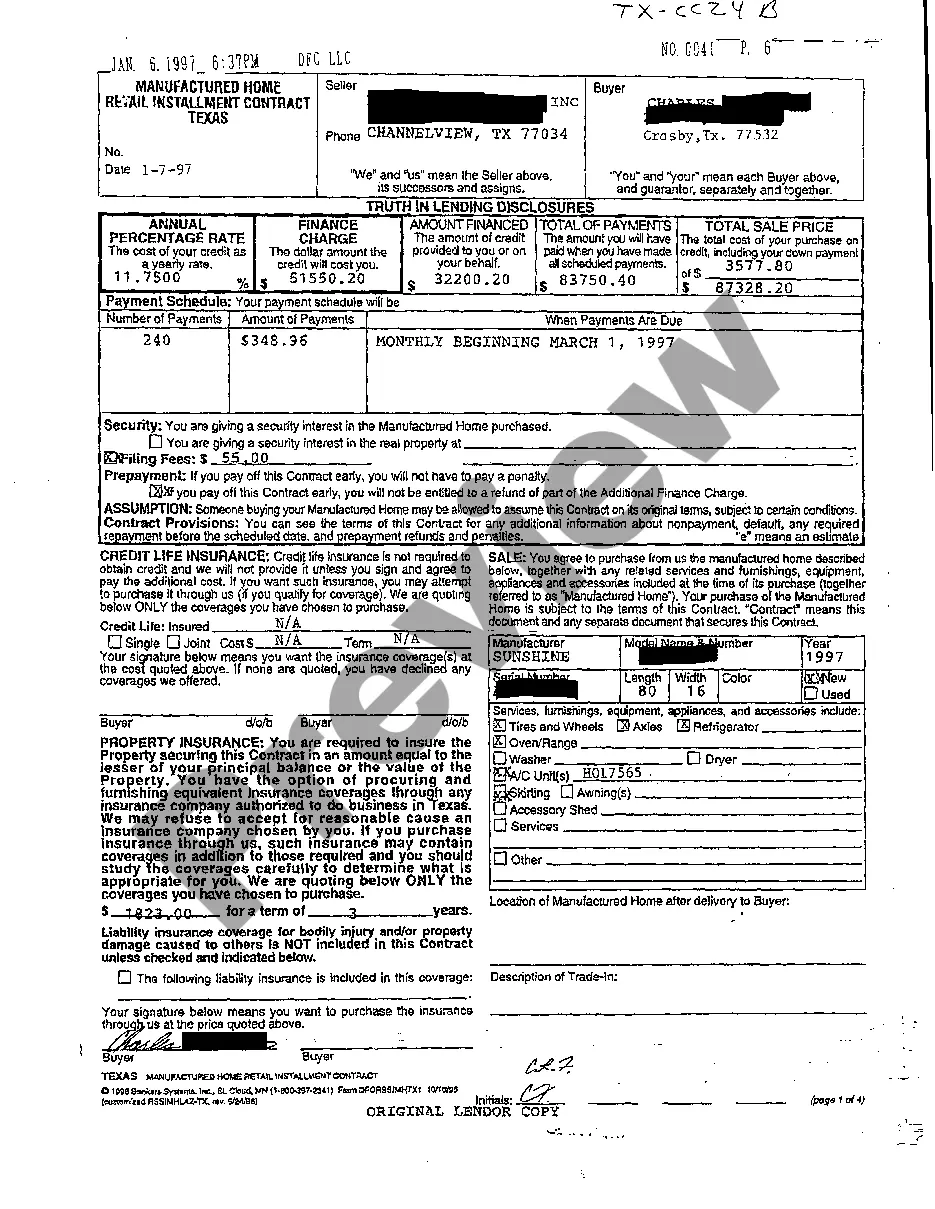

Collin Texas Truth In Lending Disclosures

Description

How to fill out Texas Truth In Lending Disclosures?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s a digital compilation of over 85,000 legal documents catering to individual and business circumstances along with various real-world situations.

