Houston Texas Real Estate Lien Note

Description

How to fill out Texas Real Estate Lien Note?

Obtaining confirmed templates tailored to your regional regulations can be tough unless you utilize the US Legal Forms library.

It's an online archive of over 85,000 legal documents for both personal and professional purposes and any practical scenarios.

All the records are correctly categorized by area of application and jurisdictional regions, making it effortless and quick to find the Houston Texas Real Estate Lien Note.

Maintaining your documentation organized and compliant with legal requirements is of utmost significance. Utilize the US Legal Forms library to consistently have essential document templates for any requirement readily available!

- Check the Preview mode and document description.

- Ensure you have selected the appropriate one that fulfills your needs and aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

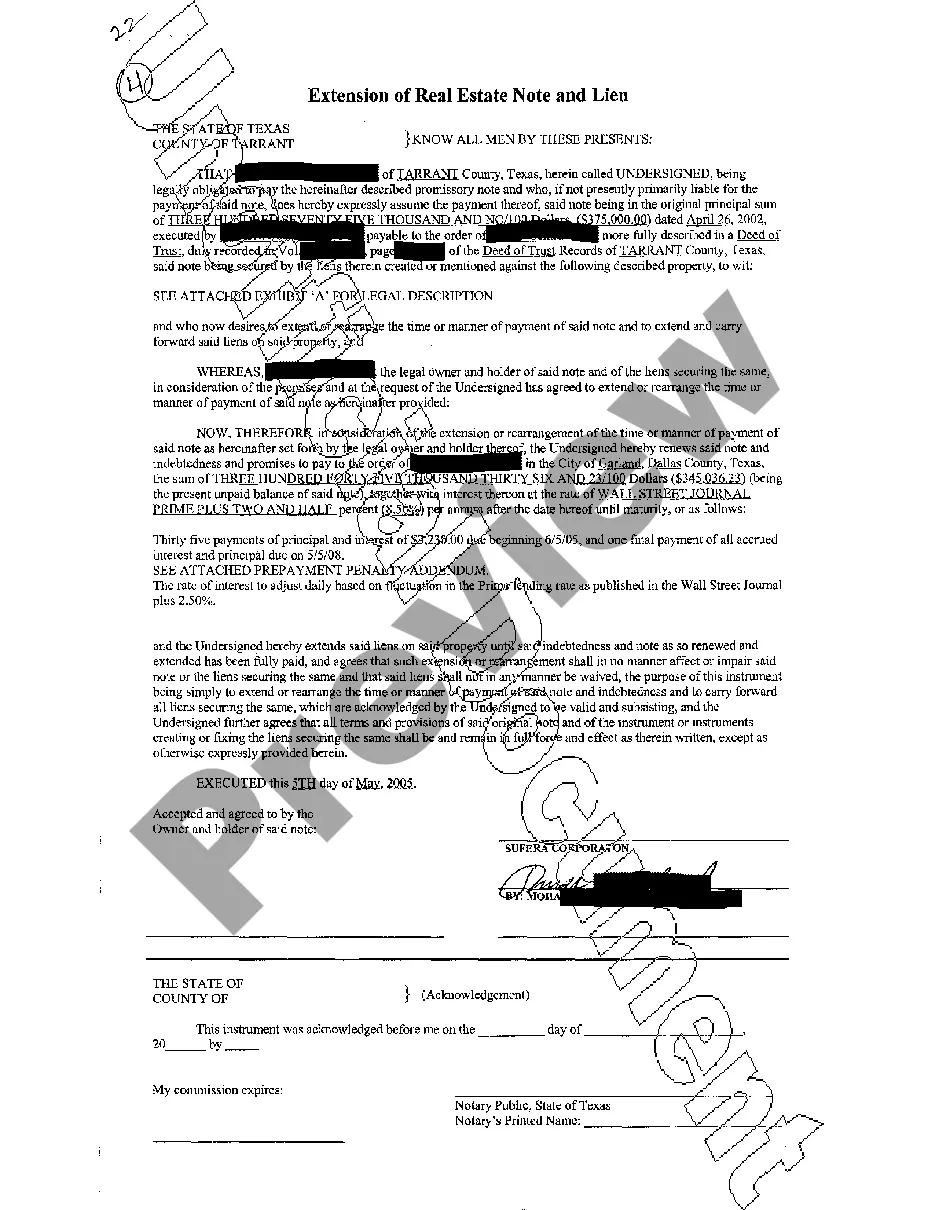

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.

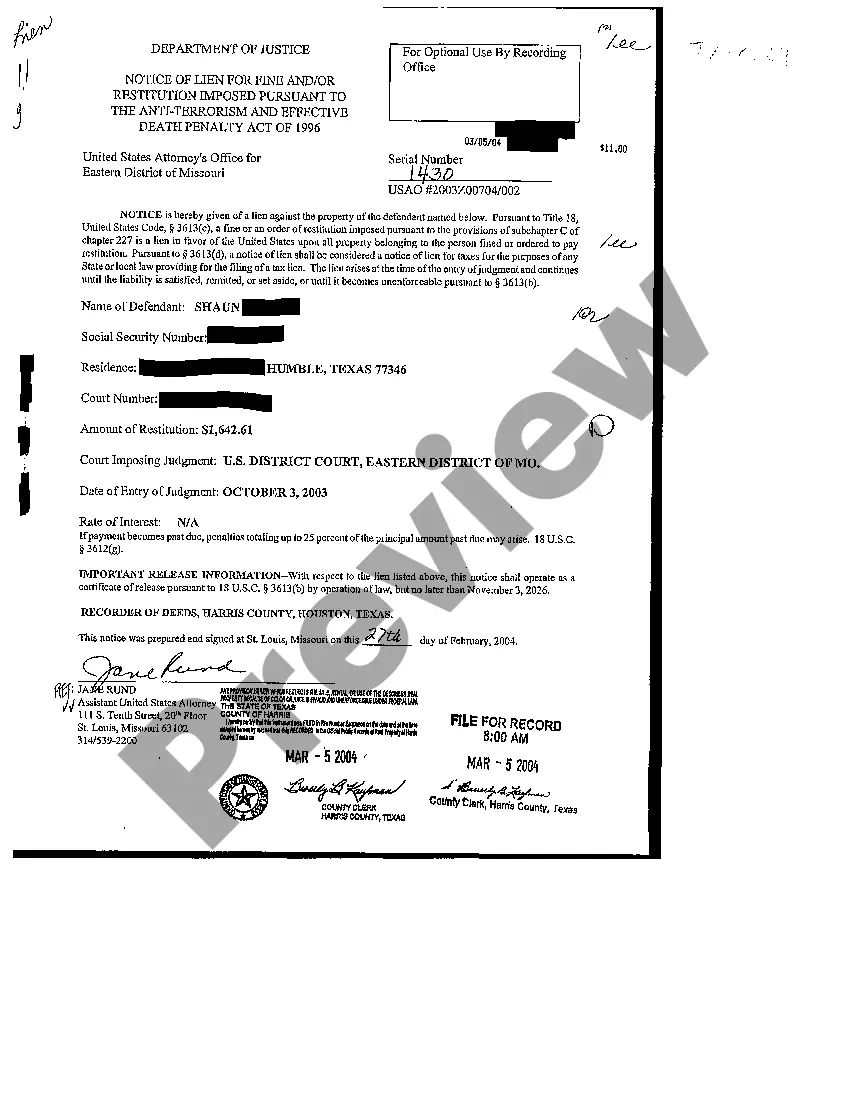

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

§52.006(b) PROPERTY CODE §52.006(B): STATE OF TEXAS JUDGMENT LIEN EXPIRES 20 YEARS AFTER FILING IN THE COUNTY CLERK'S OFFICE.

