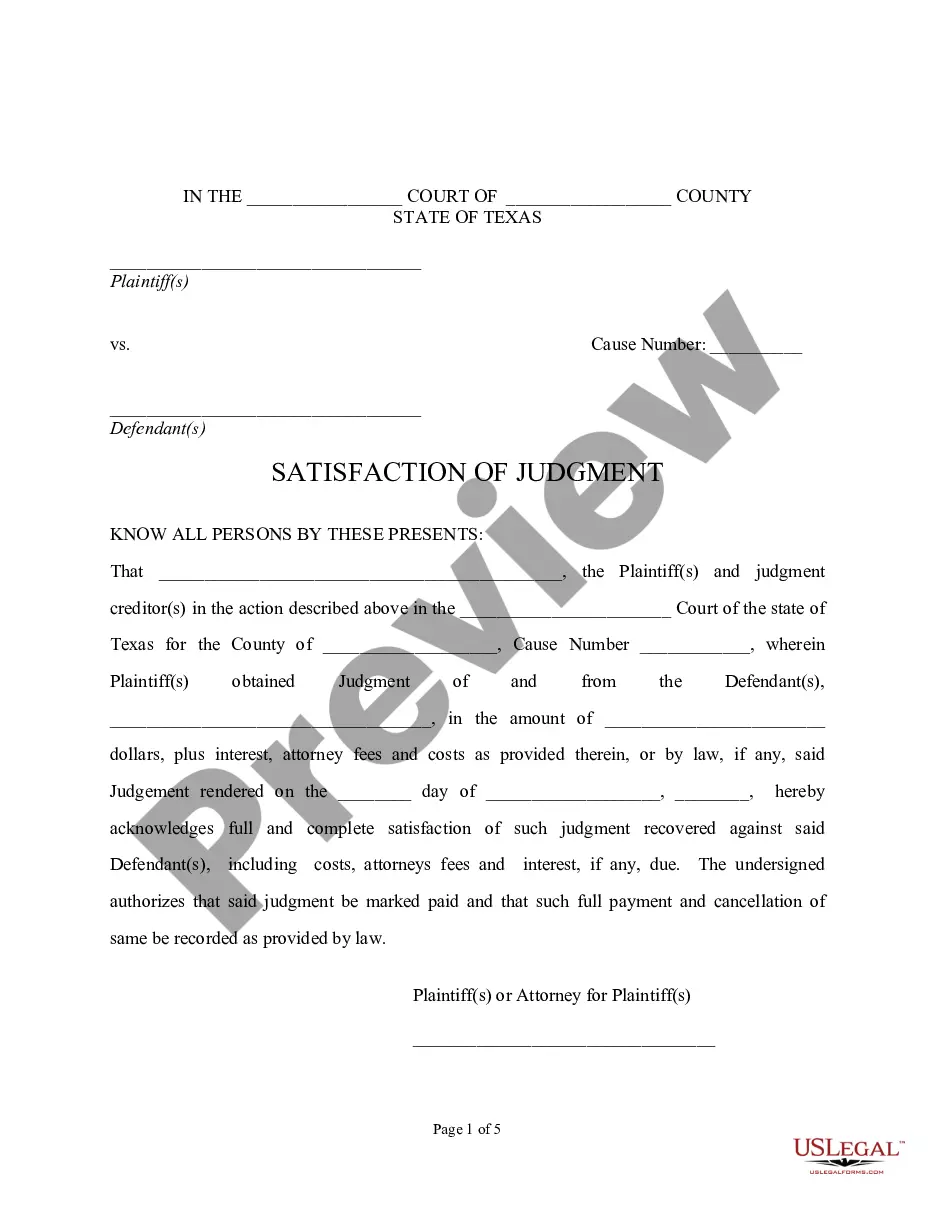

Texas Satisfaction of Judgment

Overview of this form

The Texas Satisfaction of Judgment is a legal document that confirms a judgment has been fully paid, including all associated fees, costs, and interest. This form serves as an official acknowledgment that the judgment is satisfied and instructs to mark it as paid in full. It differs from other judgment-related forms by explicitly detailing the complete payment status and releasing the debtor from the obligations of the judgment.

Form components explained

- Case information: Includes the court name, county, and case number.

- Parties involved: Identifies the plaintiff(s) and defendant(s).

- Judgment details: States the amount of the judgment and acknowledges satisfaction.

