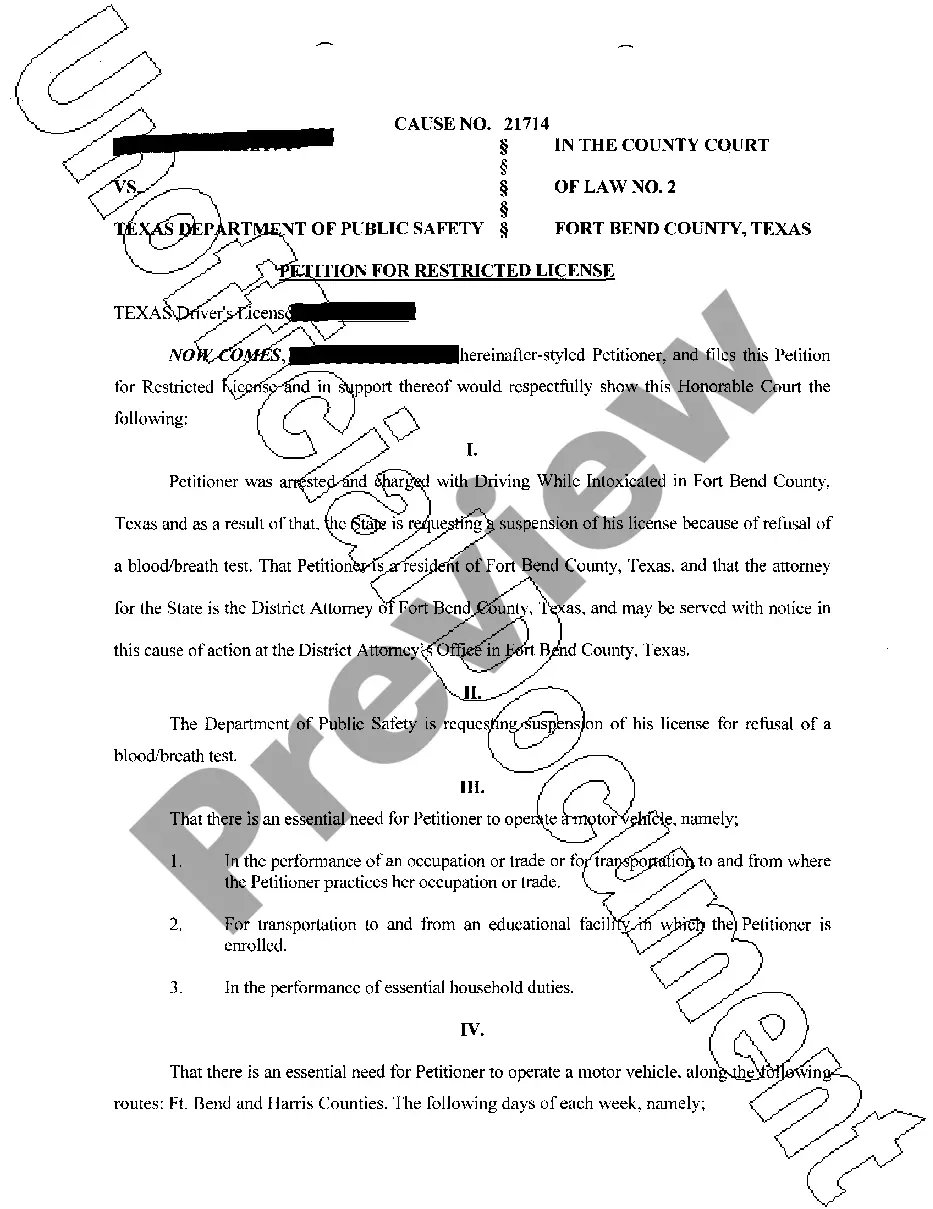

If your driver's license has been suspended, your state Department of Motor Vehicles may require you to obtain an SR-22 document, also known as a Certificate of Financial Responsibility. An SR-22 verifies the purchase of vehicle insurance coverage required by the state for reinstatement of driving privileges.

To file for an SR-22 certificate with the Texas Department of Public Safety (DPS), follow these key steps: Find an authorized insurer or contact your current provider.Pay the appropriate SR-22 fee.Have an insurer file proof of insurance or file directly to the Texas DPS.Receive confirmation.

An SR-22 is a document proving you have vehicle liability insurance and proof of financial responsibility. You may be required to maintain this proof for one year upon the first offense and three years for each subsequent offense.

A Financial Responsibility Insurance Certificate (SR-22) is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance. A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law.