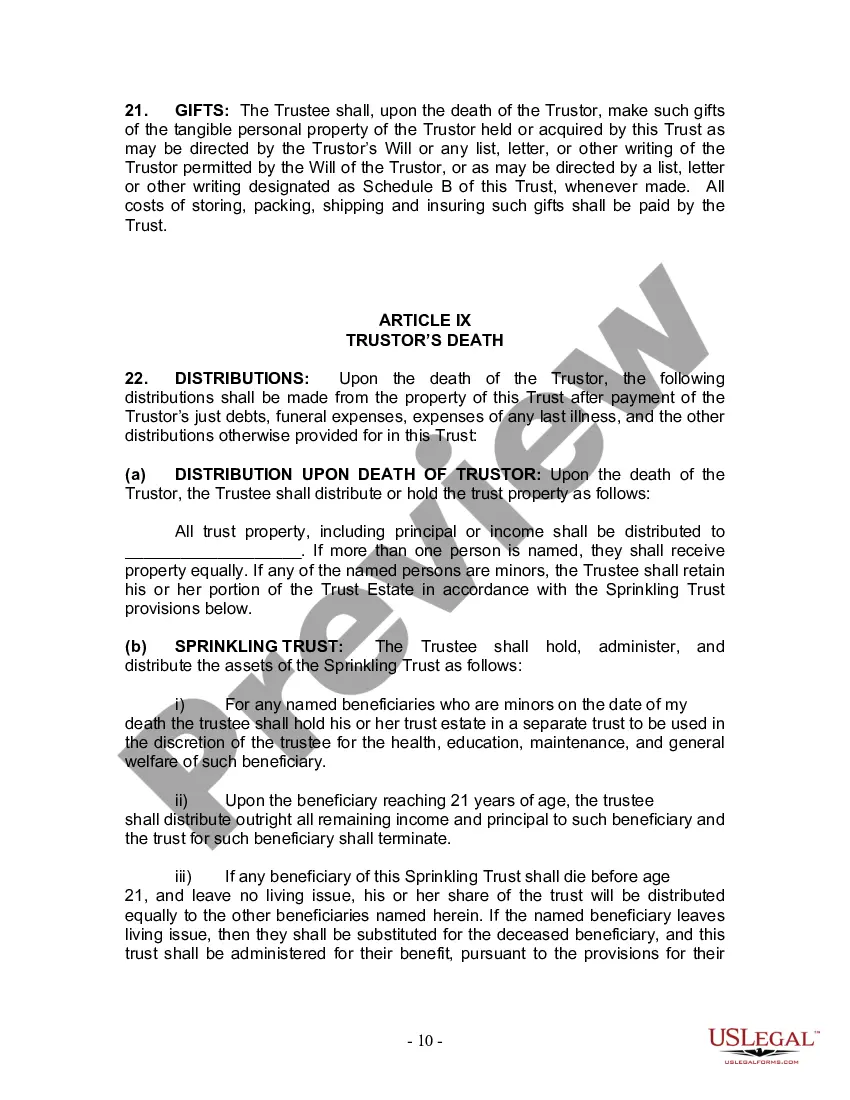

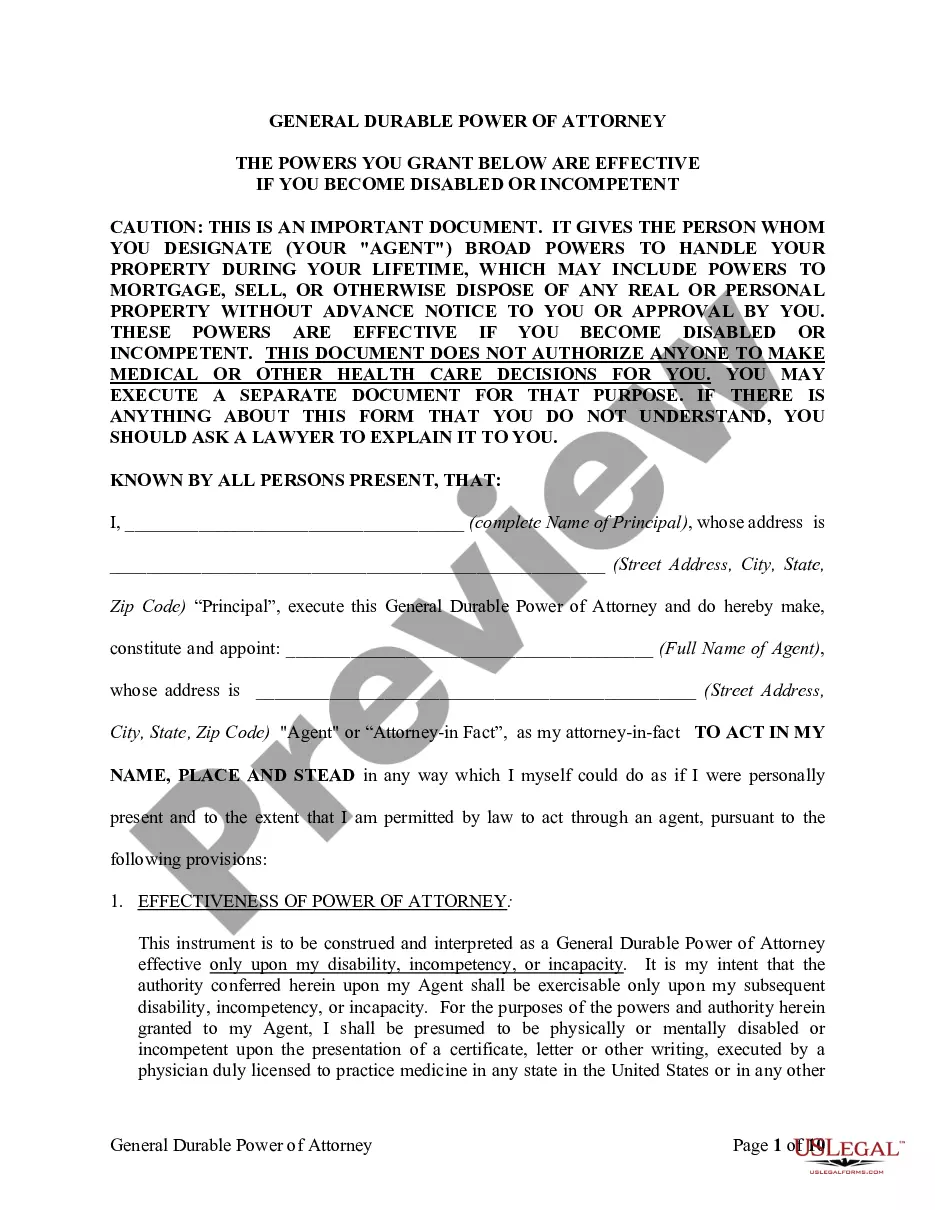

This Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Harris Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

If you are looking for a legitimate document, it’s incredibly challenging to find a superior location than the US Legal Forms site – arguably the largest collections online. With this collection, you can access thousands of document examples for business and personal objectives categorized by type and locality, or keywords.

With the advanced search feature, locating the latest Harris Texas Living Trust for Individuals Who are Single, Divorced or Widowed without Children is as straightforward as 1-2-3. Additionally, the accuracy of each document is validated by a group of experienced lawyers who routinely review the templates on our platform and update them in accordance with the latest state and county regulations.

If you are already familiar with our system and possess an account, all you have to do to acquire the Harris Texas Living Trust for Individuals Who are Single, Divorced or Widowed without Children is to Log In to your account and select the Download option.

Every document you store in your account has no expiration date and is yours indefinitely. You can access them through the My documents section, allowing you to revisit and re-download it anytime you need another copy for editing or printing.

