This is a Texas deed of trust to sure an assumption.

Harris Texas Deed of Trust to Secure Assumption

Description

How to fill out Texas Deed Of Trust To Secure Assumption?

Finding authenticated forms tailored to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements across various real-life situations.

All the files are well-organized by usage category and jurisdiction, so finding the Harris Texas Deed of Trust to Secure Assumption becomes as straightforward as ABC.

Maintaining documentation tidy and compliant with legal standards is of significant importance. Take advantage of the US Legal Forms library to always have vital document templates for any requirements right at your fingertips!

- Review the Preview mode and form details.

- Ensure that you’ve selected the correct one that matches your requirements and fully aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you find any discrepancies, use the Search tab above to retrieve the proper document.

- Proceed to the next step if it meets your preferences.

Form popularity

FAQ

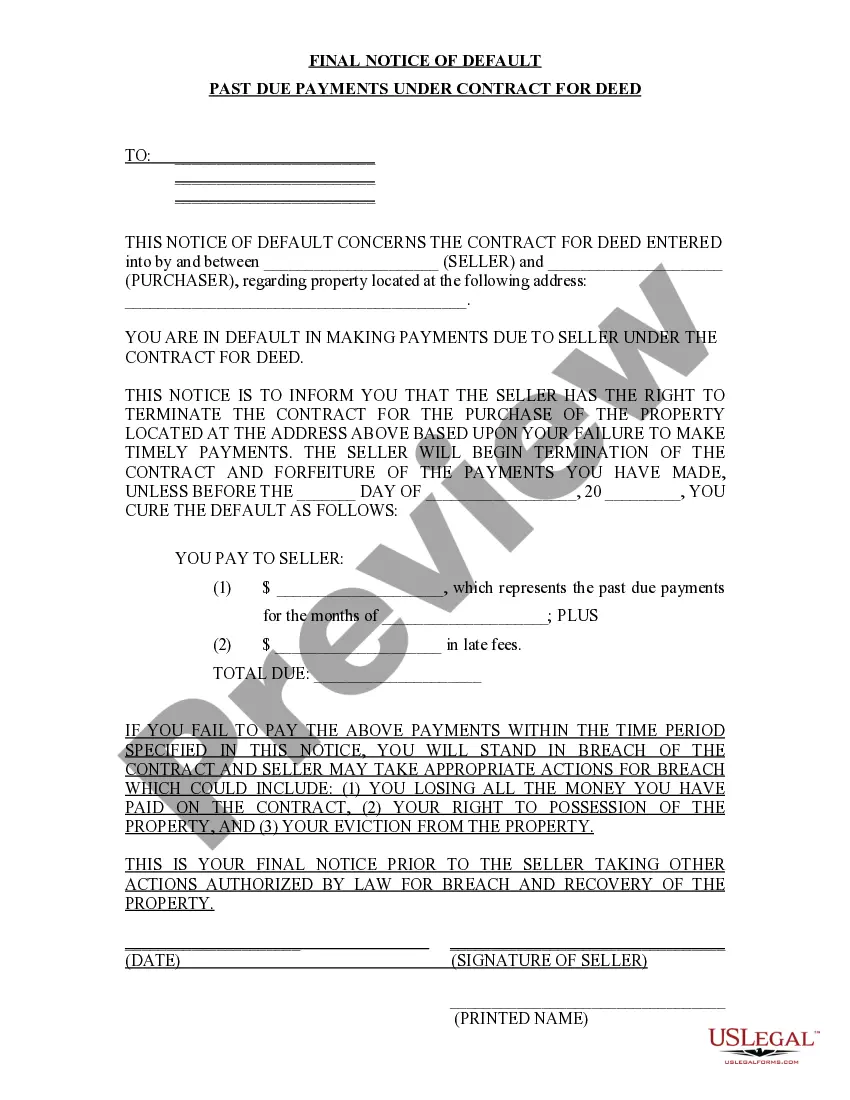

An assumption warranty deed in Texas allows a buyer to assume the seller's existing mortgage obligations, often linked to the Harris Texas Deed of Trust to Secure Assumption. This type of deed protects both parties by ensuring that the buyer takes over the mortgage and that the lender's interests are secured. It is crucial for buyers to understand their responsibilities, as they will be accountable for the mortgage payments going forward.

