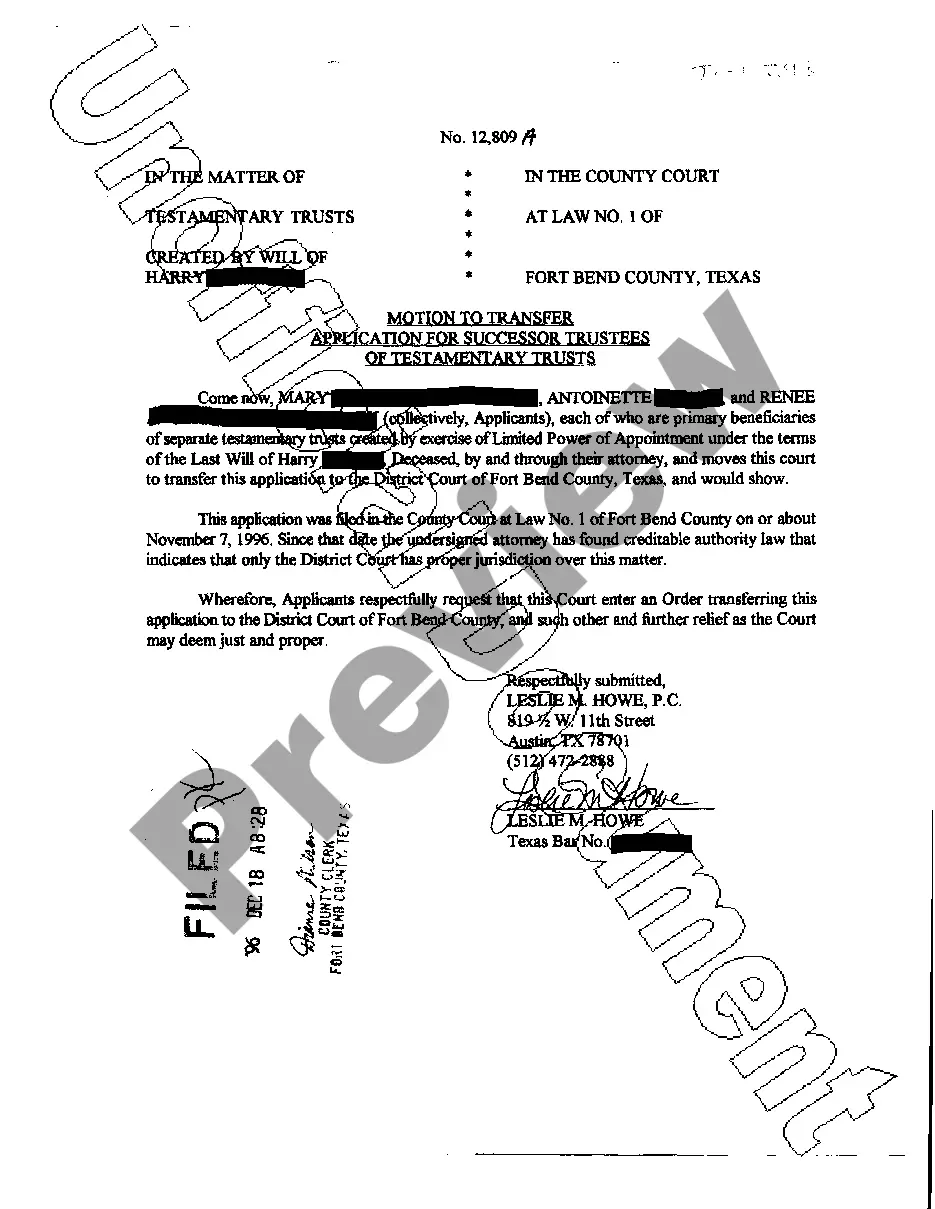

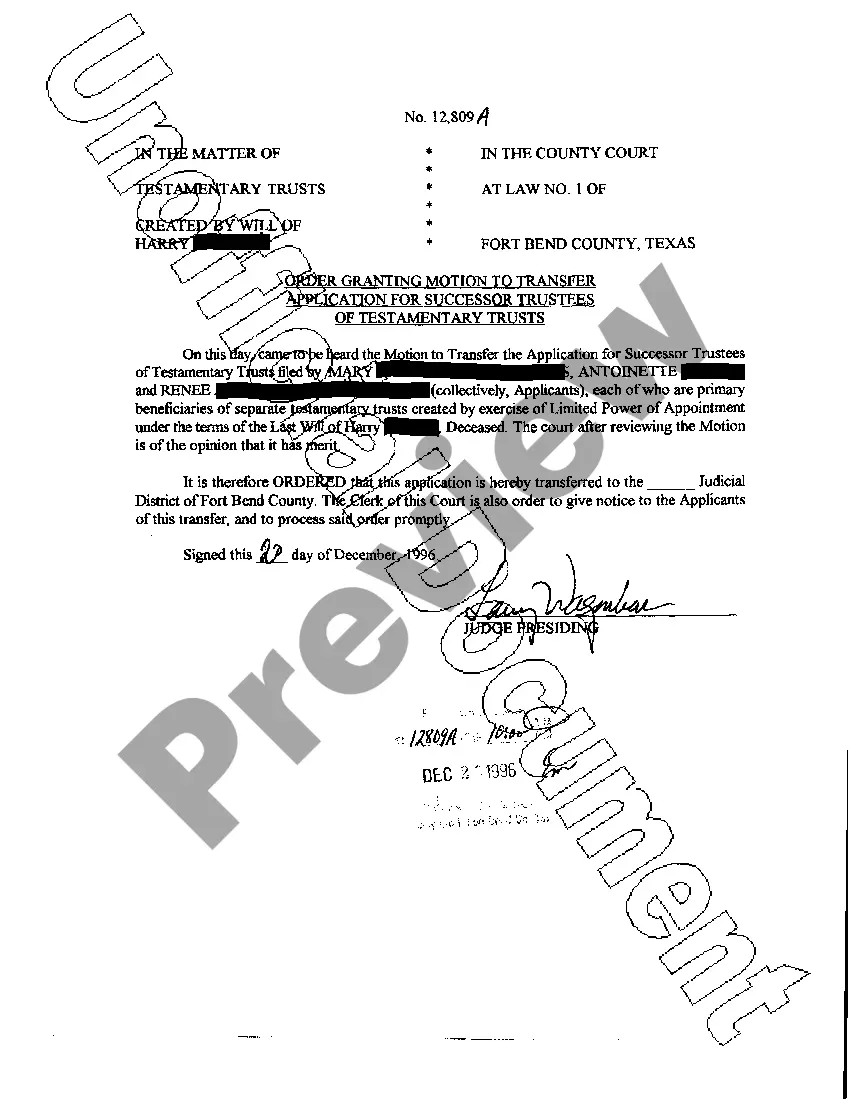

A Pearland Texas Motion to Transfer Application for Successor Trustees is a legal document filed by a party seeking to transfer the responsibility of acting as a trustee to a different individual or entity. This application is usually submitted to a court when a current trustee is no longer able or willing to fulfill their duties. It is important to note that there aren't specific types of Pearland Texas Motion to Transfer Application for Successor Trustees, as the content of the application would largely depend on the unique circumstances of the case. However, the following are some relevant keywords and content that can be utilized when writing a detailed description of this legal application: 1. Introduction: Provide a brief introduction to the Pearland Texas Motion to Transfer Application for Successor Trustees, describing its purpose, and explaining the reasons why the current trustee is seeking to transfer their responsibilities. 2. Background information: Explain the background of the trust, including details such as the creation of the trust, its purpose, relevant parties involved, and the specific terms outlined in the trust document. 3. Reasons for transfer: Detail the reasons why the current trustee is seeking a transfer of their responsibilities. This can include factors such as the trustee's incapacity, resignation, death, or conflict of interest. 4. Identification of potential successor trustees: Identify potential successor trustees who are suitable to take over the trustee role. Include their names, contact information, and relevant qualifications or experiences that make them eligible for this position. 5. Justification for successor trustees: Present a persuasive argument supporting the chosen successor trustees, highlighting their knowledge, expertise, trustworthiness, and any other relevant attributes or qualifications that make them suitable candidates for the role. 6. Consent and acceptance of successor trustees: Include any written consents or acceptance letters from the identified successor trustees, confirming their willingness to take on the trustee responsibilities. 