All the paperwork is accurately sorted by field of application and jurisdiction areas, making it simple and straightforward to search for the Collin Texas Truth In Lending Disclosures.

Maintaining orderly paperwork that complies with legal specifications is crucial. Take advantage of the US Legal Forms library to always have necessary document templates for any purposes right at your fingertips!

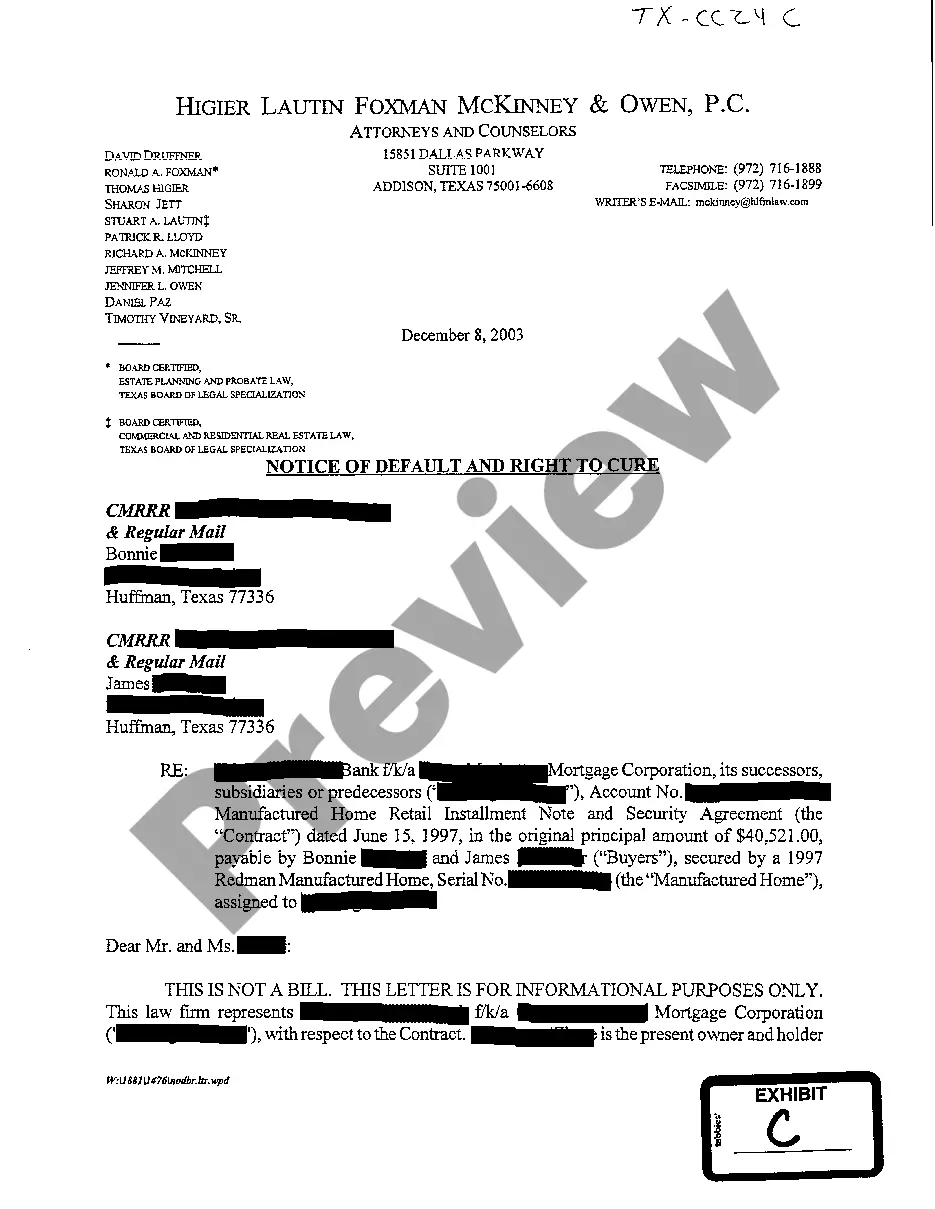

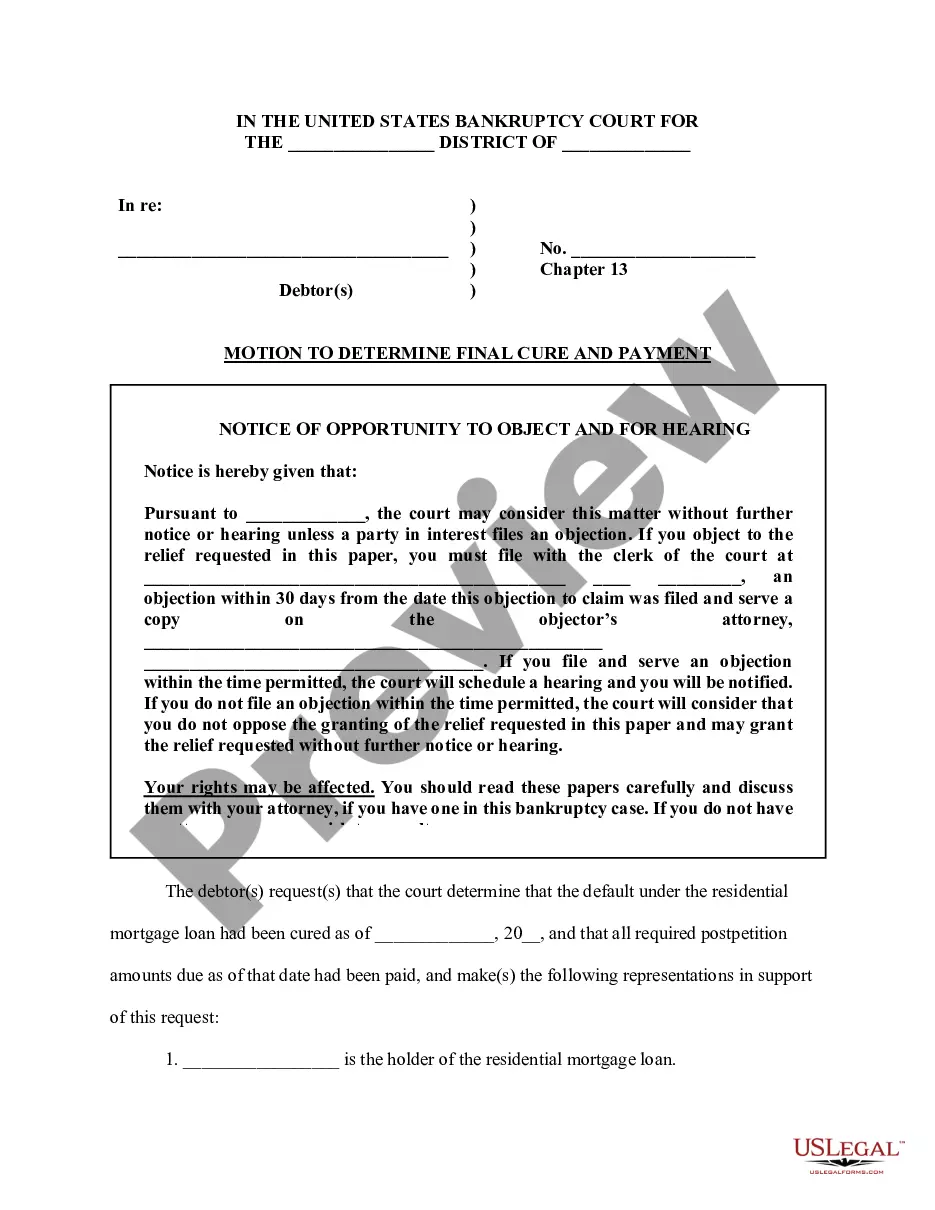

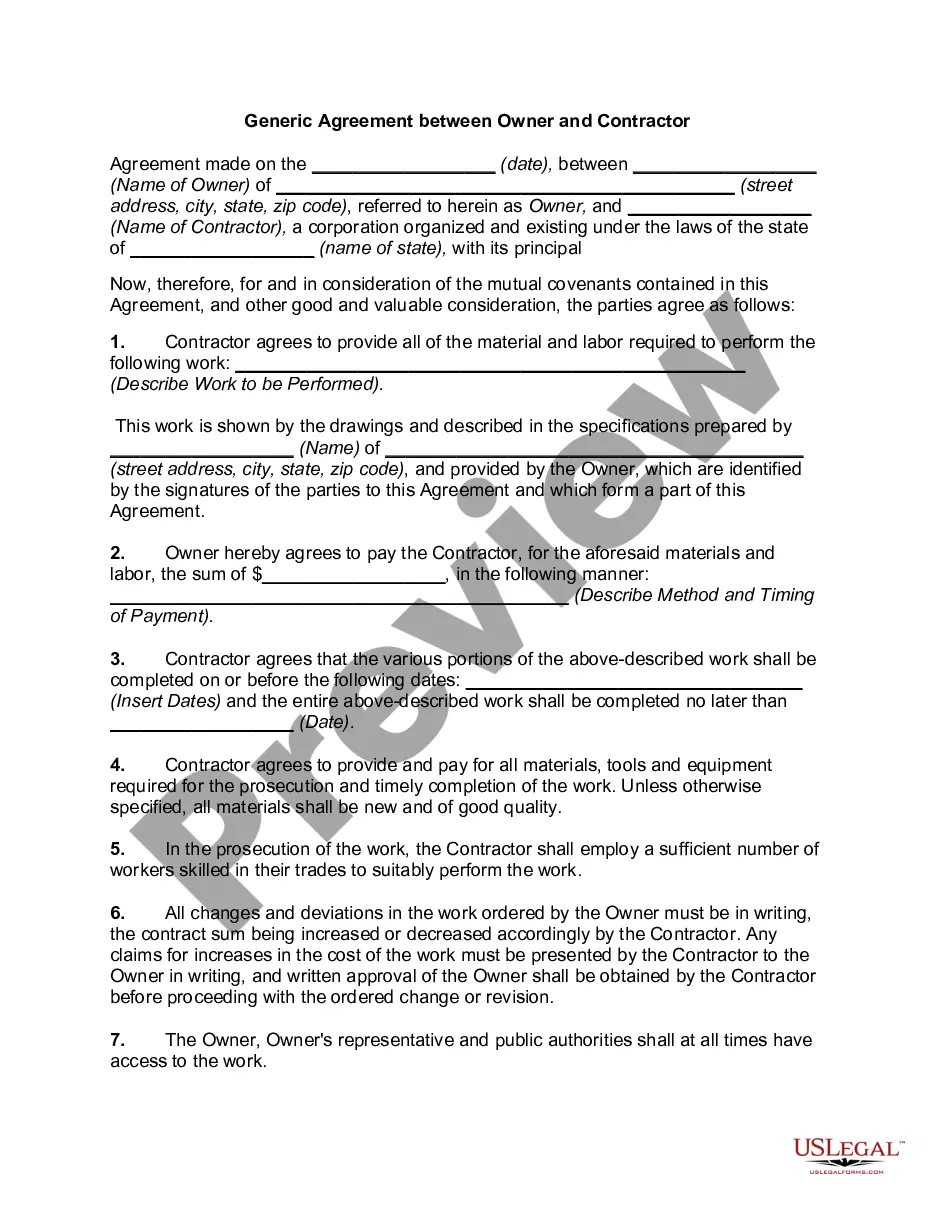

- Examine the Preview mode and document description. Ensure you’ve chosen the correct one that fulfills your requirements and aligns completely with your local jurisdiction stipulations.

- Search for an alternative template, if necessary. If you spot any discrepancies, utilize the Search tab above to find the accurate one. If it fits your needs, proceed to the following step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. It is advisable to register for an account to gain entry to the library’s resources.