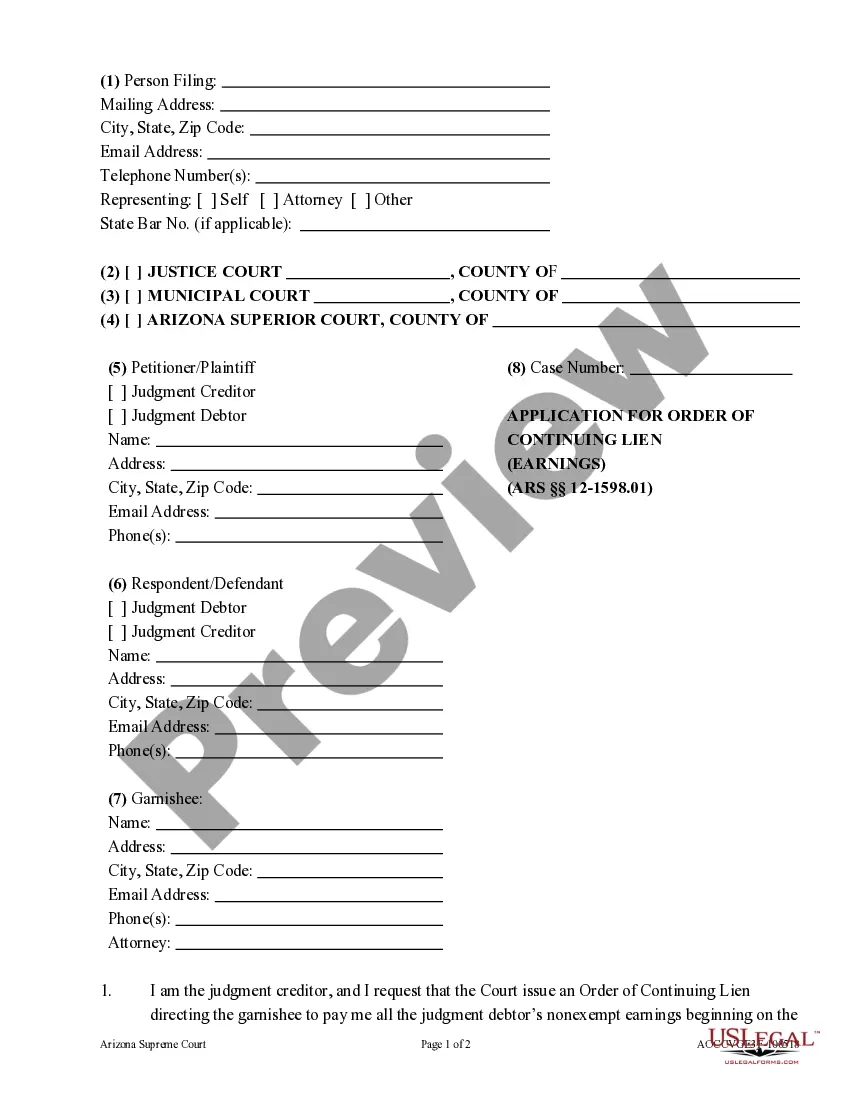

The assignment of the deed of trust is signed by the lender or their designated agent, who officially transfers the beneficial interest in the deed to another party. If the deed is secured by a Harris Texas Deed of Trust to Secure Assumption, the transaction is straightforward and must adhere to Texas law. The borrower typically does not need to sign this assignment, but they should be informed about any changes in servicing.

To file a Harris Texas Deed of Trust to Secure Assumption, you need to complete the document and include all necessary information. After gathering the required signatures, take it to the county clerk's office where the property is located. Once filed, ensure you obtain a copy for your records, as this protects your interests and maintains clarity regarding the property ownership.

A Harris Texas Deed of Trust functions by transferring the title of the property to a trustee on behalf of the lender while the borrower maintains equitable ownership. This arrangement provides security for the lender, allowing them to initiate a non-judicial foreclosure if the borrower defaults. The clarity and security this process provides benefit both parties, ensuring a smooth transaction. Utilizing platforms like uslegalforms can guide you through these procedures effectively.

Choosing a Harris Texas Deed of Trust to Secure Assumption offers specific advantages over a traditional mortgage. A deed of trust streamlines the process by allowing for a non-judicial foreclosure, which can be quicker and less expensive. This can be especially beneficial for borrowers looking to secure quicker access to their property. Also, a deed of trust typically involves three parties: the borrower, the lender, and the trustee, providing a clearer structure for the transaction.

An assumption deed allows a grantee to assume liability for existing indebtedness and promise to discharge one or more existing liens against the property.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.