7. Notice to interested parties: Outline the steps taken to notify all interested parties such as beneficiaries, co-trustees, and any other relevant individuals or entities, regarding the intended transfer of trusteeship. Include copies of the notices and any acknowledgment of receipt. 8. Proposed plan for transfer: Provide a detailed plan for the transfer of trusteeship, including a timeline, steps to be followed, and any potential issues or considerations that need to be addressed during the transfer process. 9. Attachments: Include any supporting documents, such as the original trust instrument, any amendments, relevant court orders, consents, or acceptance letters from successor trustees, and any necessary affidavits or declarations. Remember, the content of a Pearland Texas Motion to Transfer Application for Successor Trustees may vary depending on the specific circumstances of the case, so it's crucial to consult with a legal professional or attorney for guidance and to ensure all necessary information is properly addressed in the application.

Pearland Texas Motion to Transfer Application for Successor Trustees

Description

How to fill out Pearland Texas Motion To Transfer Application For Successor Trustees?

We consistently aim to minimize or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we enlist attorney services that are typically quite costly.

Nevertheless, not all legal matters are equally complicated; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button next to it. Should you misplace the document, you can always re-download it from within the My documents tab. The procedure is just as straightforward if you’re new to the site! You can establish your account in minutes. Ensure to verify if the Pearland Texas Motion to Transfer Application for Successor Trustees aligns with the laws and statutes of your state and region. Additionally, it’s vital to review the form’s details (if provided), and if you find any inconsistencies with your initial requirements, look for another template. Once you’ve confirmed that the Pearland Texas Motion to Transfer Application for Successor Trustees suits your needs, you can choose the subscription plan and proceed with payment. You can then download the document in any available file format. For over 24 years, we’ve assisted millions of individuals by supplying ready to personalize and current legal documents. Take advantage of US Legal Forms today to conserve effort and resources!