- Complete your acquisition. Provide your credit card information or use your PayPal account to pay for the subscription.

- Download the Collin Texas Truth In Lending Disclosures. Store the template on your device to continue with its fulfillment and access it in the My documents menu of your profile whenever you need it later.

Form popularity

FAQ

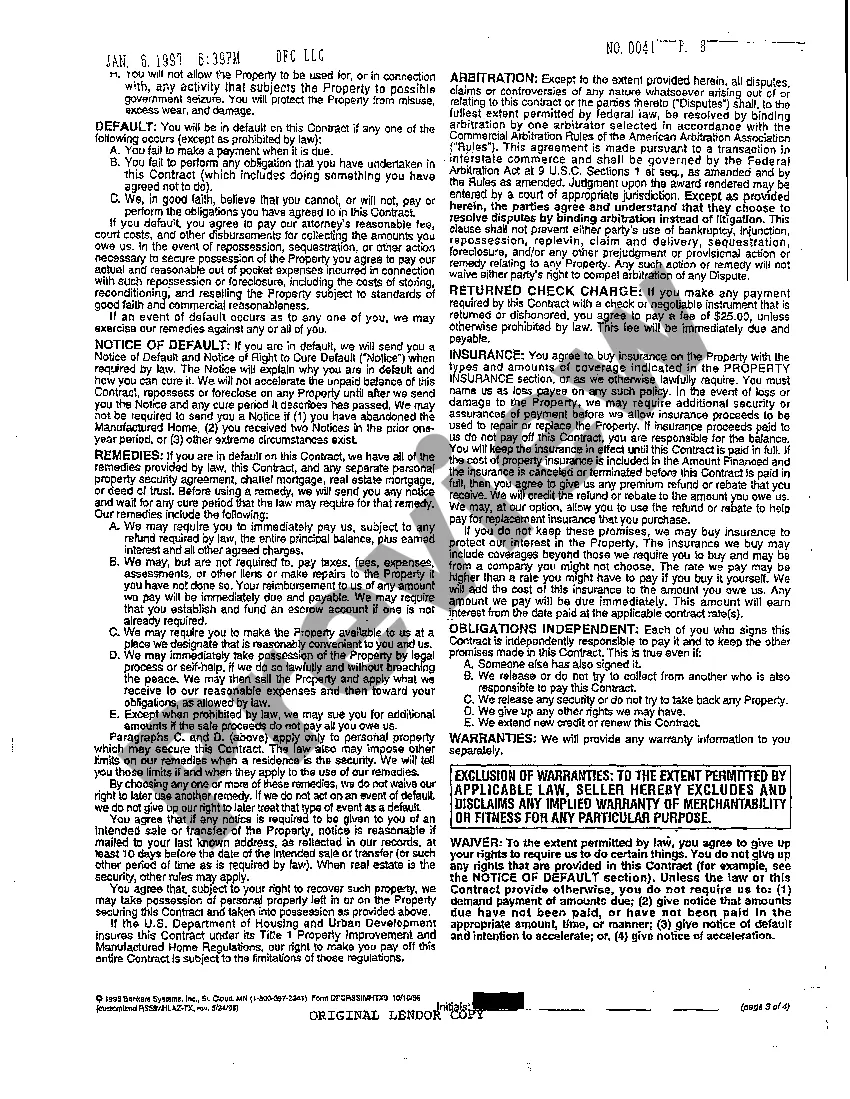

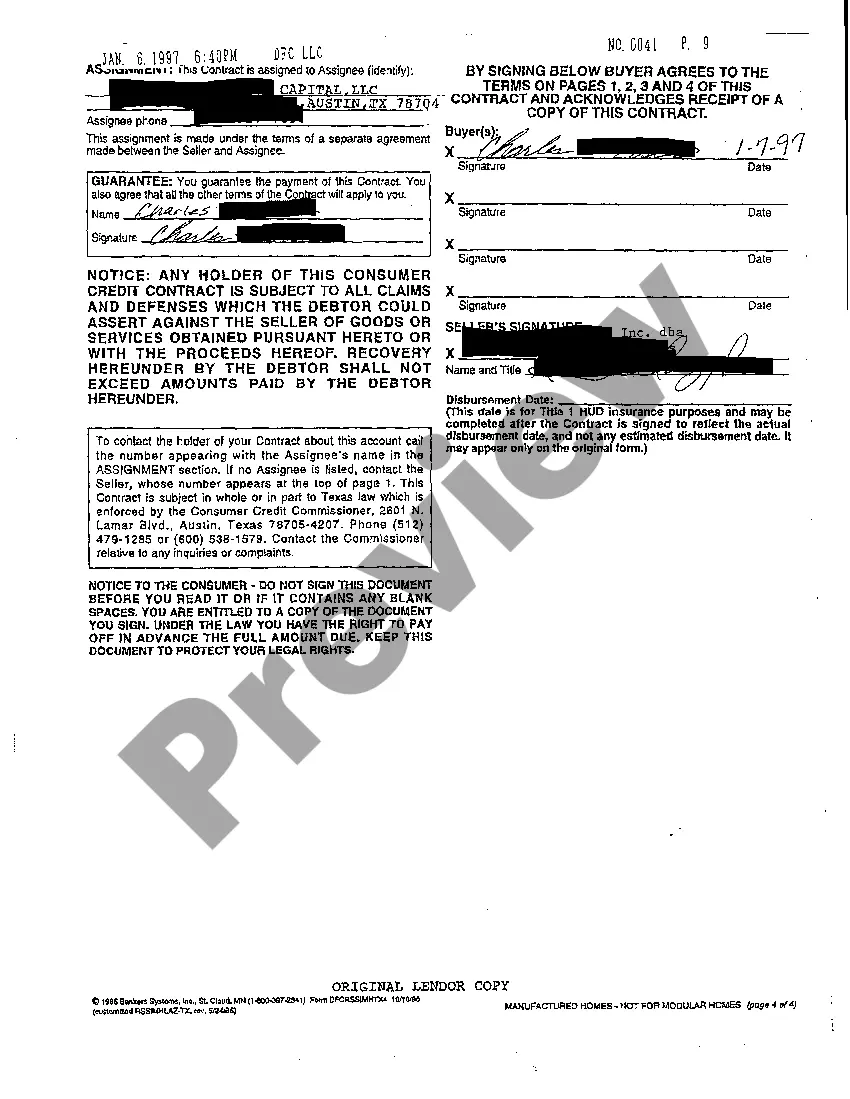

Truth-in-Lending disclosure requirements mandate that lenders provide clear and concise information about credit terms and costs. These requirements protect consumers by ensuring they are well-informed before signing on the dotted line. By adhering to Collin Texas Truth In Lending Disclosures, lenders can foster trust and transparency with their clients.

As of 2025, the TILA threshold for certain consumer credit transactions is expected to rise, impacting disclosure requirements. In Collin Texas, staying updated with these changes can help you understand how much credit you can access and under what conditions. Keeping track of these thresholds ensures you remain informed and prepared.

inLending statement is required when there is a consumer credit transaction involving financing. In Collin Texas, lenders must provide this statement for loans related to personal needs or household purchases. Understanding these conditions helps ensure you get the necessary information when engaging with lenders.

Credit card companies must disclose the APR, periodic rates, finance charges, annual fees, transaction fees, and payment terms under the Truth in Lending Act. Consumers in Collin Texas benefit from these disclosures as they promote transparency and enable wise financial choices. Being informed about these details can lead to better credit management.