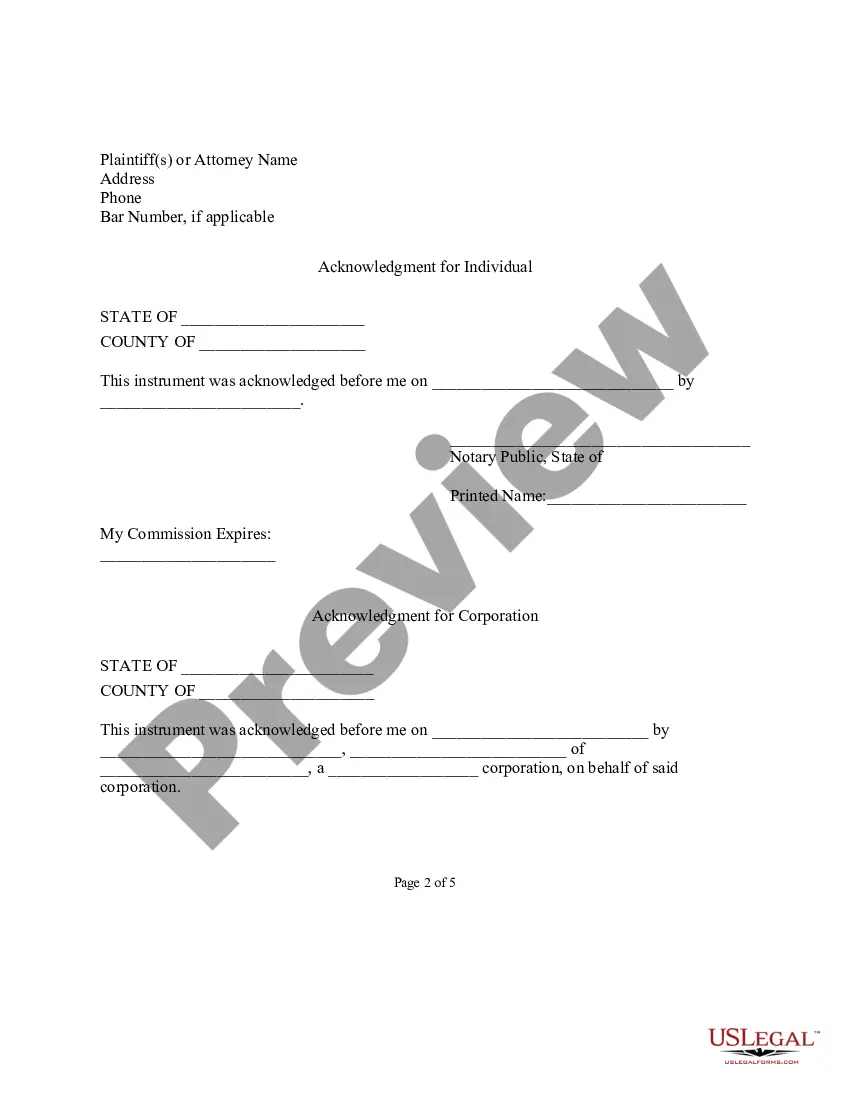

- Signatures: Requires signatures from the plaintiff or their attorney.

