Harris Texas Seller's Commercial Property Disclosure Statement

Description

How to fill out Texas Seller's Commercial Property Disclosure Statement?

If you are searching for an authentic document, it’s remarkably difficult to select a finer platform than the US Legal Forms website – one of the most extensive collections available online.

Here you can obtain a vast array of templates for organizational and personal use by categories and regions, or keywords.

With our sophisticated search functionality, locating the most recent Harris Texas Seller's Commercial Property Disclosure Statement is as easy as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the file format and download it to your device. Edit the content. Complete, modify, print, and sign the acquired Harris Texas Seller's Commercial Property Disclosure Statement.

- Furthermore, the accuracy of every document is verified by a team of experienced lawyers who routinely review the templates on our site and update them in line with the latest state and county requirements.

- If you are already aware of our platform and possess a registered account, all you need to obtain the Harris Texas Seller's Commercial Property Disclosure Statement is to Log In to your user profile and click the Download button.

- If this is your first time using US Legal Forms, just follow the steps outlined below.

- Ensure you have selected the document you desire. Review its details and utilize the Preview option to examine its content. If it doesn’t fulfill your requirements, use the Search feature at the top of the page to find the necessary file.

- Validate your choice. Click the Buy now button. After that, choose your preferred payment plan and provide the necessary information to create an account.

Form popularity

FAQ

The seller's failure to provide the required disclosures entitles you to make claims for monetary damages for undisclosed defects under either the Texas Deceptive Trade - Consumer Protection Act or the Statutory Fraud Act.

If the property is being sold by the executor of an estate, a seller's disclosure is not required. However, heirs at law and beneficiaries are not included in the list of exemptions and must therefore complete a seller's disclosure. Whether buying or selling, real estate law can be complex and confusing.

Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender (Texas Property Code Section 5.008). Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements.

Texas is one of a handful of states that are considered ?non-disclosure? states. This means there is no law that allows the state government, including appraisal districts, to force you to provide it with sales price information.

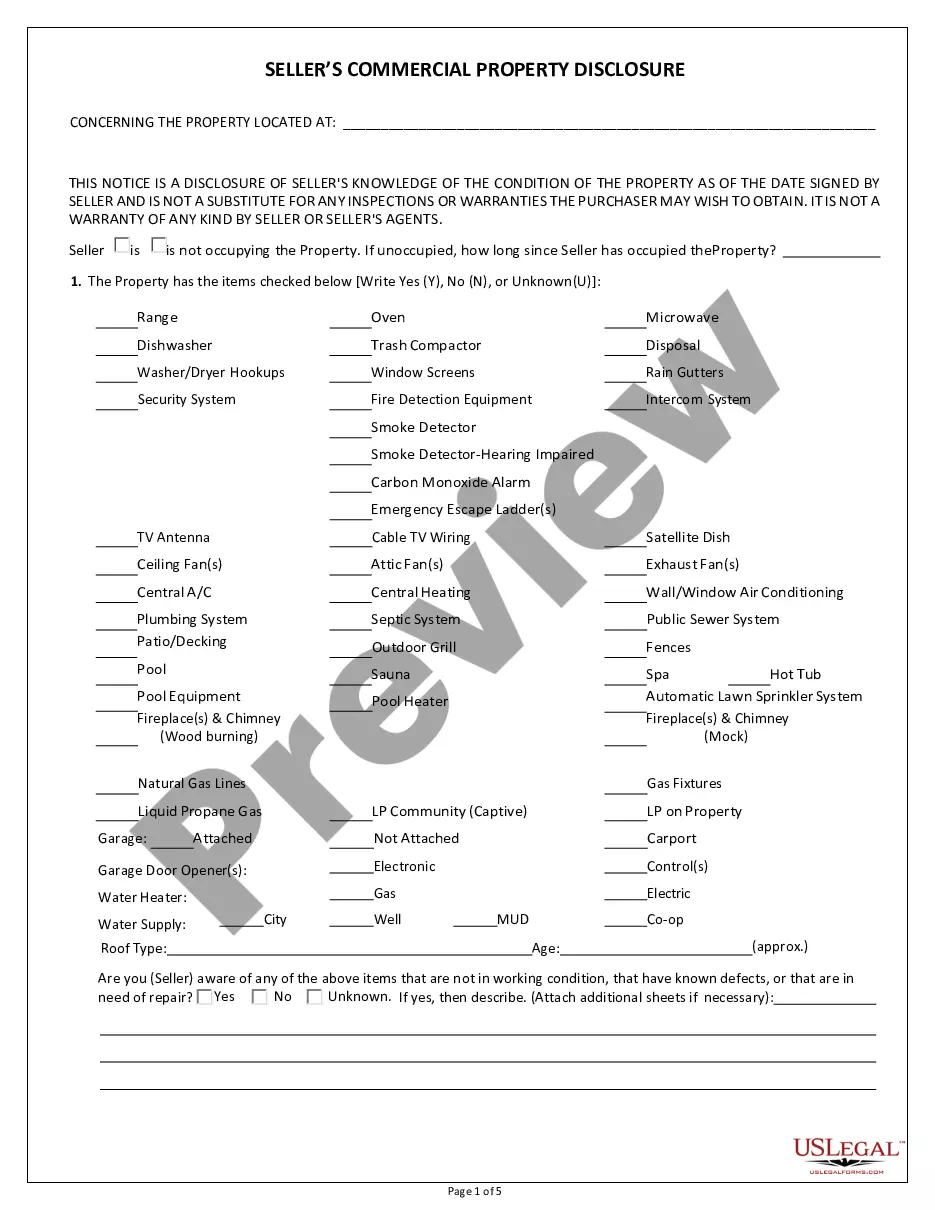

THIS NOTICE IS A DISCLOSURE OF SELLER'S KNOWLEDGE OF THE CONDITION OF THE PROPERTY AS OF THE DATE SIGNED BY SELLER AND IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR WARRANTIES THE PURCHASER MAY WISH TO OBTAIN. IT IS NOT A WARRANTY OF ANY KIND BY SELLER OR SELLER'S AGENTS. Seller.

Sellers and landlords may state if they are aware of a variety of environmental conditions and material defects. The statement, which is not required by law to complete, can describe improved or unimproved properties.

Is a Seller's Disclosure Required in Texas? Yes. Section 5.008 of the Texas Property Code requires anyone selling a single family home to fill out a seller's disclosure. It even has a script you can use to write your disclosure?so you know you've met all the requirements.

Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender (Texas Property Code Section 5.008). Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements.

Yes. Section 5.008 of the Texas Property Code requires anyone selling a single family home to fill out a seller's disclosure. It even has a script you can use to write your disclosure?so you know you've met all the requirements.

Texas is one of a handful of states that are considered ?non-disclosure? states. This means there is no law that allows the state government, including appraisal districts, to force you to provide it with sales price information.