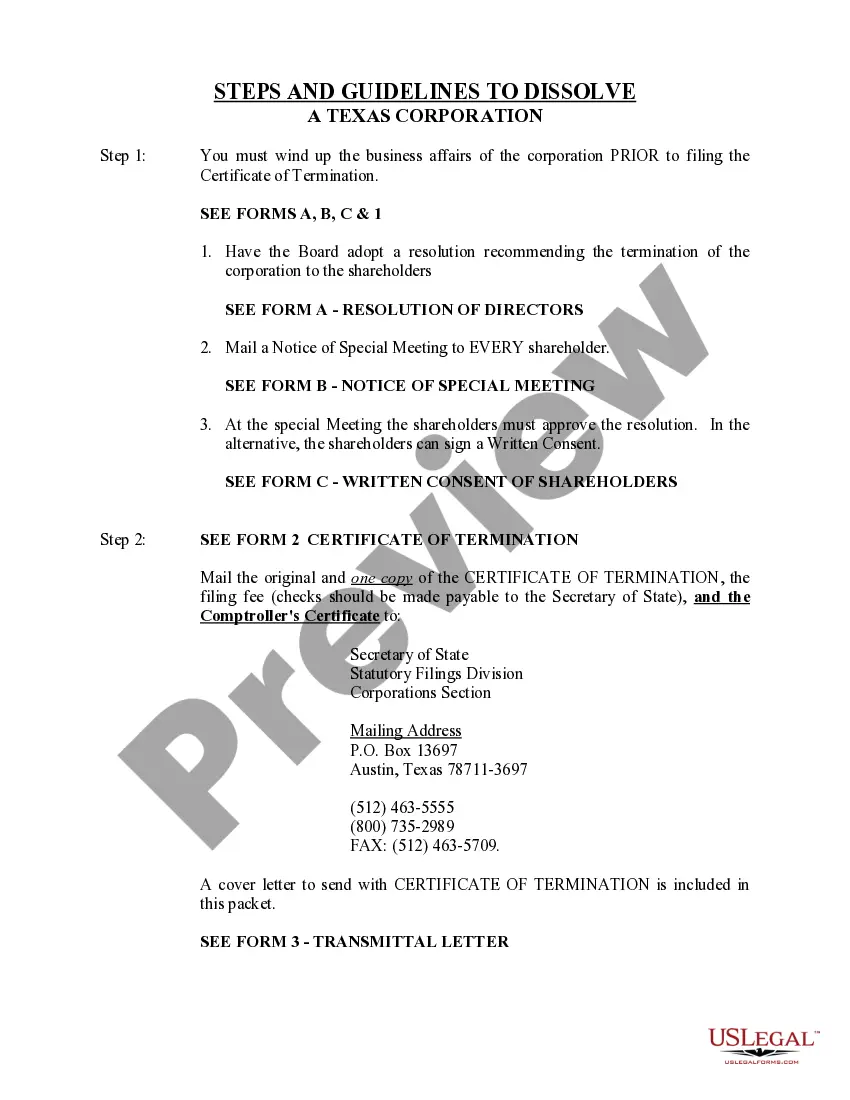

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Arlington Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you are looking for an acceptable form template, it’s hard to locate a more suitable destination than the US Legal Forms site – one of the broadest collections available online.

Within this collection, you can discover countless templates for organizational and individual needs categorized by types, states, or keywords.

Utilizing our sophisticated search feature, finding the latest Arlington Texas Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it onto your device.

- Moreover, the accuracy of each document is substantiated by a team of experienced attorneys who routinely examine the templates on our site and refresh them according to the most recent state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to access the Arlington Texas Dissolution Package to Dissolve Corporation is to Log In to your account and click the Download button.

- For first-time users of US Legal Forms, just adhere to the instructions listed below.

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to investigate its details. If it does not fulfill your criteria, make use of the Search box at the top of the page to locate the suitable document.

- Verify your choice. Click the Buy now button. Subsequently, choose your desired subscription plan and provide the necessary information to set up an account.

Form popularity

FAQ

In exchange for getting back their investment (in full or part), the shareholders return their shares to the company, which are then canceled. If a company returns any money to its shareholders while still having a debt outstanding, the creditor can sue, and the shareholders may have to return the received amounts.