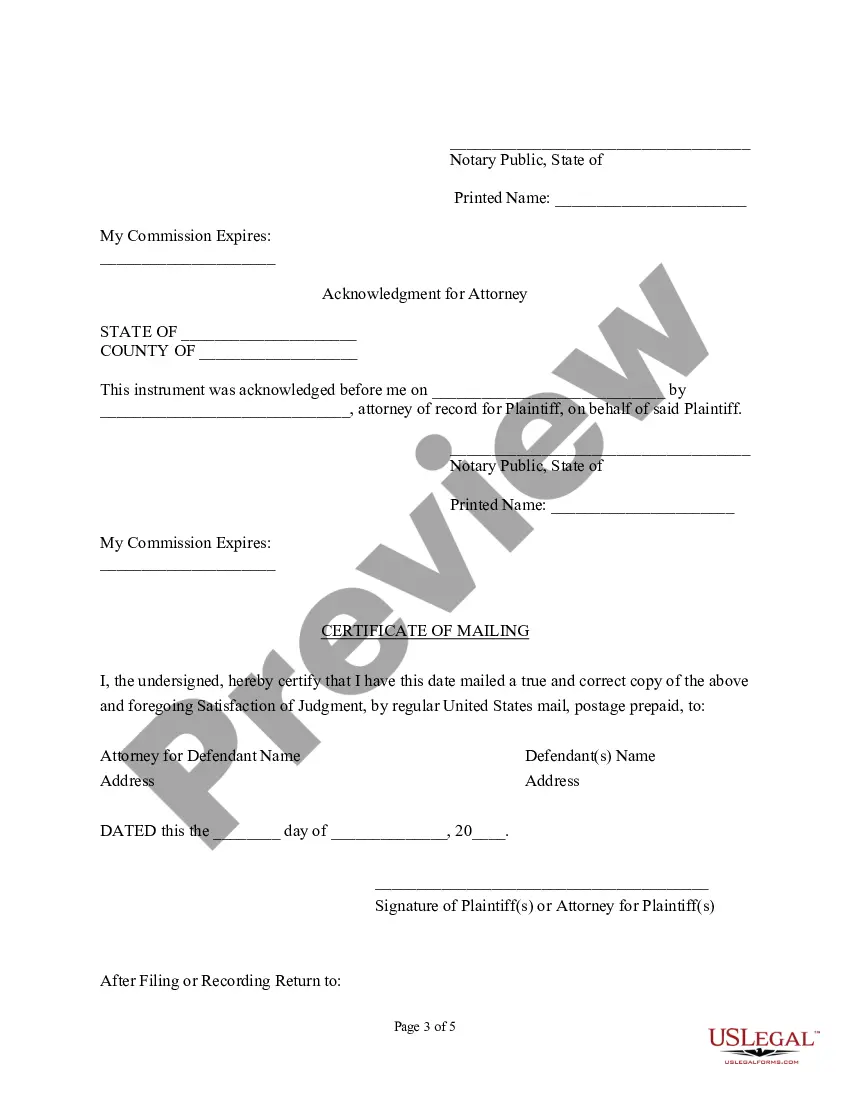

- Notarization section: Provides sections for notarization acknowledgment for individuals, corporations, and attorneys.

- Certificate of mailing: Confirms that a copy of the document was sent to the defendantâs attorney.

When to use this document

This form should be used when a plaintiff has received full payment of a court judgment against a defendant. It is essential in situations where the plaintiff needs to formally confirm that the judgment has been satisfied and ensures that any records indicating an outstanding obligation are updated accordingly.

Who should use this form

- Plaintiffs who have received full payment on a judgment.

- Attorneys representing plaintiffs in civil cases.

- Individuals or businesses that acted as judgment creditors.

How to complete this form

- Identify the court where the judgment was rendered, including court name, county, and cause number.

- Enter the names of the plaintiff(s) and defendant(s) as they appear in the original case.

- State the total amount of the judgment, including any fees, costs, and interest.

- Sign the form in the designated space, ensuring that the signature is from the plaintiff or their attorney.

- Complete the notarization section, if required, including the notaryâs signature and commission details.

Notarization requirements for this form

Yes, this form must be notarized to be legally valid. The notarization process provides an additional layer of assurance that the document is authentic and properly executed. US Legal Forms offers integrated online notarization, allowing you to complete the process through secure video calls anytime, ensuring convenience and compliance with legal standards.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately fill in case details, such as court name and cause number.

- Not including the precise amount paid, leading to future disputes.

- Omitting signatures from all necessary parties, including required notarization.

- Neglecting to send copies of the document to the defendantâs attorney.

Benefits of completing this form online

- Convenience of downloading and completing the form at any time.

- Editable fields that allow for easy customization to fit specific case details.

- Access to professionally drafted legal language, ensuring compliance with state regulations.

- Quick turnaround for managing legal processes and reducing delays in marking a judgment as paid.

Summary of main points

- The Texas Satisfaction of Judgment is essential for confirming the full payment of a judgment.

- Proper completion and notarization of the form are critical for legal validity.

- This document aids in updating public records to reflect the extinguishment of a judgment debt.

Looking for another form?

Form popularity

FAQ

If you are not able to get in touch with a clerk in your local court, you can try going to the courthouse itself. Be sure to check its hours of operation and parking details online before you go. You should ask to speak to a clerk who can help you search for civil judgment records.

When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution.The things that are taken are sold to pay the judgment. The Texas Property Code sets out the kinds and amounts of property that can and cannot be taken to pay a judgment in Texas.

In Texas, you can attach a property lien to a debtor's real estate to collect a court judgment.A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property.

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer.