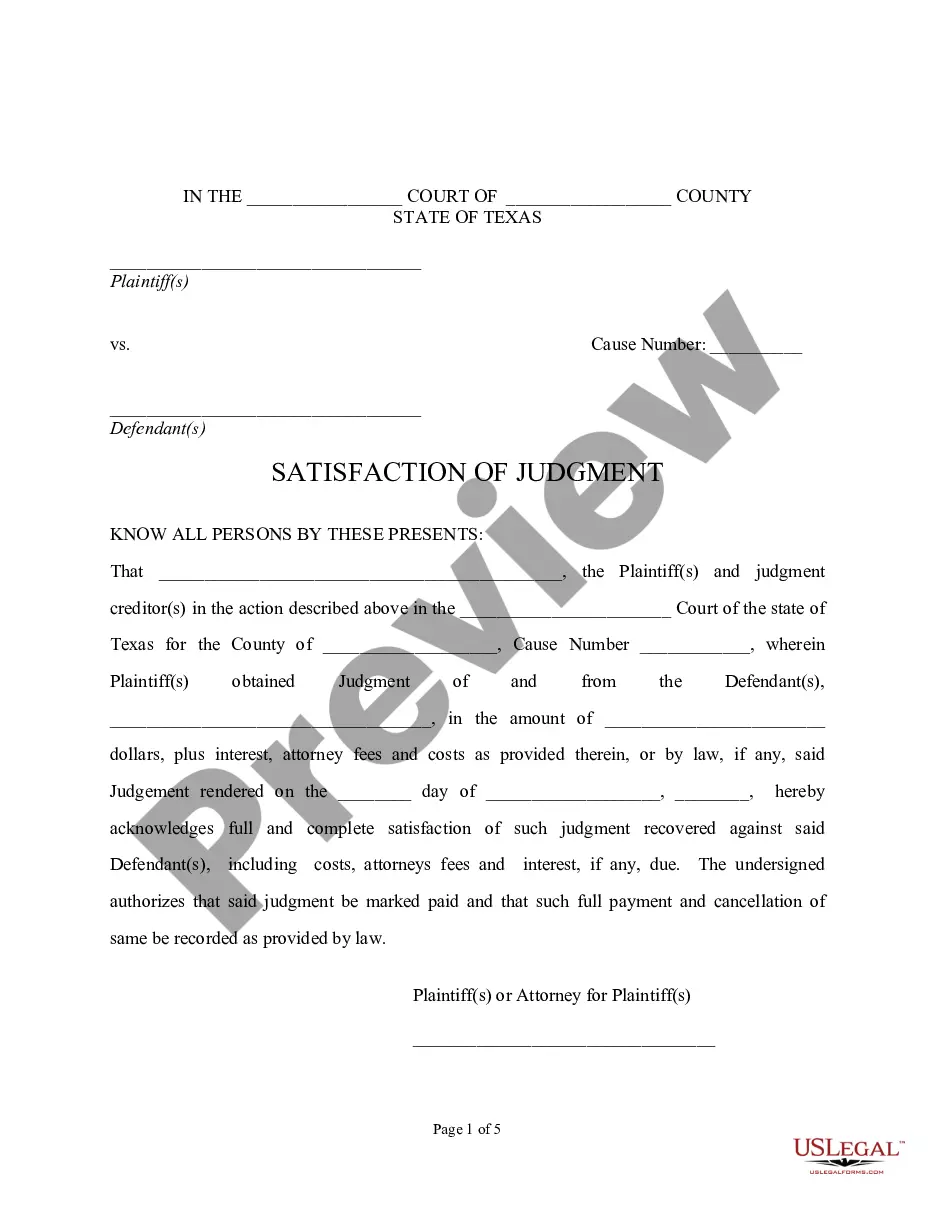

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Austin Texas Satisfaction of Judgment

Description

How to fill out Texas Satisfaction Of Judgment?

Obtaining verified templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the files are accurately categorized by area of use and jurisdiction, making the search for the Austin Texas Satisfaction of Judgment as straightforward as ABC.