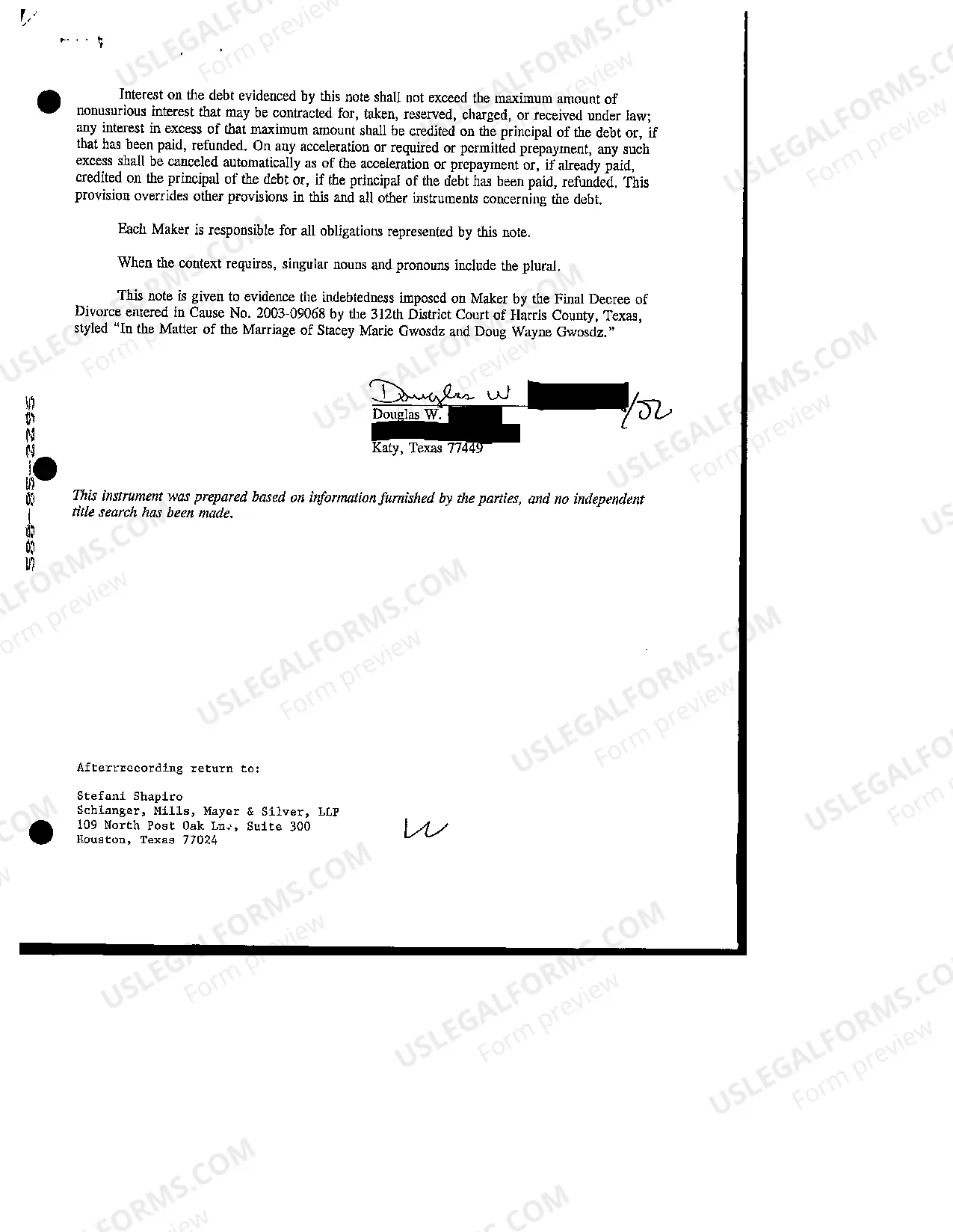

A promissory note is paper evidence of a debt that a borrower owes a lender. It outlines the amount of the loan, interest rate and schedule for repayment, all of which are legally binding. The promissory note is issued by the lender, signed by the borrower, then witnessed and initialled by the lender.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

In a real estate transaction involving a mortgage, the lender (a large financial institution, alternative lender, or private investor) would be the payee, while the home buyer entering into the loan agreement would be the maker or issuer of the promissory note.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

When a Texas mechanics lien has been paid and satisfied, the claimant must file a release of lien within 10 days after receiving a request for the release of the claim. However, there is no penalty provided by the statute. That doesn't mean that there are no consequences for failing to release it on time.

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.