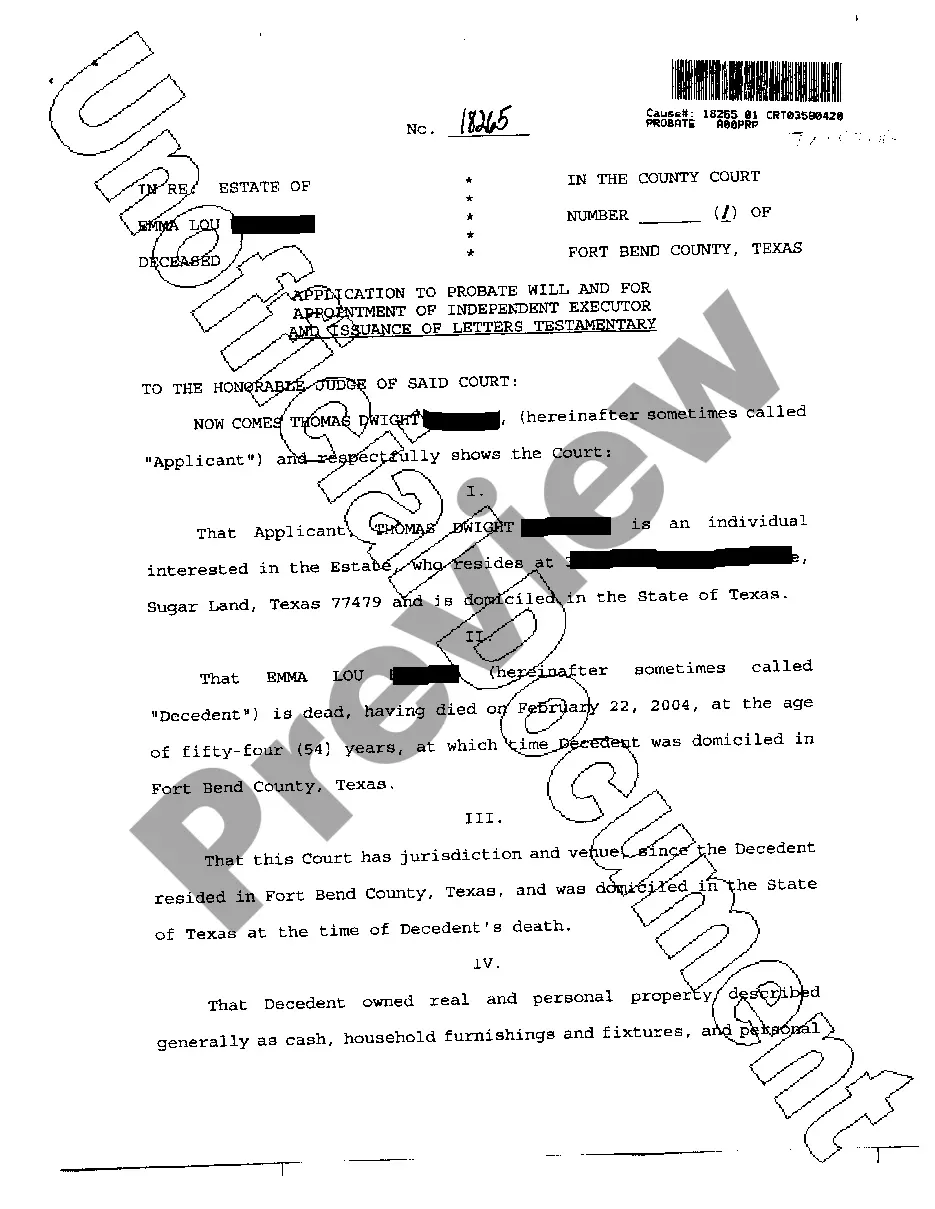

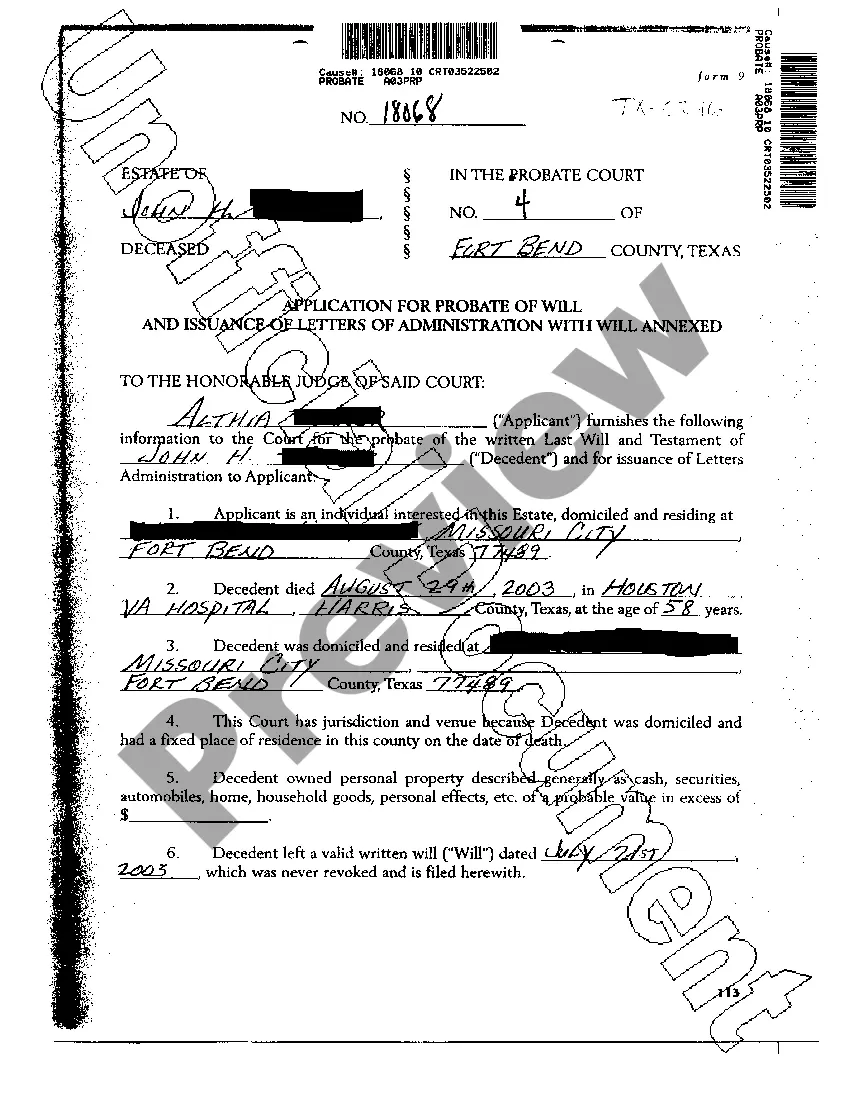

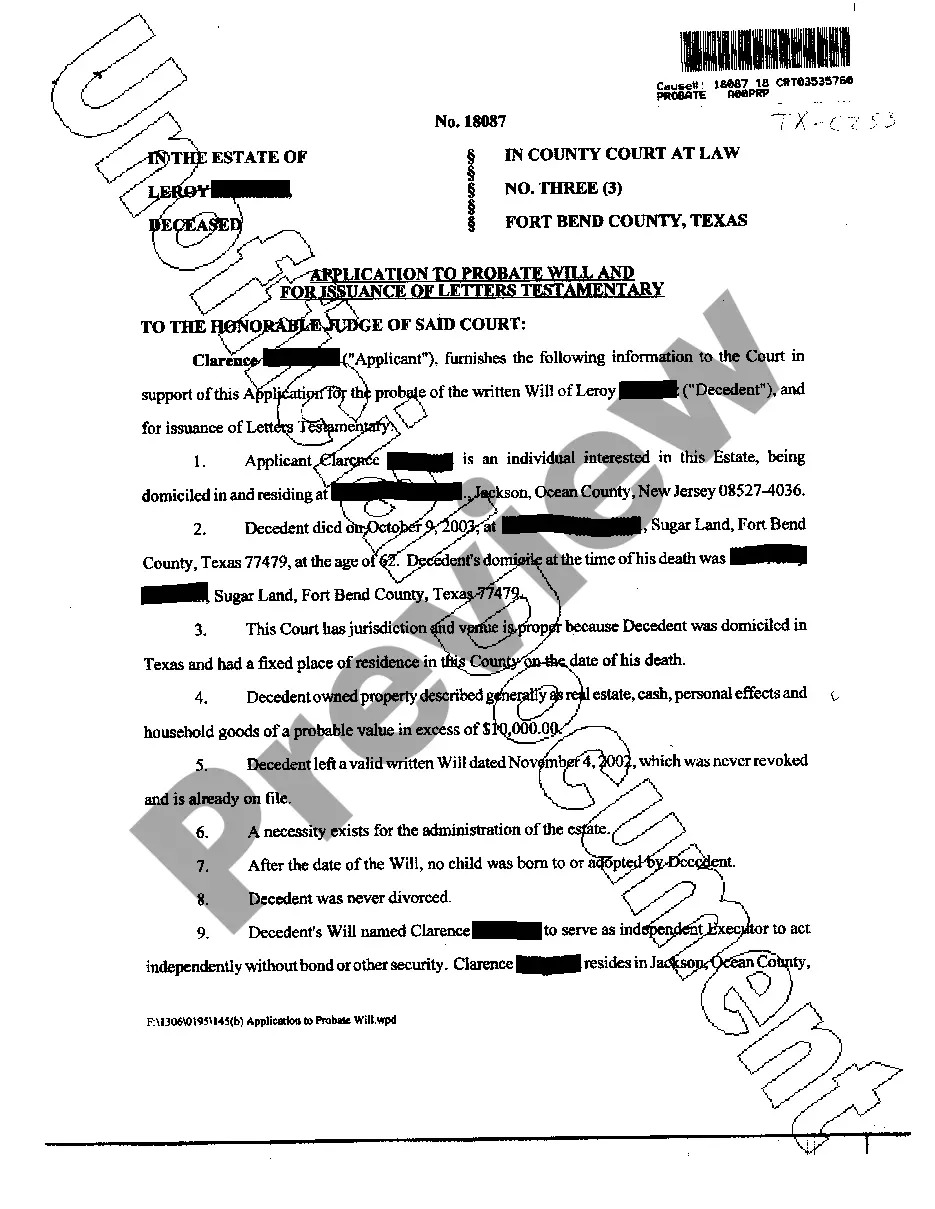

Austin Texas Application to Probate Will and for Appointment of Independent Executor and Issuance of Letters Testamentary

Description

How to fill out Texas Application To Probate Will And For Appointment Of Independent Executor And Issuance Of Letters Testamentary?

Regardless of social or professional position, filling out legal documents is an unfortunate requirement in today’s business landscape.

Often, it’s nearly impossible for someone without legal training to craft these types of documents from the ground up, primarily due to the complex terminology and legal nuances they entail.

This is where US Legal Forms comes into play.

Ensure the template you have selected is applicable to your region since the laws of one state or area do not apply to another.

Examine the document and review a brief summary (if available) of scenarios for which the form can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific forms that cater to nearly any legal scenario.

- US Legal Forms also functions as an outstanding resource for associates or legal advisors looking to enhance their efficiency by utilizing our DIY forms.

- Whether you are in need of the Austin Texas Application to Probate Will and for Appointment of Independent Executor and Issuance of Letters Testamentary or any other document applicable in your jurisdiction, with US Legal Forms, everything is within reach.

- Here's how to swiftly obtain the Austin Texas Application to Probate Will and for Appointment of Independent Executor and Issuance of Letters Testamentary using our trustworthy platform.

- If you are already a client, you can proceed to Log In to your account to access the appropriate form.

- However, if you are new to our repository, ensure to follow these steps before downloading the Austin Texas Application to Probate Will and for Appointment of Independent Executor and Issuance of Letters Testamentary.

