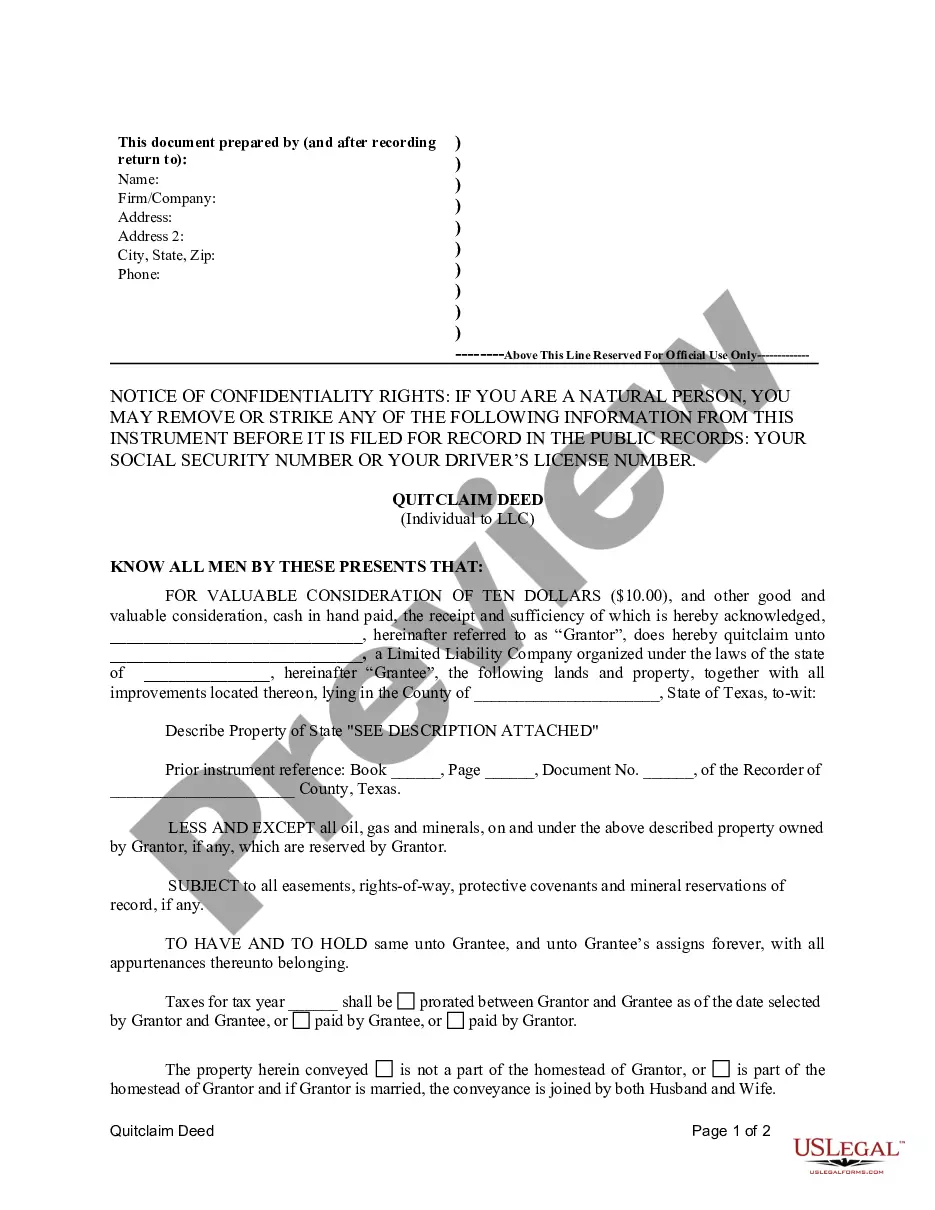

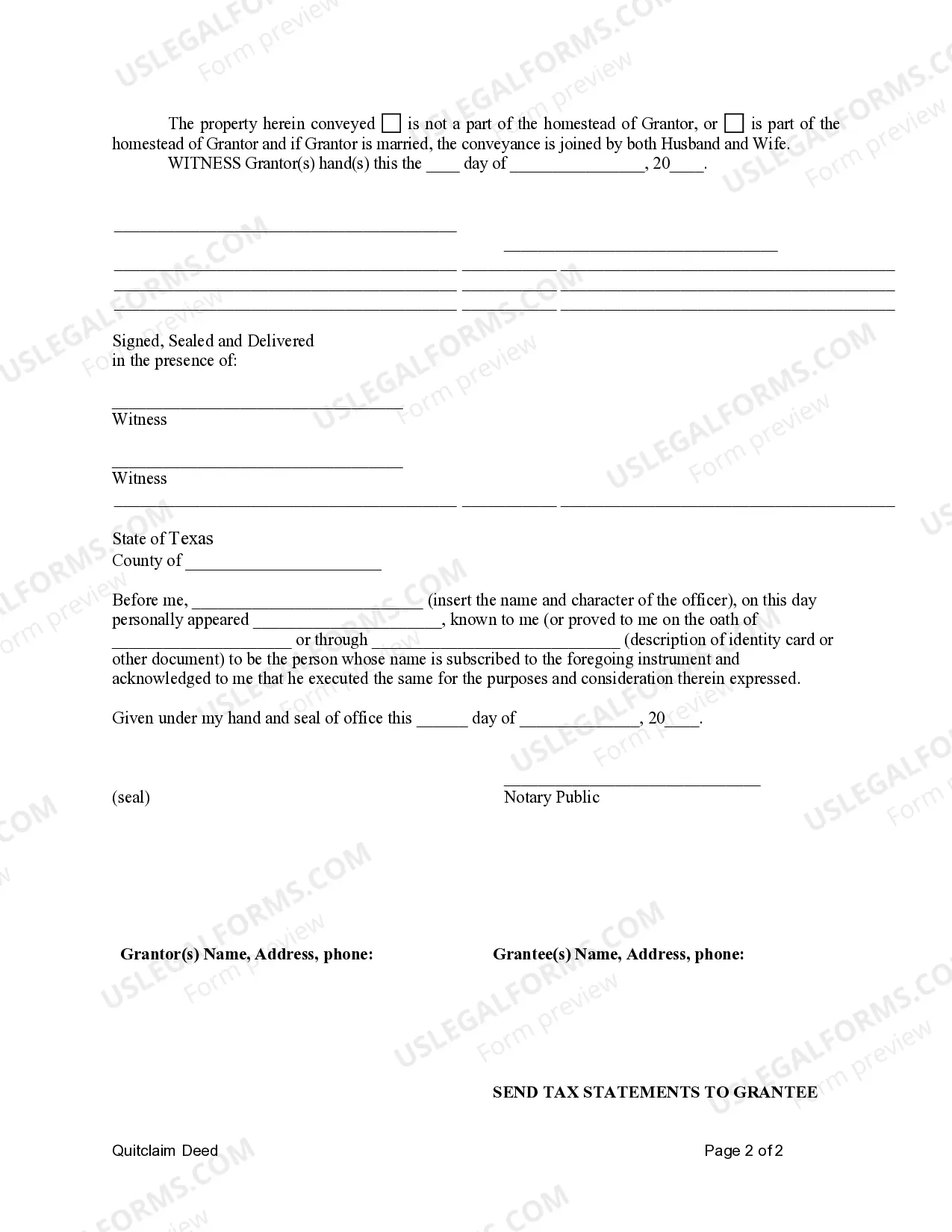

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Irving Texas Quitclaim Deed from Individual to LLC

Description

How to fill out Texas Quitclaim Deed From Individual To LLC?

Are you in search of a reliable and affordable supplier of legal forms to obtain the Irving Texas Quitclaim Deed from an Individual to an LLC? US Legal Forms is your ideal option.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are tailored and structured in accordance with the regulations of distinct states and regions.

To obtain the document, you must Log In to your account, find the needed form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can establish an account in just a few minutes, but before you do, ensure you take the following steps.

Now you can create your account. Then select the subscription plan and proceed with the payment. After completing the payment, download the Irving Texas Quitclaim Deed from Individual to LLC in any format available. You can revisit the website whenever necessary and download the document again at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending hours searching for legal paperwork online.

- Verify that the Irving Texas Quitclaim Deed from Individual to LLC is compliant with the laws of your state and locality.

- Examine the form’s specifics (if available) to understand who and what the document is meant for.

- Restart the search if the form does not meet your legal requirements.

Form popularity

FAQ

Yes, notarization is a mandatory step for a quitclaim deed in Texas. A notary public verifies the identities of the parties and ensures the deed is properly executed. If you are preparing an Irving Texas Quitclaim Deed from Individual to LLC, remember that notarization is vital for the deed’s legal acceptance in property matters.

In Texas, you file a quitclaim deed with the county clerk’s office in the county where the property is situated. It is important to check the specific filing requirements for your county, as they may vary. By utilizing resources like USLegalForms, you can easily access the necessary forms and guidelines to complete the filing process for your Irving Texas Quitclaim Deed from Individual to LLC.

To file a quitclaim deed in Texas, you will first need to complete the deed form correctly. After ensuring that it is signed and notarized, submit it to the county clerk's office in the county where the property is located. Using platforms like USLegalForms can streamline the process of obtaining and filing the necessary documents for an Irving Texas Quitclaim Deed from Individual to LLC.

In Texas, a quitclaim deed remains valid as long as it is properly executed and recorded. There is no specific expiration date for a quitclaim deed once filed. Therefore, if you are transferring property through an Irving Texas Quitclaim Deed from Individual to LLC, the deed will continue to be effective unless it is revoked or replaced by another valid deed.

Yes, a quitclaim deed must be notarized in Texas to be legally valid. Notarization helps confirm the identity of the parties involved and ensures that the document is executed properly. For those handling an Irving Texas Quitclaim Deed from Individual to LLC, using a notary is essential to prevent potential disputes in the future.

Yes, you can quit claim deed property to an LLC. This method allows for a simple and quick transfer of ownership. However, it's important to note that this type of deed does not guarantee that the title is clear, meaning there could be outstanding claims. For a smooth transition, consider using the Irving Texas Quitclaim Deed from Individual to LLC, ensuring all aspects are handled professionally.

To change your property deed to an LLC, you need to execute a quitclaim deed that transfers ownership from yourself to your LLC. This deed should then be filed with the county clerk's office where the property resides. It’s advisable to ensure that all legal requirements are met, possibly with the help of professionals. The Irving Texas Quitclaim Deed from Individual to LLC is particularly designed for such transitions.

Yes, a quit claim deed does transfer ownership in Texas. However, it only conveys whatever interest the individual has in the property at the time of the transfer. This means that if there are any claims against the property, those may still exist post-transfer. The Irving Texas Quitclaim Deed from Individual to LLC is a straightforward way to alter ownership structure legally.

Transferring property to an LLC may trigger property tax reassessment in California. This can lead to higher property taxes, especially if the property's market value increases significantly. It is essential to consult with a tax advisor to understand how these changes can impact your financial situation. Using the Irving Texas Quitclaim Deed from Individual to LLC can help manage your property legally.

Transferring property to an LLC in Texas can have various tax implications. Generally, this transfer may trigger a reassessment of the property's value, leading to higher property taxes. However, there may be tax benefits depending on your situation, such as certain deductions available to LLCs. It's wise to consult with a tax professional to fully understand the consequences when using an Irving Texas Quitclaim Deed from Individual to LLC.