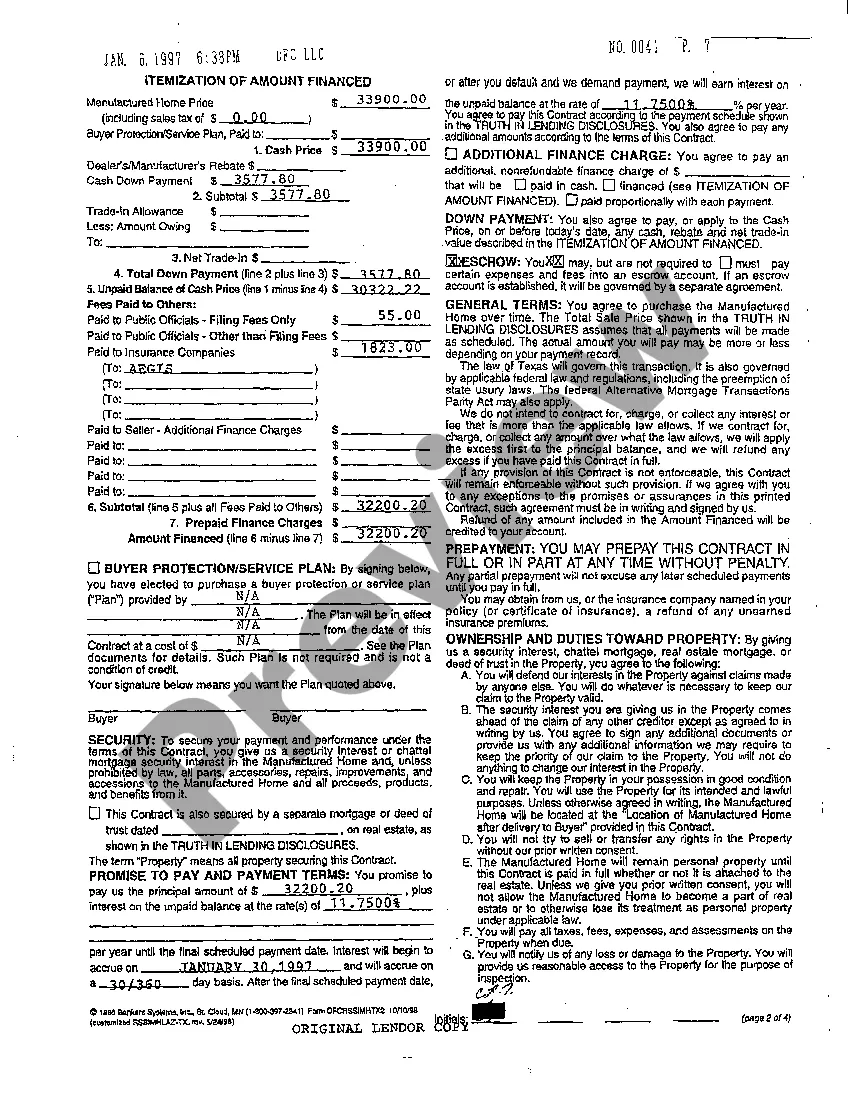

Truth-in-Lending requires clear disclosures of the APR, finance charges, total payments, and payment schedule. In Collin Texas, understanding these elements can significantly affect your financial decisions. When you know what to expect, you can confidently navigate your borrowing options.

inlending disclosure statement must include key information such as the APR, finance charges, and terms of repayment. In Collin Texas, it's essential that lenders comply with these requirements for consumer protection. Accurate disclosures allow you to compare different credit offers effectively.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices.

inLending Disclosure Statement provides information about the costs of your credit. Effective October 3, 2015, for most kinds of mortgage loans a form called the Loan Estimate replaced the initial TruthinLending disclosure, and a Closing Disclosure replaced the final TruthinLending disclosure.

The regulations found in the TILA apply to most kinds of consumer credit, from mortgages to credit cards. Lenders are required to clearly disclose information and certain details about their financial products and services to consumers by law.

inLending Disclosure Statement provides information about the costs of your credit. Effective October 3, 2015, for most kinds of mortgage loans a form called the Loan Estimate replaced the initial TruthinLending disclosure, and a Closing Disclosure replaced the final TruthinLending disclosure.