Utilize the professional directory of US Legal Forms to access the Harris Texas Living Trust for Individuals Who are Single, Divorced or Widowed without Children you were looking for, along with thousands of other professional and state-specific templates in one consolidated location!

- Ensure you have located the template you require. Review its details and utilize the Preview feature (if applicable) to inspect its contents. If it doesn’t satisfy your criteria, take advantage of the Search function at the top of the page to find the appropriate document.

- Verify your choice. Click on the Buy now button. Afterward, select the desired subscription package and provide the necessary information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the account creation process.

- Obtain the document. Choose the file format and download it to your device.

- Edit the document. Complete, alter, print, and sign the received Harris Texas Living Trust for Individuals Who are Single, Divorced or Widowed without Children.

Form popularity

FAQ

While it is not legally required to hire an attorney to set up a Harris Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children, obtaining legal advice can be very beneficial. An experienced attorney can help ensure that all legal requirements are met and that your trust accurately reflects your wishes. However, tools like the USLegalForms platform provide user-friendly templates and guidance, making it easier to create a trust on your own. Ultimately, the decision depends on your comfort level and knowledge of the process.

In Texas, there are specific rules governing the creation and administration of trusts. A Harris Texas Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with No Children must comply with the Texas Trust Code, which outlines requirements for the trust's validity, trustee responsibilities, and beneficiary rights. Additionally, the trust must have a clear purpose outlined in its terms. Compliance with these rules helps ensure the trust operates effectively and fulfills your intentions.

Trusts in Texas, including a Harris Texas Living Trust for Individuals Who Are Single, Divorced, or a Widow or Widower with No Children, can have some disadvantages. For instance, a living trust does not provide tax benefits, and the grantor might still be liable for income taxes on the trust’s earnings. Moreover, this type of trust does not protect assets from creditors unless properly structured. It is advisable to weigh these factors when considering setting up a trust.

While a living trust in Texas offers many benefits, there are some downsides to consider. Establishing a Harris Texas Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with No Children may involve upfront costs, including legal fees and potential ongoing management fees. Additionally, if you do not transfer assets into the trust properly, it may not function as intended, which can lead to complications later on. Therefore, understanding the processes involved is crucial to maximizing its effectiveness.

One of the biggest mistakes parents make when setting up a trust fund is failing to update it regularly. Life circumstances change, such as marriages, divorces, or the birth of new children, which can affect the trust's structure and beneficiaries. By not reviewing and updating the trust accordingly, parents risk creating confusion and unintended consequences. On the other hand, individuals like singles or divorced persons can avoid these pitfalls with a well-structured Harris Texas Living Trust for Individuals Who Are Single, Divorced, or Widows or Widowers without Children.

Yes, a single person with no children can benefit from establishing a trust. A Harris Texas Living Trust helps manage your assets, ensures they are distributed according to your wishes, and can even simplify the transfer process upon your passing. Additionally, it can protect your assets from probate, safeguarding your legacy. Overall, having a trust can provide peace of mind and clarity regarding your financial affairs.

In Texas, the laws governing trusts are outlined in the Texas Trust Code. This code establishes the framework for creating, administering, and ensuring the validity of trusts. Specifically, it includes provisions on what constitutes a valid trust, the duties of trustees, and the rights of beneficiaries. Understanding these laws is essential for anyone considering a Harris Texas Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with No Children.

Putting your house in a trust in Texas can offer several benefits, especially for those establishing a Harris Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. It helps streamline the transfer of ownership upon your death and may provide protection from probate. Additionally, a trust can provide specific instructions on what should happen to your home after you're gone. Consider consulting US Legal Forms to access the resources you need to make the best decision.

Yes, you can write your own living trust in Texas. Creating a Harris Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children allows you to outline how your assets will be managed and distributed. However, it's essential to ensure that the trust complies with state laws to avoid complications later. Using platforms like US Legal Forms can simplify the process, as they provide templates and guidance to help you create a valid living trust.