Form popularity

FAQ

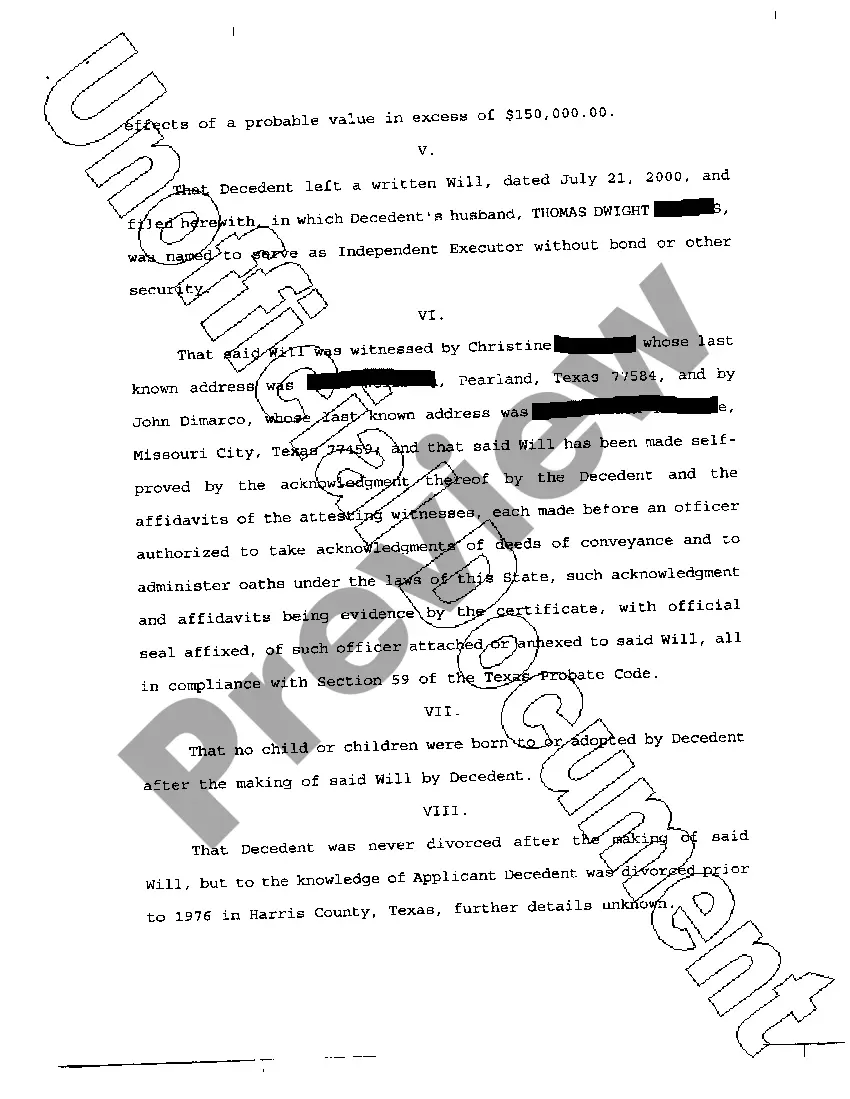

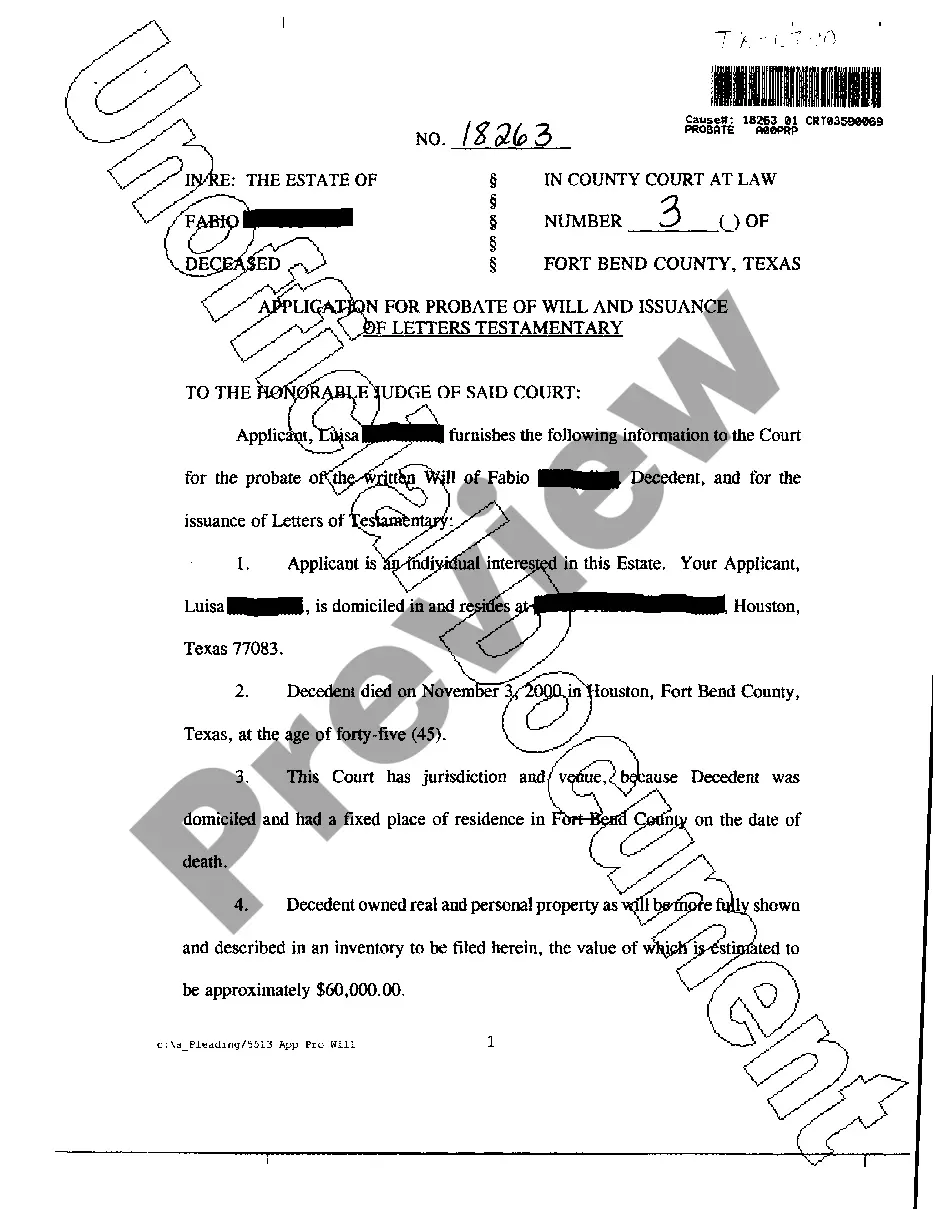

Letters testamentary or letters of administration give the personal representative the legal authority to administer the decedent's probate estate. The letters provide proof of appointment and qualification of the personal representative of an estate and the date of qualification.

An independent administration is a non-court administration. After a person has applied for letters testamentary and been qualified as independent executor by the court, the executor files an inventory of the estate's assets and their appraised value, and a list of claims of the estate.

By far, the most popular method of probating an estate in Texas is the Independent Probate Administration. In this type of administration, the Court appoints the executor or administrator to work independently of the court's supervision.

Application for Independent Administration The Application will include, among other things, the decedent's identity, domicile, and date of death, along with a list of all known heirs and the relationship of each heir to the decedent.

How Do I Obtain Letters Testamentary in Texas? In order to obtain Letters Testamentary in Texas, an eligible person must apply to the appropriate court, which is usually a statutory probate court. You must submit an Application and the Testator's original Will.

Unless limited by the terms of a will, an independent executor, in addition to any power of sale of estate property given in the will, and an independent administrator have the same power of sale for the same purposes as a personal representative has in a supervised administration, but without the requirement of court

In a dependent administration, the executor or representative must get court approval for most actions and report regularly to the probate judge. In an independent administration, the executor/representative is given more authority and autonomy to carry out his or her duties.

Letter of Testamentary, Administration or Guardianship - $2.00 each.