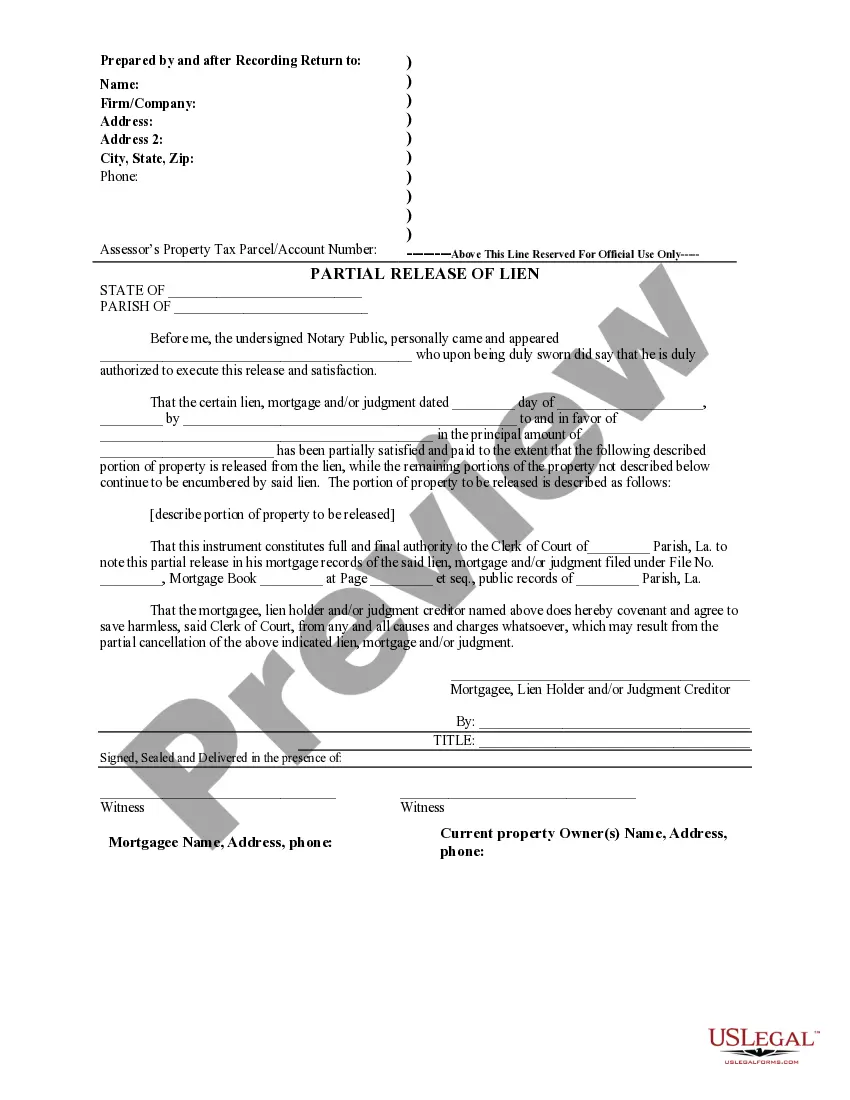

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Austin Texas Notice of Assignment to Living Trust

Description

How to fill out Texas Notice Of Assignment To Living Trust?

Do you require a dependable and affordable legal forms supplier to acquire the Austin Texas Notice of Assignment to Living Trust? US Legal Forms is your prime option.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the court, we've got you settled. Our platform provides over 85,000 current legal document templates for personal and business use. All templates we offer are not generic and are structured in accordance with the regulations of specific states and regions.

To retrieve the form, you must Log In to your account, find the necessary form, and press the Download button adjacent to it. Please keep in mind that you can download your previously acquired document templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can set up an account with great ease, but prior to that, ensure that you do the following.

You can now create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Austin Texas Notice of Assignment to Living Trust in any offered file format. You can return to the website whenever needed and download the form again at no cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to learn about legal paperwork online once and for all.

- Verify that the Austin Texas Notice of Assignment to Living Trust complies with your state and local regulations.

- Examine the form’s description (if available) to understand who and what the form is suitable for.

- Restart the search if the form is not appropriate for your legal situation.

Form popularity

FAQ

Transferring Vehicles to a Trust To transfer ownership, you will need to obtain a title change form from your DMV and complete it, naming the trustee (as trustee of your trust) as new owner. Sales tax should not apply to the transfer and if the clerk tries to apply it, you will need to speak to a supervisor.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf of the individual or individuals that the trust benefits. This means that the trustee may lease, sell, or otherwise manage the property.

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

Trusts are not legal entities that can own, manage or sell property. It is the trustee of the trust that can hold legal title to the property on behalf or for the benefit of the beneficiaries of the trust. What this means is that a trustee has the power to sell or lease the property.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).