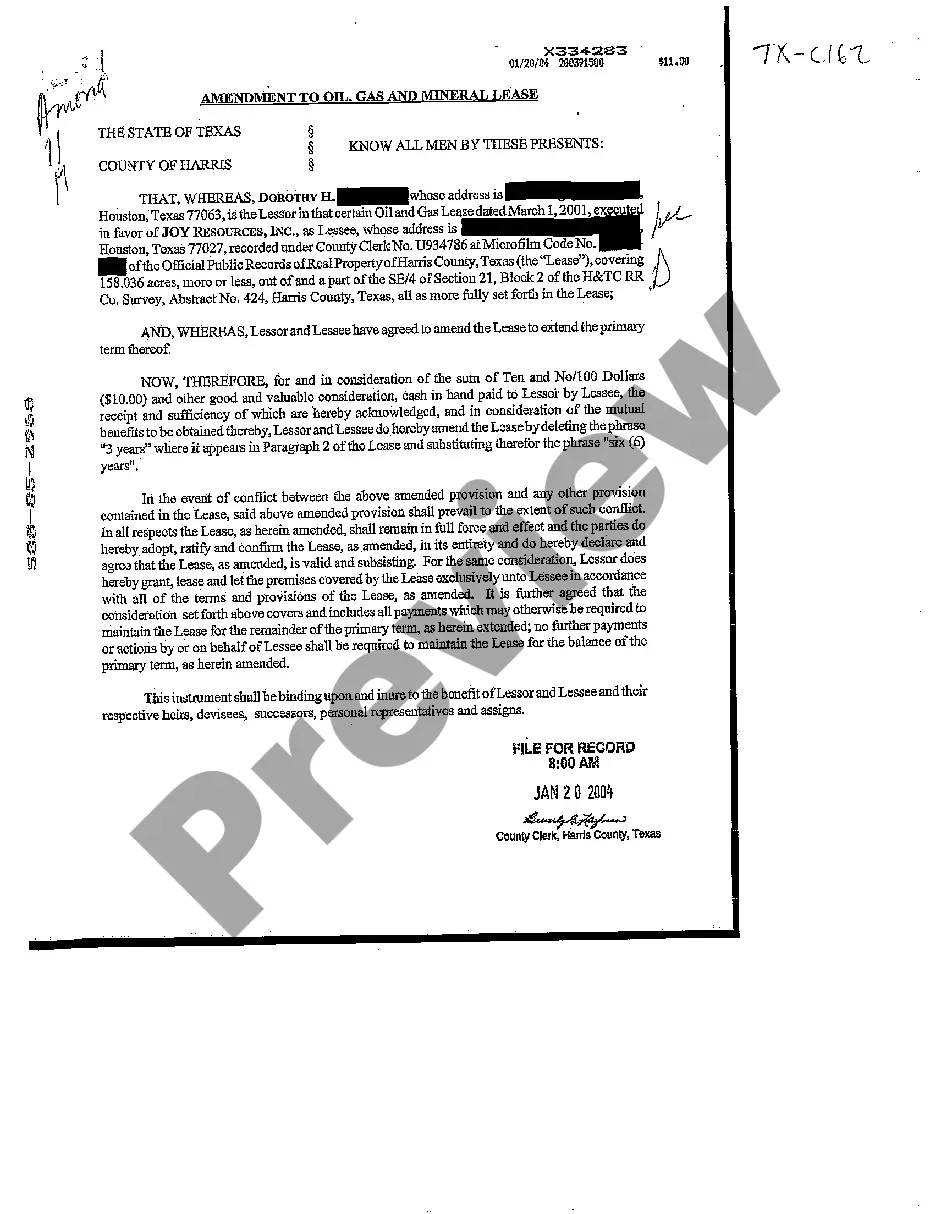

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

Fort Worth Texas Amendment to Oil, Gas, and Mineral Lease

Description

How to fill out Texas Amendment To Oil, Gas, And Mineral Lease?

Take advantage of US Legal Forms and gain instant access to any document you require.

Our advantageous platform featuring thousands of templates streamlines the process of locating and acquiring almost any document sample you may need.

You can download, complete, and authorize the Fort Worth Texas Amendment to Oil, Gas, and Mineral Lease in just a few minutes rather than spending hours searching the web for a suitable template.

Using our catalog is an excellent method to enhance the security of your form submissions. Our experienced attorneys routinely examine all the documents to ensure that the templates are applicable for a specific state and adhere to new laws and regulations.

US Legal Forms is one of the largest and most trustworthy document libraries online. Our team is always ready to support you in any legal matter, even if it's simply downloading the Fort Worth Texas Amendment to Oil, Gas, and Mineral Lease.

Feel free to fully utilize our service and make your document experience as streamlined as possible!

- How do you acquire the Fort Worth Texas Amendment to Oil, Gas, and Mineral Lease? If you already possess an account, simply sign in to your profile. The Download button will be activated for all the samples you review.

- Additionally, you can access all the previously saved documents in the My documents section.

- If you don’t have an account yet, follow these steps.

- Access the page with the desired form. Ensure that it is the template you were looking for: check its title and description, and use the Preview option when it's available. If not, use the Search field to locate the required one.

- Initiate the saving process. Choose Buy Now and select the pricing option you prefer. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Fort Worth Texas Amendment to Oil, Gas, and Mineral Lease and modify and complete, or sign it according to your needs.

Form popularity

FAQ

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals ? $25,000+ per acre is not unusual.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Apparently, at least the staff of the Railroad Commission is taking an unduly restrictive view on Texas Rule 37. This Rule provides that, without notice and an opportunity for hearing, no well shall be drilled nearer than 467 feet to a property line. 16 TEX. ADMIN.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

Landowners commonly sever and sell their mineral rights, often to big oil and gas exploration companies. The most common way of claiming mineral rights today is by buying them at auction or through private sales .

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

Like surface interests, mineral interests are passed down by inheritance. If there is a valid will, it controls who gets the property. If not, Texas laws of heirship controls.