Maintaining documentation organized and in accordance with legal standards is critically important. Take advantage of the US Legal Forms library to have the essential document templates for any requirements readily available at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the right one that fulfills your needs and entirely complies with your local jurisdiction requirements.

- Seek another template if necessary.

- If you discover any discrepancies, utilize the Search tab above to find the appropriate document.

- If it fits your criteria, proceed to the next step.

Form popularity

FAQ

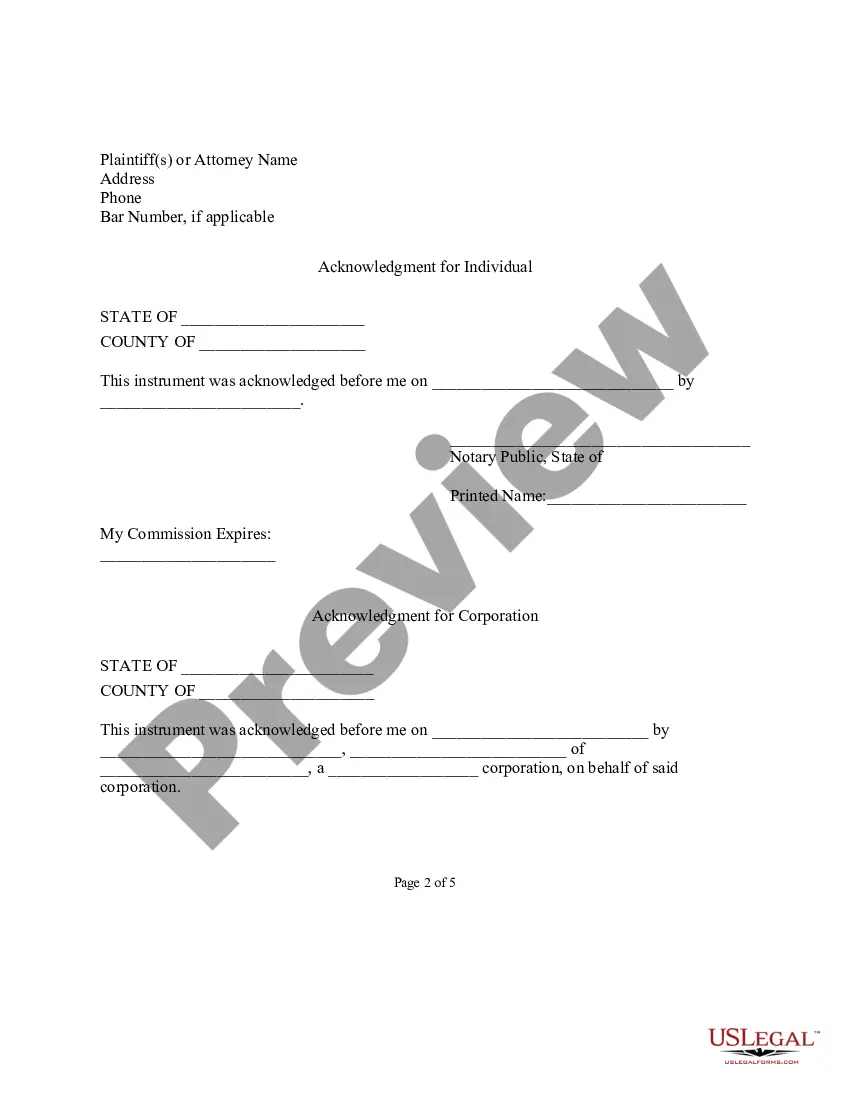

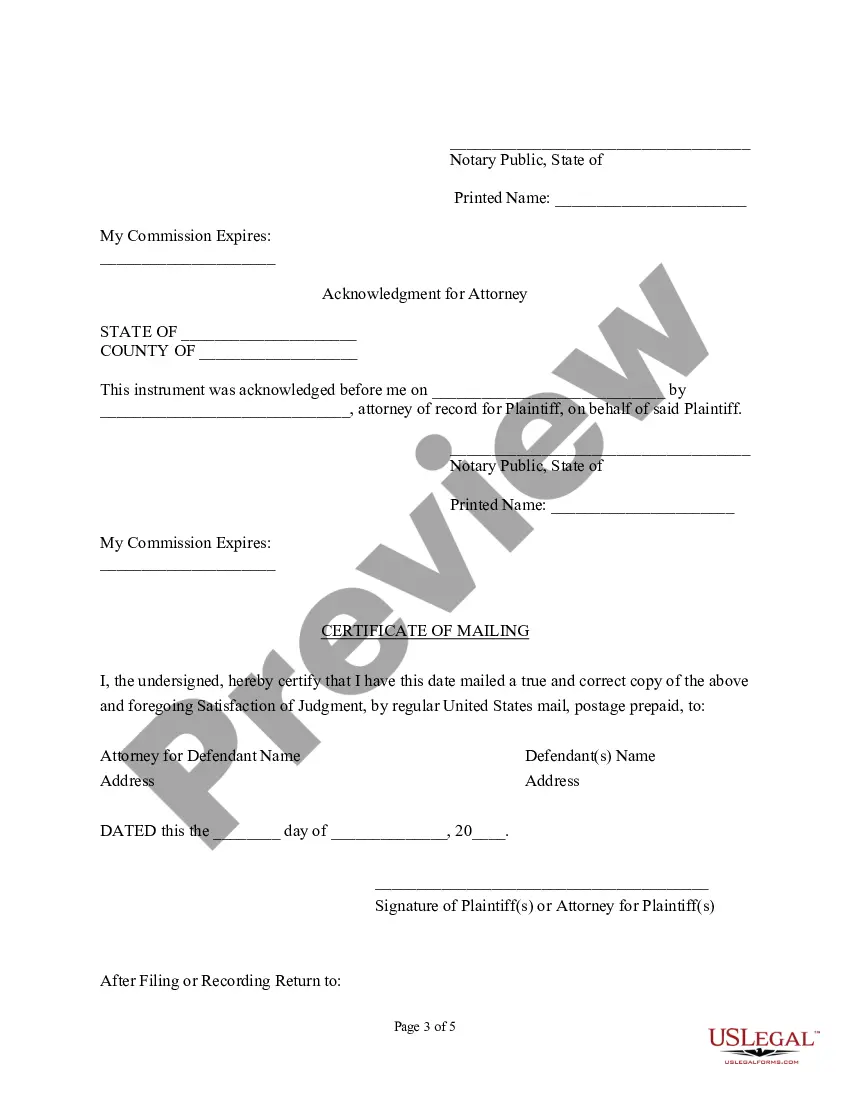

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later. It's easy to get a copy of a Satisfaction of Judgment form.

(1) Moral judgments about actions being right or wrong; (2) Moral judgments about people being good or bad; (3) Moral judgments about traits of character being good or bad, being virtues or vices.

When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution. This usually means that an officer of the law comes to the debtor's home or work place to take things owned by the debtor. The things that are taken are sold to pay the judgment.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

Satisfaction of a judgment means that the judgment is no longer a lien on the debtor's real property. The courts cannot control the actions of third parties, but usually, the fact of satisfaction is recorded by the major credit reporting agencies and included in the debtor's credit history.

It's done by filing an abstract of judgement with the county you live in. You would have a very difficult time selling any property that has a lien like this on it. You can get a partial release of a lien that resulted due to a judgement against you in Texas if the property is a homestead.

Filing a Judgment Lien A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Three commons ways to fight a false lien are to: immediately dispute the lien through statutorily provided preliminary means, a demand to/against the claimant, or a full-blown lawsuit. force the claimant to file a lawsuit to enforce the lien in a shorter period if available where you live. just wait it out.

There is no removal procedure for such liens other than entering into a payment arrangement with the taxing authority. The existence of a judgment lien or other type of lien is usually discovered when a title company checks the property records and produces a title commitment in anticipation of a sale or refinance.