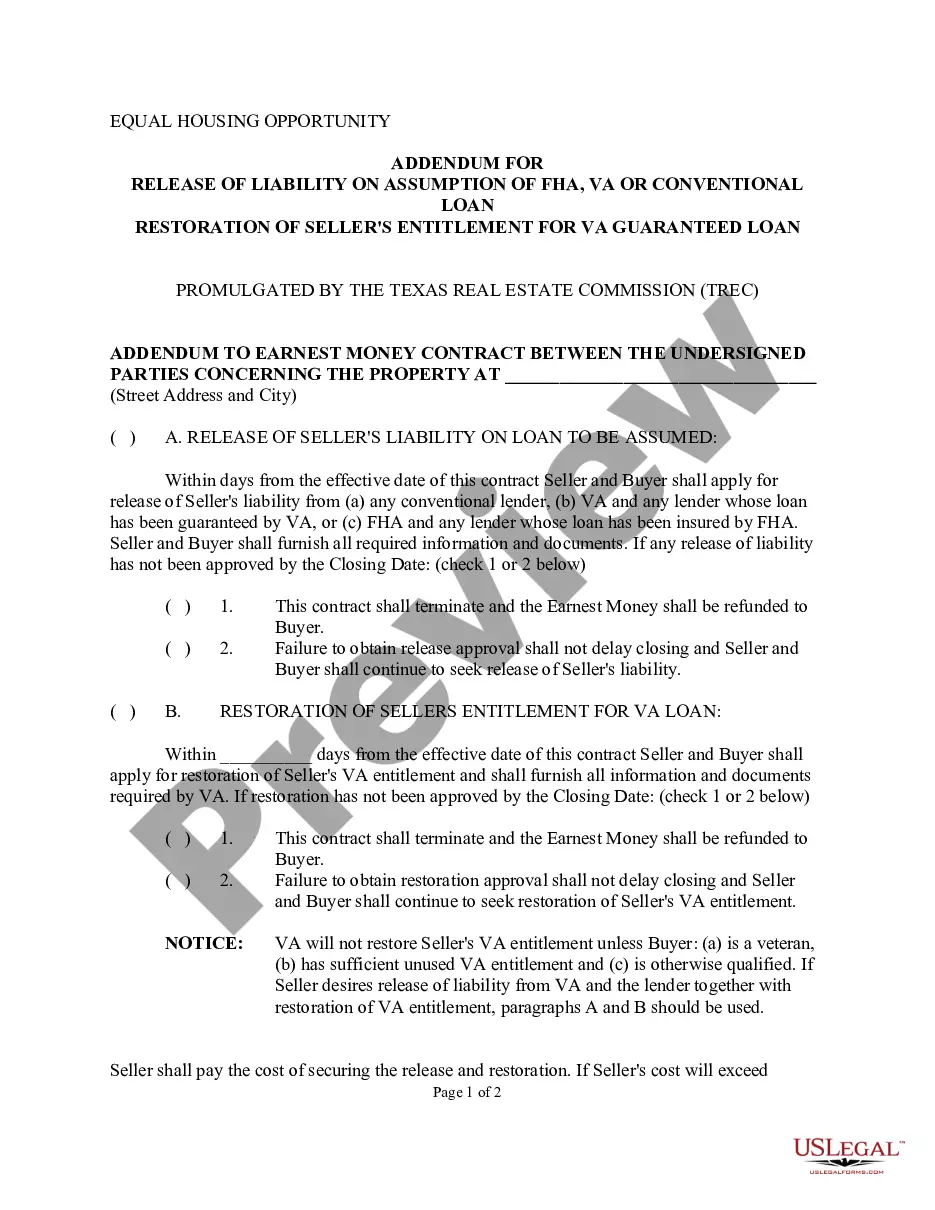

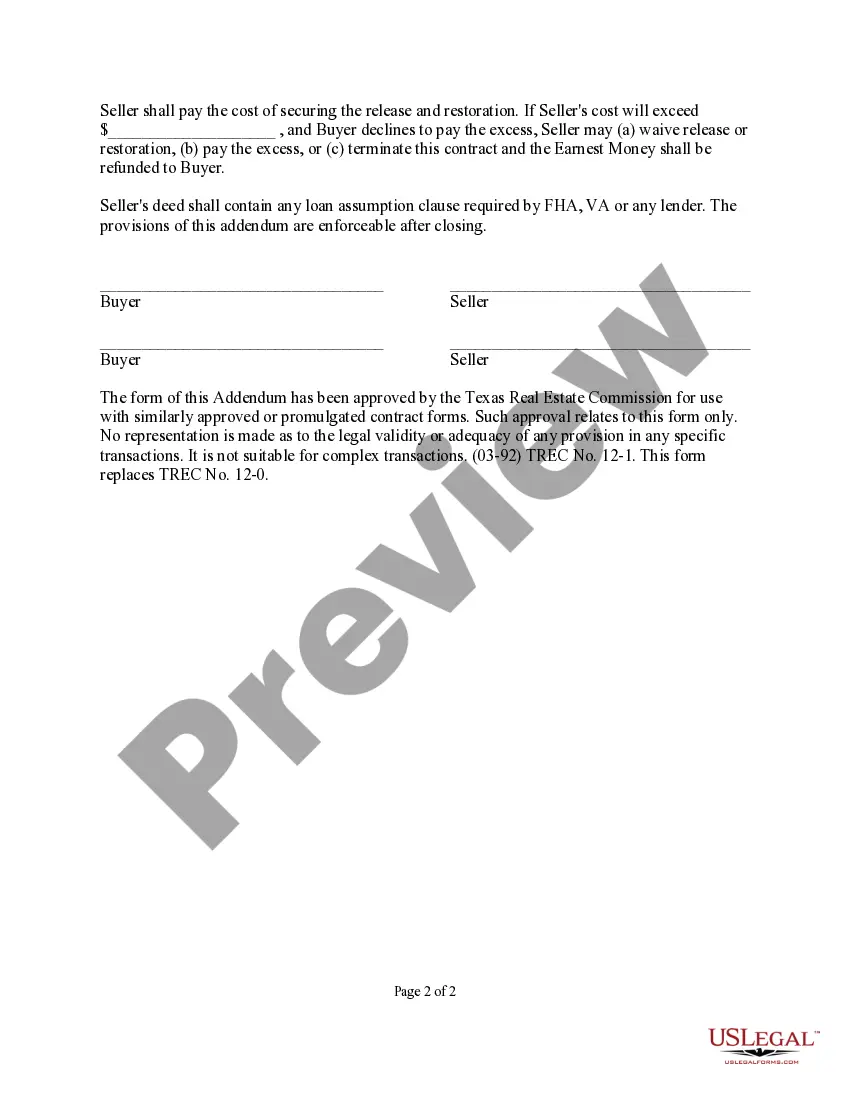

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Houston Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online resource of over 85,000 legal documents catering to both personal and professional needs, covering various real-life situations.

All files are properly categorized by usage area and jurisdiction, making the search for the Houston Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan incredibly fast and easy.

Maintaining documentation organized and in compliance with legal standards is crucial. Utilize the US Legal Forms library to easily access essential document templates for any requirements at your convenience!

- Review the Preview mode and document description.

- Ensure you've selected the appropriate document that aligns with your needs and fully complies with your local jurisdiction.

- Look for an alternative template, if necessary.

- If you identify any discrepancies, use the Search tab above to locate the appropriate one. If it meets your requirements, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

An addendum is used to clarify and add things that were not initially part of the original contract or agreement. Think of addendums as additions to the original agreement (for example, adding a deadline where none existed in the original version).

To receive VA home loan benefits and services, the Veteran's character of discharge or service must be under other than dishonorable conditions (e.g., honorable, under honorable conditions, general). Generally, there is no character of discharge bar to benefits to Veterans' Group Life Insurance.

How do I request a waiver? A Financial Status Report (VA Form 5655) A personal statement that explains why you feel you shouldn't have to repay the debt. In your statement, share more information to support your waiver request.

An addendum is an addition to a finished document, such as a contract. The most common addendum is an attachment or exhibit at the end of such a document. For example, a contract to manufacture widgets may have an addendum listing the specifications for said widgets.

A VA restoration of entitlement allows borrowers who have previously utilized their VA loan entitlement to purchase another home with the VA's guaranty again.

An addendum may include any written item added to an existing piece of writing. The addition often applies to supplemental documentation that changes the initial agreement that forms the original contract.

Does a seller have to sign the VA escape clause? No, a seller doesn't have to sign the VA escape clause. But by refusing to sign, the seller cannot accept the offer of the veteran buyer. It is worth pointing out that many buyers with all kinds of loans will insist on an appraisal contingency.

If you sell the property which secures your VA loan, you will still be legally liable to the government unless one of the following conditions is met: -Your loan is paid in full. -The VA releases you in writing from liability on the loan.

The easiest way to remove someone from a VA mortgage is to refinance the loan in the remaining borrower's name alone. A VA Interest Rate Reduction Refinance Loan (VA IRRRL) is a simple way to achieve this.

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.