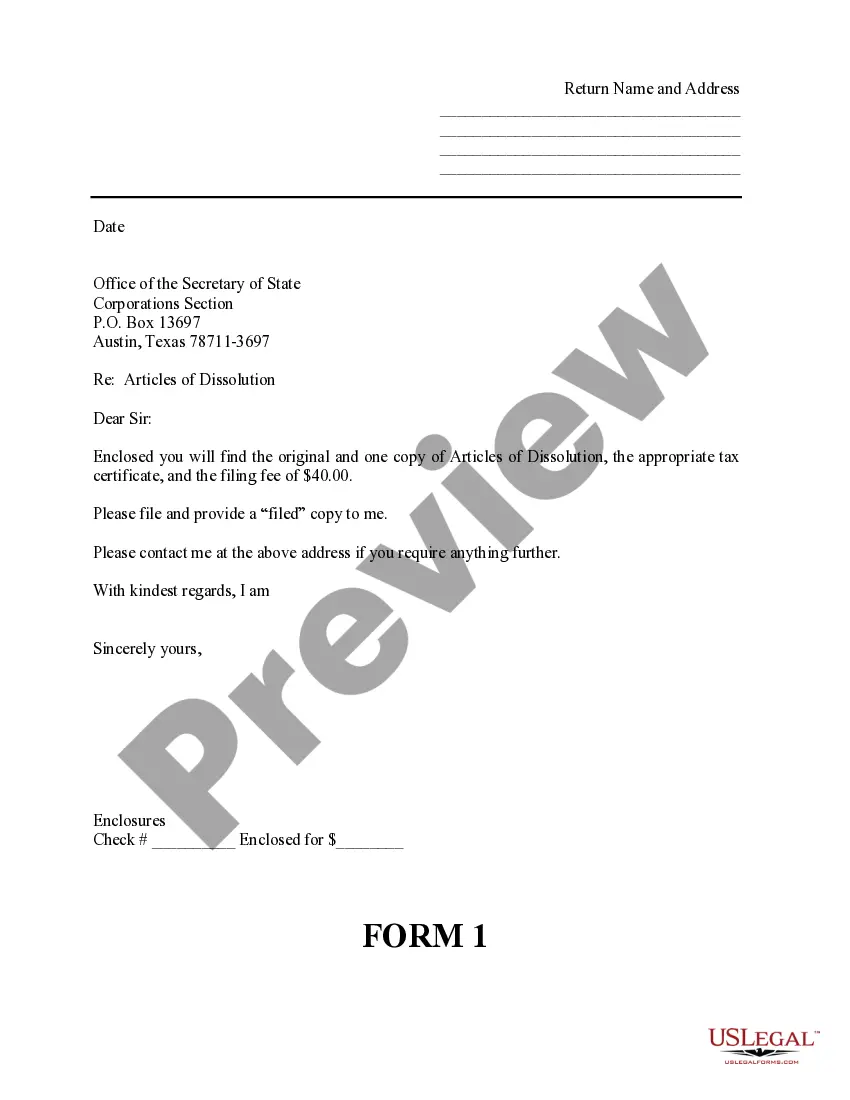

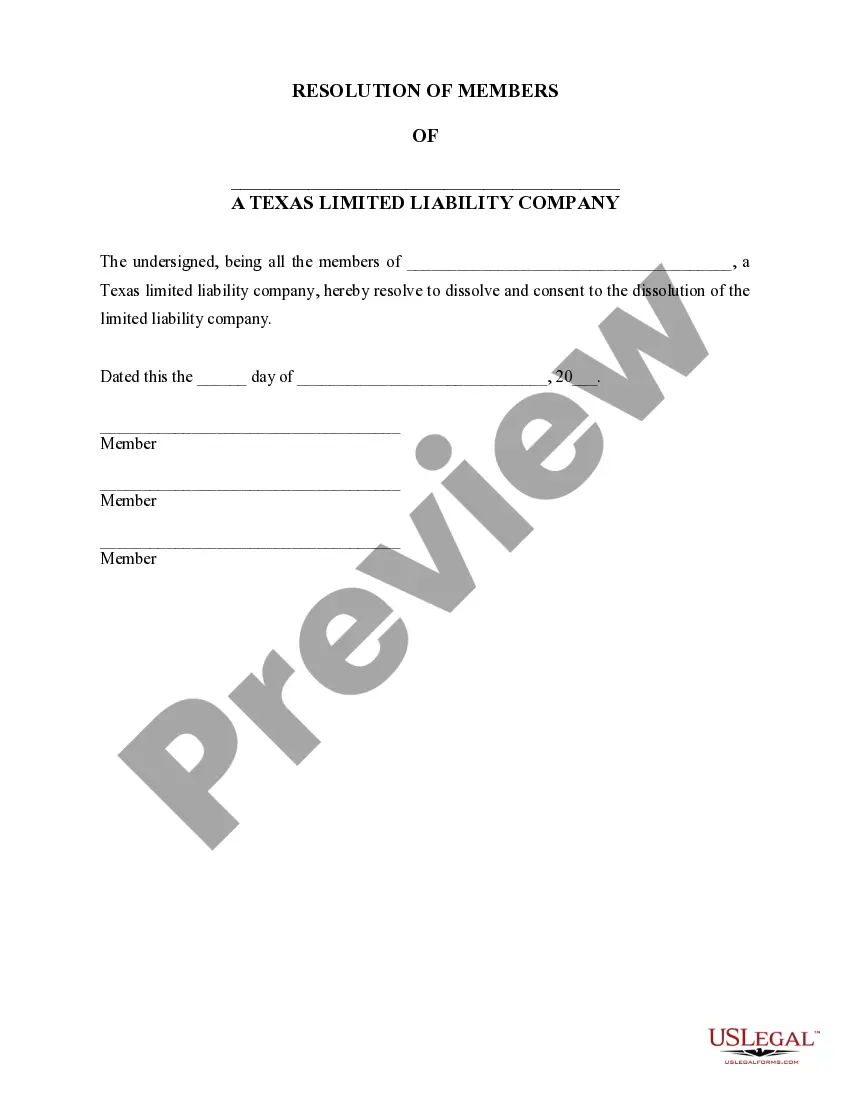

The dissolution package contains all forms to dissolve a LLC or PLLC in Texas, step by step instructions, addresses, transmittal letters, and other information.

Arlington Texas Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Texas Dissolution Package To Dissolve Limited Liability Company LLC?

If you are searching for an appropriate form template, it’s challenging to discover a more user-friendly service than the US Legal Forms website – one of the largest collections online.

With this collection, you can access thousands of templates for both business and individual needs categorized by type and location, or keywords.

Utilizing our premium search feature, acquiring the most up-to-date Arlington Texas Dissolution Package to Dissolve Limited Liability Company LLC is as easy as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the document. Specify the file type and download it onto your device.

- Moreover, the accuracy of every document is confirmed by a team of expert attorneys who routinely review the templates on our site and refresh them according to the latest state and county requirements.

- If you are already familiar with our platform and possess a registered account, all you have to do to obtain the Arlington Texas Dissolution Package to Dissolve Limited Liability Company LLC is to sign in to your account and click the Download button.

- Should you be using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have selected the template you desire. Examine its details and utilize the Preview function to review its content. If it falls short of your expectations, use the Search feature at the top of the page to locate the right document.

- Confirm your selection. Press the Buy now button. Subsequently, choose your preferred pricing plan and provide the necessary details to register an account.

Form popularity

FAQ

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

It will take 4-6 weeks for the CPA to process your request. Once you receive your certificate of account status, you will need to attach it to your certificate of termination.

Certificates of termination processing time could vary but in most cases it is 3-5 days. The hard work is done at the Texas Comptroller's office. A form 05-359, Request for Certificate of Account Status, takes 4-6 weeks to process and receive your tax clearance.

Texas law says that dissolving an at-will partnership requires the agreement of a majority-in-interest of the partners, meaning a group of partners who together own more than 50 percent of the partnership.

In Texas, does an LLC have an expiration date? A limited liability company's articles of organization may allow its members to designate the duration of the company. An LLC's expiration date can be specified but if no expiration date is specified, the LLC might continue indefinitely.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

To file a certificate of termination using SOSDirect: Logon and select the Business Organizations Tab. In the Change Documents frame below Web Filings, input the filing number, if you know it, for the entity for which you need to file the termination and click on File Document.

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.