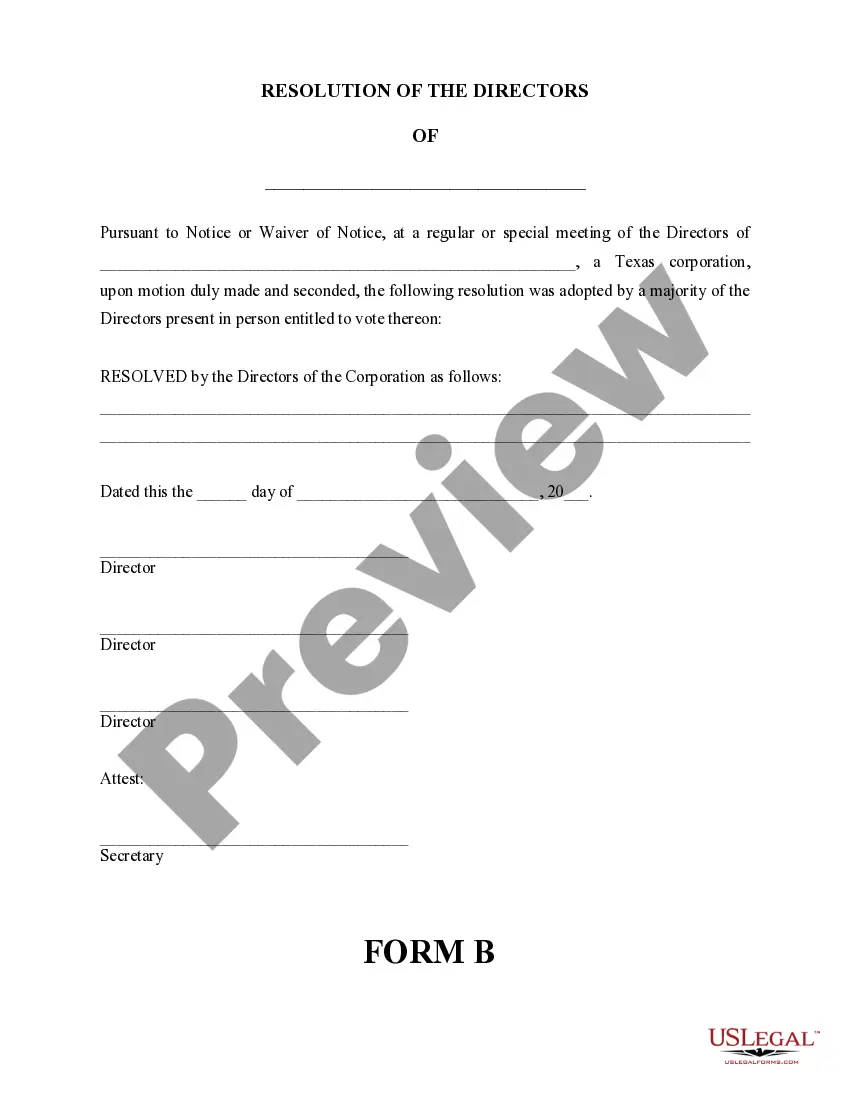

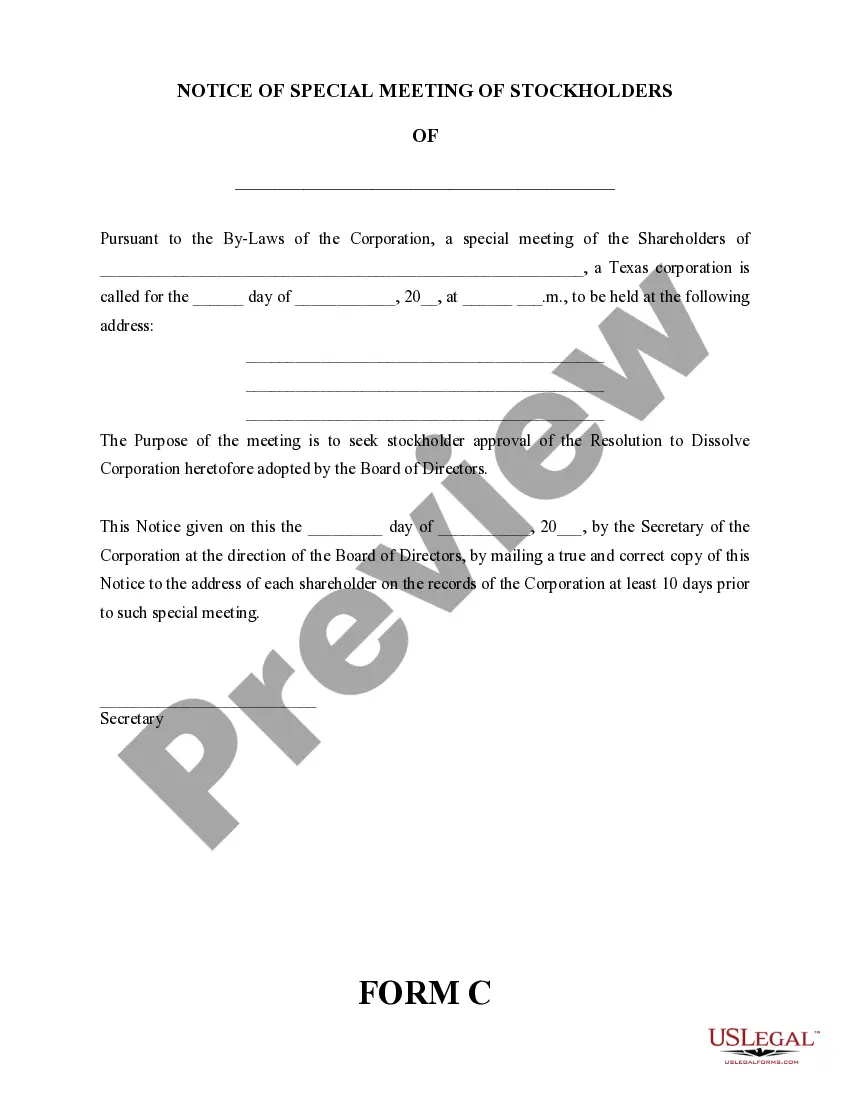

How do you dissolve a Texas corporation? To dissolve your Texas corporation, you file Form 651 Certificate of Termination of Domestic Entity and accompany that with a tax clearance certificate from the Texas Comptroller of Public Accounts indicating that all taxes have been paid by the entity.

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee.

Summary chart for terminating a Texas entity. Texas Domestic Entity TypeGoverned by BOCFeeFor-profit or professional corporation that neither commenced business nor issued sharesForm 651 Word, PDF$40For-profit or professional corporation that commenced business and/or issued sharesForm 651 Word, PDF$405 more rows

How much does it cost to dissolve a California business? There is no fee to file the California dissolution forms.

Typically, you should expect to pay around £3000 to £7000. If a company's assets do not cover these fees, the directors may be personally liable for the costs. Compulsory Liquidation. This is a type of closure that is forced by creditors or HMRC.