- Our library empowers you to take control of your affairs without resorting to legal representation.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search.

- Capitalize on US Legal Forms whenever you need to locate and download the Pearland Texas Motion to Transfer Application for Successor Trustees or any other document efficiently and securely.

Form popularity

FAQ

How should I choose a successor trustee? Most people select a spouse, a child, or another family member as their successor trustee for a personal trust. But for larger trusts, many trustors select an institution or a private trustee, like a private professional fiduciary, as their successor.

Often, the trust says the successor trustee will take care of paying for the settlor's funeral expenses, and the settlor's outstanding debts (like, recent medical expenses and credit card bills), and then distribute what is left to the beneficiaries of the trust.

You also need to understand that there is a distinction to be made between who inherits a trust when someone dies (the beneficiaries) and who shall have the responsibility of administering the trust, paying the bills and taxes, and distributing what's left to the beneficiaries (the successor trustees).

The simple answer is yes, a Trustee can also be a Trust beneficiary. In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary. Nearly every revocable, living Trust created in California starts with the settlor naming themselves as Trustee and beneficiary.

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.

Appointment of a successor trustee refers to the process of having a new trustee take over management of a trust. Most trusts are managed by their creators during their lifetime. But trusts don't die with their makers, and that is why a successor trustee takes over.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

The name of the trustee of the trust will be on title of your trust assets. So, if you put a bank account into your trust, you would need to rename the bank account to be your name, as trustee, followed by the name of the trust.

It is common for trust deeds to provide, for instance, that in the case of death of one of the trustees, the other trustees can appoint the next trustee or that it would be one of the heirs of the family of the author, say legal experts.